Who’ll stop lying under oath? Empirical evidence from tax evasion games

Texte intégral

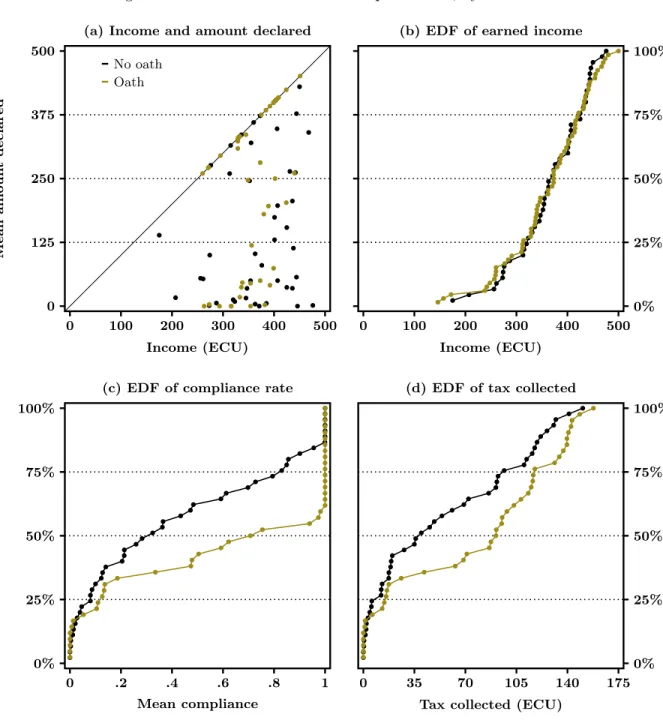

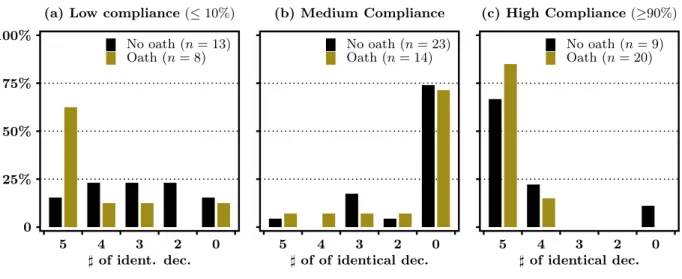

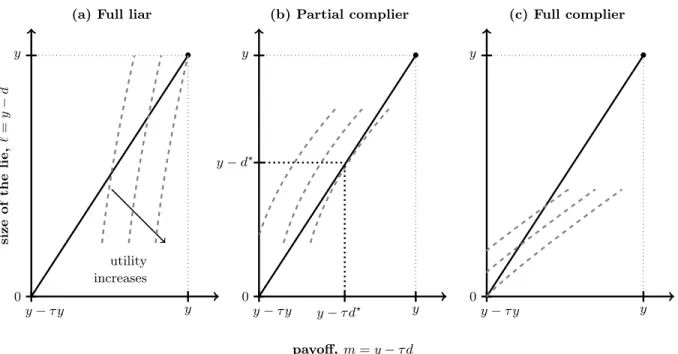

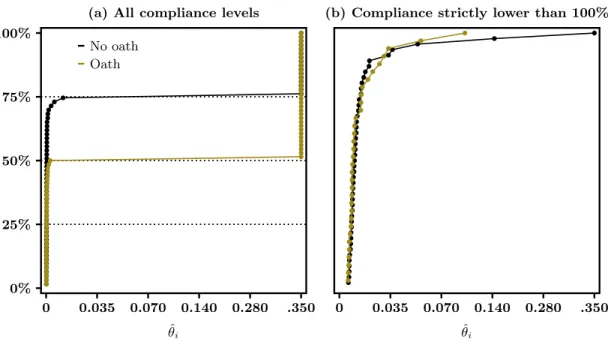

Figure

Documents relatifs

Teachers sometimes face many problems with students in the English classroom, in particular, with the student who have the same native language because they use

The study was applied on a sample of (300) counselors had been selected in a random sample from vocational and school guidance centers of ten provinces.After

La question de l’irréductibilité des cas singuliers et donc de la nécessité de les multi- plier pour parvenir à une hypothèse générale n’est donc qu’une ques- tion mal

Disposer d’un petit robot programmable aux fonctionnalités extrêmement simples permet de démarrer un travail autour de la robotique pédagogique avec les plus jeunes de nos

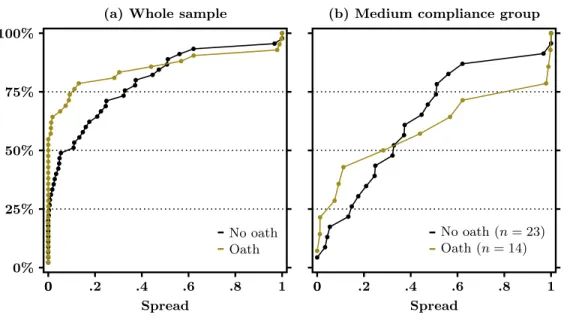

Altogether, we find that individual communication behavior varies in quantity – since senders send more often informative messages in the oath treatment –and does change in quality –

The former provides for the general, simplified in comparison to the past, legal framework with regard to both corporate and personal income taxation, while the latter

Following Pinkas and Loui's analysis [PL92], it is convenient to see non-monotonic syntax-based entail- ment as a two-steps procedure which rst generates and selects preferred

Our paper models competition between OFCs and onshore banking cen- ters by considering, successively, strict bank secrecy with pure tax evasion and tax information exchange with