frssl

MITLIBRARIES

DEWEY]

• /V1(4-|S

3

9080 02874 5187

Massachusetts

Institute

of

Technology

Department

of

Economics

Working

Paper

Series

The

Co-Movement

of

Housing

Sales

and Housing

Prices:

Empirics

and Theory

William

C.

Wheaton

Nai

JiaLee

Working

Paper

09-05

March

1,2009

Room

E52-251

50

Memorial

Drive

Cambridge,

MA

021

42

This

paper can be

downloaded

withoutcharge from

the SocialScience

Research

Networl<Paper

Collection at4th Draft:

March

1.2009.The

co-movement

of

Housing

Sales

and Housing

Prices:

Empirics

and

Theory

By

William C.

Wheaton

Department

ofEconomics

Center for Real Estate

MIT

Cambridge,

Mass

02139wheaton@mit.edu

and

Nai Jia

Lee

Department

ofUrban

Studiesand PlanningCenterfor Real Estate

MIT

The

authorsare indebted to, theMIT

Center forReal Estate,the National Association ofRealtors andto Torto

Wheaton

Research.They

remain responsiblefor all resultsandconclusions derivedtherefrom.

ABSTRACT

This paper

examines

thestrong positivecorrelation that existsbetween

thevolume

of housingsales and housing prices.We

first closelyexamine

gross housing flows in theUS

and dividesales into

two

categories: transactionsthat involve achange

orchoiceoftenure, as

opposed

to owner-to-ownerchurn.The

literature suggeststhatthe lattergeneratesa positive sales-to-price relationship, but

we

find thatthe formeractuallyrepresents the majority oftransactions. Forthese

we

hypothesize thatthere isa negativeprices-to-sales relationship. This runs contraryto a different literature

on

liquidityconstraints and loss aversion. Empirically,

we

assemble a large panel database for 101MSA

spanning 25 years.Our

results are strong and robust. Underneath the correlationlies apairof

Granger

causal relationshipsexactly ashypothesized: higher salescause higher prices, but higherpricescauses lower sales.The two

relationshipsbetween

salesand pricestogether providea

more

complete picture ofthehousing market-

suggestingthe strongpositive correlation in the dataresults from frequentshifts inthe price-to-sales

Digitized

by

the

Internet

Archive

in

2011

with

funding

from

Boston

Library

Consortium

Member

Libraries

I. Introduction.

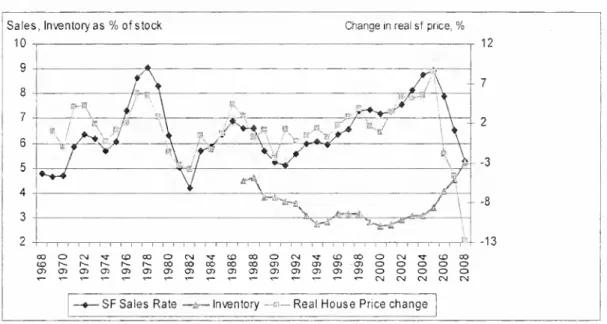

As shown

in Figure 1 below, there isa strongpositive correlationbetween

housingsales(expressedas a percentofall

owner

households) andthemovement

in housing prices (R"=.66).On

the surfacethe relationship looksto be closetocontemporaneous.There is also a

somewhat

lessobviousnegativerelationshipbetween

pricesand the shorter series on the inventory ofowner

units for sale(R"=.51).A

number

ofauthorshaveoffered explanations forthese relationships, in particular that

between

pricesand sales.Figure 1:

US

Housing

Sales,Prices,Inventory

Sales,Inventoryas

%

ofstock 10ChangeInrealsf price,

%

12

aD^~^-r^r^r^oooooooococj)a)cj)aiai

o

o

o

o

o

o

o

o

o

o

CNJ CM CN CM CNJ-SFSalesRate Inventory -^"—RealHousePricechiange

In one camp,there is a

growing

literature ofmodels

describinghome

owner

"churn" inthe presenceofsearch frictions

[Wheaton

(1990),Berkovec

andGoodman

(1996).

Lundberg

and Skedinger (1999)]. Inthese models, buyersbecome

sellers-

thereare no entrants or exitsfrom themarket. In such a situation the roleofprices is

complicatedby the factthat ifparticipants pay higherprices, theyalso receive

more upon

sale. It isthe transaction cost of

owning

2homes

(duringthemoving

period)thatgroundsprices. Ifprices are high, thetransaction costs can

make

trading expensiveenough

toalmost inverselyto expected salestimes

-

equal to the vacant inventory dividedby

thesales flow. In thesemodels, boththe inventory and saleschurn are exogenous. Following

Pissarides (2000) ifthe

matching

rate isexogenous

or alternativelyofspecificform, thesales timewill be shorterwith

more

saleschurn andprices therefore higher.Hence

greater salescausehigherprices. Similarly greater

vacancy

(inventory) raises salestimesand

causes lowerprices.There are also a seriesofpapers

which

proposethat negativechanges in prices will subsequentlygenerate lowersales volumes. This again isa positiverelationshipbetween

thetwo

variables, butwith oppositecausality.The

firstofthese is by Stein(1995) followed by

Lamont

and Stein (1999) andthenChan

(2001). Inthese models,liquidityconstrained

consumers

are againmoving

from one house toanother ("churn")and

must

make

adown

payment

in orderto purchase housing.When

pricesdeclineconsumer

equitydoes likewise and fewer householdshave

theremainingdown

payment

to

make

the lateralmove.

As

prices rise, equity recoversand so doesmarket liquidity.Relying instead on behavior economics,

Genesove

andMayer

(2001) and then Englehardt (2003)show

empiricallythat sellerswho

would

experience a loss ifthey sell set higher reservations than thosewho

would

not experience a loss.With

higher reservations, themarketasa

whole would

see lower salesifmore

andmore

sellers experience lossaversion as pricescontinueto drop.

In this paper

we

tryto unravel therelationshipbetween

housing prices and housing sales,and in addition,the housing inventory. First,we

carefullyexamine

grosshousing flows in the

AHS

forthe 11 (odd) years inwhich

thesurvey is conducted.We

find the following.

1). There generallyare

more

purchases ofhomes

by

rentersornew

householdsthan there are

by

existingowners.Hence

the focus in the literature onown-to-own

tradesdoes;7o/ characterizethe 7?zo/'077(yof housing salestransactions.

2).

The

yearlychange

in thehomeownership

rate is highly correlated negativelywith housingprices. In years

when

prices are high, flows into rentinggrow

fasterthanflows into

owning

andhomeownership

startsto decline.When

prices are low, net3).

We

alsoexamine which

flows addto the inventoryoffor-sale units (calledLISTS)

andwhich

subtract (calledSALES). Own-to-own

moves, forexample

do both.We

show

thatthemovements

in inventoryare also positively correlated with price.When

prices are high

LISTS

increase relativetoSALES,

the inventory grows,andwhen

pricesare low, the reversehappens.

4). This leads usto hypothesize thatthere isjointcausality

between

salesandprices.

Owner

churn generatesa positive schedulebetween

sales and prices assuggestedby

frictional markettheory.At

thesame

time, inter-tenure transitionsshould leadto anegative schedule.

Along

the latter,when

prices are high salesdecrease, listsincreaseandthe inventory starts to grow. Inequilibrium, the overall housing marketshould rest at the

intersection ofthese

two

schedules.To

test these ideaswe

assemble aUS

panel database of101MSA

across 25years. This datais from the

NAR

andOFHEO.

The

NAR

inventory data is tooscatteredand short tobe included in thepanel so our empiricsare limited totestingjust the

hypothesized relationships

between

salesand prices.Here

we

find:5). Usinga

wide

range ofmodel

specifications andtestsofrobustnesshousingsalesjC>o.s77/'ve/)'"Granger cause" subsequent housing price

movements.

Thisreinforcesthe relationship posited in frictional search models.

6). There is equally strong empirical support

showing

that pricesnegatively'Granger cause" subsequent housingsales. This relationship is exactlythe oppositeof

that posited bytheories ofliquidity constraints and loss aversion, but is consistent with

our hypothesis regarding inter-tenurechoices.

Our

paper is organized as follows. Insection IIwe

setup an accountingframework

formore

completelydescribing grosshousing flows fromthe 2001AHS.

This involves

some

careful assumptionsto adequatelydocument

themagnitude

ofall theintertenure flows relativetowithin tenure churn and to household creation/dissolution. In

Section 111,

we

illustratethe relationshipsbetween

these flowsand housingpricesusingthe 1 1 years for

which

the flow calculationsare possible.We

alsopresentourhypothesized pair ofrelationshipsbetween sales and prices as well asthe relationshipof

eachto thehousing inventory. In sections IV through VI

we

present our empiricalfrom

1982-2006. It isherewe

findconclusive evidence thatsales positively"Granger cause"prices andthat pricesnegatively"Granger

cause" sales.Our

analysis is robusttomany

alternative specificationsandsubsample

tests.We

conclude withsome

thoughtsabout futureresearch aswell astheoutlook for

US

house prices and sales.II.

US

Gross

Housing

Flows: Sales,Lists,and

theInventory.Much

ofthe theoretical literatureon sales and prices investigateshow

existinghomeowners

behave

as theytryand

sell theircurrenthome

to purchaseanew

one.This flow ismost

often referred to as "churn".To

investigatehow

important arole "churn"plays in the ownership market,

we

closelyexamine

the2001American Housing

Survey.In "Table 10"ofthe Survey, respondentsare asked

what

thetenurewas

ofthe residence previouslylived in-

forthosethatmoved

duringthe lastyear.The

totalnumber

ofmoves

in thisquestion isthesame

asthetotal in"Table 11"-

asking aboutthe previousstatus ofthe current head(the respondent). In "Table 11" itturns out that

25%

ofcurrentrenters

moved

from

aresidence situation inwhich

theywere

notthe head (leavinghome,

divorce, etc.).

The

fraction is asmaller12%

forowners.What

ismissing is the jointdistribution

between

moving

by the headandbecoming

ahead.The

AHS

isnotstrictlyableto identify

how many

currentowners

moved

either a)from

anotherunittheyowned

b) anotherunitthey rented orc) purchased ahouseasthey

became

anew

ordifferenthousehold.

To

generate the full setofflows,we

use information in "Table 11" aboutwhether

theprevious

home

was

headedby

the current head, a relativeoracquaintance.We

assume

that all currentowner-movers

who

were

alsonewly

created households-were

counted in"Table 10" as previousowners. Forrenters,

we

assume

that all renter-moversthat

were

alsonewly

created householdswere

counted in "Table 10" in proportion torenter-owner households inthe full sample. Finally,

we

use theCensus

figures thatyearforthe net increase in eachtype ofhousehold and fromthat and the data

on

moves

we

areable to identify household"exits" by tenure.Gross household exitsoccur mainly through

deaths, institutionalization (such as to a nursinghome), or marriage.

Focusingonjustthe

owned

housing market,theAHS

also allowsusto accountLISTS)

and allofthose transactions thatremove

houses from the inventory (herein calledSALES).

There aretwo

exceptions.The

first is the net deliveryofnew

housing units. In2001 the

Census

reports that 1,242,000total unitswere

deliveredto the for-salemarket. Sincewe

have nodirect countofdemolitionswe

usethat figure also as netand it iscountedas additional

LISTS.

The

second is the netpurchases of2"'^ homes,which

count

asadditional

SALES,

butaboutwhich

there is simply littledata"". In theory,LISTS

-SALES

should equal thechange

in the inventoryofunits forsale.These

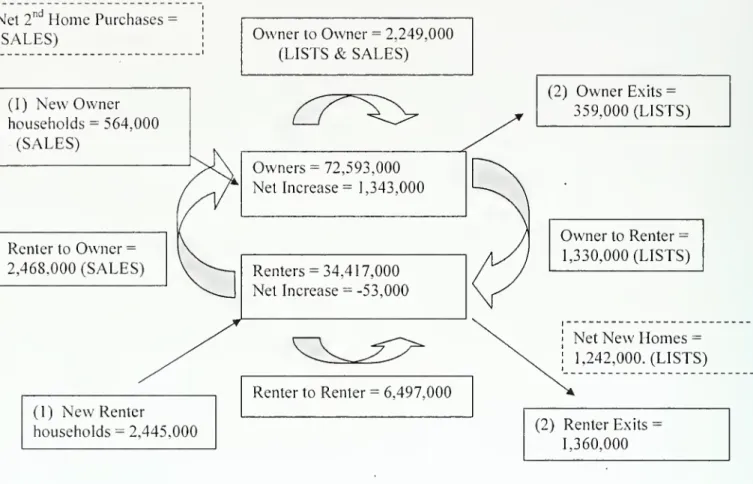

relationships aredepicted in Figure 2 and can be

summarized

with the identitiesbelow

(2001 values areincluded).

SALES

= Own-to-Own +

Rent-to-Own

+

New

Owner

[+ 2"^*homes]

=

5,281,000LISTS =

Own-to-Own +

Own-to-Rent

+ Owner

Exits+

New

homes =

5,179,000Inventory

Change =

LISTS

-

SALES

Net

Owner

Change =

New

Owners

-

Owner

Exits+ Rent-to-Own

-

Own-to-Rent

Net

RenterChange =

New

Renters-

RenterExits+ Own-to-Rent - Rent-to-Own

(1)

The

only other comparabledata is fromthe National Association ofRealtors(NAR).

and it reports that in 2001 the inventory ofunits for salewas

nearly stable.The

NAR

however

reports ahigher level ofsales at 5,641,000. This7%

discrepancy could beexplained by repeat

moves

within asame

year since theAHS

asks only aboutthemost

recentmove.

It could also represent significant 2"home

saleswhich

again are not part ofthe

AHS

move

data.What

ismost

interesting to us is that almost60%

ofSALES

involvea buyerwho

isnot transferring ownership laterally from one houseto another.

So

called"'Churn" isactually ami)writyofsalestransactions.

These

various inter-tenure sales also are thecriticaldeterminants ofchange-in-inventory since"Churn'" salesdo not affect it. .

Thegroulh instockbetween 1980-1990-2000 Censusesclosely matchessummed completions suggesting

negligibledemolitionsoverthosedecades.The samecalculationbetween 1960 and 1970howeversuggests

removal of3 millionunits.

"Net second homepurchases might beestimatedfromtheproduct

of: theshareoftotal grosshome

purchasesthataresecondhomes(reportedby Loan Performanceas 15.0%) andthe shareofnew homes in

total homepurchases(Census,25%).This wouldyield3-4%oftotaltransactionsorabout200,000units.

Figure

2:US

Housing

Gross Flows

(2001)ind

Net

2Home

Purchases(SALES)

(1)New

Owner

households=

564,000(SALES)

RentertoOwner

=

2,468.000(SALES)

(1)New

Renter households=

2,445,000Owner

toOwner

=

2,249,000(LISTS

&

SALES)

Owners =

72,593,000Net

Increase=

1,343.000 Renters=

34,417,000Net

Increase=

-53,000 Renterto Renter=

6,497,000 (2)Owner

Exits=

359.000(LISTS)

Owner

toRenter=

1,330.000(LISTS)

Net

New

Homes =

1,242,000.

(LISTS)

(2) Renter Exits

=

1,360,000Most

inter-tenureSALES

would seem

to beevents that one might expect tobesensitive (negatively) to housing prices.

When

prices arehighpresumably

new

createdowner

household formation is discouraged orat least deflected intonew

renterhouseholdformation. Likewise

moves

which

involve changes intenurefrom

rentingtoowning

alsoshould be negatively sensitive tohouseprices.

Both

resultbecause higherpricessimplymake

owning

a house lessaffordable.At

thistimewe

are agnostic abouthow

net 2"home

salesare related to prices.On

the other sideof Figure 2,most

ofthe events generatingLISTS

should beatleast

somewhat

positively sensitive toprice.New

deliveries certainlytryto occurwhen

to"cashout",

consume

equityor otherwise switch to renting.At

thistimewe

are stillseeking a directdatasource

which

investigates inmore

detailwhat

events actuallygeneratetheown-to-rent moves.

Thus

the flows in andoutofhomeownership

inFigure 2 suggestthatwhen

prices are high sales likely decrease, lists increaseand the inventorygrows.

These

eventswould

easily generateadownward

sloping schedulebetween

pricesand sales such asdepicted in Figure 3

below -

incompliment

totheupward

scheduledeveloped bytheorists for

owner

occupied churn. Figure 3 presentsamore

completepicture ofthe housing market than the models ofStein,

Wheaton,

orBerkovec

andGoodman

-

since itaccounts forthe very large roleofinter-tenuremobilityaswell as forowner

churn.FIGURE

3:Housing

Market

Equilibriuni(s)Search Based Pricing

(own-to-own "churn")

3 o

Pricingbased Sales

{Inter-tfriurcclioiccs)

Sales/Inventory

III.

Further

AHS

Empirical

Analysis.Unfortunately the gross flows in Figure 2can only be assembled forthe 1 1 years

2007." In

Appendix

IIIwe

present all ofthecalculated flows foreach ofthese 1 1 yearsalong withthe

OFHEO

price index.The

number

of timeseries observationsis notmuch

to

work

with so insteadwe

just illustratesome

graphs. In Figure4,we

show

houseprices against thecalculatedchange

in inventory. This isLISTS-SALES

where

each ofthese iscalculated using the setofidenties in (1). There is a strong positive relationship [R"=.53].

When

prices are highLISTS

rise,SALES

fall and the inventorygrows.Figure

4: PricesversusInventory

Change (LISTS-SALES)

year

Inventorychange •PriceIndex

InFigure 5,

we

examine

the percentagechange

inthenumber

ofrenters andowners

ineach ofthe 11 years-

again with respect to prices.Here

there is an inverse relationshipbetween

pricesand the increase inowners

[R"'=.48] and a positiverelationship

between

prices andthe increasein renters [R~=.29].When

prices are high, thenumber

ofrentersseems

torise relative toowners

and theoppositewhen

prices arelow.

Thus

there is aparallel negative relationshipbetween

pricesand thechange

in thePrior to 1985, the

AHS

useddifferentdefinitionsofresidence,headshipandmoving,sothesurveysarenotcomparable withthemorerecentdata.

homeovvnership rate.

While

these correlations are based on only 11 observations-

they atleastspan a longer22 year period.

Figure5: Pricesversus

Tenure

Changes

1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2907

•ChangeOwners ChangeRenters PriceIndex

IV.

Metropolitan

Salesand

PricePanel

Data.To

more

carefully studythe relationship(s) between housing salesand housingprices

we

have assembled a large panel data base covering 101MSA

and the years 1982through 2006."*

While

farmore

robustthan an aggregateUS

time series, examining""There have beenafewrecentattemptstestwhetherthe relationship betweenmovementsinsales

and pricessupport one. orthe other, orboth theories described previously.Leung,Lau.andLeong(2002)

undertakeatime seriesanalysisofHong KongHousingand concludethatstrongerGrangerCausalityis

foundforsalesdrivingprices ratherthanpricesdrivingsales. AndrewandMeen(2003) examinea

UK

Macrotimeseriesusinga

VAR

model and concludethattransactionsrespondtoshocksmorequicklythan prices,butdonot necessarily"GrangerCause"priceresponses. Bothstudiesarehamperedby limited observations.annual dataatthe metropolitanlevel does

have

a limitation, however, since itcannot useCensus

orAHS

data.The

latter containmore

detail aboutthesources ofsalesandmoves,

but theCensus

isavailableonly every decade and theAHS

sample isjusttoosmall togenerate

any

reliable flowsattheMSA

level.Forsales data, the onlyother consistent source isthatprovided

by

theNationalAssociation ofRealtors

(NAR).

The

NAR

data isforsingle family unitsonly (itexcludescondominium

sales in theMSA

series), but is available foreachMSA

overthe full periodfrom 1980 to 2006.'

To

standardize the sales data,raw

saleswere

compared

with annualCensus

estimates ofthenumber

oftotal households in those markets. Dividingsinglefamily sales

by

total householdswe

get avery crude sales rateforeach market. In1980

thiscalculated sales ratevaried

between

1.2%

and5.1%

across ourmarketswith anational average valueof 2.8%.

By

contrast, inthe 1980census,8.1%

ofowner

occupied householdshadmoved

in duringthe lastyear.By

2000,the ratioofnationalNAR

singlefamilysales tototal households

had

risen to4.9%, while theCensus

owner

mobility rate just inchedup

to 8.9%.Of

course our crude calculated averagesales rates should always be lowerthan thecensus reportedowner

mobility ratessince the former excludescondo

transactionsand non-brokered sales. In additionwe

are dividingby

total householdsratherthanjust single family

owner-occupied

households. Separate renter/ovv'nersinglefamilyhousehold seriesatyearly

frequency

are not available for all metropolitan markets.The

price datawe

use istheOFHEO

repeat sales series [Baily,Muth,

Nourse

(1963)]. Thisdata series has recently been questioned fornot factoring outhome

improvements

or maintenance and for not factoring in depreciation and obsolescence[Case, Pollakowski,

Wachter

(1991), Harding, Rosenthal. Sirmans(2007)].These

omissions could generatea significantly bias in the long term trend ofthe

OFEHO

series.Thatsaid

we

are left withwhat

is available, and theOFHEO

index isthemost

consistentseries availablefor

most

US

markets overa long timeperiod.The

only alternative is topurchase similar indices from

CSW/FISERV,

although they havemost

ofthesame

methodological issues as the

OFHEO

data.'

NAR

dataontheinventory ofunits for sale isshorter,andavailableonlyforonly asmallersample oflargermetropolitanareas.Hence

we

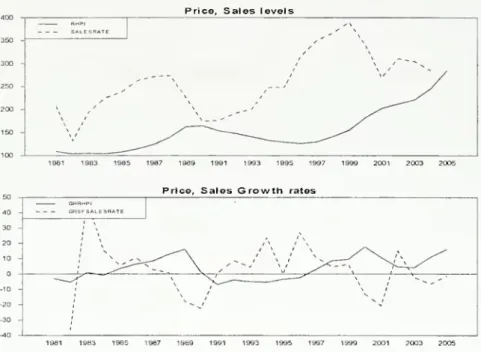

excludeitfromtheanalysis.In Figures 6 and 7

we

illustratetlieyearlyNAR

sales ratedata, alongwith theconstant dollar

OFHEO

price series-

both in levelsand differences- fortwo

marketsthatexhibit quite varied behavior,Atlantaand

San

Francisco.Over

this time frame, Atlanta'sconstant dollar prices increase very littlewhile

San

Francisco's increasedalmost200%.

San Francisco prices, however, exhibitfar greater pricevolatility. Atlanta's averagesales rate is close to

4%

and roughly doubles over 1980-2006. while San Francisco's isalmosthalfofthat (2.6%) and increases

by

only about50%. These

trends illustrate the topicalrange ofpatterns seen across our sample of101 metropolitan areas. In appendix I

we

presentthe

summary

statisticsfor each market's price and sales rate series. Invirtually all markets there is a long term positive trend in the salesrate, as well as in real house prices.Figure

6: Atlanta Sales, Prices700

Prico, Sales levels

_ RHP> , - SALESRATE /

.y~"

"

500 ' 400 ' ^ ^ ~-" \ ^ ' ,,'"

/ 300 -\/ \" 200 -1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 20O5Price, Sales Growth rates

GHHMPI GRSF SALESRATE 2 -'-.

r\

,-.^ ,-, ;--. r— ^^"^ ^^"--^ ', 2 -,' M -,' 1981 1983 1335 1987 1989 1991 1993 1995 1997 1999 2001 2003 2006 13Figure

3:San

Francisco Sales, Prices400 Price, Sales lovels

RHP. ^v - SALESRATE ^ ' \ / \ 300 250 \ / \^

"y

200 /\_

^ '' ' 150 1QO '''__^

^

^

^^-^

1981 1983 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 200550 Price, SalesGro wth rates GRRHPI 40 ORSFSA LESRATE 30 \ 20 10 ;

'>^-<r^

\ -'""^'' \ '>

/

/^\^

x,^

; ^^ X s * -10 20 ^' -30 "—

1981 1963 1985 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005Given

the persistenttrends in both series it is importantto testmore

formally forseries stationarity.

There

aretwo

tests available foruse with panel data. In each,the nullhypothesis isthat allofthe individual series haveunit roots and are

non

stationary.Levin-Lin (1993) and Im-Persaran-Shin (2002) both developa test statistic forthe

sum

oraveragecoefficient ofthe lagged variable ofinterest

-

across the individuals(markets) within the panel.The

null isthatall ortheaverage ofthese coefficients is notsignificantly different

from

unity. In Table 1we

reportthe results ofthistest for bothhousingprice and sale rate levels, aswell as a2"*^ orderstationarity test forhousing price

and sales ratechanges.

RHPI

(Augmented

by 1 lag)T.4BLE

1: Stationarit> testsLevin

Lin's TestCoefficient

T

Value

T-StarP>T

Levels -0.10771 -18.535 0.22227 0.5879

First Difference -0.31882 -19.822 -0.76888 0.2210

IPS

testT-Bar

W(t-bar)P>T

Levels -1.679 -1.784 0.037

FirstDifference -1.896 -4.133 0.000

SFSALESRATE

(Augmented

by 1 lag)Levin

Lin'sTest

Coefficient

T

Value

T-StarP>T

Levels -0.15463 -12.993 0.44501 0.6718

First Difference -0.92284 -30.548 -7.14975 0.0000

IPS

testT-Bar

W(t-bar)P>T

Levels -1.382 1.426 0.923

First Difference -2.934 -15.377 0.000

With

the Levin-Lintestwe

cannotreject the null (non-stationarity) for eitherhouse price levelsor differences. In terms ofthe sales,

we

can reject the null fordifferences in sales rate, but not for levels.

The

IPS test (which is argued tohavemore

power)rejectsthe null forhouse price levels and differences andfor sales rate

differences. In short, both variables

would seem

to be stationary in differences, butlevelsare

more

problematicand likely non-stationary.V.

Panel

Estimations.Our

panel approach usesawell-known

application of Granger-typeanalysis.We

willask

how

significant lagged sales are in a panelmodel

ofpriceswhich

uses laggedpricesandthen several conditioningvariables.

The

conditioning variableswe

choose aremarketarea

employment,

andnationalmortgage

rates.The companion model

is toaskhow

significant lagged prices are ina panelmodel

ofsales using lagged sales andthesame

conditioningvariables. Thispair ofmodel

isshown

(2)-(3).P,.r

=

"o+

^\^,:i-\+

'*2'^/.7-i+

P''"^i.T+

S,+

^i,i (2)s.j

=

ro+

7,^,.7--,+

r2P..T-^+

^'^..T+

+n,+

^,,t (3)In ourcase there is significantconcern about the stationarity ofboth price and

sales rate levels. This

same

concern should not be presentfordifferences.Hence

we

willneed toestimate the

model

in firstdifferences aswell as levels-

asoutlined in equations(4) and (5).'

AP,7.

=a^+

a^AP,J_,+

a,AS,j_,+

jB'AX^j+

+S,+

s^^ (4)^..T =

/o+

rAS,.r-\+

/2^,,r-i+

^'^"^..r+

+n,+

^,,t (5)In panel

VAR

models

with individual heterogeneity there exists a specificationissue. Equations (4) and (5) or (2) and (3) will have an errorterm that is correlated with

the lagged dependentvariables [Nickell, (1981)].

OLS

estimation will yieldcoefficientsthat areboth biased and also that are not consistent inthe

number

ofcross-sectionobservations. Consistency occurs only inthe

number

of time series observations.Thus

estimates and any tests on the parameters ofinterest(thea andy)

may

not bereliable.These problems might

not be serious in ourcase sincewe

have 26 time seriesobservations

(more

thanmany

panel models).To

be on the safe side, however,we

alsoestimated the equations following anestimation strategy

by

Holtz-Eakin et al.As

discussed in

Appendix

II,thisamounts

to using 2-period lagged values ofsales and pricesas instruments with

GLS

estimation. ' .vv, ",'

From

eitherestimates,we

conducta "Granger"causality test. Sincewe

are onlytesting for a single restriction,the/ statistic is thesquare root ofthe

F

statisticthatwould

be used totest thehypothesis in thepresence ofa longerlag structure (Greene, 2003).

Hence,

we

can simply use a/ test (appliedto theo:, andy^) ^s the check of whetherchanges in sales "Granger cause" changes in priceand vice versa.

Intable 2

we

reportthe results ofequations (2)through (5) in each setofrows.The

firstcolumn

usesOLS

estimation, the secondtheRandom

EffectsIV

estimatesfrom

Holtz-Eakin et al.

The

firstsetofequations is in levels, whilethe second setofrows

reportsthe results using differences. In all Tables, variablenames

are selfevidentanddifferencesare indicated with theprefix

GR.

Standard errorsare in parenthesis.Among

the levels equations,we

first notice thatthetwo

conditioning variables,the national

mortgage

rate and localemployment

havethewrong

signs intwo

cases.The

mortgage

interest rate intheOLS

price levels equation and localemployment

intheIV

*

In (3)and(4)the fixedeffectsarecross-section trends ratherthan cross sectionlevels as in(1)and(2)

sales rateequation are miss-signed.There is alsoan insignificant

employment

coefficientinthe

OLS

sales rate equation (despite almost2500

observations).Another

troublesomeresult isthatthe price levels equation has excess

"momentum"

-

lagged prices haveacoefficientgreater than one.

Hence

prices (levels) cangrow

on theirown

withoutnecessitating any increases in ftindamentals, orsales.

We

suspect that thesetwo

anomaliesare likely the resultofthe non-stationary featuretoboththe price and sales

series

when

measured

in levels. Interestingly, thetwo

estimation techniquesyield quitesimilarcoefficients

-

asmight be expected with a largernumber

oftime seriesobservations.

When we move

tothe resultsofestimating the equations in differencesall ofthese issuesdisappear.

The

lagged price coefficients are small so theprice equationsarestable in the 2"'' degree, and thesigns ofall coefficients are both correct

-

and highlysignificant.

As

to the questionofcausality, in every price or pricegrowth equation, laggedsales or growth in sales is always significantly positive. Furthermore in ever}' salesrateor

growth

in sales rate equation, lagged prices (or itsgrowth) are alsoalways significant.Hence

there is clear evidenceofjoint causality,butthe effectof

laggedpriceson

sales isalways

ofa

negative sign.Holding

lagged sales (and conditioningvariables) constant, ayearafterthere isan increase in prices

-

sales fall.The

isthe oppositeofthat predictedby theories ofloss aversion or liquidity constraints, but consistent with our hypothesis.

TABLE

2: Sales-PriceVAR

Fixed Effects

E

Holtz-Eakin estimator LevelsReal Price

(DependentVariable)

Constant

Real Price (lag 1)

Sales Rate(lag 1)

Mortgage Rate Employment -25.59144** (2.562678) 1.023952** (0.076349) 333305** (0.2141172) 0.3487804** (0.1252293) 0.0113145** (0.0018579) -1247741** (2 099341) 1 040663** (0.0076326) 2.738264** (0,2015346) -0.3248508** (0.1209959) 0.0015689** (0.0003129) 17

Sales Rate

(DependentVariable)

Constant

Real Price (lag 1)

Sales Rate (lag 1)

Mortgage

Employment

First DifferenceGR

Real Price (DependentVariable) ConstantGR

Real Price (Lag 1)GR

Sales Rate (Lag 1)GR

MortgageRateGR

Employment 2.193724** (0.1428421) -0.0063598** (0,0004256) 0.8585273** (0.0119348) -0.063598** (0.0069802) -0.0000042 (0.0001036) -0.4090542** (0.1213855) 0.7606135** (0.0144198) 0.0289388** (0.0057409) -0.093676** (0.097905) 0.3217936** (0.0385593) 1.796734** (0.1044475) -0.0059454** (0.0004206) 0.9370184** (0.0080215) -0.0664741** (0.0062413) -0.0000217** (0,0000103) -0.49122** (0.1221363) 0,8008682** (0.0148136) 0.1826539** (0.022255) -0.08788** (0.0102427) 0.1190925** (0.048072)GR

SalesRate (DependentVariable) ConstantGR

Real Pnce (Lag1)GR

Sales Rate (Lag 1)GR

MortgageRate 0.7075247 (0.3886531) -0.7027333** (0.0461695) 0.0580555** (0.0183812) -0.334504** (0.0313474) 1.424424** (0.3710454) -0.8581478** (0.0556805) 0.0657317** (0.02199095) -0.307883** (0.0312106)GR

Employment 1.167302** (0.1244199) 1.018177** (0.1120497) ** indicates significance at5%.

We

have experimented withthesemodels

usingmore

thana single lag, butqualitatively the results are the same. In levels, the priceequation with

two

lagsbecomes

dynamically stable inthe sensethat the

sum

ofthe lagged price coefficients is less than one.As

to causal inference, thesum

ofthe lagged sales coefficients ispositive, highlysignificant, and passesthe

Granger

Ftest. Inthe sales rate equation, thesum

ofthetwo

lagged sales rates is virtually identical to the singlecoefficient

above

andthe lagged pricelevels areagain significantly negative (intheir sum). Collectivelyhigher lagged prices

"Granger

cause"a reduction in sales.We

havesimilar conclusionswhen

two

lags areused inthe differences equations, but indifferences, the 2"''

lag is alwaysinsignificant.

As

a tlnal test,we

investigate a relationshipbetween

thegrowth

in housepricesand the levelofthe sales rate. Inthe search theoretic

models

sales ratesdetermine pricelevels, but ifprices are slowto adjust, the impactofsales mightbetter

show

up on pricechanges. Similarly the theoriesofloss aversion and liquidity constraints relate price

changesto sales levels.

While

the mixing oflevelsand changes in time seriesanalysis is generally not standard,thiscombination ofvariables is also the strong empirical factshown

in Figure 1. In Table 3 price changesare tested for Grangercausality againstthelevelofsales (as a rate).

TABLE

3: Sales-PriceMixed

VAR

Differences and Levels FixedEffects

E

Holtz-Eakin estimatorGR

Real Price(DependentVariable)

Constant

GR

Real Price(lag 1)Sales Rate(lag 1)

GR

Mortgage RateGR

EmploymentSales Rate

(DependentVariable)

Constant

GR

House Price (lag 1)Sales Rate(lag 1)

GR

Mortgage Rate -6.61475" (0.3452743) 0.5999102** (0.0155003) 1.402352** (0.0736645) -0.1267573** (0.0092715) 0.5059503** (0.0343458) -0.0348229 (0.0538078) -0.0334235** (0.0024156) 1.011515** (0.0114799) -0.0162011** (0.0014449) -1.431187** (0.2550279) 0.749431** (0.0141281) 0.2721678** (0.0547548) -0.0860948** (0.0095884) 0.3678023** (0.0332065) 0.0358686 (0.0026831) -0.0370619** (0.0026831) 1.000989** (0.0079533) -0.0151343** (0.0014294)GR

Employment 0,0494462** (0.0053525) 0.043442** (0.0049388) indicates significanceat5%

19In terms

cf

causality, these resultsare no differentthan themodels

estimatedeither in all levels orall differences.

One

yearafter an increase in the levelofsales, thegrowth

in houseprices accelerates. Similarly, one year after housepricegrowth

acceleratesthe levelof

home

sales falls (ratherthan rises). All conditioning variables aresignificant and correctlysigned and lagged dependentvariables have coefficients less

than one.

VI. Testsof Robustness,

In panel

models

it isalwaysagood

ideatoprovidesome

additional testsofthe robustnessof

results, usually by dividing up either the cross section ortimeseries ofthe panel into subsets andexamining

these results as well.Here

we

perform bothtests. Firstwe

divide theMSA

marketsintotwo

groups: so-called "coastal"citiesthatbordereitherocean, and"interior" citiesthatdo not.

There

are 31 markets in theformergroup and 70 in the latter.The

coastalcities are often felt tobethose with strong price trends andpossiblydifferent market supply behavior.

These

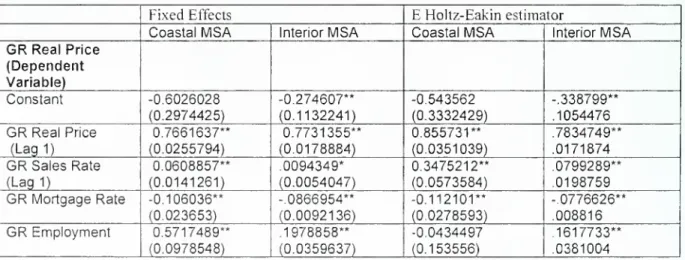

results are inTable 4.The

second test isto divide the sample up by

year-

in this casewe

estimate separatemodels

for1980-1992

and 1993-2006.

The

year 1992 generallymarks

the bottom ofthehousing market fromthe 1990 recession.

These

resultsare depicted in Table 5. Both experimentsusejustthedifferences

model

thatseems

toprovide the strongestresuhsfrom

theprevious section.TABLE

4:Geographic

Sub

PanelsFixedEffects EHoltz-Eakinestimator

Coastal

MSA

InteriorMSA

CoastalMSA

InteriorMSA

GR

Real Price (Dependent Variable) Constant -0,6026028 (0.2974425) -0.274607** (0.1132241) -0.543562 (0.3332429) -.338799** .1054476GR

Real Price (Lagi) 0.7661637** (0.0255794) 0.7731355** (0.0178884) 0.855731** (0.0351039) .7834749** .0171874GR

Sales Rate (Lag 1) 0.0608857** (0.0141261) .0094349* (0.0054047) 0.3475212** (0.0573584) .0799289** .0198759GR

Mortgage Rate -0.106036** (0,023653) -.0866954** (0.0092136) -0.112101** (0.0278593) -0776626** .008816GR

Employment 0,5717489** (0.0978548) .1978858** (0.0359637) -0.0434497 (0.153556) .1617733** .038100420

GR

Sales Rate (Dependent Variable) Constant 2.098906** (0.7412813) 0.0396938** (0.4541917) 3.03388** (0.7426378) 0.8084169* (0.4261651)GR

Real Price (Lagi) -0.8320889** (0.0637485) -0 5447358** (0.0637485) -0.9763902** (0.0798291) -0.8519448** (0.0919725)GR

SalesRate (Lag1) -0.0004387 (0.0352049) 0,0770193** (0.0216808) -0,0350817 (0.0402424) 0.1111637** (0.0251712)GR

Mortgage Rate -0.2536587** (0.0589476) -0.3772017** (0.0369599) -0.2390963** (00595762) -0.3323406** (0.036746)GR

Employment 1.265286** (0.2438722) 1.172214** (0.1442662) 1.102051** (0,2223687) 1.03251** (0.1293764) Note: a) *- 10 percent si b)MSAs

denoted c)MSAs

denotedgnificance. **- 5 percent significance.

coastal are

MSAs

near the East orWest

Coast (seeAppendix

I).interiorare

MSAs

that are not locatedatthe EastorWest

Coast.In Table 6,the results of Table4 hold up remarkably strong

when

thepanel is divided by region.The

coefficientofsales rate (growth)on prices is always significantalthough so-called "costal" cities have larger coefficients. In theequationsofprice

(growth) on sales rates, the coefficients are alwayssignificant, andthe point estimates

are very similar as well.

The

negativeeffect ofpriceson sales rates is completelyidentical across the regional division ofthe panel sample. Itshould be pointed outthat all

ofthe instruments arecorrectly signed and significantas well.

The

conclusion is thesame

when

thepanel is splitintotwo

periods (Table 5).The

coefficients ofinterestare significantand ofsimilarmagnitudesacross time periods, and

all instruments aresignificant and correctly signed as well.

The

strongnegative impact ofprices on sales clearlyoccurred during 1982-1992 as well as overthe

more

recent periodfrom 1993-2006. With fewertime series observations in eachofthe (sub) panels in Table 7, the Holtz-Eakin estimatesare

now

sometimes

quite differentthan theOLS

results.

TABLE

5:Time

Subpanels

Fixed Effects

E

Holtz-Eakinestimator1982-1992 1993-2006 1982-1992 1993-2006

GR

Real Price (Dependent Variable) Constant -2.63937** -0.1053808 -1.237084** -0.2731544 21(0.2362837) (0.1453335) (0.2879418) (0.1943765)

GR

Real Price (Lag1) 0.5521216'* (0.0271404) 0.9364014** (0.0183638) 0.6752733** (0.0257512) 0.9629539** (0.0196925)GR

SalesRate (Lagi) 0.0194498** (0.0073275) 0.0363384** (0.0097935) 0.1622147** (0.0307569) 0.0874362 ** (0.0307703)GR

Mortgage Rate -0.2315352** (0.0193262) -0.0707981** (0.0116032) -0.1432255** (0.0244255) -0.0812995** (0.0163056)GR

Employment

0.6241497** (0.063533) 0.4310861** (0.0501575) 0.157348* (0.0910416) 0.3441402** (0.0493389)GR

Sales Rate (Dependent Variable) Constant -6.269503** (0.9018295) 4.398222** (0.447546) -4.898023** (0.8935038) 3.00473** (0.4587499)GR

Real Price (Lagi) -0.8795382** (0.1035874) -0.5704616** (0.0565504) -1.080492** (0.1243784) -0.4387881** (0.066557)GR

Sales Rate (Lagi) 0.0056823 (0.027967) -0.025242 (0.0301586) -0.0035275 (0.0350098) 0.066557 (0.029539)GR

Mortgage Rate -0.5636095** (0.0737626) -0.1934848** (0.0357313) -0.550748** (0.0819038) -0.2720118** (0.0420076)GR

Employment

2.608423** (0.2424878) 0.4856197** (0.154457) 2.026295** (0.2237316) 0.7631351** (0.1325586) Note:a)

Column

labeledunder1982-1992

refertothe results using observationsthatspanthose years..

b)

Coiumn

labeledunder1993-2006

refer to the results usingobservations thatspanthose years.

VII.

Conclusions

- _We

have

shown

thatthecausal relationshipfrom

prices-to-sales is actuallynegative

-

ratherthan positive.Our

empirics arequite strong.As

an explanation,we

have

arguedthat actual flows in the housing marketare remarkably large

between

tenuregroups

-

and that a negative price-to-sales relationshipmakes

senseas a reflection ofthese inter-tenure flows. Higherprices lead

more

householdsto choose rentingthanowning

and these flows decreaseSALES.

Higher pricesalso increaseLISTS

and sotheinventory grows.

When

pricesare low, entrantsexceed exits into ownership,SALES

increase,

LISTS

declineas doesthe inventory.Our

empirical analysis alsooverwhelmingly

supports the positivesales-to-pricerelationshipthat

emerges from

search-basedmodels

of housing churn.Here, a high sales/inventory ratio causeshigher prices and a low ratiogenerateslowerprices.Thus

we

arrived ata

more

completedescription ofthehousing marketatequilibrium-

asshown

with the

two

schedules in Figure 3.Figure 3 offers a compellingexplanation for

why

in the data, the simpleprice-sales correlation is so

overwhelmingly

positive.Over

timeitmust

bethe "pricebasedsales" schedule thatis shifting up and

down.

Remember

thatthisschedule is derivedmainly from the decision to enteror exittheownership market. Easy credit availability

and lowermortgage rates, for

example would

shift the schedule up (or out). Forthesame

level of housingprices, easier credit increases the rent-to-own flow, decreasesthe

own-to-rent flow, and encourages

new

households toown.

Salesexpand

and the inventorycontracts.

The

end result ofcourse is a rise in both prices as well assales. Contractingcreditdoesthe reverse. In the post

WWII

historyofUS

housing, such creditexpansionsand contractions have indeedtended todominate housing market fluctuations [Capozza,

Hendershott,

Mack

(2004)].Figure 3 also is useful for understandingthe current turmoil in the housing

market.

Easy mortgage

underwritingfrom "subprime capital" greatlyencouragedexpanded

homeownership from

themid

1990s through2005 [Wheaton

andNechayev,

(2007)]. This generated an outward shift inthe price-based-salesschedule.

Most

recently,rising foreclosures have

expanded

therent-to-own flow and shiftedthe"pricebasedsales" schedule back inward. This has decreased both sales and prices. Preventing

foreclosures through creditamelioration theoretically

would

move

thescheduleupward

again, but so could any countervailing policy ofeasing

mortgage

credit. It is interestingtospeculateon whetherthere might be

some

policy thatwould

shiftthe"search basedpricing" scheduleupward. This

would

restore prices, although itwould

not increase sales.For

example

some

policy to encourage interest-freebridge loanswould

certainlymake

iteasierfor

owners

to"churn". Likewisesome

form ofhome

sales insurance might reducethe riskassociated with

owning two

homes. That said, such policieswould seem

to be aless direct

way

ofassistingthemarketversussome

stimulus tothe"price-based-sales"schedule.

REFERENCES

Andrew,

M.

andMeen,

G., 2003,"House

priceappreciation, transactions and structuralchange

in the British housing market:A

macroeconomic

perspective", RealEstateEconomics,

31, 99-116.Baiiy, M.J.,R.F.

Muth,

andH.O.

Nourse, 1963,"A

RegressionMethod

forReal EstatePriceIndex Construction". Journal

of

theAmerican

StatisticalAssociation, 58, 933-942.Beri<ovec. J.A. and

Goodman,

J.L. Jr.. 1996,"Turnover asaMeasure

ofDemand

forExisting

Homes", Real

EstateEconomics, 24 (4), 421-440.Case, B., Pollakowski,H., and Susan

M.

Wachter, 1991."On

Choosing

among

Housing

Price IndexMethodologies,"AREUEA

Journal, 19, 286-307.Capozza,D., Hendershott, P., and Charlotte

Mack,

2004,"An Anatomy

ofPriceDynamics

in Illiquid Markets: Analysis and Evidence from LocalHousing

Markets,"Real

EstateEconomics,

lil'A, 1-21.Chan,

S., 2001, "Spatial Lock-in:Do

FallingHouse

PricesConstrain Residential Mobility?",Journalof

Urban

Economics,

49, 567-587... • .Engelhardt, G. V., 2003,

"Nominal

lossaversion, housing equity constraints, and household mobility: evidence fromthe United States."Journalof

Urban

Economics, 53(1), 171-195. v ; .

Genesove, D. and C.

Mayer.

2001, "Loss aversionand sellerbehavior: Evidencefrom

the\\ous,'mgma-rkQX." QuarterlyJournal

of Economics

A\6

{A), \21>l>-\26f).Greene,

W.H.,

2003,Econometric

Analysis, (5"^ Edition), Prentice Hall,New

Jersey.Harding, J., Rosenthal, S., and C.F.Sirmans, 2007, "Depreciation of

Housing

Capital,maintenance, and house price inflation...".Journal

of

Urban

Economics,

61,2, 567-587.Holtz-Eakin. D.,

Newey,

W., and Rosen, S.H, 1988, "Estimating Vector Autoregressions with Panel Data", £co/70777e/;7ca, Vol. 56, No. 6, 1371-1395.Kyung

So

Im,M.H.

Pesaran, Y. Shin, 2002, "Testingfor Unit Roots in HeterogeneousPanels",

Cambridge

University.Department

ofEconomics

Lamont,

O. and Stein, J., 1999, "Leverage andHouse

PriceDynamics

in U.S. Cities."RAND

Journalof Economics,

30,498-514.Levin,

Andrew

and Chien-Fni Lin, 1993, "Unit RootTests in Panel Data:new

results."Discussion

Paper

No. 93-56,Department

ofEconomics, UniversityofCalifornia at SanDiego. .

~

Leung, C.K.Y., Lau, G.C.K. and Leong, Y.C.F.,2002, "Testing AlternativeTheories of

the Property Price-Trading

Volume

Correlation." The Journalof Real

Estate Research, 23(3). 253-263.Nickell, S., 1981, "'Biases in

Dynamic

Models

with Fixed Effects," Econowetrica, Vol.49,No. 6. pp. 1417-1426. --.. ,

_.^-PerLundborg, and Per Skedinger, 1999, "Transaction Ta.xes ina Search

Model

oftheWo\ismgMar\.Qi'\ Journal

of Urban

Economics, ^5,2, l>i5-l>99.Pissarides, Christopher,2000, Equilibrium

Unemployment

Theory, 2" edition,MIT

Press,

Cambridge,

Mass.Stein, C. J., 1995, "Pricesand Trading

Volume

in theHousing

Market:A

Model

withDown-Payment

Effects," The Quarterly JournalOf

Economics, 1 10(2), 379-406.Wheaton,

W.C., 1990, "Vacancy, Search, and Prices in aHousing

MarketMatching

Model,''Journalof

PoliticalEconomy,

98, 1270-1292Wheaton.

W.C.

andGleb Nechayev

2008,"The

1998-2005Housing

'Bubble' andtheCurrent 'Correction': What's differentthis time?"Journal

of

RealEstate Research, 30,1,1-26.

APPRENDIX

I: Sales,PricePanel

Statistics MarketCode

Market AverageGRRHPI

(%) AverageGREMP

(%) AverageSFSALES

RATE

AverageGRSALES

RATE

(%) 1 Allentown* 2,03 1.10 4.55 4.25 2 Akron 1.41 1.28 4.79 4.96 3 Albuquerque 0.59 2.79 5.86 7.82 4 Atlanta 1.22 3.18 4.31 5.47 5 Austin 0.65 4.23 4.36 4.86 6 Bakersfield* 0.68 1.91 5.40 3,53 7 Baltimore* 2.54 1.38 3,55 4,27 8 BatonRouge

-0.73 1.77 3,73 5,26 9Beaumont

-1.03 0.20 2.75 4,76 10 Bellingham* 2,81 3.68 3.71 8.74 11 Birmingham 1.28 1.61 4.02 5.53 12 Boulder 2.43 2.54 5.23 3.45 13 BoiseCity 0.76 3.93 5.23 6.88 14 BostonMA*

5.02 0.95 2.68 4.12 15 Buffalo 1.18 0.71 3.79 2.71 16 Canton 1.02 0.79 4.20 4.07 17 Chicago IL 2.54 1.29 4.02 6.38 18 Charleston 1.22 2.74 3.34689

19 Charlotte 1.10 3.02 3.68 5.56 20 Cincinnati 1.09 1.91 4.87 4.49 21 Cleveland 1.37 0.77 3.90 4.79 22Columbus

1.19 2.15 5.66 4.61 23 Corpus Christi -1.15 0.71 3.42 3.88 24 Columbia 0.80 2.24 3.22 5.99 25 Colorado Springs 1.20 3.37 5.38 5.50 26 Dallas-Fort Worth-Arlington -0.70 2.49 4.26 4.64 27 DaytonOH

1.18 0.99 4.21 4.40 28 Daytona Beach 1.86 3.05 4.77 5.59 29 DenverCO

1.61 1,96 4,07 5.81 30 Des Moines 1.18 2,23 6.11 5.64 31 Detroit Ml 2.45 1.42 4.16 3.76 32 Flint 1.70 0.06 4.14 3.35 33 FortCollins 2.32 3.63 5.82 6.72 34 FresnoCA*

1.35 2.04 4.69 6.08 35 FortWayne

0.06 1.76 4.16 7.73 36 Grand Rapids Ml 1.59 2,49 5.21 1.09 37 GreensboroNC

0.96 1,92 2.95 7.2226

38 Harrisburg

PA

0.56 1.69 4.24 3.45 39 Honolulu 3.05 1.28 2.99 12,66 40 Houston -1.27 1.38 3.95 4.53 41 IndianapolisIN 0.82 2.58 4.37 6.17 42 Jacksonville 1.42 2.96 4.60 7.23 43 KansasCity 0.70 1.66 5.35 5.17 44 Lansing 1.38 1.24 4.45 1.37 45 Lexington 0.67 2.43 6.23 3.2546 Los Angeles

CA*

3.51 0.99 2.26 5.4047 Louisville 1.48 1.87 4,65 4,53 48 Little Rock 0.21 2.22 4.64 4.63 49 Las

Vegas

1.07 6.11 5.11 8.14 50Memphis

0.46 2.51 4.63 5.75 51 Miami FL 1.98 2.93 3.21 5,94 52 Milwaukee 1.90 1.24 2.42 5,16 53 Minneapolis 2.16 2.20 4.39 4.35 54 Modesto* 2.81 2.76 5.54 7.04 55 Napa* 4.63 3.27 4.35 5.32 56 Nashville 1.31 2.78 4.44 6.38 57New

York* 4.61 0.72234

1 96 58New

Orleans 0.06052

2.94 4.80 59Ogden

0.67 3.25 4.22 6.08 60Oklahoma

City -1.21 0.95 5.17 3.66 61Omaha

0.65 2.03 4.99 4.35 62 Orlando 0.88 5.21 5.30 6,33 63 Ventura* 3.95 2.61 4.19 5,83 64 Peoria 0.38 1.16 4.31 6,93 65 Philadelphia PA* 2.78 1.18352

2.57 66 Phoenix 1.05 4.41 4.27 7.49 67 Pittsburgh 1.18 0.69 2.86 2.75 68 Portland* 2.52 2.61 4.17 7.05 69 Providence*482

0.96 2.83 4.71 70 Port SL Lucie 1.63 3.59 5.60 7.18 71 RaleighNC

1.15 3.91 4.06 5.42 72Reno

1.55 2.94 3.94 8.60 73 Richmond 1.31 2.04 4.71 360 74 Riverside* 2.46 4.55629

5.80 75 Rochester 0.61 0.80 5.16 1.01 76 Santa Rosa* 4.19 3.06490

2.80 77 Sacramento* 3.02 3.32 5.51 4.9478 San FranciscoCA*

423

1.09261

4.7379 Salinas* 4.81 1.55 3.95 5.47 80

San

Antonio -1.03 2.45 3.70 5.52 81 Sarasota 2.29 4.25 4.69 7.30 82 Santa Barbara* 4.29 1.42 3.16 4.27 83 Santa Cruz* 4.34 2.60 3.19 3.24 84San

Diego* 4.13 2.96 3.62 5.45 85 Seattle* 2.97 2.65 2.95 8.10 86 San Jose* 4.34 1.20 2.85 4.5587 SaltLakeCity 1.39 3.12 3.45 5.72

88 St. Louis 1.48 1.40 4.55 4.82

89

San

Luis Obispo* 4.18 3.32 5.49 4.2790 Spokane* 1.52 2.28 2.81 9.04 91 Stamford* 3.64 0.60 3.14 4.80 92 Stockton* 2.91 2.42 5.59 5.99 93

Tampa

1.45 3.48 3.64 5.61 94 Toledo 0.65 1.18 4.18 5,18 95 Tucson 1.50 2.96 3.32 8.03 96 Tulsa -0.96 1.00 4.66 4.33 97 Vallejo CA* 3.48 2.87 5.24 5.41 98 WashingtonDC*

3.01 2.54 4.47 3.26 99 Wichita -0.47 1.43 5.01 4.39 100Wnston

0.73 1.98292

5.51 101 Worcester* 4.40 1.13 4.18 5.77Notes:Table provides theaverage real price appreciation overthe25 years,

average job growth rate, averagesalesrate, and growth in sales rate. ;

*

Denotes

"Costal city" in robustness tests.APPENDIX

IILet A/7,.

=

[zip,./.,....,zVP^y]'and As-,.=

[A5'|./.,....,z\5';^j.] ',where

iVis thenumber

ofmarkets. Let W-,.

-

[e,Apy_,,zlSy^,,,A.^,^

]be the vectorofrighthand

side variables,where

e is avector ofones. Let F, =[s^J.,...,£.^,]betheA^x

1 vectorof transformeddisturbance terms. Let

5

=

[aQ,a^,a2,J3^,S^]' bethevector ofcoefficients for the

equation. ,- ; -

_.—

Therefore,

Apr

=^^/5 +V^

. (1)'

Combining

all theobservations foreach time period intoa stacl<; ofequations,we

have,Ap

=

WB

+

V.

(2)The

matrixofvariablesthat qualify for instrumental variables in periodT

will beZj^ =[e,ApT^-,,As,_,,AX,j], (3)

which

changes with T.To

estimate B,we

premultiply (2) byZ' to obtainZ'Ap^Z'WB

+

Z'V

.

(4)

We

then forma consistent instrumental variables estimatorby applyingGLS

to equation(4),

where

the covariance matrix Q.= E{Z'VV'

Z] .Q

is notknown

and has to beestimated.

We

estimate(4) foreach time period and form the vectorofresiduals foreachperiod and form aconsistentestimator,

Q

, forQ

.5

,theGLS

estimatoroftheparametervetor, is hence:

B

=

[W'Z{Q.y'Z'WY'W'Z(Q.y'Z'Ap.

(5)The

same

procedure appliestothe equation wherein Sales (S)are on theLHS.

APPENDIX

III:AHS

Data

(House

PriceData from

Census)

year 138S 1937 1989 1991 1993 1995 1997 1999 2001 20CB 2005 2007 Rchange 1061 300 414 266 616 -312 116 -65 -53 -181 665 952 change 481 1071 1055 7S2 710 1603 1102 1459 1343 776 978 -221 Nev; Qel. 1072.5 1122.3 1026.3 837,6 1CB9,4 10655 1116,4 1270.4 1241.8 1385,3 1635.9 1216,5 Nev/ 537 553 482 473 557 579 409 430 564 501 641 688 NewR 27H 2877 2751 2381 2725 2959 2377 2387 2445 2403 2507 26SS RR ^25 7438 7563 7485 7184 7714 7494 6934 6497 63 S9 7291 7152 OR 1491 1448 1654 1129 1143 1186 1413 1309 1330 1233 1273 1426 OO IMS 2049 1913 1697 1769 1933 2074 2478 2249 2381 2913 2391 RO 2074 225G 2110 1980 2177 2337 2203 2378 2468 2305 2a)7 2032 Exits S39 295 -117 562 881 127 102 40 359 797 997 1515 RExits 1143 17S9 1881 1764 1075 2120 1465 1333 1360 1512 508 1123IjsB 520a5 4914,8 4481,3 4225,6 4 S32.4 43S15 47054 5097.4 5179.3 5797.3 eBia9 654aS

Sales laB 4863 4510 4150 4503 4399 4691 5236 5281 S1S7 6161 5111

Price 244.1647 264.3485 27a2473 256.9754 253.5429 253.331 25a1007 274.0435 295.7802 322.0329 37L4579 337,935

RealMedianHouse

PrKB 1454aai 1S621S7 158258.4 1563S4.1 156S7S9 159199.3 166624.9 175750.3 13^404.1 2030625 232526,1 217900