Asset pricing and expected inflation

Texte intégral

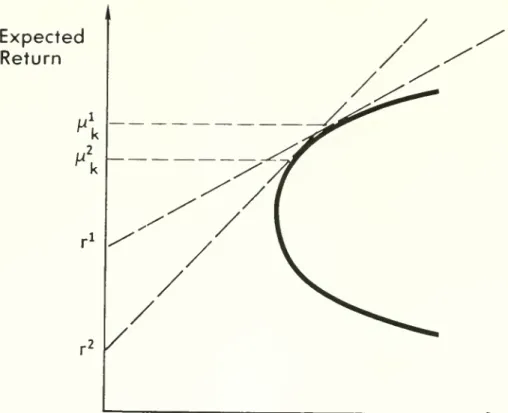

Figure

Documents relatifs

Nau (2003) studies the second order approximation of the risk premium for non EU preferences in the state- preference framework and obtains a generalised measure of risk aversion

Abstract ˗ We calculate the expected lateness for a late job in an M/M/1/K queue (i.e., the expected waiting time in the system after a threshold lead time l, given that the

Methods: We calculated relative phylogenetic diversity (i.e. phylogenetic diversity corrected for species richness), standardized effect size of the richness of top 25%

We will not use that fact in the following, but it suggests that it is highly probable that some link is to be made between random Fibonacci sequences and hyperbolic geometry;

Data from second-year family medicine residents show that 73% of them used or were exposed to EMRs as part of their clinical training; 75% expect to be using EMRs upon

In order to take maximal advantage of sparse data sets, the Flawed SGD-QN algorithm (see Figure 2 in the original paper) splits the stochastic parameter update (1) in two halves

More exactly, according the information available, the decision-maker can assign a probability or a possibility to a given event, and define an additive fuzzy

The cap rate, the equivalent of the dividend-price ratio in commercial real estate markets, captures time variation in expected returns but not expected rent growth rates of