MIT LIBRARIES 3

9080 03130 2398

|

HB31 .M415working

paper

department

of

economics

CHARACTERIZING

PROPERTIES

OF

STOCHASTIC

OBJECTIVE

FUNCTIONS

Susan Athey 96-1 Oct.1995massachusetts

institute

of

technology

50

memorial

drive

Cambridge, mass. 02139

CHARACTERIZING

PROPERTIES

OF

STOCHASTIC

OBJECTIVE

FUNCTIONS

Susan

Athey1

INTRODUCTION

Thispaperstudies optimizationproblems wherethe objectivefunctioncan bewritteninthe form V(8)

=

\jt{s)dF{s\6), where;risapayofffunction,F

is a probabilitydistribution, and6

andsare real vectors. For example,thepayofffunctionn

mightrepresentanagent'sutilityora firm'sprofits, thevectorsmightrepresentfeaturesofthecurrent stateoftheworld,andtheelementsof6 mightrepresent an agent's investments, effort decisions, other agent's choices, or the nature of the

exogenousuncertainty in the agent'senvironment.

The economic

problem underconsideration often determinessome

propertiesofthe payofffunction; forexample,autilityfunctionmight be

assumed

tobe nondecreasing andconcave, whileamultivariate profit function might have sign restrictions

on

cross-partial derivatives. These assumptionsthen determine asetIT of admissiblepayofffunctions.We

mightthenwishtoanswerquestionssuch as: Isasetof investments

6

isworthwhile?Are

there decreasingreturns tothose investments?Does

one investment increase thereturns to anotherinvestment?To

answerthose questions,we

needtoknow

whetherV(Q) satisfiestheappropriate properties,i.e., nondecreasing, concave, or supermodular.1The

goalofthispaperistodevelopmethods suchthat,given aparticularpropertyP

(suchasnondecreasing),asetof admissiblepayoff functionsII,andaparameterizedprobability distributionF,

we

can determinewhetherthefollowing statementistrue:J7i(s)dF(s;6)

satisfiesproperty

P

in6

foralln

inIL (1.1)Thatis,given

P

andII,we

wishtodescribethesetofprobability distributionswhichsatisfy(1.1).Thispaperrestrictsattention tothecase

where

the propertiesP

andsets IIare"closedconvexcones."

We

definea propertyP

tobea"ClosedConvex Cone" (CCC)

propertyifthesetof functionswhichsatisfy

P

isclosed(under an appropriate topology),positivecombinations of functionsintheset are also intheset,andconstant functionsare in theset. ImportantexamplesofCCC

propertiesinclude nondecreasing,concave,supermodular,anypropertywhichisdefinedby

placingasign restrictiononapartialderivative,and combinations oftheseproperties. Thus,ifthepayofffunction representsa

consumer'sutility,IIcouldbethe setofunivariate,nondecreasing,concave payofffunctions;ifthe

1Intuitively,

afunctionissupermodularif.givenanytwoarguments ofthe function, increasingoneincreases the returns toincreasing the other.

When

thefunctionisdifferentiable,thisamountstopositive cross-partial derivativesbetween every pairof arguments. Supermodularityisimportantinthecontext of comparativestatics(seeTopkis(1978),payoff functionrepresentsafirm's profits asa functionof

two

complementaryqualityinnovations,n

couldbethesetofbivariate,nondecreasing,supermodularpayofffunctions.Forsets IIandforproperties

P

whichareCCC,

thispaperdevelops a characterization ofwhichprobability distributions satisfy(1.1). Checking(1.1) directlyisdifficultbecause,ingeneral,Ifmight bea verylargeset.

Thus

we

ask,When

isitpossibletofinda smallersetofpayofffunctions,denotedT,sothatforanyprobability distributionF, statement(1.2)belowwillbetrueifandonlyif(1.1)is

true?

J

7t(s)dF(s;8)satisfiesproperty

P

in6forall%

inT

( 1.2)We

canthinkofT

asa"testset" forII: ideally,T

isasetofpayofffunctionswhichissmallerandeasier tocheckthanII,butitcan beusedtotestwhether

J7C(s)dF(s;0)satisfiesproperty

P

in6,givenonlytheinformationthat

K

isinthe largersetII.Usingthese ideas,

we

canrestatethegoalofthepaper:we

wanta theorywhichhelps us determinethebest"testset"fora givenII.

We

proceedintwo

steps. First,we

examinethecasewheretheproperty

P

is"nondecreasing"; second,we

study otherCCC

properties.The

firstcasehasbeenthefocusofthe literatureonstochasticdominance, wheredifferentauthorshavestudieddifferentsets II. 2

Thispaperunifies andextends the existing literatureonstochasticdominance,providing an exact characterizationof themathematical structureunderlyingall stochastic

dominance

theorems.We

furtherprovideanalgorithmforgenerating

new

stochasticdominance theorems whichrelaxesthead hocdifferentiabilityandcontinuityassumptions whicharecommon

inthis literature.3 In thesecondpartofthepaper

we

show

thatthemethodsfromstochasticdominance can beappliedtocharacterizewhen

V{6)satisfiesotherpropertiesP,includingconcavityandsupermodularity.We

now

provideanoverview of ourresults. In thefirstpartofthispaper,we

show

thatfortheproperty nondecreasing,ifIIisa closedconvex cone andcontains constantfunctions,thenthebest

T

isthe setof"extremepoints"ofII. Just asabasisgenerates alinearspacevia linearcombinations, so asetofextremepointsgeneratesa closedconvex conevia positivelinearcombinations andlimits.

Thus,

we

show

thatifwe know

onlythatapayofffunctionk

liesintheclosedconvex coneII,andwe

wanttoknow

ifV(6)isnondecreasing,itisequivalenttocheckthatV(0)isnondecreasingon

a smaller2

Inparticular,the univariate stochasticdominanceproblem has beenstudiedby Rothschild andStiglitz(1970,1971)and

HadarandRussell (1971); notable contributionstothe multivariateproblemincludeLevyand Paroush(1974),Atkinson and Bourguignon(1982),andMeyer(1990). Shakedand Shanthikumar (1994) provide areferencebookonthe subjectof stochasticordersandtheirapplicationsineconomics,biology,andstatistics.

3Brumelle and Vickson (1975)

takeafirststeptowardsrelaxing theseassumptionsandidentifying themathematical structurebehind stochasticdominance; in contrast to theirwork, whichprovides only sufficientconditions fora stochasticdominancerelationship,thispaperprovidesanexact characterizationofallstochasticdominancetheorems.

setofpayofffunctions, theextremepointsof n. Itwilloftenbe

much

easier to verifymonotonicityof V(6) forthe setofextremepointsofn

thanforn

itself. Inthispaper, theprocedureof usingtheextreme pointsof

n

asatestsetfor II willbe referredtoas the "closedconvex cone"method

of provingstochasticdominancetheorems.Examples

fromthe existing stochasticdominanceliterature,whichare specialcasesofthis result,includeFirstOrderStochastic

Dominance (FOSD),

wheren

isthe setofunivariate,nondecreasing payofffunctions,andSecond OrderStochasticDominance

(SOSD), whereTIisthe setofunivariate,concave payofffunctions. In the case of

FOSD,

the setofextreme pointsisthe setofone-step functionswhicharezerouptosome

constant,and onethereafter. ThesearepicturedinFigure 1. Inthecase of

SOSD,

thesetofextremepointsisthe setof "angle," or"min"functions,picturedinFigure2,where eachfunctiontakes the

minimum

ofitsargumentandsome

constant.The

closedconvex conemethod

for stochasticdominancehasbeenrecognizedandexploredinthecontextofparticular setsofpayofffunctions (Topkis,1968;Brumelle andVickson, 1974; Gollierand

Kimball, 1995).4 However,thispapergoes

beyond

the existing literature intwo

respects. First,by

developing appropriateabstract definitions todescribestochasticdominancetheorems,we

areabletomake

general statements aboutthe entire class ofstochasticdominance

theorems, including thosewhich havenotyetbeenconsideredintheeconomicsliterature. Second and

more

importantisthe fact thatwe

proveanew

resultaboutthisclassof theorems:we

proveformallythatthe"closedconvex cone" approachtostochasticdominanceisexactlythe rightone.By

thiswe mean

that (1.1)and(1.2) returnthesame

answerforeveryprobability distributionF

ifandonlyiftheclosedconvex coneofT

(uniontheconstantfunctions,ifthesearenotinT)isequaltoIT;

no

otherT'swillalwaysmake

(1.1)and(1.2) equivalent. Inthiscase,clearlythesmallestsetwhichgeneratesIIisthebestsettocheck.

The

secondpartofthispaper showsthatthe"closedconvex cone"method

canalsobeappliedto characterizeotherpropertiesofV(6).We

asktwo

questions:First,forwhatpropertiesP

istheclosedconvex cone approachvalid?

And

second,forwhatpropertiesP

istheclosedconvex cone approachexactly therightone, as in thecase ofstochastic

dominance?

We

firstshow

thatifP

isaCCC

property,thentheclosedconvex cone approach can always be usedtocharacterize

when

V(6)satisfies P.We

thenfinda subsetofCCC

properties,whichwe

call"Linear DifferenceProperties," forwhichwe

canshow

thattheclosedconvex cone approachisexactlythe rightoneforcheckingwhetherV(0)satisfies P.

Examples

of LinearDifference Properties include monotonicity, supermodularity, concavity,andpropertieswhichplace signrestrictionson

partial derivatives. Combinations oftheseproperties,however,arenotingeneralLinear DifferenceProperties,althoughsuch combinationsare

4Independently, Gollier

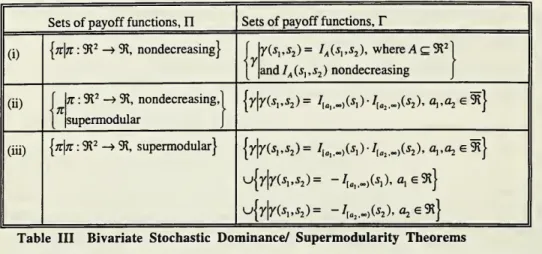

CCC

properties. Table Isummarizesproperties whichareCCC

propertiesandLinear DifferenceProperties.

TABLE

ILINEAR DIFFERENCE

PROPERTIES

AND

CLOSED

CONVEX

CONE

PROPERTIES

Property Closed

Convex Cone

Linear Difference PropertyNondecreasing Yes Yes

Supermodular Yes Yes

Concave/Convex(Multivariate) Yes Yes

SignRestrictiononaPartial Yes Yes

Derivative

Constant Yes

No

Nondecreasingand Concave Yes

No

ArbitraryCombinationsof Yes

No

CCC

PropertiesArbitraryCombinationsof Yes

No

LDP

PropertiesFor

many

sets ofpayofffunctions,n,

whicharecommonly

studiedineconomics, the existing literatureon

stochasticdominancehasimplicitly identified theextremepointsof thosesets. Insuchcases, theproblemof characterizing a Linear Difference Property (suchassupermodularity)

becomes

quitestraightforward:simply looktothe the existingliteraturetofind theappropriatetest set,T, for the setofpayofffunctionsIIunderconsideration. Then,usingthe resultsofthispaper,

we know

that (1.2) characterizes the setof parameterizedprobability distributions forwhichthe stochastic objectivefunctionwillbe supermodularforallpayoff functionsinII.

We

illustratethis techniqueby

showinghow

the closedconvex cone approach can be usedtocharacterize theproperty supermodularityforseveralimportantclassesof payofffunctions. These

resultscaninturnprovidesufficient(andsometimesnecessary) conditionsforcomparativestatics

conclusions. Inparticular,

we

examineapplications inprincipal-agent theory,welfareeconomics,andThis paper proceedsas follows. InSection2,

we

introducea motivatingexample,theproblemofa risk-averse agent's choice ofeffort. Inthisproblem,

we

characterizethepropertiesnondecreasing, concave,and supermodularforthe agent'sexpectedutilityfunction.Our

generalanalysisofstochasticdominancetakes placeinSection3.

We

provideanexact characterization ofstochasticdominancetheorems, highlightingtheimportantroleplayed

by

linearityofthe integral.We

furtherextendourresulttoincorporate "conditionalstochasticdominance." Section4developscharacterizationsof other

propertiesof f7t(s)dF(s;d)andprovides applicationsoftheproperty supermodularity. InSection5,

we

analyze conditions underwhich

functions oftheform

J

K(x,s)dF(s;6) are supermodularor

concave in (x,d), showing

how

to apply stochasticmonotonicity resultsto this problemas well.Section6concludes.

2

MOTIVATING EXAMPLE:

A

RISK-AVERSE AGENT'S

CHOICE OF

EFFORT

Inthissection,

we

present a motivatingexample, wherewe

analyzehow

a risk-averse agent's choice ofeffort affects herexpected payoffs, andhow

that choice ofeffort interacts with exogenousparameters

which

describethe probability distribution. Formally,we

characterize the properties nondecreasing, concave,and supermodularfortheagent'sexpectedutilityfunction. Theseresultsare specific examples—

exampleswhere

the payofffunctionis nondecreasing and concave—

ofastochasticdominancetheorem, a"stochasticconcavity theorem,"anda"stochasticsupermodularity theorem." These examplesillustratethe parallel structureunderlyingthethree classesof theorems.

Considerarisk-averse agent

whose

utility {it)dependsontheoutputofastochasticproduction technology,wheretheoutputisdenoteds. Supposethattheagent'seffort(c)affectsthe probability distributionofs. Further,consider a parametertwhichrepresentsexogenous changesinthe stochasticproduction technology. For example,achangeintmightrepresentaworker

moving

from one jobto another. Then,we

canwrite theagent'sproblemasfollows:max

fk(s)•dF(s;e,t)-c(e)

Firstobservethatitisnottrivialto verify thatV(e,t)

=

\it(s) dF(s;e,t)isnondecreasingineffort:anincrease in effortwhichisproductiveonaveragemightnotincreaseexpectedutility ifthe effort also

increasesthe riskinessofthe distribution. Second,notethatifV(e,t)-c(e)isconcaveineffort,then

thefirstorder conditions

(FOCs)

characterizetheoptimum,a propertywhichisusefulintheanalysissome

economicproblems,suchasprincipalagent problems. Further,ifV(e,i)failstobe concavein e,thenthere existssome

linearcostfunction c(e)=

ae

suchthattheFOCs

failtocharacterizethenondecreasingint. If V(e,t) failstobesupermodular, thenevenif

V

isconcave, there existssome

linear costfunction c(e)

=

ae

suchthat e*{i) fails to be nondecreasing in t (this follows fromMilgrom

andShannon

(1994);seeTheorem

A.lintheAppendix). Thus,therequirementthatV(e,t) satisfiesthepropertysupermodular(orconcave,respectively)issufficient for thedesiredeconomicconclusion, andfurtheritcannot berelaxedaslongas

we

requirethattheconclusion holdsforall linear cost functions.Letus firstidentifyconditionsunder whichV(e,i)isnondecreasingine.

The

followingwell-known

resultisadaptedfromtheRothschildandStiglitz(1970,1971)work

onstochasticdominance (wherewe

suppresstinthe notation):Proposition 2.1 Thefollowing twoconditions are equivalentforallprobabilitydistributions F(-,e):

(i)

For

allK

nondecreasingand

concave, \lt(s) dF(s;e) isnondecreasingine. (ii) Thefollowing aresatisfied:(a) \sdF(s;e) isnondecreasingine. a

(b)

For

all a, -\F(s;e) isnondecreasingine.Intuitively,forarisk-averseagent

who

likesincome,effortwillincreaseexpectedutility ifandonlyif effortincreasesthemean

income(condition(ii)(a))andreducesthe "riskfunction" (condition(ii)(b)).Thisresultisoftenusedinthefinanceliterature;ithasbeencalledSecond Order MonotonicStochastic

Dominance

(SOMSD).

In this paper,

we

willwork

with a restatement of Proposition 2.1,which

emphasizes thatconditions(i)and(ii)are actuallysymmetricconditions.

The

following propositionisequivalenttoProposition2.1 (where

A

1bethespaceofprobability distributionsdefinedonSR, and Si indicates the

extendedrealline,thatis, SR

u

{-00,00}):Proposition 2.1' Thefollowingtwoconditionsare equivalentforall F(-;e)eN:

(i)

For

alln

inthe set YlSOM=

[ti\k:SR-»%

nondecreasing, concave},J7t(s) dF(s;e) is nondecreasingine.

(ii)

For

allyinthe setT

SOM=

{y\y(s)=

min(a,s),ae

9t}, jy(s) dF(s\e) isnondecreasingConditions (i) and(ii)ofthisPropositionsimply restateconditions(i)and (ii)ofProposition2.1,

except that

we

have replaced -JF(s;e) with jmin(a,s)dF(s;e) in condition (ii). It isstraightforwardto verify(usingintegrationbyparts) that theformer termisnondecreasingifandonly

ifthelattertermis. This conditionisnot usually associated with

SOMSD

(seeBrumelle and Vickson(1975) foranexception). This

way

ofwriting theSOMSD

theoremillustratesthe mathematicalstructureunderlyingthe stochasticdominancetheorem.

As

written inProposition2.1',the resultsaysthatinsteadofcheckingthat j n(s) dF(s;e) isnondecreasingin X for allpayofffunctionsin the

relativelylargeset, II50M,itisequivalenttocheckthat \y(s)dF(s;e) isnondecreasingine forall

payoff functionsin thesmallerset,

T

S0M.The

twosetsofpayoff functionsarepicturedinFigure2.The

relationshipbetweenthetwo

setsof payoff functionscanbedescribedas follows: T1S0M isequaltotheclosedconvex coneofthesetwhichistheunion of

T

S0Mandthefunctionsy{s)

=

1andy(s)=

-1. Thatis,by

takingpositivecombinationsandlimitsof sequences(or nets)of elements ofthelatter set,

we

cangenerateanyfunctionin TISOM,whichis itselfaclosedconvex cone. In Section3,

we

willshow

that this"closedconvex cone"relationshipbetweenTlSOM and

r

SOM holdsforallstochasticdominancetheorems.

Now,

letusask adifferent,butrelated, question:When

isJx(s) dF(s;e)concavein effort? This

problem

was

addressedby

Jewitt (1988),who

analyzes conditions underwhich

the FirstOrder Approach(FOA)

toanalyzing principal-agentproblemsisvalid.The

FOA

requires thatiftheagent'sFOCs

aresatisfied,thentheagent'schoiceofeffortmust beoptimal. ExtendingJewitt'sanalysis,we

canshow

thatthe sufficient conditionshe derivesare in factnecessary.5The

followingresult isanalogoustoProposition2.1:

Proposition 2.2 Thefollowing twoconditions are equivalentforall

F(;e)e

A

1:

(i)

For

all%

inthe set YlS0M, \k(s)•dF(s;e) isconcaveine. (ii)

For

allyinthe setT

SOM',\y(s) dF(s;e) isconcaveine.

Proof: Thiswillbeestablished asa simplecorollaryof

Theorem

4.1below, together with Proposition2.1.

Q.E.D.

5Jewittfirstderives conditionsunderwhichthe agent'sutilityfunctionisincreasingand concaveinoutput,giventhe optimalcontract;hethenaddresses the questionof concavity oftheexpectedutilityfunctionin effort. It isonlythelatter

Proposition2.2saysthatexpected payoffsareconcaveine forallpayoff functionsin

U

SOM ifandonlyifexpected payoffs areconcaveineforallpayofffunctionsin

T

SOM. Again,this theoremisusefulbecausecondition (ii)is easier to checkthat condition(i): the set

r

SOM ismuch

smaller.Condition (ii) can be interpreted asrequiring thatthere are decreasing returns to e in terms of increasingthe

mean

anddecreasingthe "riskfunction." Notethatthe pairofsetsof payofffunctions,(

n

SOM

,

T

SOM

),isthe

same

inbothpropositions.Now

we

turn toask afinalquestion:When

istheoptimal choice ofeffortmonotone

nondecreasingint,whichparameterizesthe stochasticproduction technology?

More

precisely,how

can t affecttheprobability distributionover outputin sucha

way

that monotonicity oftheoptimal effort int isensured, without any additional information about the cost of effort function or the agent's preferences? This question has not been answeredin the existingliterature; thus,the following proposition provides a

new

insight into thecomparativestaticsproblem. Notethatthispropositionistrue irrespectiveofwhetherexpectedutilityismonotoneineffort.

Proposition 2.3 Thefollowing three conditions are equivalentforall F(-;e,f)e

A

1:

(MCS) For

allcostfunctions cand

allK

in IlSOM, e'(t)=

argmax\K(s)dF(s;e,t)-c(t) ise Js

monotone

nondecreasingint.6(i)

For

alln

e

TlS0M, \K{s)dF{s;e,t) issupermodularin{e,t\ (ii)For

allye

T

S0M, jy(s) dF(s;e,t) issupermodularin(e,t).Proof:

The

equivalence ofparts(MCS)

and(i)followsdirectlyfromMilgrom

andShannon

(1994), as stated in

Theorem

A.1intheAppendix.The

equivalence of(i)and(ii)willbeestablished asacorollaryof

Theorem

4.1belowtogetherwith Proposition2.1.Q.E.D.

The

formaldefinitionof supermodularity (andthecomparativestaticstheoremwhichreliesuponit) canbefoundintheAppendix. Intuitively, V(e,t)issupermodulariftincreasesthe returns toeffort.Proposition2.3providesnecessaryandsufficientconditionsfor

monotone

comparativestaticsinthisproblem. If(ii)isviolated,then

we

canconstructpayofffunctionsandcost functionssuchthatthechoiceofeffortisnotmonotonicint. Thus,

we

haveidentified theexact conditionswhichensuremonotone

comparativestatics. Condition (ii)requiresthateandtarecomplementaryinterms of increasingthemean

ofthe probability distributionandinterms of reducingtherisk.The

intuitionisstraightforward:sincearisk-averse,income-lovingagentlikeshigh expectedreturnsandlowrisk (as

"In general, theoptimal emaybe aset. Then,thistheoremrequires that thesetbe nondecreasingintheStrongSet Order, as definedintheAppendix.

shown

inSOMSD),

variableswhicharecomplementaryinincreasingthemean

anddecreasingthe risk arecomplementaryinincreasingexpectedutilityofsuch anagent. Notethatifeitheroneofeand/ does notaffectthemean

orthe riskinessof the agent'sincome,thecorrespondingcomplementarityconditionsare satisfiedtrivially.

Notice that Propositions 2.2 and 2.3 have astructure

which

is very similarto the existingstochasticdominanceresult,as stated inProposition2.1. In Section3,

we

willbuild aframeworkforanalyzing Proposition2.1 andotherstochasticdominancetheorems. In Section4,

we

willformalizethe relationshipbetweenPropositions2.1through2.3.

3

MONOTONICITY OF STOCHASTIC

OBJECTIVE

FUNCTIONS

The

goal ofthis section is to provide a unifiedframework

for analyzing stochasticdominance

theorems. In Section 3.1,we

introduce aframework which

incorporates the existing stochasticdominanceliterature,arguingthateachstochasticdominance theoremdescribesarelationshipbetween twosetsofpayofffunctions. InSection3.2,

we

provearesultwhich

characterizesamathematicalrelationshipbetweentwosetsofpayoff functionswhichisequivalenttothe relationshipdetermined

by

the stochasticdominancetheorem. Section3.3extendsthe result tothecaseofconditionalstochastic

dominance.

3.1

A

UnifiedFramework

forStochasticDominance

In this section,

we

introducetheframework which

we

willuse to discuss stochasticdominance

theoremsasanabstract classof theorems,andtodrawpreciseparallelsbetweenstochasticdominancetheoremsandothertypesof theorems.

Letusfirstconsideranotherwell-known exampleof astochasticdominancetheorem,FirstOrder

Stochastic

Dominance

(FOSD). Thistheorem can bestated asfollows(where IA(s) istheindicator

functionforthesetA):

Proposition 3.1 Thefollowingtwoconditions are equivalentforall

F(;0)e

A

1:

(i)

For

alln

e

n

TOs

{k\k:9i-»%

nondecreasing},JK(s)dF(s;6)isnondecreasinginft

(ii)

For

ally

e

T

FOm

{y\y(s)

=

IM

(s),ae

Sfi}, jy(s)dF(s;6) isnondecreasinginftThistheoremhasthe

same

structure as theSOMSD

theorem, Proposition2.1

'.

The

setsofpayoff functionsare illustrated inFigure 1. Thistheoremsaysthatinsteadof checkingthatexpected payoffsarenondecreasing in

8

forallnondecreasing payofffunctions,IF

,itisequivalenttocheckthatfunctionsofupperintervals.

The

latter setofpayoff functionsismuch

smaller,andso condition(ii)iseasier tocheckthatcondition(i); condition(ii)can be reducedto a restrictionwhichrequiresthat

1

-

F(a;6),thecomplement

ofthecumulativedistributionfunction,isnondecreasingin8

forae9?.The

latterrequirementisthemore

standardway

ofstatingFOSD.

Thereare

many

otherexamplesofstochasticdominancetheorems,some

with multiplerandom

variables;

we

will discussotherexamples belowin Section4.5. Ingeneral, stochasticdominance theoremsallhaveaparallel structure, as illustrated inPropositions2.1'and3.1. However,different stochasticdominance theoremsarecharacterizedby

different(11,0pairs.The

SOMSD

theoremstates thatthe pair(U

SOM,T

SOM

)satisfiesaparticular relationship; the

FOSD

theoremstatesthatthe pair(IT™,

r

F0)satisfiesthe

same

relationship.To make

thisrelationship precise,we

introduce a formaldefinitionofthestatement

"A

pairofsetsofpayofffunctions,(n,D,satisfiesastochasticdominancetheorem." Ifthatstatementistrue,then

we

willsaythat(11,0isa stochasticdominance

pair.We

willusethe abstract definition tomake

statementsaboutthe classofstochasticdominancetheorems,and

how

thatclassoftheoremsrelatestootherclassesof theorems.We

allowformultidimensionalpayofffunctions andprobabilitydistributions, usingthe followingnotation:the setofprobability

distributions

on

SR" is denoted A", with typical elementF:SR

n—

»[0,1]. Further, for a given parameterspace 0,

we

will use the notation A"etorepresent the setofparameterized probabilitydistributions

F

:9?"x

-»[0,1] suchthatsuchthat F(;0)eA" forallds 0.Definition 3.1 Consider a pair ofsets of payofffunctions(TI,r), with typical elements

K

:9T

—

>SRand

y

:9?"—

> SR. Thepair(II,T) isastochasticdominance

pair ifconditions (i)and

(ii)are equivalentforallparameter spaces withapartialorderand

allF

€

A

n e:(i)

For

allttgU,

jn(s)dF(s;6)is

nondecreasing

in 6.(ii)

For

ally eT,

Jy(s)dF(s;6)

is

nondecreasing

in 6.Further,

we

definetheset I.SDT tobethe setofall(11,0pairswhichare stochasticdominancepairs,as follows:2

5Dr=

{(II,r)|(n,r)isastochasticdominancepair}Thus,

when

agiven (11,0pairisastochasticdominancepair,we

write (II,T)e

Z

SDr.Definition3.1 clarifiesthestructureofstochastic

dominance

theorems. Stochasticdominance theoremsidentify pairs ofsets of payofffunctionswhich

havethe following property: givenaparameterized probability distribution F, checking that all of the functions in the set

(fy(s)dF(.s;0)|y

er|

are nondecreasing. Stochasticdominance

theorems are useful because, in general, thesetT

issmaller thantheset II.We

canthinkofthisdefinition asa statement aboutthe equalityoftwosets. First, letus definethe set ofadmissible parameter spaces for the property "nondecreasing" together with probabilitydistributionsparameterized

on

those spacesas follows:V

ND=

{(F,0)|©has apartialorderandF

eA

n

ej

Now,

we

canrephrasethe definition as follows:(11,0isastochasticdominancepairifj(F,0)€

V

nN

M

7r(s)dF(s;d)isnondecreasingon V/reIli=

|(F,0) e

V

ND \JY(s)dF(s;0)n isnondecreasingonVy

e

Ij

Definition3.1 differsfromthe existing literature(i.e.,Brumelleand Vickson, 1975),inthatthe existingliteraturegenerallycomparestheexpected valueof

two

probability distributions,sayF

andG,viewing

J7t(s)dF(s) andJ7t(s)dG(s) as

two

different linearfunctionalsmapping

payofffunctionsto Si. In contrast,byparameterizingthe probability distributionand viewing

Jn(s)dF{s\6)asabilinear

functional

mapping

payofffunctionsand(parameterized)probability distributions tothereals,we

areableto createan analogy betweenstochastic

dominance

theorems andstochasticsupermodularity theorems,an analogywhichwould

notbeobvious usingthestandardconstructions.The

utilityofthis definition willbecome more

clearwhen

we

formalizethe relationshipbetweenstochasticdominance andstochasticP

theorems,forotherpropertiesP

(suchassupermodularity).To

provide specific examples ofpairs ofsets ofpayoff functionswhich

satisfy stochasticdominancetheorems,

we

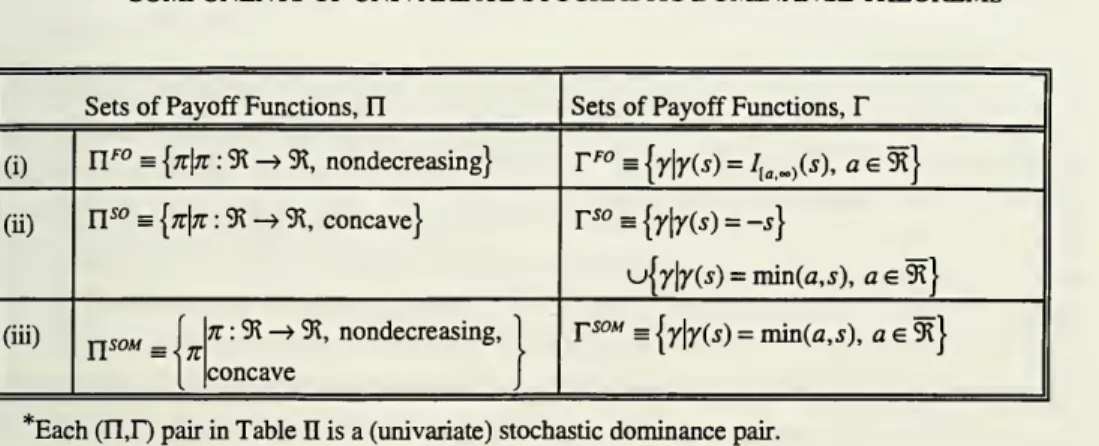

summarizethree univariate stochasticdominance theoremsinTableIt. Thereare potentially

many

otherunivariate stochasticdominance theorems(forexample,theorems wherethe setofpayofffunctionsimposesrestrictionson

the third derivativeof thepayofffunction);however,we

willsimplyreportthe threemostfamiliar univariate stochasticdominance theoremshere.TABLED

COMPONENTS

OF UNIVARIATE STOCHASTIC

DOMINANCE

THEOREMS"

SetsofPayoffFunctions,II SetsofPayoffFunctions,

T

(i)

U

F0=

{n\n:SR->%

nondecreasing}r

F°={

r

\y(s)=

I [a„)(s),aeX}

(ii)n

5°s

{n\n:SR->%

concave}r

S0={Y\Hs)

=

-s} iu{y|y(.y)

=

min(a,s),aeSRJ

(iii)

YlSOM

=

\n

k

:SR—

» SR, nondecreasing, 1 concaver«w

_

|y|y

(j)_

min(fl,s), ae9?}Each(II,r)pairinTableII isa(univariate)stochasticdominancepair.

TableII (iii)correspondstoa

SOMSD

theorem,asshown

inProposition2.1

',whileTableII(i)

correspondstoa

FOSD

theorem, Proposition3.1. Let usnow

illustratethe interpretationof Definition3.1 andTableIIwith athirdexample:Second OrderStochastic

Dominance

(SOSD),shown

inTableII (ii). Itisknown

thatJK{s)dF{s;8)

isnondecreasingin

6

forallunivariate,concave payofffunctionsifand onlyif \min(a,s)dF(s;d) is nondecreasingin

8

forallaeSi,

and\sdF(s;6)

does notdepend on 6. Observethatboth y(s)

=

s and y(s)=

-s

areincludedinT

so;thisforcesthemean

ofthe distribution tobeboth nonincreasingandnondecreasing,and henceconstantin6.

Thereare

many

otherstochasticdominance theoremsinadditiontothe univariateexamplesgiven above.Levy

and Paroush(1974) deriveresultsforbivariate functions,whileMeyer

(1990) extends theseresultsand examinessome

multivariatestochasticdominance theoremsas well.We

will reportsome

of theseresults inSection4.5,wherethemain

objectiveistoapply theseresults toproblemsofstochasticsupermodularity.

3.2 ExactConditionsfor aStochastic

Dominance Theorem

Inthissection,

we

studynecessaryandsufficientconditionsforthe pair(11,1")tobeastochasticdominancepair.

We

wanttospecify theexactmathematicalrelationshipwhichisequivalenttothestatementthat (II,T)

e

Z

sor.We

willfirstdiscussourresultanditsimplications;then, inSections3.2.1and3.2.2,

we

willprovidethemathematicalargumentsunderlyingtheresult.The main

resultofthissectionisthat (II,T)e

I,SDT ifandonlyifthefollowing statementistrue: theclosure(underanappropriate topology) oftheconvex cone ofIIu

{1,-1} isequaltotheclosure(underthattopology) oftheconvex coneof

Tu

{1,-1}, where {1,-1} denotesthesetcontainingthetwoconstantfunctions, {n{s)

=

1}u

{it{s)=

-1}.We

formalizethisusingthefollowingnotation:cc(nu

{1,-1})=

cc(ru

{1,-1}) (3.1)In thecontext ofspecific setsofpayofffunctions

n,

the existing literature identifies similar,but stronger sufficientconditions for thecorresponding stochasticdominance

theorems, usingamore

restrictivenotion of closure(i.e.,atopology with

more

opensets)thantheone whichwe

will identifybelow. For example, Brumelle and Vickson(1975) arguethat (3.1)issufficientforthe {Yl,T) pairs

shown

inTableIItobestochasticdominancepairsunderthetopology ofmonotone

convergence. In thispaper,usingthe abstract definitionwe

have developedfora"stochasticdominancepair,"we

are able toformallyprovethat the sufficientconditionshypothesizedby

Brumelleand Vickson(1975)are in fact sufficient foranystochasticdominance

theorem, notjust particularexamples. Further, the resultthat (3.1)isalsonecessaryfor (Tl,T) tobeastochasticdominancepairisanew

contributionofthispaper.

We

now

arguethat this resulttellsuswhen we

cannotdo

betterthan theclosedconvex cone method. First,observethatunlessT

isa subsetofn,thereisno

guaranteethatstochasticdominance theoremsprovide conditionswhichare easier tocheckthanJ7C(s)dF(s;0)nondecreasing in

6

foralljrell. For example,

n

might beasetwhichisnot aclosedconvexcone. Itsclosedconvex cone might bemuch

larger,anditmightnotbepossibletofindasubset,T,ofthatclosedconvex coneforwhichiseasier tocheckthat expectedpayoffsare nondecreasingin 6. Thus, (3.1) indicates that stochasticdominancetheorems,asdefinedinDefinition3.1, aremostlikely tobeuseful

when

IIisa closedconvexcone. For example,inthecaseofFOSD,

we

considerthe setof payofffunctions IIF0.Itiseasytoverify thatpositive scalarmultiplesand convex combinationsofnondecreasing functions

arenondecreasingfunctions, as are limitsofsequencesornetsofnondecreasingfunctions. Finally,

constant functionsare also in ITF0.

When

ITcontainstheconstant functionsandisa closedconvexcone,(3.1)becomes:n

=

cc(ru{l,-l}) (3.2)In principle,the mostuseful

T

is the smallestsetwhose

closedconvex

coneisII.However,

in general, there willnotbeauniquesmallestset.To

seethis,consider the caseofFOSD,

wherethe setr

FOcontains indicator functions ofupperintervals.

By

taking limitsof sequences of convexcombinations of elements of

T

FOu

{1,-1},andappropriatelyscalingthesefunctions,

we

cangenerateanynondecreasingfunction. However,

we

canalsodefine thesett

FO=

{y\y(s)=

I[a„,($), a

e

q\, whereQ

representsthe rationals,andnotethatn

F0=

cc(fF0u

{1,-1}) .While

f

F0

c

T

FOpracticethesmallerset

f

F0 isnot anyeasier tocheck. Thus, stochasticdominance

theorems aregenerallystatedso that

T

isthesmallestclosedsetwhose

closedconvex coneis II;we

willcallsucha setthe"extremepoints"ofII.Finally,because(3.2)isnecessaryandsufficientfor(H,T)tobeastochasticdominancepair

when

n=cc(IIu{l,-l}),we know

thatwe

cannotdo anybetterthanlettingT

bethe setofextremepoints ofII: thereisnosmaller or easier-to-check closedsetof payofffunctions, f, suchthat (II,f) is a stochasticdominancepair. Thisiswhatwe

mean

when

we

saythatwe

have provedthattheclosedconvex cone methodisthe "right"approach.

In the next

two

subsections,we

prove that (3.1) characterizes stochasticdominance

pairs.Considertheproblemof orderingtwoprobability distributions,

F

1and

F

2,where

we

saythatasetofpayoff functionsIIorders

F

1higherGower)than

F

2if \7r(s)dF\s)>

(<)\x(s)dF2(s) forallK

inII; ifneither inequalityholdsforalln

inII,thenwe

saythatthe distributionsarenotorderedby

II. InSection 3.1.1,

we

firstshow

that II orderstwo

distributions exactly thesame

as the setcc(IIu{l,-l}).

We

thenshow

thattwo

sets, II and T, order arbitrary pairs of probabilitydistributions in the

same

way

ifand

onlyif(3.1) holds, thatis,theirclosedconvex

conesarethesame. InSection3.2.2,

we

use theseresults toprovethe characterizationofstochasticdominancepairsaccordingto(3.1).

3.2.1

The Main

Mathematical

ResultsWe

beginby

provingsome

generalmathematicalresults aboutlinearfunctionalofthe form\Kdfi.

Our

results are variationsonstandardtheoremsfromthe theoriesoflinearfunctional analysis,topologicalvector spaces, andlinearalgebra; the

main

contributionofthis sectionistodefinetheappropriatefunction spacesandtopologyandrestatetheprobleminsuch a

way

thatwe

canadaptthesetheoremstosolvethe stochasticdominanceproblem.

We

willwork

with aclassof objectsknown

as finitesignedmeasureson

9t",denotedW.

Any

finite signedmeasure\ihas a"Jordandecomposition" (see

Royden

(1968), pp. 235-236), sothatfi

=

/i+—

it

,where eachcomponent

isapositive,finitemeasure.We

willbeespecially interested in finitesignedmeasureswhich havethepropertythat \d/i=

0,sothat \d/i+=

\dfi~. Denotethesetofallnon-zerofinitesignedmeasures which havethispropertyby^»;

we

are interested inthis setbecause elements ofthis setcan alwaysbewritten as \i=

—

[F

1-

F

2],whereitisapositive scalar,andF

1and

F

2areprobability distributions; likewise, forany

two

probability distributionsF

1and

F

2 , themeasure

F

1Inthissection,

we

willproveresultswhichinvolveinequalitiesof theform\n

d/i>

0, wherefieg*. Sincepositive scalarmultipleswillnotaffectthisinequality,and becausethe integraloperator islinear,

we

canwithoutlossofgenerality interpretthisinequality as jJt(s)dF1(s)

>

J7t(s)dF2(s) for theappropriatepairofprobabilitydistributions.The

formernotationwillbeeasier towork

withinterms of provingour

main

results, andfurtheritwillbeusefulinprovingresultsinSection4aboutstochastic

P

theoremsforpropertiesP

other than "nondecreasing."Now

letus begin our formalanalysis. LetP* bethe setofbounded, measurable payofffunctionson 9?". Definethe bilinearfunctional f5:P'

x%"

-»SR by

/J(7T,/i)=

jady..Then

f}{P",7X«)isaseparated duality: thatis,forany

&*

(J?,thereisan

eP*

suchthat j3(7T,/i,)*

Pix,^),

and forany it

x

*

n

2,thereis a \ieW*

suchthat fi{Kvii)*

/J(7T2,/0-7Our

choiceof(P",3£") issomewhat

arbitrary:allof ourresultsholdif

we

letA" bea subset ofmeasurable payofffunctionson9?" andwe

let

B

nbe anysubsetofTff,solongasp\AnJBn)isa separatedduality. Forconsistency

we

willusethe pair{P*,WP)inour formalanalysis.We

now

construct ourtopology,where

would

like to findthe coarsesttopology (thatis,the topology withthefewestopensets)suchthatthesetofallcontinuouslinearfunctionalson

P*(thedualof P*)isexactly the set {/J(-,//)|/ie2£*}; this is the

weak

topology a{P',tKH)

on

P*.By

Bourbaki

(1987, p. 11.43), this topology uses as a basisneighborhoods

of theform

N(7z;£,(Hi,—,Hk))

=

\ftmax|/J(7T-7t,fl,)\

<

£

k

wherethereisaneighborhoodcorrespondingtoeachfiniteset (/^,...,^t )<z

W

and each e>

0.We

will returnto clarify the relationshipbetweenthistopologyandothertopologiesinthediscussionfollowing

Theorem

3.4,below.Let cc(A) denote theconvex cone ofasetA,andlet

A

denote theclosure ofA

(where the topologyisunderstoodtobe a^P*,?^)inthediscussionbelow,unlessnoted).We

now

usethe fact thatthefunctional P(7t,^i)=

\ndiiislinearandcontinuousinitsfirstargumenttoprovethefollowing simplelemma.

The

proof ofthislemma

is elementary, butwe

state ithere because all ofthemathematicalresults inthispaperbuilduponit.

Lemma

3.2 Considera setof payofffunctionsIIcP».Then

thefollowing twoconditionsareequivalentforall jl&g>:

(i)

For

alln

e

II,\nd\i>

0.7Theboundedness assumption guarantees

thatthe integralofthepayofffunctionexists. Itispossible toplaceother

restrictionsonthepayofffunctionsandthespaceoffinitesignedmeasures sothatthe pairisaseparated duality,inwhich case theargumentsbelowwouldbe unchanged;forexample,itispossible torestrictthepayofffunctionsandthesigned measuresusinga"boundingfunction."Formorediscussionsofseparateddualities,seeBourbaki(1987,p.n.41).

(ii)

For

all7tecc(Uu

{1,-1}),jnd/i>0.

Proof: First,

we

show

(i)implies(ii).Fix ameasure fieg'.Then

thefollowing implicationshold:

For

allK

ell,jndn>0

=>

Forall;rellu

{1,-1},J;rd/i>0

(Since J d[i

=

-j

dji=

0).=>

Forallff€cc(nu

{l.-l}),J^d//>0

(Since [tt, rf/z>

and Jn

2dfi>0

implies J[a,^,

+

a

27T2]d/i=

a^TTid\i+

a

2\n

2dfi>0

when

a,,a2>0).

=>

For

a//K

ecc(IIu{l,-l}), J7rd//>

(Recall that foracontinuousfunction/,

/(A)

c

/(A).The

implicationthen followsbecausethehalf-space [x

e

9^|jc>

0}isclosed,andthe linear functional P(;/l)iscontinuousforall/*.)That(ii)implies(i)followsbecauseIT

c

cc(IIu

{1,-1}). £?.£.£>.Lemma

3.2canberestatedanotherway:thesetofmeasures//e^»

forwhich jndfi>

forall7Te

IIisexactlythe

same

as the setofmeasures [ie£*

forwhichJtt^

>

for all ite

cc(Ilu

{1,-1}).Formally,

{/i€^-|J^d/x>0

V;renj

=

{//Gf*IJ^rd/t>0

V;recc(IIu{l,-l})}As

discussedabove,becausepositive scalarmultiplesdo

not reversethe inequalitiesand becausethefunctionalfiislinear initssecondargument,thelatterequalityisequivalenttothefollowing:

FKF^A^JTrdF^JKdF

2Vn

e

III=

If^F

2eA^TtdF

1ZJndF

2V/r

e

cc(IIu

{!,-1})Thatis,forany

two

probabilitydistributions, IIordersthetwo

distributions exactlythesame

asBuilding

from

thislemma,

we

turn toprove themain

mathematical theorem underlyingthe characterizationofstochasticdominancetheorems,aswellasthe characterizationsof otherproperties inSection4. Thistheoremmakes

use ofthe linearityofthefunctional /J(tt,jU) in n.The

proofthat(ii) implies (i)relies on

Lemma

3.2,while theproofthat (i) implies (ii)makes

useofa standard separating hyperplane argument. Notethatthechoiceof topology,whichdeterminesthemeaningofclosure,iscriticalforthe applicationofthe separatinghyperplane theorem.

Theorem

3.3 Consider a pair ofsetsof payofffunctions(II,I*),whereIIand

T

aresubsetsofP

t. Thenthefollowingtwoconditions are equivalent:

(i)

lii€$'\J7tdn>0 V;rell} =

j/ie£-|Jy^>0 Vyerj.

(ii)

cc(U

u

{1,-1})=

cc(ru

{1,-1}).Proof: Firstconsider(ii)implies(i). Supposethat

cc(IIu

{1,-1})=

cc(Tkj{1,-1}).Then

we

have: j//e2'|Jffd!/i£

VTrellj

=

|/X6f*|J^d//>0

V;recc(IIu{l,-l})j (ByLemma

3.2.)=

In e -f

^jydfi>

V76cc(ru{l,-1})}

(Byassumption.)=

{nep\jydfi>0

Vyer}

(ByLemma

3.2.)Now

we

provethat(i)implies(ii). Define II=

cc(U

u

{1,-1})andF =

cc(Tu

{1,-1}).Suppose(withoutlossofgenerality) that there existsa

y

e

f

suchthaty

e

fl.We

know

thatthe

(XP'&P)

topologyisgeneratedfromafamilyofopen,convexneighborhoods. Recallfrom abovethatthesetof continuouslinearfunctionalson P»isexactlythe set

{p(-,H)\fisTX'}. Usingthesefacts,acorollary tothe

Hahn-Banach

theorem8impliesthat8SeeDunford

and Schwartz (1957,p.421),Kothe(1969,p.244)fordiscussionsofthe relevanttheorems aboutthe separationofconvexsets. SeealsoMcAfeeandReny(1992)forarelated applicationoftheHahn-Banachtheorem, where theseparatinghyperplanealsotakes theform of an element ofJ*.

since flisclosedandconvex,there existsa constant candafi.

e

7JF (aseparatinghyperplane)sothat P(x,n.)

>

cforall iteft,and /J(y,//,)<

c.Since {1,-1}

€

flandis flconvex, €fl as well. Thus, /?(0, /x.)=

>

c.Now

we

willargue

we

cantakec=

withoutlossofgenerality. Supposenot.Then

there existsan

e

flc

suchthat c

<

/?(#,//.)=

c<

0.Choose

anypositive scalarp

suchthatp

>

—

>

1(which cimpliesthat

pc<c).

Since flisa cone, pit€

ft. But, f}(pk,iL.)= pc<c,

contradicting thehypothesisthat/J(7T,/i.)

>

cforallK

eft. So,we

letc=

0.Because {1,-1}

e

ft,and fi{n,^u)> foralln

e

ft,we

concludethat /3(1,//.)=

-p\l,/i.)=

0,andthus jJ^,

=

0. So, fi.eg', andwe

haveshown

that \7tdfi,>

forall 7Tgft,butJyrfyU,

<

0,whichviolatescondition(i). Q.E.D.The

proofofTheorem

3.3 is analogous tothe proofofthe "bipolartheorem"from

the theory of topological vector spaces(seeSchaefer, 1980,p. 126). ThisresultisdifferentbecauseW,

not£",isthedualofthespaceP";thisaccountsfor theinclusionoftheconstant functionsincondition(ii) of

Theorem

3.3.As

above,we

canrestatecondition(i)ofTheorem

3.3as follows,withoutlossofgenerality:If

,F

2e A" I\k dF

l>

\izdF

2 Vtte

n

j= If

1 ,F

2e

A" IjydF

1>

jydF

2Vy

e

T

jThe

theoremfirststatesthatiftwosets ofpayofffunctionshavethesame

closedconvexcone,then theywillorderanypairofprobability distributions thesame

way. Second,thetheoremstatesthatiftwosetsofpayoff functions orderallpairsofprobability distributionsthe

same

way,thosetwosetsof payoff functionsmust havethesame

closedconvexcone.3.1.2 Exact Characterization of Stochastic

Dominance

Theorems

Building

from

themathematicalresultsofthelastsubsection,we

now

statethemain

resultof Section3. ThistheoremappliesTheorem

3.3 togivenecessaryandsufficientconditionsforapair (Il,r)to satisfyastochasticdominancetheorem.Theorem

3.4 Considera pair ofsetsofpayofffunctions(II,T),whereIIand

T

are subsetsofP

1. Thenthefollowingtwoconditionsare equivalent: (i) Thepair(II,T)isastochasticdominancepair.

Proof:

To

seethat(ii)implies(i),fixapair(11,0and assumethat(ii)holds. Consideranarbitrary probability distribution F(;0) eA",and choose 8H

>

6L. DefineF

1=

F(;6

H) andF

2=

F(;0

L). Let//=

F

1-

F

2,andnotethat/I6£* .

Now,

notethatTheorem

3.3impliesthatFor

allTen,

\itd(F

l-

F

2)

>

<=>

For

allyer, \yd{F

x-

F

2)

>

Sincethismust betrueforall

6

H>6

L,then(II,r)isastochasticdominancepair.To

see that(i)implies(ii),notethatif(ii)fails,then (withoutlossofgenerality) there existssome y

ef

suchthaty

efl. Butthen,byTheorem

3.3there existsa iue

£* sothatjndfi,

>

forall iteft,but Jyd/x.<

0. Let fc=

jd^:

=

jdfc

. Let=

{6L,6H},where

6

H>6

L,anddefineaparameterizedprobability distributionas follows:F(;6

H)= j/C

andF(;0

L)=

j/z;. Butthen,Jn(s)dF(s;9)isnondecreasingin forall

^

6

II,while\y{s) dF(s;d)isstrictlydecreasingin6. Q.E.D.

Theorem

3.4provides an algorithm forgenerating stochasticdominance

theorems, and forchecking whether (11,0pairs satisfystochasticdominancetheorems. Itgives theweakestpossible

sufficientconditionsonaparticular(n,r)pair toguaranteethatitisastochasticdominancepair:if cc(II

u

{1,-1})*

cc(Tu

{1,-1}),thenthere willalwaysexistaparameterizedprobability distributionsuchthat

fy(s)dF(s;d)isnondecreasingin

8

forally

e

T,but Jn(s)dF(s;6)isstrictlydecreasingin6

forsome 7ren.

However,

Theorem

3.4makes

useoftheweak

topology,which might belessfamiliarthansome

others;forthisreason,

we

willnow

discussthe relationshipbetweenclosureintheweak

topologyandclosureinothertopologies. Inparticular,

some

existing stochasticdominance

theoremshavebeen provedby showingthattheclosureundermonotone

convergence oftheconvex cones ofthetwosets are equal (Brumelle and Vickson, 1975; Topkis, 1968). This raises the question,what

is therelationshipbetweenthoseresults,andresultsusing the notion of closureunderthe

weak

topology?The

followingcorollaryanswersthat question.Corollary 3.4.1 LetT beanytopology

on P>

suchthat thejunctionals {/J(-,//)|/l€

w\,

are continuous linear Junctionals. Supposethat(11,0isa pair ofsetsofpayofffunctions, eachinp:

Ifcc(Ilu{l,-l})T

=cc(ru{l,-l})

T

(closuretaken with respectto t),then(11,0

«

astochasticdominancepair.

Proof: Tisfinerthano(p*pK?) (by Bourbaki,

TVS

n.43). For anysetA

in"P*,we know

AcA

rcA

ff. Takingclosuresin

(RP'W)

ofeachset,we

concludethatA

c

=

A

T. Thus,if

cc(nu{l,-l})

r=cc(ru{l,-l})

T,then

cc(nu{l,-l})

a=cc(ru{l,-l})

ff. This implies

that (Il,r)isastochasticdominancepairby

Theorem

3.4. Q.E.D.To

seethe intuitionbehindthis result, firstnotethat,giventwo

topologies T, and r2,wherez, iscoarserthan 12 (written T,

c

T2 ),theclosureof asetA

under %2 (-A*2)iscontainedinthe closureof

A

undert,(

A

T

>).Thisistruebecausethe finertopology has

more

closedsets;A

Tl isa closedsetunder T2,butsincex2 isfiner,theremight bea closedsetwhichisastrictsubsetofA

T

< butthatstillcontains

A.

Sincethe

weak

topologyiscoarser thananytopologywhichmakes

the linear functionals /?(7T,/x)continuousinn,theclosureof asetof payoff functionsunder

monotone

convergenceiscontainedin theclosureofthesetundertheweak

topology. Thus,iftheclosed(undermonotone

convergence)convex conesoftwosetsofpayoff functionsarethesame, thentheclosed (underthe

weak

topology)convex conesof those

two

setsofpayofffunctionswillbethesame. Thistellsusthatcheckingthat theclosed(undermonotoneconvergence)convexcones oftwosetsofpayoff functionsarethesameissufficient to establish that the

two

setsofpayofffunctions satisfyastochasticdominancetheorem.Thus, in practice,

when

checking whether (TIT) satisfy sufficientconditionsforastochasticdominancetheorem,itispossibletocheck whethertheclosureoftheconvex conesofthetwosetsare equivalent,usinganytopologywhichisconvenient (providedof coursethatthetopology guarantees continuity of the functional /?(•,/*))•

The

topologies ofmonotone

convergence, dominatedconvergence, and uniform convergence are examples oftopologies

which

might be useful in applications.Remark

1We

havecharacterizedthe relationshipbetweenY1S0M andT

SOM asfollows:n

sou=

cc(n

soMu

!!_!})=

cc(T

somu

[i-i])Since

much

ofthe existing literatureinvolvesintegrationby

parts,itisusefultoillustratethe relationshipbetweenintegrationby

partsandourcharacterization.We

can viewthe integrationby

partsasameans

of discoveringtheextremepointsof asetofpayoff functionswhich formsa closedconvexcone.

In thecasewherethedistributionfunctioniscontinuousanddifferentiablewith respectto

support [0,J], both Propositions 2.1' and 3.1 can be proved directly

by

first rewritingexpectedprofits using integration

by

parts, and then taking the partial derivative ofthisexpression withrespect to theparameter(s). It isthe integration

by

partswhichdeterminesthe relationshipbetweenU

S0M andF

SOM,andestablishingthis relationshipplays adirect role in

the proofs of both Propositions 2.1'

and

3.1.We

can rewrite the functional P(7Z,F)=

J' 7t(s)dF(s) as follows,usingintegration

by

parts:f

7C(s)dF(s) Js=0=

\k(s)-

n\s)

s+

s f' n"(s) ds]•f

dF(s) (3.3) Js=0 J Js=0+

7r\s)\

SsdF(s)-\

Sk"{s)\

S min(s,v)dF(v)ds Jj=0 Jj=0 Jv=0Notethatthefunctions y(s)

=

s and y(s)=

min(a,s),which

determinethe setoffunctionalT

SOM,appearinthisexpression,asdothefunctions n' and 7t",whichcharacterizethe setof

payofffunctions, TlSOM. Infact,

we

canseethatthefunctionalf K(s)dF(s)isthe limitof a

Js=0

sequenceofpositivecombinationsoftheexpected value ofthefunctionsin

T

SOM,pluslinearcombinationsof

J

dF(s).

The

set TlSOM isdefined sothat %' and-n"

are positive; thus, the functions y{s)=

sand y(s)=

min(a,.s) arepositive inT

S0M.The

constant functions {1,-1}areincludedbecause f dF(s)isconstantat1,butthe coefficientJj=0

\k(s)

-

7t'(s) s+

sJ* iz"(s) ds

canbepositiveornegative.

To

seehow

this isused in the study ofmono

tonicity, note thatwe

canevaluate thefunctional given in (3.1) at a parameterized probability distribution F(;0) (i.e., take

P(n,F(;d))) andthendifferentiate,asfollows:

-§}Jlo n(s)dF(s;d) (3.4)

=

k'(s)-^jsdFisid)

-H

o n"(s) JqJJ min(s,v)dF(v;6)dsThis expression canbe usedtoprovethe

SOMSD

theoremdirectly. Ifthemean

and j^Tmn(v,s)dF(v;0) are nondecreasingin 6, thenfor any nondecreasing,concave payofffunction, this expression is clearly positive.

On

the other hand, if themean

orj^min(v,s)dF(v;9) weredecreasingin

8

somewhere,we

couldconstructa nondecreasing,concave payofffunctionwhichputalloftheweightonthefailures.

What

theintegrationby

parts

shows

usis thatinsteadof checkingthat /J(tt,F(;0)) is nondecreasing in6

forallit

6

n

S0*f

(the left-handsideof(3.4)),

we

cancheckthat p(y,F(;6)) isnondecreasingin6

secondsetof conditionsiseasier tocheck.

The

constant functions {1,-1}from

abovedo

not appearinT

SOMbecause [1-dF(s;&)=

1isalwaysconstantin0.We

emphasizethe fact that theJj=0 sets

U

S0M andT

50Maredeterminedby the integration

by

parts (equation 3.3),notby

thesubsequentdifferentiationwithrespect to theparametersofthe distribution.

Inananalogous way,

we

canevaluatethe functionalf n(s)dF(s)attheparameterized

Js=0

probability distribution

F(;0

X,62),using equation(3.3),andtake themixed

partialderivative:The

proofofthe stochasticsupermodularity theoremfollows similar argumentsto thatofSOMSD.

Thisexampleclarifiesthe relationshipbetweenthenew

stochasticsupermodularitytheoremandthe existing stochasticdominanceresult.

3.3 Conditional Stochastic

Dominance

Inthissection,

we

show

thatTheorem

3.4 can be extendedtothe caseof"conditionalstochasticdominancetheorems."

We

willusethefollowingnotation:f dF(t;6)

G(

S;6,K)=

±£^

J dF(t;6) jx(s)dF(s,6) \dF(s,6) seKWe

now

introduceanobjectwhichisanalogoustoastochasticdominancetheorem:Definition 3.2 Consider apairofsets of payofffunctions(II,T), with typical elements

it:SR"->SR

and

y

:9?"-»SR. LetK

beacollectionofsubsetsof9?". Thenthepair (TIX)isaK-conditionalstochastic

dominance

pair ifconditions(i)and

(ii)are equivalentforall withapartialorder

and

allF

:9T

x

->[0,1]suchthatsuchthat F{;6)e

A":(i)

For

allneU.

and

allKeK,

k{G\K)isnondecr

easingin 6.(ii)

For

allyeT

and

allKeK,

y(6\K)isnondecreasing

in 6.Theorem

3.5 Consider apairofsetsof payofffunctions(Yl,T),whereIIand

T

aresubsets ofP

1. Let

K

heacollection ofsubsetsof9t\ where 9?"€ K. Thenthefollowingtwoconditionsare equivalent:

(i) The pair (TIT)isa ^-conditionalstochastic

dominance

pair.(ii) cc(II

u

{1,-1})= ccOTu

{1,-1}).Proof:

We

canapplytheproofofTheorem

3.4almostexactly. Letn^

=

{n

IK\neII},andlikewisefor Tk.

Then

notethatcc(Ilu{l,-l})=

cc(Tu

{1,-1})impliesthatcc(U

Ku{I

K,-IK})=

cc(TKu

{IK,-IK})forallK. Then,foreveryK

we

applyTheorem

3.4,(ii)implies(i).

To

show

that(i)implies(ii),theargumentsofTheorem

3.4canbeusedtoshow

thatif(ii)fails,then(i)mustfailforthecasewhereK

=

9?". Q.E.D.One

exampleof a conditionalstochasticdominance theorem whichhasappearedinvariousformsin theliterature(seeWhitt(1982)) involvesthe setofnondecreasingpayofffunctions, as follows:Theorem

3.6 The following conditions are equivalent:(i)

For

all it:9?"—

»9? nondecreasingand

allsublattices#c

91", k(6\K)isnondecreasingin6.

(ii)

For

allincreasingsetsAc

9?"and

allsublattices isfc9?", f dG(s;6,K) is JAnKnondecreasingin6.

Proof: Apply

Theorem

3.5together withthe fact thatcc({k\k nondecreasing}

u

{1,-1})=

cc({IA\IA(s)nondecreasing}

u

{1,-1}). Q.E.D.Thistheoremisusuallyprovedusing algebraic arguments; but usingthe resultsofthispaper,

we

see thatitfollowsasanimmediatecorollaryofTheorem

3.5. First, take thecase wheren-1.

Then

condition(ii)isequivalenttorequiringthatF(s;6)satisfiestheMonotone

Likelihood Ratio(MLR)

Order(foraproof,seeWhitt(1980)),definedasfollows:Definition 3.2 The parameter

6

indexes theprobability distribution F(;6)e

A

1accordingto the

Monotone

Likelihood RatioOrder

(MLR)

if,forall6

H>

L, thereexistnumbers

-oo<a<b<°°

and

a nondecreasingfunctionh:[a,b]-»9? suchthat F(a;6H)

=

0, F(b;6L)

=

1,and

jKdF(s;dH)

=

jKh(s)dF(s;GL)forall K^[a,b].When

thesupportofF

isconstantin6,andF

has a density/, then an equivalent requirementisthat/satisfiesthe

Monotone

Likelihood Ratio Property(MLRP),

as follows:f(sH;6)

f(sL;6)

isnondecreasingin

6

foralls11>

Milgrom

(1981) introduced theMLRP

to theeconomics literaturein thecontext of signaling problems.The

density/satisfies theMLRP

ifandonlyifthelogofthedensityissupermodular.The

MLR

impliesFOSD

(butnotthe reverse); thatis,ifF(s;6)satisfiesMLR,

thenthe distribution F(s;6)isdecreasingin flpointwise.

FOSD

does not placeanyrestrictionsonthemovements

of F(s;6)apartfromthe restriction thatchangesin6 donotcausethe distribution to cross.

The

MLR,

ontheother hand,requires that foranysublatticeK,the distribution conditionalonK

satisfiesFOSD.

Now,

supposethatn>

1. Ifwe

assumethatthevectorsisa vectorofaffiliatedrandom

variables(see

Milgrom

andWeber

(1982),who

defineaffiliationandshow

thatifthe distributionhas adensity, thelogofthatdensitymust be supermodular9),then condition(ii)requires thateachmarginal, Ffaid),

satisfies

MLR.

The

mostgeneralcase,wherethevectorsisanarbitraryvectorofrandom

variables,has nottoourknowledge beenanalyzedintheliterature.

We

havepresentedTheorem

3.6 toillustratethe relationshipbetweenseveral existingresults.The

framework developedinthispapershowsthattheproof ofTheorem

3.6isanimmediateconsequence; previous analyseshavereliedonmore

complicated arguments. But,Theorem

3.6isjustoneexample;inhisanalysisof firm entryandexit inadynamicenvironment,

Hopenhayn

(1992) derives anotherconditional stochasticdominanceresult,which heterms

monotone

conditionaldominance. Thisresultconsidersthecase of

n

=

IlFOandK

isthe setofindicatorfunctionsofupperintervals.Our

theorem showshow

togenerateother conditional stochasticdominance theoremsasapplicationsarise.4

OTHER

PROPERTIES

OF

STOCHASTIC OBJECTIVE FUNCTIONS

Thissectionderivesnecessaryandsufficientconditionsfortheobjectivefunction, j 7c(s)dF(s;&), to

satisfyproperties

P

otherthan"nondecreasing in 0,"forexample,the propertiessupermodularorconcavein8.

We

asktwo

questions:(i)For whatpropertiesP

istheclosedconvex conemethod

ofproving stochastic

P

theoremsvalid? (ii)For whatpropertiesP

canwe

establish that the closedconvex coneapproachisexactly the right one, as in thecaseofstochasticdominance?

We

proceedas follows. InSection4.1,we

introduce notationanddefinitionswhichextend ourstochasticdominance frameworkto"stochasticsupermodularity theorems,"andfor arbitrary properties

P,"stochastic

P

theorems." Section 4.2answersquestion(i),showingthattheclosedconvex coneapproachtoprovingstochasticdominance theoremsisvalid forall"stochastic

P

theorems,"whereP

isa

CCC

property. InSection 4.3we

introduceanew

classofproperties,Linear Difference Properties(LDPs),whichisa subset of

CCC

properties.We

show

thatexamplesofLDPs

includeconvexity,9In fact,Milgrom and Weber

(1982) also showthat, for general distributions, affiliationis equivalentto log-supennodularity oftheSR"derivativeon a product measure.

supermodularity,andallpropertieswhichplacea signrestriction

on

aderivative (refer toTableIforasummary

ofCCC

propertiesand LDPs). Section 4.4 addresses question(ii),provingthattheclosedconvex cone approachisexactlythe rightoneforallstochastic

P

theoremswhen

P

isanLDP.

Section 4.5 applies the resultsofthis sectionto thecaseofsupermodularity, providingexamples of(11,1") pairsfromthe stochasticdominanceliterature(whichare also stochasticsupermodularitypairs,byourmainresult)anddiscussingapplicationsofstochasticsupermodularity theorems.

4.1 StochasticSupermodularity

Theorems

and

StochasticP

Theorems

We

now

introduce a constructwhich

we

will callstochasticP

theorems,which

are preciselyanalogous to stochastic

dominance

theorems. Let us begin witha specific example, stochasticsupermodularity theorems. Using

two

parallel definitions,we

will be abletoidentifythe closerelationshipbetweenthe stochastic

dominance

theoremsandstochastic supermodularity theorems. Stochasticdominance

theorems focuson

monotonicity of expectedprofitswith respecttoasingleparameter, whilestochastic supermodularitytheoremsexamine whether increasingone parameter

increases the returns(inexpectedprofits) toincreasingtheotherparameter(recallthatsupermodularity

canbecheckedpairwise). Proposition2.3isanexample ofastochasticsupermodularity theorem.

The

followingdefinitionispreciselyanalogoustoDefinition3.1:Definition 4.1 Consider a pair ofsetsofpayofffunctions(II,F), with typical elements

it:

9T

—

>9?and

y

:9?"—

»91. The pair(II,T)isastochastic supermodularity pairifconditions(i)

and

(ii)are equivalentforalllattices©

and

allF

e

A" e:(i)

For

alln

sU,

fJt(s)dF(s;6) is

supermodular

in 6.Js (ii)

For

allyeT,

[y(s)dF(s;6) is

supermodular

in6.Further,

we

definethe setZ

J5r tobethe setofall(II,r)pairs

which

arestochasticsupermodularity pairs,analogousto "Lsm

.To

placeourexamplefrom

Proposition 3.3 in thisframework,thepair(U

SOM,r

SOM)ismI.

!lsr.When

comparingDefinition3.1 (stochasticdominance theorem) andDefinition4.1 (stochasticsupermodularity theorem), itishelpfulto recall that stochastic

dominance

theoremsandstochasticsupermodularity theorems are bothcharacterized

by

(11,0pairscorresponding to sets oflinear functionalsoftheformf5(K,-),whicharethencomposed

with parameterizedprobability distributions.Thus, itis possibleto

compare

thetwo

types of theoremsdirectly, even thoughin a stochasticdominancetheorem,theparameter spaceisanysetwith apartialorder,whileinastochasticdominance

More

generally,we

can definea classoftheoremscalled StochasticP

Theorems, which aredefinedforanarbitrarypropertyP.

We

are interested inpropertiesP

togetherwithparameterspacesQ

pwhicharedefined sothat,givenafunction h:P

—

> 9t,thestatement "h(6)satisfiespropertyP

on

0/'

iswell-definedandtakesonthefollowingvalues: "true"or"false."LetQ

p denotethesetof allsuch parameter spaces 0,,. Further, fora givenproperty P,we

willdefinethe setof admissibleparameter spacestogetherwithprobability distributionsparameterizedonthosespaces:

V

nP

=

{(F,e

p)\epee

pandF

eA%

p}.

Definition 4.2 Consider apairofsetsof payofffunctions (IT,r), withtypical elements

K

:SK"—

>9?and

7:9?"—

>9?. Thepair(II,O

w

astochasticP

pairifconditions(i)and

(ii)are equivalentforall(F,Q

P)eV

p:(i)

For

all 7teTl,j7t(s)dF(s;6) satisfies property

P

on©

p.(ii)

For

allyeT,

fy(s)dF(s;6)satisfies property

P

on 0„.Js

For example,forastochasticconcavitytheorem, 0,, can be any convexset, andcondition (i)of Definition 4.2 isinterpreted, "Forall tte

n,

Jn(s)dF{s;6) is concave in 6."

As

in the case ofstochasticdominance,

we

let I.SPT bethe setofallstochastic

P

pairs foragiven property P. Alsoanalogousto stochasticdominance,

we

canrewrite therequirementof Defintion 4.2as follows:l(F,e) e

V

p \J7t(s)dF(s;6)satisfiesP

on Vttenj

=

|(F,0)ev;\jy(s)dF(s;G)satisfiesP

onV/

€rl

Inthenextsection,

we

show

thattheclosedconvex conemethod

of provingstochasticdominancetheoremscanbeextendedtoallstochastic

P

theorems,ifP

isa closedconvex coneproperty.4.2 The Closed

Convex

Cone Approach

isValidforallCCC

PropertiesInthissection,

we

identifyaclassofproperties,whichwe

call"ClosedConvex Cone" (CCC)

properties,suchthatthefollowing statementistrue:forallproperties

P

whichareCCC,

ifapair(IIJ)

is astochastic

dominance

pair, then(tl.DisastochasticP

pair;thus, forallCCC

properties, theclosedconvex cone