I

IT

m

HD28

The

International

Center

for Research

on

the

Management

of

Technology

The

Death

Knells

of

Mature

Technologies

Carl W.I. Pistorius*

James

M.

Utterback

February

1995

WP

#

135-95

Sloan

WP

#

3859-95

''Institute for

Technological

Innovation

University of Pretoria

Will

appear

inTechnological

Forecasting

and

SocialChange

©

1995

Massachusetts

Institute ofTechnology

Sloan School

ofManagement

Massachusetts

Institute ofTechnology

38

Memorial

Drive,

E56-390

MASSACHUSETTSINSTITUTE

OFTECHNOLOGY

:T

271995

LIBRARIESABSTRACT

The

oscillatory' behavior in themature

phaseof

some

technologies' diffusion-related S-curvesare investigated, specifically with regard to the influences that other technologies can

have on

the oscillations

The

notionof

mortality indicators is raised, i.e.whether

such behavior is asignal that the

mature technology

isunder

attackfrom

anemerging technology

The

case ofstructural panels in the

wood

products industry is considered as an example,and

anupdated

forecast

of

the substitutionof

oriented strandboard

forplywood

ismade

It isconcluded

thatfactors such as

macroeconomic

business cycles are primarily responsible for the oscillations inplywood's

S-curve, although it isargued

that anemerging technology

can also contribute toperturbations in a

mature

technology's S-curve.Two

possible alternative explanations for theoscillatory behavior are also discussed, viz a previously

proposed

chaos-formulation and amathematical

model

basedon

modified Lotka-Volterra equations Thismodel

shows

thatoscillatory behavior in

mature

technologies' S-curves can also resultfrom

symbioticinteraction

between

two

technologiesunder

certain circumstancesIntroduction

Oscillatory behavior in the

mature

phase of the diffusion-related S-curvesof

technologies is aphenomenon

that hasbeen

recognizedand

discussed in the literature.One

of

the reasonswhy

this type ot oscillatory behavior is

of

more

than passingacademic

interest, is the questionwhether

the oscillations signal thedemise

of themature

technologies, iewhether

thev aremortality indicators foi

mature

technologies, as has beenproposed

previously in the literaturetechnologies, but also in the

development

and execution oi'end-game

strategies formature

technologies In this paper

we

address the questionwhether

the oscillations are indeedmortalitv indicators, or in the general case,

whether

they are insome

\\a\ triggered b\ theinteraction with another technology

Although

this paperdoes

not attempt to speak the finalword

on

the subject, it adds to the debate by consideringtwo

casesIn the first case, that of

plywood

being "attacked" by oriented strand board(OSB)/waferboard.

it isshown

that the oscillatory behavior inplywood's

S-curye correlatesvery well with the fluctuations in the residential fixed investment pattern in the

US,

and it isconcluded

that thismacroeconomic

effect rather than theemergence

of

OSB

causes theoscillations in

plywood's

S-curve This leads to the conclusion that oscillatory behavior per seis not a mortality indicator in the sense described

above

However,

it is possible to identifysome

perturbations in the S-curve that can be ascribed to theemergence

of

anew

technology

In the

second

case, a conceptualmodel

isdeveloped

to illustrate themore

general case ofinteraction of

one

technology with anotherOther

authorshave argued

that the oscillatory'behavior in the

mature

phase ofan S-curvemay

be a chaotic effectHowever,

thesearguments

have not taken into account the interaction of another

technology

with the technologyexhibiting the oscillatory behavior In this paper, a mathematical

model

is formulated toshow

that the symbiotic interaction

between

two

technologies can also give rise to chaos-likeoscillatory behavior in S-curves This conceptual

model

is offered to illustrate another (but notnecessanK

the only) possible cause for the oscillatory behaviorThe

model

is basedon

interaction

among

two

technologies is explicitlyaccounted

foi here, rather than justmodeling

one technology competing

against themarket

Mortality indicators of

mature

technologiesThe

identificationand

tracking ofemerging

technologieshave

important implications for acompany

from

a strategic viewpointAs

major

new

technological innovations createnew

industries

and

destroy old ones, it is essential that firms formulate strategiesand

deplovresources in a timely fashion

New

technologies bring withthem

the requirements fornew

strategies,

new

organizational structuresand

new

measures

of competitivenessFrom

theviewpoint of

managing

acompany's

R&D

effort, for example, earlvwarning of

anemerging

technology obviously can aid in the selectionof

projects, indicatewhich

research directions topursue

and

which

to stay clearfrom

Similar issues are ofconcern

to directorsof

publicresearch institutions and policy

makers

Barbe

et al.have

done

research toexamine

theway

companies

perceivenew

technologies vis-a-vis its competitors and theconsequences

of thecompanies'

responses [1 asquoted

by 2]They

found

that the earlier acompany

perceived thethreat of a

new

technology, themore

flexible its range of strategic responseswas

They

conclude

that it is important for acompany

to gather and process information assoon

aspossible before competitors erect barriers to entry Similar

arguments

canbe

made

toshow

theimportance

of

identifyingemerging

technologiesfrom

a national rather thancompany

viewpoint

Relying

on chance

successes is not a satisfactoryway

ofgoing about the search foremerging

technologies This is particularly relevant

when

one

considers the fact thatnew

technologicalinnovations very often originate

from

outside a particular industrywhich

it impacts (see forI l '-i-'i,;>-\ )<)

example

[3])The

implication is that there isno

obvious place to lookand

furthermore it isvery difficult to determine if

something

that is detected is actually anew

technology that is"emerging"

Once

such anemerging

technology hasbeen

identified,however,

there arevarious

ways

inwhich one

cankeep

track ofits progress, all with their different strengths andweaknesses.

A

systematicframework

for gathering and processing data is amuch

more

rewarding

strategy than grasping for straws in thewind

Several staicturedapproaches

thatcan be

employed

to aid in the search foremerging

technologieshave been

suggested (see forexample

[4-9], tomention

only a few)Rather than directing the search at the

new

emerging technology

itself,however,

itmay

beadvantageous

to use an indirect route byfocusing

on

thedemise of mature

technologiesFrom

the

accumulated

knowledge

baseon

the processesof

technological innovation, especially thediffusion

of technology

and the substitutionof one

technology with another,we

know

that therise of an

emerging

technology is often associated with thedemise

of an older,more

mature

technology In this regard, Foster speaks

of

attackers anddefenders

[10] Relying heavilyon

S-shaped

growth

curves, heshows

how

an older, defendingtechnology

canbe

attackedby

anew.

emerging technology

In the casewhere

thenew

technology

is attacking an older,established

technology

in a particularmarket

niche,one

can thus argue that ifit is possible todetect signals that

a mature

technology' is "dying",such

signalsmay

indicate thaia

newtechnology is

emerging

Ifthis hypothesis is true, the identification of mortality indicators ofmature

technologies can be a powerful technique to aid in the identification ofemerging

technologies It will be particularly useful in generating clues suggesting

where

to search foremerging

technologies, since the market niche hasnow

been identifiedThe

abilit) to identifycan be equally useful

from

the viewpoint of thecompany

that has an interest in the oldertechnology, since such a

company

willhave

to formulate and execute an appropriate andtimely response to the attack [11] In order to pursue this line

of

reasoning, it thusbecomes

necessary' to investigate the characteristics

of

mature

technologies, particularly with the aim offinding signals that indicate that the

mature

technology is being attackedby

anew. emerging

technology

Such

mortality indicators will be particularly useful ifthey can be identified in realtime

To

illustrate the concept, consider forexample

Modis

and

Debecker's

findingson

patterns ofactive service contracts in the

mini-computer

industry [12]Thev examined

the service lifecycle

of

computers and found

that the cumulative salesof

computers

followS-shaped

curves,but that the service lives

of

thesame

computers

follow so-called end-of-life curvesThe

lattertake explicit account ofthe mortality

of

products In their analysisModis

and

Debecker

kepttrack

of

thenumber

of

active service contracts for certain generationsof computers,

notingthat

hardware maintenance

contracts forcomputers

closely followsystems

sales Initially thenumber

of

contracts increases at thesame

rate as salesHowever,

whereas cumulative

salesfollow the logistic S-curve. the

number

of

active contracts reaches apeak

and

then startsdeclining as

machines

ageand

become

obsoleteModis

and

Debecker

point out that thegraph

depicting active service contracts

peaks

before the cumulative salesJoes

As

an explanationfor this

phenomenon,

they argue that " the totalnumber

ofunits soldof

a particular productincreases with time, reaching a ceiling at the

end of

the product's life cycleThe number

oi'products /// use.

however,

never reaches thesame

ceiling as there is a certain mortalityamong

the products sold"

They

found

thatcomputer

generations are replaceddue

to technologicalobsolescence

because

of aging per se.and confirmed

the notion thatcomputer

models

are.,

., ;

phased oui as a generation, as

opposed

to personal cars, for example, thai are phased outindividual

Computer

models

thus phase out as their generationbecomes

outdated,independently of

when

theywere

soldIn the case of

computer

models, thenumber

of service contractsmay

thusprove

to be amortality indicator for

mature

technologiesAlthough

there are certainlymany

aspects andcharacteristics

of

mature

technologies that can be investigated as potential mortality indicators,we

shall concentrateon one

particularphenomenon

in this paper, viz the oscillatory behaviorthat is

sometimes

detected in themature

phase of the diffusion-related S-curveof

some

technologies

Oscillatory

behavior

inS-curves

The

S-curve is a verv wellknown

concept in innovationmanagement

and

hence it will not beelaborated

on

here in any detail, save tomention

that it has application in explaining diffusion,substitution as well as technological progress

There

is strong empirical evidence that inmany

cases, the diffusion

of

atechnology

over time displays asmooth

growth

pattern—

in fact, thatis the

whole

notion underlying the shapeof

the S-curve.However,

the actual data points veryoften exhibit erratic behavior in the sense that they deviate

from

thesmooth

curve.Although

some

of these deviations can be ascribed tomeasurement

error,many

ofthem

cannot, andtherefore

must

be ascribed to other influencesThe

deviations often exhibit a clear oscillatorybehavior in the

mature

phase, and it is to these oscillations thatwe now

turn our attention Justas the rate of diffusion of a technology can be ascribed to

many

factors (see [13-19]. forexample),

one

cannow

also askwhat

causes the oscillatory behavior in themature

phase ofSeveral authors

have

commented

on

fluctuations thatsome

growth

curves develop as theyenter the

mature

phase,among

them

Montrey

and

Utterback [20], Marchetti [21],Modis

and

Debecker

[22],and

Modis

[23. 24]With

regard to the oscillatory behavior in themature

phase of the S-curve,

Modis

states 'At

the extremities of the substitution processdeviations

from

the logisticgrowth

patternhave

been

observed

As

the substitutionapproaches

completion

—

above

90%

—

the trajectorv pattern breaks intorandom

fluctuations'" [24] Marchetti notes that " these logistics or quasilogistics can

become

oscillators'

when

approaching

saturation (a possible solutionof

Volterra equations oftenappearing in ecological contexts)" [21]

These

comments

support the notion that theappearance

ofoscillations in themature phase of

some

technologies' S-curves is a recognizedphenomenon

Montrey

and Utterback,however,

go

furtherand

lav the seed for the hypothesisthat such oscillations

may

actually indicate theemergence

of

anew

technology

attacking theold Referring to the oscillations in the

mature phase of plywood's

S-curve, they state "...We

venture to hypothesize that the type of variance in production

of

acommodity,

such asshown

for

plywood

in recent years is a clear signof

the vulnerabilityof

that product to anemerging

substitution such as the

one

depicted forwaferboard and

oriented strandboard

(OSB)

The

same

patternappears

in chartsof

sales of several othercommodities

such asaluminum"

[20]The

questionsnow

arisewhether

the oscillations in themature

phaseof

a technology'sS-curve are mortality indicators

and

ifsounder

which

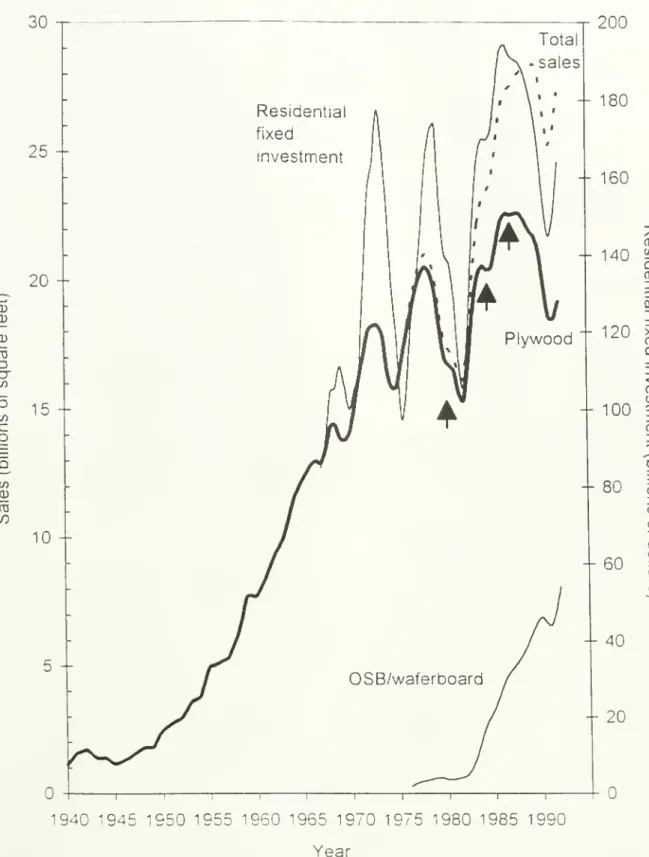

circumstancesFigure 1

shows

the sales o\~phwood

andOSB/waferboard

in theUS

Note

boss thegrowth

curve of

plywood

grossssmoothly

(withminor

oscillations), but then breaks intopronounced

oscillations in the

mature

phase, and hoss theemergence

of

a nesstechnology

(OSB

waferboard) coincides with the onset of oscillatory- behavior in the S-curve oi' themature technology

(plvwood

in this case) Since external factors such as those referred to in aearlier in tins section

have

such an important influenceon

the rate ofdiffusion, is it reasonableto assert that they, or other external factors, will also cause or influence the oscillations'1 If so.

this

would weaken

theargument

that the oscillations are triggered by theemergence

of

anemerging technology

For

example. Girifalco points out that erratic behaviorfrom

thesmooth

S-curve can be attributed to changes in the business, political

and

socialenvironments

or tothe specific differing characteristics of the adopters [25] Davies has

shown

that thegrowth

curve exhibits oscillators- behavior

due

to the fact that the industry (niche) isexpanding

orcontracting [17]

A

chaos

formulation has alsobeen proposed

byModis

andDebecker.

and isdiscussed later in this

paper

From

a mortality indicator viewpoint,however,

the question thatarises is

whether

these oscillations arebrought

about by theemergence

of a challengingnew

technology in

some way

or another Ifso. is this a necessary, sufficientand unique

conditionfor the oscillations

Obviously

ifone

canshow

that the oscillations are triggeredby

theemergence

ofanew

technology

{and only by theemergence

of

anew

technology), it will be anextremely

powerful and

useful indicator withprofound

implicationson

the ability to identifyand track

emerging

technologies as well asend-game

strategies formature

technologiesAlternatively, the

weaker

casewhere

anemerging technologv

also influences (but is not solelyresponsible for) the oscillatory behavior in a

mature

technology's S-curve is also useful,although less so and

more

complicated to apply operationallyDiffusion of

plywood and

OSB/waferboard

Montrey and

L'tterback investigated the diffusion ofplvwood

andOSB

waferboard

in the lightframe construction industry [20.26] This case is discussed here as an illustrative

example

forI-several reasons, viz it is a

good

example

of oscillatory behavior in amature

technology'sS-curve, it illustrates the interaction

between

two

technologies within thiscontext (asopposed

tojust

one

technologycompeting

against themarket)

and it hasdrawn some

discussion in theliterature

After

World

War

II,and

particularly since the 1950s,plywood became

thedominant

staicturalpanel in the industry', having gradually displaced

lumber

as the preferred sheathing material forfloor, wall and

roof

constructionHowever,

since the late1960s

severaldevelopments

led tothe

appearance

of

new

unveneered

panels (notablywaferboard

andOSB)

that startedchallenging

plywood's

dominance

[20], vizTechnology

relateddevelopments

There

were

processadvancements

for themanufacture

of

chip or flake based panelsRaw

materialdevelopments

The

pricesof

plywood were

increasing fast,due

in part to thedepletion

of

suitable timber supplies for themanufacture of

plywood

On

the other hand,suitable

new

timber supplies forunveneered

panelswere

being exploited atlower

costsLately there has also

been

some

environmental pressures that tend to limit theraw

materialsupply of

plywood

Market

developments

The

remainingraw

material supplv forplvwood

had been

decliningin quality

Political

developments

There

hadbeen

some

changes

in buildingcodes

thatmade

theunveneered

panelsmore

acceptableThe

new

unveneered

structural panelswere

mainly waferboard,COM-PLY

and

OSB

first

marketed

in 1976. but had notproven

to be a very successful product and has almostdisappeared as a serious competitor

OSB

hasbeen

commerciallyproduced

since 19S1 and hasbeen

very successful It hasproven

to be superior towaferboard

and insome

respects also toplvwood

All threeof

theplywood

substitutes aremarketed

as structural sheathingcommodities

Montrev

and Utterbackconcluded

thatplywood

was. andwould

continue to be.at a severe cost disadvantage with regard to the

newer

panels, and that therewas

no doubtthat

plywood

was

under

attackfrom

thenewer

panels [20].OSCILLATORY BEHAVIOR

OF

THE

S-CURVE

Consider

now

again Figure 1which

shows

the salesof

plywood

andOSBwaferboard

in theUS

(as well ascombined

sales) in billionsof

square feet, calculatedon

a 3/8" basisThe

dataon

plywood

was

obtainedfrom

Montrey

and Utterback

for the period1940-1975

[20]From

1976

onwards

both theplywood

and

OSB

datawere

obtainedfrom

[27]Waferboard

and

OSB

have been

grouped

together as a categoryof

unveneered

panelscompeting

withplywood

as in

Montrey

and Utterback's originalpaper

[20]The

sharp upturn in the curve for theunveneered

panels in the earlv1980s corresponds

with the introduction ofOSB

Note how

theplywood

sales generally follows an S-curveand

has a relatively uneventful life untilapproximately

1970

when

the sales curve starts oscillatingThe

fact that these oscillationscorrespond

with theemergence

of theunveneered

panelsprompts

the questionwhether

theoscillations in

plywood's

S-curve are causally related to theemergence of unveneered

panels,i e

whether

the fluctuations indicate the presence ofa superior substituteand

are triggered bythe resulting fluctuations in

demand

If so, itwould

lend credibility to the hypothesis thatattack

from

anemerging

technology, andhence

that oscillations can be interpreted as mortalityindicators

Montrey

and Utterback ascribe the oscillations inplywood's

curvethroughout

the 1970s tothe '

erratic nature

of

the overallwood

productseconomy

during thatdecade"

They

comment

that " the steepdrop

in themid-1970s

coincides with the nation's recessionduring that period, during

which

housing constructionsank

to verylow

levels" In order totest this statement,

we now

compare

residential fixed investment trends in theUS

withplywood's

S-curve.The

assumption

is that, since the lightframe

construction industry is amajor

contributor to the residential fixed investment and this industry isone

ofplywood's

main markets

[28], anexamination

ofthe correlationbetween

time series data for residentialfixed investment and

plywood

saleswould

be agood

indicator to test the hypothesis thatoscillations in the curve for

plywood

arecoupled

tomacroeconomic

business cyclesData

forresidential fixed investment

was

obtainedfrom

Gordon

[29] for the period1950-1979,

andfrom

Statistical Abstractso^

theUS

[30] for the period after that'The

residential fixedinvestment is also

shown

in Figure 1 (in constant1982

dollars)The

correlationbetween

themarket swings

in the curve for residential fixed investmentand

the oscillations in the total salesis remarkable

(Note

thatwe

are looking specifically at the phases rather than the amplitudes,since

we

arecomparing

sales in billionsof

square feet in the caseof

plywood

with billions ofdollars in the case of residential fixed investment ) Since

plywood

constitutes amajor

part ofthe

market

share, itwould

be fair toconclude

that sales ofplywood,

and

particularK theoscillations in its S-curve. are indeed

coupled

tomacroeconomic

business cycles, specificallyresidential fixed investment

One

should,however,

be careful about the causality implied inthe residential fixed investment curve driven by the

plywood

sales"1Ifthe latter is the case, it

may

be that theplvwood

curve oscillates for reasons other than the residential fixedinvestment

and

that the residential fixed investment only follows theplywood

curveA

more

plausible explanation is that the residential fixed investment in the

US

isdetermined

bymacroeconomic

conditions and that it should be considered as a"demand"

curve or driver inthis setting Surely decisions to build

new

housing is notdetermined

bv theamount

of timbersold

—

rather the otherway

around

Timber

products are supplied inter alia to fulfill thedemand

for housingand hence

theplywood

curve followsthe residential fixed investment It isalso interesting to note

how

both theplywood

and

OSB/waferboard

curves tend to track theresidential fixed investment in the latest years for

which

the data are given Recall that thesharp upturn in the

OSB/waferboard

curve in the early eightieswas

caused

by theemergence

o\~

OSB

as a technology Itwould

seem,however,

that asOSB

becomes

an establishedtechnology and gains significant

market

share, its fortunes are also linked to residential fixedinvestment in a

more

pronounced

way

The

dips in the curvesaround 1990

illustrate this pointIt will be interesting to see if

OSB

continues to track the oscillatory behaviorof

the residentialfixed investment curve in years to

come, and

if the couplingbetween

theplywood

curve andresidential fixed investment decreases as

plywood

losesmarket

shareThe

arguments

in the previous paragraph leadsone

toconclude

that oscillations inplywood's

S-curve are primarily the result of fluctuations in the residential fixed investment pattern and

therefore are not triggered by the

emergence

ofOSB/waferboard

Hence

the oscillationscannot be interpreted to be mortality indicators per se

The

questiondoes

arise,however,

ifthe

emergence

of thenew

technology contributes tosome

secondary or smaller perturbationsS-cun.es

of

plywood

andOSB/wafcrboard

as well as the S-curve ofthecombined

salesNote

that there are three "hiccups"

superimposed

on

the general oscillatory patternof plvwood's

S-curve (indicated with small

arrows

in Figure 1)At

the first hiccup, theS-curve

of

plywood

tracks the

S-curve of

the total sales very closelyAt

this pointOSB/waferboard

had

not reallymade

anvmarket

impact and the total sales for all practicalpurposes

therefore represents thesales

of plvwood. At

thesecond

hiccup,however,

the dip inplywood's

S-curve ismuch

more

severe than that

of

the total sales and furthermore there isno

hiccup at that time in theS-curve

of

OSB/waferboard

This could be interpreted tomean

that theplywood

sales lag total salesfor a while, but then catches

up

again It istempting

to speculateon

the causeof

this deviationin the

plvwood

salesOne

hypothesis mightbe

that thedemand

for structured panelswas

being taken

up by

theunveneered

panels rather than byplywood

The

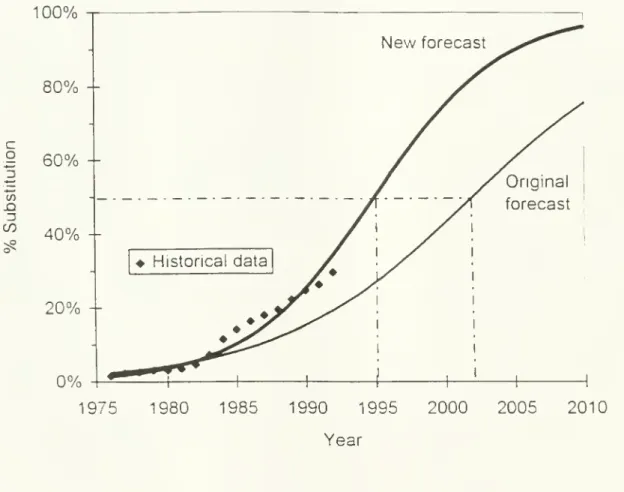

historical data inFigure 2

shows

how

theunveneered

panels gainedmarket

share at theexpense of plywood,

lending support this hypothesis- If this is the case,

why

does

plywood

then recover, asindicated

by

theplywood

curve thatresumes

growth

after the hiccup7A

possible explanationis that the

demand

forunveneered

structured panelswas

greater than the capacityand

that theresulting slack

was

then takenup

byplywood

Table 1

shows

thedemand/capacity

ratios ofplywood

andOSB

in theUS

for the period 1981to

1989

[27] Ifwe now

focuson

the period1983-1987, which corresponds

with the periodwhere

the trends inplywood

salesseemed

to lag the trend in residential fixed investment cycleas

shown

in Figure 1,we

note that the industrydemand/capacity

ratio increasedfrom

SO

toS7 (with a high of

OSS

in 19S6), reSS°o

The

demand/capacitv

ratio forplywood

increased

from

S2 to 0.8-4 (with a highof

87

in 1986), i.e 24%

However,

thedemand

capacity ratio forOSB

increasedfrom

58 to90

(with a high of 93 in 1986). i e55°o

There

is thus evidence of amuch

steeper increase in thedemand/supply

ratio forOSB

than forplvwood

Thismav

indeed indicate thatOSB

supplvwas

harderpushed

tomeet

demand

and hence

unfulfilled orders mighthave been

filled byplywood

Note

that eventhough

capacity

was

still larger thandemand,

there might havebeen

regional factors, for example, thatcaused short

term

shortages inOSB

This explanation of interactionbetween plvwood

andOSB/waferboard

can account for the hiccup in theplywood

curvearound

1985, and so lendsupport to the larger hypothesis that an attacking

emerging

technology can contribute to theperturbations in a

mature

technology'sS-curve

In order to identifv such aphenomenon,

one

would

thus typically subtract the sales curveof

the contributing technologyfrom

the total salescurve

and

isolate irregularitiesThe

third hiccupseems

to exhibit a similar behaviorwhere

boththe total sales

and

thatof

OSB/waferboard

is growing, but the salesof

plwvood

is dippingJust as

one

treedoes

notmake

a forest,one

ortwo

hiccups in an S-curvedo

not constitute anoscillatory pattern

However,

thearguments

above

support the general conclusion that anoscillatory pattern in the S-curve are not necessarily triggered bv the attack

from

anemerging

technology

What

does

seem

plausible,however,

is that anemerging technology

can. togetherwith other factors, give rise to perturbations in the S-curve (but not necessarilv to

oscillations)

Given

thearguments advanced

in the previous paragraph, this statement shouldimmediately be qualified bv saving that such perturbations should be carefullv analyzed within

the context of other influences (such as

macroeconomic

business cvcles) and that themere

existence

of

oscillations or perturbations is notenough

to qualify' as a inortalitv indicatorOne

of the difficulties, of course, is to distinguish

between

such indicatorsand

regular statisticalfluctuations

As

the dataon

the residential fixed investment shows, the oscillations can beeffects o\~ the

emerging

technology Interpreting the signal thus entailsmore

than justobserving an oscillators' pattern or perturbations

As

thisexample shows,

external influencessuch as the general

economic

climate and business cycles can play a significant roleTaking

into

account

measurement

errorsand

other sourcesof

fluctuationsand

oscillations mentioned,together with effects caused by business cycles, it is evident that a certain

amount

of signalprocessing will

have

to bedone on

an S-curve to extract potential signalsfrom emerging

technologies

FORECASTING THE

SUBSTITUTION

PROCESS

Montrey

forecasted the substitutionof

OSB/waferboard

forplywood

in1982

[26] Treatingwaferboard

andOSB

asone

product categoryand

using a Fisher-Prymodel

[31], heformulated the forecast in the

form

/(0

=

-[l

+ tanha(/-/

)] (1)where

f(t)

=

fraction of takeoverof

OSB/waferboard

in yearta

=

half the initial exponential takeover ratet

(l

=

year inwhich

the substitution is50%

completed

The

constantswere found

to bea=0

071 1and

t=2002.

i.e the forecast indicated that half theUS

structural panelmarket

would

bemade

up of unveneered

panels(waferboard and

OSB)

bythe year

2002

In their 19 Q paper.Montrey

and Utterback refer to the19S2

forecast, andspecificallv to the fact that a

14S°o

substitutionwas

predicted for1985

whilst the truesubstitution

was

in fact15%

[201(However,

basedon

the constants given in their paper, itwould

seem

that themodel

given in their1990

paper actually predicts a S16%

substitutionrather than a 14

8%

substitution in 1985Hence

the rate substitutionwas

even

brisker thanthey predicted).

Having had

the benefitof

severalmore

years ofhistorical data, the temptationof updating the forecast again

was

too great to resist (and in retrospect probably against thepresent authors' better

judgment)

Subsequently the substitution dataof

OSB/waferboard

forplywood

for the period1976

to1992

was

applied in a Fisher-Prvmodel

similar to the originalone

described bvMontrey

and Utterback.The

parameters for thenew

forecastwere

determined with the software

accompanying

Porter el al.'sbook

[4]Based

on

thenew

data.the coefficients for the

new

forecastwere

found

to bea=0.10S7

and

t„=1995

As

in theoriginal forecast, it

was assumed

here thatplywood

and

OSB/waferboard

address thesame

market segments

and that theyaccount

for the totalmarket

between them

Thisassumption

isa

rough

approximation, sinceMontrey

and

Utterback state that there are mutually exclusivemarket

segments

for bothplywood

and

OSB

[20]The new

forecast isshown

in Figure 2 together with the historical data as well as the originalforecast

According

to thenew

forecast, the substitution will be50%

completed

in 1995The

fact that this forecast predicts a stronger current

showing

forOSB

than is evidenced bv thecurrent historical trend is slightly worrying.

However,

there is strong evidence thatOSB

willcontinue to

grow

at theexpense

of plywood.

As

ofSeptember

1994

therewere

indicationsthat at least 15

new

OSB

plantswere

likely to be build inNorth

America

before the turn ofthecentuiA [32] At the

same

time there is also evidence ofa fallingplywood

production This isin

pan

due

to the lack of raw material, environmental pressuresand governmental

resourcethis

purpose

[33]The

statement thatNew

oriented strandboard

mills,meanwhile,

havefilled the void left as

plywood

mills shutdown

because

they couldn't get big logs to peelAs

even

more

oriented strandboard

capacity is added, itmay

elbow

aside olderplvwood

millswith uncertain

and

expensive log supplies" [34], is typical of opinions expressed in themedia

circa late

1994

The

issue iswhether

capacity tomanufacture

OSB

can bemade

available asfast as

plywood

capacity fallsaway

[35]As

a defensive strategy,one

can expectplywood

manufacturers to target niche

markets

that are not addressedby

OSB

A

chaos formulation

We

now

turn our attention to alternative explanations for the oscillatory behavior This part isintroduced by a discussion

of

a previouslyproposed chaos

formulation,and

is then followedby the presentation of a modified Lotka-Volterra

model which

illustrateshow

the symbioticinteraction of

two

technologies can give rise to oscillatory behavior in themature

phase of anS-curve

Referring to the oscillatory behavior in the

mature

phaseof

some

technologies' S-curves,Modis

comments

that "These

deviationshave been

explained in termsof

states of chaos,which

areencountered

when

the logistic function is put in discrete form,which

becomes

essential in order to analyze data via

computer

programs which

employ

iterative techniques,but it can also be justified theoretically

because

populations are discrete quantities after all"[24] In another article

Modis

and

Debecker

make

thecomment

that "The

annual rate of apopulation

growth

into anew

niche had oftenbeen

seen to follow a logistic pattern that brakesinto fluctuations ol~

random

character and sizable amplitude just before reaching the ceiling"[22]

Thev

thenproceed

to explain the oscillatory behavior of thegrowth

curves withchaos

,. c,.

theory

Modis

andDebecker's

paper suggests a justification for an investigation into theseemingly chaotic nature

of

the oscillations in themature

phaseof

S-curvesIn addition to

Modis

and Debecker's

contributions, several other articleshave been

publishedover the last couple

of

years toshow

the relevance ofchaotic behavior and the associated useof fractals to

growth

models

of technologies and technological forecasting (see forexample

Gordon

andGreenspan

[36,37],Bhargava

el al. [38],Gordon

[39,40] andModis

[23.41])The

conclusion thatBhargava

el al.come

to is telling of the sentiment ofmany

ofthe papers,viz "... the

importance of

the logistic equation in describingeconomic

and

social behavior isundeniable

However,

one must

be prepared for the greater richnessof

the behavior of thesolutions, particularly for large values of the nonlineantv

parameter

X" [3S]The

logisticequation that is referred to is the discrete difference equation

form of

the differential equationfor

which

(1) is the solution, andwhich

leads to chaoticand

oscillatory behaviorwhen

X

islarge (X being a

parameter analogous

toa

in (1))According

to the narrative inModis

andDebecker's

article [22], theyhappened

upon

thechaotic behavior whilst searching for

ways

inwhich

to speedup

algorithms to generateS-curves

By

discretizing the calculation, they not onlvsucceeded

in generating the S-curves, butalso fluctuations in both the initial and

mature

phases of the curveRecognizing

that thefluctuations

were

akin to the oscillations that are oftenobserved

on

growth

curves, theyinvestigated the appropriateness

of

a chaos explanation for thephenomenon

Thev

proceeded

to investigate the effect by

changing

the natureof

parameters in the discrete representation ofthe S-curve Their simulations yielded systems with seemingly chaotic behavior, and

hence

their claim that

chaos

theory can account for theS-shaped growth

curve, oscillations in themature

phase of S-curves. as well as similar fluctuations oftenobserved

in the earlygrowth

phases ofa technology

They

also suggest that chaotic behavior can exist in the transitionaryperiod

when

one

S-curve is replacedby

another, i.e.when

themature phase of one growth

curve is blended into the early phase

of

the next curveThe

annual productionon bituminous

coal in the

US

is held as anexample

Modis

andDebecker's

statements that ".One

could reasonably expect that anupcoming

growth

phase in anew

market

niche will be heralded by precursors and,once

installed, willproceed

at an acceleratedrhythm

in the beginning",and

"A

well-establishedS-curve

willpoint to the time

when

chaotic oscillations should be expected; it iswhen

the ceiling is beingapproached

In contrast, an entrenchedchaos

will reveal nothing aboutwhen

the nextgrowth

phase will start" [22] deserve

some

comment

The

notionof

precursors that indicate anew

growth

phase isnoteworthy and

lends support to the hypothesis that oscillatory behavior (orperturbations) in the

mature

phaseof

technology'sgrowth

may

indicate the rise of anemerging

technologyDrawing upon

the inherentdeterminism

in chaotic systems,Modis

andDebecker

seem

to imply,however,

that there is a certain inevitability in the onsetof

thechaotic oscillations

Gordon

alludes to thesame

notionwhen

he savsof

chaotic oscillationsgenerated by a simulation

of

sales as a function oftime, "An

analystwould

understandably,wonder

about the causes for themarket swings

What

caused

them

9 In fact,no

externalitieswere

responsible, allof

thecomplex

behavior ofthis curve resultsfrom

within thesystem

...To

search for externalities responsible for themarket

performance

would

be

misplaced effort,for in this example, all

of

the chaotic behaviorcomes

from

internal sources" [40]Modis

refersto

Montrey

and Utterback's explanations for the fluctuations in thegrowth

curve ofplywood

b\ stating that "

From

1970

onward

a pattern of significant (plus or

minus 20

percent)instabilitN appeared,

which

Montrey

and Utterbacktried to explain

one

byone

in terms ofsocioeconomic arguments

Given

a patternone

can alwayscorrelate other

phenomena

to itThis type ofpattern,

however,

couldhave been

predicted a

pnon

by chaos formulations" [23]The

arguments

presented in the previous sectionseem

to indicate,however,

that the residentialfixed investment did play a

dominant

role in determiningthe oscillatory behavior in

plywood's

S-curve

The

chaos-based

model

thatwas

referred to in this section describes atechnology

which

competes agamst

the market, i.e. the formulationdoes

not explicitlyaccount for the effects of

one

ormore

technologies Oftenone

finds,however,

thattwo

or

more

technologies arecompeting

or are interacting withone

another in a givenmarket segment

In the next section a

mathematical

model which

involvestwo

interacting technologies and that can alsolead to

oscillator, behavior, is described This

model

is applicableto the general case of

two

interacting technologies and is not restricted to the interaction of

emerging

and

mature

technologies It should be stressed that the

model

is presented asa conceptual one, very

much

in the

same

vein as thechaos

formulationof

Modis

and Debecker

[22], rather asone

that haswithstood the test of time

Modeling

the oscillatorybehavior with modified Lotka-Volterra

equations

The

differential equation.s) describing the diffusion of a technologymust

bebased

on

theunderlying

mechanisms

involved In order tomodel

thediffusion characteristics of a

technology, it is therefore necessary that the extent of the

resources available be taken into

account Finite resources are often

embodied

in amarket

nicheoffinite size

A

single equationcannot,

however, descnbe

thegrowth

and competition ofit does not account for their respective effects

on

one

another It can at bestmodel

thediffusion of

one

technology into amarket

[42]To

model

the competition oftwo

technologies,one

would

need to set up a differential equation for eachof

the technologies basedon

theunderlying drivers and inhibitors for that technology, together with coupling coefficients that

reflect the technologies" effect

on one

another'sgrowth

rate In order to address theproblem

at hand, it is necessary to

model

both the technologies explicitly, each with itsown

equationThey

must

then becoupled

with coupling coefficients toaccount

for the interactionbetween

them

A

system

of differential equations rather than a single equation is therefore requiredSuch

asystem

that is applicable to thisproblem

hasbeen

formulatedsome

timeago

bv theecologists

Lotka

and Volterra. but until very recentlywas

not widely applied to the diffusionof technology

The

system of equations that theydeveloped

hasbecome known

as theLotka-Volterra equations

Several authors

have

shown

orcommented

on

the fact that theLotka-Volterra

equations canbe successfully applied to

model

technological diffusion,among

them Bhargava

[43], Farrell[44], Marchetti [21,45],

Modis

[23],Nakicenovic

([46] asquoted by

Marchetti [45])and

Porter el al. [4] Marchetti

comments

that 'I

am

fairlyconvinced

that the equations Volterradeveloped

for ecologicalsystems

are vers'good

descriptorsof

human

affairs In anutshell, I

suppose

that the social system can bereduced

to structures thatcompete

in aDarwinian way,

their flow and ebb being described bv the Volterra equations, the simplestsolution of

which

is a logistic" [21 ]Even

though

the Lotka-Volterra equationsmay

be suitable tomodel

technological diffusionand substitution, the question arises

however,

as to the appropriatenessof modeling

theoscillatory behavior in the

mature

phase of the S-curve, with these equationsThere

areseveral references in the literature that suggest that the Lotka-Volterra equations

may

indeedlead to a

modeling

solution for the oscillatory behavior thatwe

areconcerned

with herePorter el a!., for example, state that " Oscillatory

models

are a final class ofmodels

accommodated

by the Lotka-Volterra equations Periodic behaviors arecommonly

found

innatural populations and they can be successfully

modeled

using the Lotka-Volterra equationsOscillators' behaviors

have been

observed inconsumption and

mining patterns in the 'unitedStates and in car

and

transportation systems inEurope

These growths

oftenshow

alogistic start followed

by

an overshoot and then oscillationaround

asupposed

limitThe

more complex

populationmodels

such as Lotka-Volterra, can represent such behaviors if theforecaster has correctly surmised their

form..."

[4]The

above

reference to a logistic equationthat overshoots and then oscillates

around

a limit is strongly indicativeof

the type ofoscillations that

we

are interested in, i.e those that aresometimes observed

in themature

phase

of

a technology Recall also Marchetti'scomment

quoted

earlier to the effect thatS-curves can

become

oscillatorywhen

approaching

saturationand

that this is a possible solutionof

Lotka-Volterra equationsConsider

now

two

technologieswhich

are interacting in a symbioticway

Symbiosis

is anecological

term and

refers to the association oftwo

differentorganisms

Using attached to eachother or

one

within the other to theirmutual advantage

The

term

is related to the concepts ofmutualism and commensualism,

but for thepurpose

ofthis discussion, it ismeant

to imply theinteraction

among

two

technologies such that each has a positive influenceon

the other'sgrowth

rateA

system ofnonlinear differential equations(which

isbased on

Lotka-VolterraciN , dt

—

= a

nN-b

nN-

+c

nm

NM

(2)dKl

,—

=

a

m

A

1-

b,„A

I~+

cim

A4N

(3 )where

N(t)and

Al(() represent the "populations"of

thetwo

technologies (such as sales, forexample)

and all coefficients are positive This set of equations differsfrom

traditionalLotka-Volterra equations in the sense that both ^-coefficients are positive,

and

furthermore hasbeen

modified to depict symbiosis

by

having positive signs forboth

the coefficients that regulate theinteraction

among

thetwo

technologies (cnm

and

cmn

).A

generic phasediagram

for thisformulation is

shown

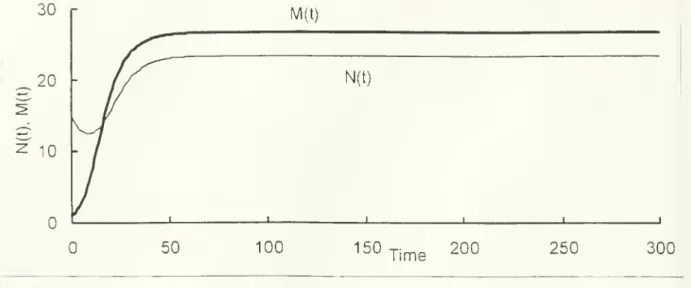

in Figure 3.The

equilibrium lineson

the associatedphase

diagram

thatindicate

where

dN

di=0

and dhl

dt= Q are respectively givenby

N

=

^L

+ ^SL

M

(4)b„ o„

M

h"< KA "'"c..,„ c..

inn

The

axes of thephase diagram

are also equilibrium lines, i edM/dt=0

on

the yV-axiswhere

A/-0

anddN.dt=0 on

the A/-axiswhere N=0. The

equilibrium point(N*,M*)

represents theposition

where

dN

dt=

and

dM/dt=0

simultaneously (i e the intersectionbetween

thesetwo

lines) and is normally a stable point, in the sense that

once

it hasbeen

reached, the trajectorywill terminate there

The

arrows

in the four subregionsof

thephase

diagram

indicate thedirectional derivatives in those regions

Note

that time is aparameter

for a trajectoryon

thephase

diagram

Pielou's iterative solution for the set of equations [47] are modified to account for the

symbiotic interaction, yieldingthe solution

where

andwhere

N(t +

l) ;v N(t)

fc

)\-P

nN(,)-\^\P

nMU

(6) ?=

ea" (7)P„

b n(e a »-1)

(8)M(l

+

1)X,„M{t)

\+

p

m

M{t)-C-f

L \ (9)An "

L' 10) p, b,„(ea»<-\)

(11)In order to illustratethe

dynamics

ofthis formulation, considernow

thesystem

\'{D=

.Y(0.1-0.01.V-c„„

(A/)

( 1

.\/m

=A/(0

15-001.\/-c„„,.Y)

(13)with c„„,=0.005

and

cmn

=0.005

Let the initial conditions be Af(0)=\and

N(0)=\5

It should

be stressed that the

numeric

valuesof

the coefficients as well as the initial values are notintended to relate to any real situation

—

the coefficientsa

and b in thisexample

were

randomly chosen

with c adjusted to illustrate thedynamics

conceptuallyThe

resultinu timedomain

plotand

associated phasediagram

areshown

in Figures 4and

5Note

how

thetrajectory

on

the phasediagram approaches and

terminateson

the equilibrium pointComing

back

to the oscillatory behavior in themature phase

of an S-curve,we

note that aninteresting

phenomenon

occurswhen

cmn

cmn

approaches

b„b

m

Consider

again the phasediagram

in Figure 3As

expected, a trajectory that initiates in subregion 1approaches

theequilibrium point

However,

rather than terminate at the equilibrium point (as in Figure 5), thetrajectory

seems

toovershoot

and then breaks into an oscillatory patternA

cursory inspectionofthe oscillators' pattern in the time

domain

reminds

one of

a chaos-like state Figures 6and

7show

the timedomain

plot and phasediagram

when

cm

„=0.005

and cnwi

=0.0157,

yieldingvalues

of

b„b„ =0.000]

and c„„,t„„,=0000079

(whereas

in the previous caseciwic'>nn

=

Q000025)

Both

technologies live fairly uneventful lives in thetime

domain,

followingregular

growth

along S-curves untilapproximately

/= 240

when

theyboth

break intochaos-like oscillatory patterns

By

examining

the timedomain

plot in Figure 6,one might

wonder

what

gives rise to thesudden

burstof

oscillations in themature

phase after thetwo

technologies coexisted for a long time during

which both

followednormal

logisticgrowth

Itturns out that there is nothing mystical about the time

when

theoscillations start

An

examination

of

the associated phasediagram

in Figure 7 reveals that the timewhen

theoscillations start corresponds with the time

when

the trajectory in the phasediagram

reachesthe equilibrium point Ifthe coefficients are

known,

the phasediagram

can be constaicted andsubsequently the time

when

the oscillations willcommence

can be predictedThe

chaotic oscillationsobserved

here are a far cryfrom

thoseshown

in Figure 1Note

thatthe

two

technologies simulated in Figure 6 break into oscillations simultaneously—

something

that

plywood

andOSB/waferboard

in Figure 1do

notdo

Keep

in mind,however,

that thesystem

shown

here is purely to illustrate the concept, and that the possibility that theplywood/OSB/waferboard

case cannot bemodeled

with thismodel

should not be dismissedout

of hand

without further investigationof

the behavioral characteristicsof

themodel

Itshould also be kept in

mind

that the simulated results presented herewere

generated with adifference equation

and

the time increments in themodel

hence plays an important role in thebehavior, particularly

when

a chaotic situation occurs.Note

that themodel

alsosometimes

yieldsnegative values for

N

and

A-/,something

that cannot occur ifN

and

M

represent the realsales of the technologies for example,

where

we

assume

M,N>0.

Nevertheless, the resultsobtained here indicate that, in principle,

one

can expect oscillatory behavior in themature

phase of S-curves

under

certaincircumstances

when

two

technologieshave

a symbioticinteraction

From

the natureof

equation (1)we

know

that in theabsence

of

anothertechnology, oscillatory behavior

does

notoccur

and hence

we

can infer that (within the realmsofthe model), the chaos-like oscillations in the

mature

phase ofthe S-curve can also be causedbv symbiotic interaction

among

multiple technologies, inwhich

case the onset of chaosdepends

very stronglyon

the ratios of the coefficients in the underlying Lotka-Yolterraequations

Note

that the systemmodeled above changed

its behaviorfrom

stable to oscillatorywhen

theratios of the coefficients

changed

(i e thechange

depicted in Figures 4and

5 versus that inFigures 6 and 7) In general,

one

canassume

that the coefficients will be timedependent

ratherthan constant, and furthermore that external forces can and will influence their values

dvnamically with time It is then entirely conceivable that a chaotic solution

may

result if thevalues

of

the coefficientschange

relative toone

anotherto support such a solution This bringsus

back

to the issueof

thepre-determinedness of

the chaotic nature that hasbeen

discussed inthe literature

The

issue boilsdown

to the questionwhether

thegrowth curve

that a particulartechnology

exhibits is geneticallyencoded

into the technology (similar to thegrowth of

some

animate or organic objects, for

example)

Ifone

takes theview

that technological diffusion andsubstitution are social rather than natural

phenomena,

there is anargument

to bemade

thatthere is

no predetermined

inevitability in thegrowth

of technology

The

diffusion pattern andparticularly the rate

of

diffusion, aredetermined

by various external factors, althoughwe

certainly

acknowledge

that the inherent characteristics of the innovation ortechnology

caninfluence these factors

We

must

also not exclude the possibility that,from

amodeling

viewpoint, the

growth

of

a particulartechnology

may

be describedby

differentmodels

alongits

growth

path, as suggestedby Tingyan

[48], forexample

It is quite feasible that thegrowth

may

be described by the general Lotka-Volterra equations as suggestedby Bhargava,

where

the coefficients of the equations

change

with time as they are actedupon

by externalforces [43]

Depending

on

the relationshipand

ratiosbetween

the coefficients, thesvstem

may

then exhibit

smooth

growth, oscillatory oreven

chaotic behavior in various phasesof

thegrowth

cycleThese

will be dictated by the ratios of the coefficients atany

givenmoment

asthev. in turn, are influenced bv external forces

Even

thouuh

some

technologicalurowth

patterns

may

exhibit chaotic oscillations, the question that should beasked

is."What

drove

thesystem to chaos "

[39]

Conclusions

The

paper startedby

discussing the notionof

mortality indicators that signal thedemise

ofmature

technologiesThe

questionwas

posed whether

the oscillations thathave been observed

in the

mature

phase ofsome

technologies' S-curves are indications that such technologies arebeing attacked

by emerging

technologies, i ewhether

the oscillations are mortality indicatorsThe

case of the substitutionof

plywood

by

OSB/waferboard

was

investigated, and itwas

shown

that the oscillations inplywood's

S-curve track the phasesof

the residential fixedinvestment in the

US

Hence

it isconcluded

that the residential fixed investment pattern istherefore primarily responsible for the oscillations and that the oscillations are not mortality

indicators

The

riseof

OSB/waferboard

does,however,

seem

to contribute to perturbations inthe

mature

technology's S-curve(plywood

in this case)A

further conclusion can thus bemade

that theemergence

of anew

technology canhave

a contributory influenceon

perturbations in a

mature

technology's S-curve, although the oscillations can bedominated

byother effects such as

macroeconomic

business cyclesGiven

the fact that accurate and reliablemortality indicators can

have

profound

managerial implicationsand

that the surface has onlybeen

scratched in this paper with regard to death knells ofmature

technologies, further pursuitof the notion

of

mortality indicators is certainly to berecommended

One

avenue

of researchmay

be the applicationof

signal processing techniques to "extract" potential signals that arecaused b\