iiiiiiiiiiiiiiiiiiiiiriilmHiifiiiiiiiiiiiiiiiiiiiii j

DEWEY

3

9080 02874 5138

no-

o^-

^

ZQo<\

Massachusetts

Institute

of

Technology

Department

of

Economics

Working

Paper

Series

The

Co-Movement

of

Housing

Sales

and

Housing

Prices:

Empirics

and

Theory

William

C.

Wheaton

Nai

JiaLee

Working

Paper

09-05

March

1,2009

REVISED:

May

24,2009

Room

E52-251

50

Memorial

Drive

Cambridge,

MA

02142

This

paper

can be

downloaded

withoutcharge from

the SocialScience

Research

Network

Paper

Collection at4th Draft:

May

24, 2009.The co-movement

of

Housing

Sales

and Housing

Prices:

Empirics

and

Theory

By

William C.

Wheaton

Department

ofEconomics

Center for RealEstate

MIT

Cambridge,

Mass

02139

wheaton@mit.edu

and

Nai Jia

Lee

Department

ofUrban

Studiesand Planning Center for Real EstateMIT

The

authors are indebted to,theMIT

Center for Real Estate,theNational Associationof Realtorsand toTortoWheaton

Research.They

remain responsibleforall results andconclusions derived there from.

ABSTRACT

This paper

examines

the strongpositive correlation that existsbetween

thevolume

of housingsales and housing prices.We

firstexamine

gross housing flows in theUS

and divide sales intotwo

categories: transactions that involve achange orchoice oftenure, asopposed

to owner-to-owner churn.The

literature suggeststhat the latter generatesa positive sales-to-price relationship, butwe

find that the formeractually representsthe majorityoftransactions.We

develop a simplemodel

ofthese inter-tenure flowswhich

suggests they generate a negativeprice-to-sales relationship. This runs contrarytoa differentliterature on liquidityconstraints and loss aversion. Empirically,

we

assembletwo

data basesto test themodel: a shortpanel of33MSA

covering 1999-2008 and a long panel of101MSA

spanning 1982-2006.Our

results from both arestrong and robust.Highersales "Granger cause" higher prices, but higherprices "Granger cause" both lower

salesand a

growing

inventory ofunits-for-sale.These

relationshipstogether provide amore

completepicture ofthe housing market-

suggestingthe strong positivecorrelationDigitized

by

the

Internet

Archive

in

2011

with

funding

from

Boston

Library

Consortium

Member

Libraries

I. Introduction.

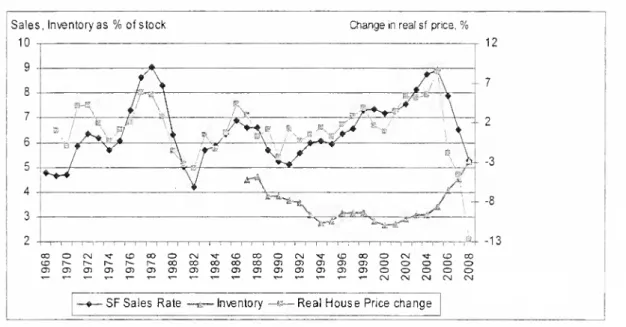

As shown

in Figure 1 below, there is a strongpositive correlationbetween

housingsales (expressed as a percent ofall

owner

households)and themovement

inhousingprices

(R

=.66).On

the surfacethe relationship looksto be closetocontemporaneous. There isalso a

somewhat

less obviousnegative relationship betweenpricesandthe shorter serieson the inventory ofunits for sale

(R

=.51),A

number

of authorshaveoffered explanations forthese relationships, in particular thatbetween

pricesand sales.

Figure 1:

US

Housing

Sales,Prices, InventorySales, Inventoryas

%

ofstock 10Changeinreal stprice,

%

~+^-Z<

^**=N^

12 13ooorsj-^-cocoocMTrcoooocMTrtocoorM-^-cDco

tor^-r-r^r^r^cococococoa^oa^aicDooooo

T—^.—

T-T-T-T-r-.—

-^-.—T-T-T—

T-T-CMCMCMCMCN

SF

Sales Rate Inventory —a—

RealHousePricechangeOn

the one hand, there isagrowing

literature ofmodels

describinghome

owner

'"churn*" inthe presenceofsearch frictions

[Wheaton

(1990),Berkovec

andGoodman

(1996),

Lundberg

and Skedinger (1999)]. In these models, buyersbecome

sellers-thereare no entrantsorexits

from

the market. In such a situation ifparticipantspay higher prices, they alsoreceivemore

upon

sale. It is thetransaction costofowning

2homes

(duringthe

moving

period) that actually determines price levels.The

greater transaction costsaccompanying

high pricescanmake

trading expensiveenough

to erase the original gainsfrom moving. In this environment Nash-bargained pricesmove

almost inverselytosalesduration

-

equaltothe vacant inventory dividedby

the sales flow. Inthese models, both the inventoryand sales churn areexogenous. Following Pissarides (2000) ifthematching

rate isexogenous

or alternatively ofspecific form, greatersaleschurn will shorten duration and lead to higherprices. Similarly greatervacancy (inventory) raises sale duration and causes lower prices.There alsoare aseries of papers

which

proposethat negative changes in prices will subsequently generate lower salesvolumes. Thisagain is apositive relationshipbetween

thetwo

variables, butwith oppositecausality.The

first ofthese isby

Stein (1995) followedby

Lamont

and Stein (1999) and thenChan

(2001). In these models,liquidity constrained

owners

areagainmoving

from one house to another(''churn") andmust

make

adown

payment

in orderto purchasehousing.When

pricesdeclineconsumer

equity does likewise and fewerhouseholds havethe remaining

down

payment

necessaryto

make

a lateralmove.

As

pricesrise, equityrecovers and so does market liquidity.Relying instead on behavior economics,

Genesove

andMayer

(2001) andthen Englehardt (2003)show

empiricallythat sellerswho

would

loosesome

equityupon

sale sethigher reservationsthan thosewho

would

not.With

higherreservations, the market as awhole

should see lowersales if

more

andmore

sellersexperience loss aversion aspricescontinue todrop.

Inthis paper

we

tryto unravel the relationshipbetween

housingprices andhousing sales, and in addition, the inventory of housingunits for sale.

We

accomplish the following:1). First,

we

carefullyexamine

gross housing flows in theAHS

forthe 1 1 years inwhich

thesurvey is conducted and findthere aremore

purchases ofhomes

by rentersornew

households than thereare by existing owners.Hence

the focusonown-to-own

trades doesnot characterizethe majorityofhousing sales transactions.2).

We

alsoexamine which

flows add tothe inventory offor-sale units (calledLISTS)

andwhich

subtract (calledSALES).

'Own-to-own moves,

forexample do

both.We

show

with a simplemodel

oftenure choice flowsthathigherpricesshould generatemore

LISTS,

lowerSALES,

and hence a larger inventory.When

prices are low, the reversehappens.3). This leads us to hypothesize a veryspecific form ofjoint causality

between

salesand prices.

Own-to-own

churngenerates a positive schedulebetween sales andprices as suggested by frictional markettheory. At the

same

time, inter-tenure transitions should lead toa negative schedule. In equilibrium, the overall housing market should restatthe intersection ofthese

two

schedules.4).

To

testthese ideaswe

firstassemble aUS

panel data baseof33MSA

from 1999-2008.The

shortnessofthepanel is due to limited data on the for-saleinventory.An

estimated panelVAR

model

perfectly confirms ourhypothesized relationships. Sales positively drive subsequent priceswhile pricesnegatively drive subsequent sales andalso positively increasethe inventory.5).

We

also assemblea longer panel of101MSA

from 1982 to2006

onjust salesand prices.

Using

awide

range ofmodel

specificationsandtests ofrobustnesswe

find again thatsalespositively"Granger cause" subsequent housing pricemovements,

whileprices negatively"'Grangercause" subsequent housingsales.

These

jointrelationshipsare exactlyas ourmodel

suggestswhen

owner

churn iscombined

with inter-tenuremoves.

Our

paper is organized as follows.In section IIwe

setup an accountingframework

formore

completely describing gross housing flows fromthe 2001AHS.

This involves

some

careful assumptionsto adequatelydocument

the magnitude ofall theintertenure flows relative towithin tenure churn and to householdcreation/dissolution. In

Section III,

we

develop asimple stylizedmodel

ofthe inter tenureflowsto illustratehow

theycan generate a negativerelationship

between

pricesand salesand a positive relationshipbetween

prices and inventory.We

present ourhypothesized pair ofrelationships

between

pricesand thesales/inventory ratio. In sectionIV

we

testthese ideas with a shortpanel data base (33MSA)

that coversthe inventoryaswell as pricesand sales. In sections

V

through VIIwe

present an analysis ofa longer panel datasetbetween

just salesandprices across 101MSA

coveringthe yearsfrom 1982-2006.Here

again

we

find conclusive evidencethat salespositively"Granger cause" prices and that prices negatively"Granger cause" sales.Our

analysis is robusttomany

alternative specificationsand subsample tests.We

conclude withsome

thoughts about historicII.

US

Gross

Housing

Flows: Sales, Lists,and

the Inventor}'.Much

ofthe theoretical literature on sales and prices investigateshow

existinghomeowners

behaveastheytry and sell theircurrenthome

to purchaseanew

one. This flow ismost

often referred to as "churn".To

investigatehow

important arole "churn" plays in the ownershipmarket,we

closelyexamine

the 2001American Housing

Survey.In "Table 10"ofthe Survey, respondentsare asked aboutthe tenureofthe residencethey previously lived in

-

forthosethatmoved

during the lastyear.The

totalnumber

ofmoves

in this question isthesame

asthetotal in "Table 11"-

asking aboutthepreviousstatusofthecurrent head (therespondent). In "Table 1

1"

itturns out that

25%

ofcurrentrenters

moved

from a residence situation inwhich

theywere

not the head (leavinghome,

divorce, etc.).

The

fraction is a smaller12%

forowners.What

is missing is thejoint distributionbetween

moving

by the head andbecoming

a head.The

AHS

is notstrictlyable to identify

how many

currentowners

moved

eithera)from

anotherunit theyowned

b)anotherunitthey rented orc) purchaseda house asthey

became

anew

ordifferenthousehold.

To

generate the full setofflows,we

use information in"Table 11" aboutwhether

the previous

home

was

headed bythe currenthead, a relative oracquaintance.We

assume

that all currentowner-movers

who

were

alsonewly

created households -were

counted in "Table 10" as beingpartofapreviousowner

household. For renters,we

assume

that all renter-moversthatwere

alsonewly

created householdswere

counted in"Table 10"inproportionto renter-ownerhouseholds inthe full sample. Finally,

we

use theCensus

figures thatyear forthe netincrease in each type of household, andfrom

that togetherwith the dataonmoves

we

are able to identify household "exits" bytenure.Gross household exitsoccur mainly through deaths, institutionalization(such as to a nursing home), or marriage.

Focusingonjustthe

owned

housingmarket,theAHS

alsoallows usto accountfor virtually all oftheevents thatadd units to the inventoryof houses for sale (herein called

LISTS)

and all ofthose transactionsthatremove

units fromthe inventory (herein calledSALES).

Therearetwo

exceptions.The

first isthe netdelivery ofnew

housingmarket. Since

we

have nodirect count ofdemolitions'we

use thatfigure also as netand

it is counted asadditional

LISTS.

The

second isthe net purchases of2ndhomes,which

must

be counted as additionalSALES,

butaboutwhich

there is simply little data". In theory.LISTS

-

SALES

should equalthechange in the inventoryofunits forsale.These

relationships are depicted in Figure 2and can be

summarized

with the identitiesbelow

(2001

AHS

values are included).SALES

=

Own-to-Own

+ Rent-to-Own

+

New

Owner

[+ 2 ndhomes]

=

5.281.000LISTS

=

Own-to-Own +

Own-to-Rent

+ Owner

Exits+

New

homes =

5,179.000 InventoryChange

=

LISTS -

SALES

Net

Owner

Change =

New

Owners

-

Owner

Exits+

Rent-to-Own

-

Own-to-Rent

Net

RenterChange =

New

Renters-

Renter Exits+

Own-to-Rent

-

Rent-to-Own

(1)

The

only othercomparabledata is from theNational Association ofRealtors(NAR).

and itreports that in2001 the inventory ofunits for salewas

nearly stable.The

NAR

however

reportsaslightly higher level ofsales at 5.335.000 existing units. This small discrepancy could beexplained by repeatmoves

withinasame

year since theAHS

asksonlyaboutthemost

recentmove.

Itcould also represent 2ndhome

saleswhich

again are not partoftheAHS

move

data.What

ismost

interesting to us is that almost60%

ofSALES

involve a buyerwho

is nottransferringownership laterally from one

owned

houseto another.So

called"churn"is actually a minorityofsalestransactions.

The

variousflowsbetween

tenure categoriesalso arethemore

critical determinant ofchange-in-inventory since"churn"salesleave the inventory unaffected. .

Thegrowth in stockbetween 1980-1990-2000 Censusescloselymatchessummedcompletionssuggesting

negligibledemolitionsoverthosedecades. The samecalculation between 1960 and 1970howeversuggests

removal of3 millionunits.

2

Netsecondhomepurchasesmight beestimatedfromtheproductof: theshareoftotal grosshome

purchasesthat aresecondhomes(reported by LoanPerformanceas 15.0%) andtheshare ofnew homes in total homepurchases(Census,25%). Thiswouldyield 3-4%oftotaltransactionsorabout200,000units.

Therearenodirectcountsoftheannualchange in2" homestocks.

The

AHS

isarepeatsample of housingunitsand excludesmovesintonewhouses.Thuswecompare itsFigure2:

US

Housing

Gross Flows

(2001)>nd

Net

2Home

Purchases(SALES)

(1)New

Owner

households=

564,000(SALES)

RentertoOwner

=

2,468.000(SALES)

(1)New

Renter households=

2.445,000Owner

toOwner

=

2,249.000(LISTS

&

SALES)

Owners =

72,593,000Net

Increase=

1,343,000 Renters=

34,417,000Net

Increase=

-53,000 Renterto Renter=

6,497.000 (2)Owner

Exits=

359,000(LISTS)

Owner

to Renter=

,330,000(LISTS)

Net

New

Homes

=

1.242,000.(LISTS)

(2) RenterExits

=

1,360,000In Figure 2.

most

inter-tenureSALES

would

seem

to be eventsthatone might expectto be negatively sensitive tohousing prices.When

prices are high presumablynew

created

owner

household formation is discouraged orat leastdeflected intonew

renterhousehold formation. Likewise

moves

which

involvechanges intenure from renting toowning

also should be negatively sensitive tohouse prices.Both

result becausehigher pricessimplymake

owning

a house lessaffordable.At

thistimewe

are agnostic abouthow

net 2ndhome

salesare related to prices.On

theotherside ofFigure 2,many

ofthe events generatingLISTS

should be atleast

somewhat

positively sensitive to price.New

deliveries certainlytryto occurwhen

to "cash out",

consume

equity orvoluntarilychoose to switchto renting. Atthis timewe

are still seeking a direct data source

which

investigates inmore

detailwhat

events tend to generate the own-to-rentmoves.Thus

theflows inand outofhomeownership

inFigure 2 suggestthatwhen

prices are high sales are likely to decrease lists increaseandtheinventory grow.

The

AHS

hasbeen conducted only semi-annually until recently and alsohas used consistentdefinitions ofmoving

only since 1985. InAppendix

IIIwe

calculate the flowsforeachofthe 11

AHS

surveys between 1985 and 2007.The

flows are remarkablystable, although there exists

some

yearto yearvariations. In all years,own-to-own

moves

("chuirT) are less thanthe

sum

ofnew

owners

plus rent-to-ownmoves. Sincethe2001 survey, theAHS

calculated values forLIST-SALES

have increased significantly. This isconsistent withthe

growing

national for-sale inventory reported in theNAR

dataoverthis period.

III.

A

stylizedmodel

of inter-tenureflows.Here

we

assume

that thetotalnumber

of householdsT

is fixed withH

<

T

beinghome

owners.Those

notowning

rent atsome

fixed (exogenous) rent-

hencewe

largely ignore the rental market.The

total stockofunitsavailable for ownership U(p) isassumed

to

depend

positively on price (longrun supply) and with fixed rentswe

ignore rental supply. In this situation the inventoryofunits for sale is the difference between theowner

stockandowner

households: I=

U(p)-

H.Households

flow outof ownershipatsome

constant rateawhich

could representunemployment,

foreclosure,or othereconomic

shock. Rental households purchase units out oftheowner

stock(become

owners)atsome

rate s(p)which

we

presume

depends negativelyon price.High

prices (relative to the fixed rent)make

ownership lessappealing, but in general renterswishto

become

owners

becauseofsome

assumed

advantage(atax subsidy forexample).

-

hencethe purchaserate isalways positive.The

equationsbelow

summarize

both flows (timederivatives) andsteady statevalues (denoted with *). In Equation (2) the stable

homeownership

ratedependsnegativelyon prices and the constant

economic

shock rate.When

pricesgenerate a sales rate equal to theeconomic

shockrate,homeownership

is50%.

Equation (3) cleanlydivides up the inventory

change

intothesame

two

categoriesfrom

ourmore

detailedflow diagram:LISTS-SALES.

Here

LISTS

are stockchange(new

construction) plusown-to-rent flows

(economic

shocks) whileSALES

are rent-to-own flows.The

equilibrium levelof

SALES

is in (5),and the equilibrium inventory in (4).The

lattermust

beconstrained positive.dH/dt

=

s(p)[T-H]-aH,

H'

=

S("P)T

(2)a

+

s(p) dlIdt=

dU

Idt-

dH

Idt= [dU

Idt+

aH]-

s(p)[T- H],

(3 )l'=U(p)-H'

=

<*U(P)+ s(P)U(P)-sT>o

(4)a

+

s{p).

as(p)T

s(p)[T-H

]=

—

(5)a

+

s{p)In (6)

we

derive comparative staticswhich

show

thatas prices increase,the steadystate valueofthe inventory

grows

and thesteady state level ofSALES

decreases-

ashypothesized aboutthe flows

which

were diagramed

in Figure 2.dl' I

dp

= dU/dp-dH'

/dp=

dU/dp-

P

[\—

^7

>0

(6)a

+

s a+

sd

(s(P

)[T-H'])/dp=

£™^[l-^_]

<

a

+

sa

+

sAgain,the conclusions

above

follow from theassumptionsthat long run stock is positively related toprice and the salesrate is negative relatedto price.Thus

thissimplemodel

ofinter-tenure flows establishes a negative relationshipbetween

housingpricesand Sales/Inventoryratios. Alternatively, there should bea positive relationship

between

pricesand duration.

With

thisnew

schedulebetween

pricesand durationwe

arenow

readytobetter describethe full setofrelationships in theowner

marketbetween

sales, pricesand the inventor)'.We

combine

thisnew

schedule with a positive schedulebetween

prices and the Sale/Inventory ratio-

created fromthe variousmodels

ofown-to-own

decisions. Inthese latter

models

itis sales that are determining prices, while with themodel

in (2)-(5)above

it is prices that aredeterminingsales.At

amore

complete equilibrium (in theownership market) sales, pricesand the inventory all rest atthe intersection ofthe

two

schedules

shown

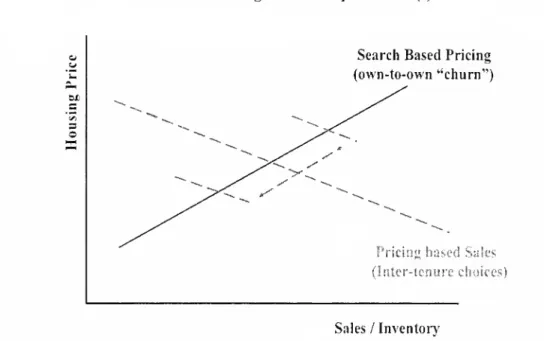

in Figure3. Figure 3 presents amore

completepicture ofthe housing market thanthemodels

ofStein,Wheaton,

orBerkovec

andGoodman

-

since itaccountsforthevery large role ofinter-tenure mobility aswell as for

owner

churn.FIGURE

3:Housing

Market

Equilibrium(s)Search BasedPricing (own-to-own "churn")

WO

Pricingbased Sales (Inter-tenure choices)

Sales/Inventory

The

out-of-equilibriumdynamics

ofthismodel

are alsoappealing andseem

inlinewith

economic

intuitionas well. Considera permanentincrease ineconomic

shocks(a).

Using

(2)- (5),owner

householdsdecline, andthe inventory increases. Saleshowever

also increaseand sothe impact on duration is technically ambiguous. Within a

wide

range ofreasonable parametervalues however,

we

canshow

that the sale/inventoryratiodeclineswith greatera

-

the netshift in the price-to-sales schedule is therefore inward.The

new

equilibrium then results in lowerprices with a lowersales/inventory ratio as well (a higherduration). Ifwe

shiftthe s(p) scheduleup (e.g. a greater tax subsidy)thenumber

ofowners

increases, the inventory drops, and sales increase. This leadsto an4

unambiguous

rightward shift in the price-to-salesschedule with a corresponding rise inequilibrium Sales/Inventory (drop in duration). Pricesof course rise as well.

The

next task isto see ifwe

canempirically identifythe relationships in Figure 3.Forthis,

we

examine

two

several panel databases with different degreesofrichness.The

first data base isshorterand covers only 33

MSA.

Its advantage isthat it includes dataon

the inventory for sale by market

-

a serieswhich

theNAR

has collected only recently.The

second database ismuch

longer, covers 101MSA,

but includes only informationon

sales and prices.

IV.

A

Short Panel

Analysis ofMetropolitan

Sales, Pricesand

Inventory.Carefully constructed series on house prices areavailable from the late 1970sor early 1980s and fora

wide

rangeofmetropolitan areas.The

pricedatawe

use isthe deflatedOFHEO

repeat sales series [Baily,Muth,

Nourse

(1963)].This data series has recently been questioned fornot factoring outhome

improvements

ormaintenance andfornot factoring in depreciation and obsolescence [Case,Pollakowski,

Wachter

(1991), Harding. Rosenthal, Sirmans (2007)]. Thatsaidwe

are leftwithwhat

isavailable, andthe

OFHEO

index is themost

consistent series available formost

US

markets overa longtimeperiod.

The

only alternative isCSW/FISERV,

and it is available forfar fewer metropolitan areas that in turn aredisproportionately concentrated in the south and west.In termsofsales,the only consistent source isthatprovided

by

theNational Association ofRealtors(NAR).

The

NAR

data is forsingle family unitsonly (it excludescondominium

sales attheMSA

level), butis availableforeachMSA

over a periodfrom

1980to the present.

The

more

limitingdata series is thaton the inventory of housingunits forsale.

Here

theNAR

distributesMSA

data only from 1999 orlater.We

have beenable toputtogetherall three series since 1999 for33

MSA,

and Figures4 through 6 depictthe 33 series foreach variable.The

patterns arequitediscernable and inAppendix

I

we

presentsummary

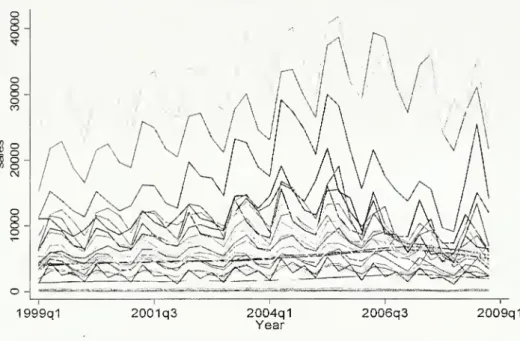

statisticsforeach market.In Figure 4

we

clearly see all house prices risingand thenfalling since 1999.The

sample almost evenly divides

between

marketwhere

thismovement

is verypronounced

and those with onlythe slightestofchanges. Interms ofthe inventory, Figure 5shows

thatover the firsthalfofthe samplethe inventory

was

roughly constant. After2004

itrises and falls in a pattern again similarto prices. Boththe Pricesand Inventoryare

raw

series andexhibit little seasonality.

As

forsales, in Figure 6we

see a littlebit ofthesame

"hump

shaped"pattern, but itseems

weaker.What

ismore

problematic with the sales data is thestrong pattern ofseasonality in each series-

seasonalitythatvaries by specificmarket in

many

cases.Figure4:

Quarterly Real

House

Prices (33MSA),

1999-2008

o

inn

o

o

o

OJ D.E

o

o

O

o

o

-1999q12001q3

2004q1 Year 2006q3 2009q1Figure5:

Quarterly

For-SaleInventory (33MSA),

1999-2008

o

o

o

o

o

m

o

o

o

o

o

\ro

o

o

o

o

Q) COo

o

o

o

o

o

o

o

1999q1 2001q3 2004q1 Year 2006q3 2009q1 13Figure

6:Quarterly

House

Sales (33MSA),

1999-2008

o

9c

c

c

o

n

8g

o

o

CM1

o

8

o

1999q1 2001q3 2004q1 Year 2006q3 2009q1These

observations suggestthata panelVAR

is an appropriate instrumenttotestthe relationships

between

prices, sales and inventory. In theVAR

we

will have each variable depending on lagged values ofitselfand theothervariables. Ifthe panel is of order one,we

also can use each coefficient asaneffectivetestof"Granger

causality".Before turningto such amodel, however,

we

needtoexamine

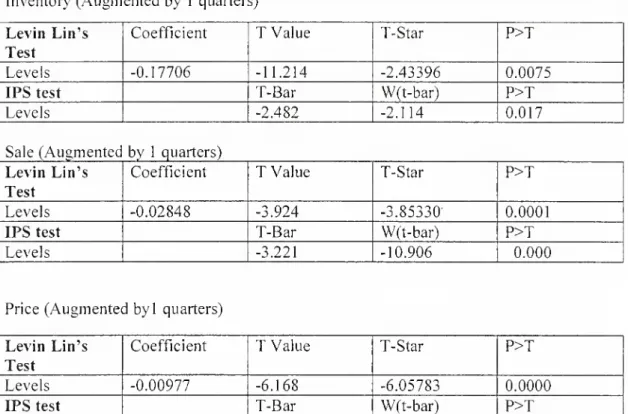

each seriesto see ifthey are stationary. Therearetwo

tests available foruse with panel data and in each, the null hypothesis is thatsum

oraverageofallthe individual series have unit rootsand arenon

stationary. In Levin-Lin (LL, 1993) the null hasno constant(ordrift)while in

Im-Persaran-Shin (IPS, 2002) the null includes a constantto allow fordrift. In Table 1

we

reportthe resultsofthis testfor housingprices, sales and inventory

-

in levels.With

the possible exception ofprices,where

we

can be confident only atthe7%

level, the non-stationary null is rejected andwe

should be on solid grounds undertaking our proposedVAR.

Table

1: Stationary tests,Short PanelInventory'

(Augmented

by 1 quarters)Levin

Lin'sTest

Coefficient

T

Value T-StarP>T

Levels -0.17706 -11.214 -2.43396 0.0075

IPS

testT-Bar

W(t-bar)P>T

Levels -2.482 -2.114 0.017

Sale

(Augmentec

by 1 quarters)Levin

Lin'sTest

Coefficient

T

Value T-StarP>T

Levels -0.02848 -3.924 -3.85330 0.0001

IPS

testT-Bar

W(t-bar)P>T

Levels -3.221 -10.906 0.000

Price

(Augmented

byl quarters)Levin

Lin's TestCoefficient

T

Value T-StarP>T

Levels -0.00977 -6.168 -6.05783 0.0000

IPS

testT-Bar

W(t-bar)P>T

Levels -1.750 -1.477 0.070

In panel

VAR

models

with individual heterogeneitythere exists a specification issue: the errorterm can becorrelatedwith the lagged dependent variables [Nickell, (1981)].OLS

estimation can yield coefficients that areboth biased and also that arenot consistent in thenumber

ofcross-section observations. Consistency occursonly in thenumber

of time series observations.Thus

estimatesand anytests on theparameters ofinterest

may

notbereliable.These

problems might notbe serious inourcase sincewe

have 32 quarterlytime series observations(morethanmany

panel models).To

be on thesafe side, however,

we

also estimated the equations following an estimation strategy byHoltz-Eakin et al.

As

discussed inAppendix

II, thisamounts

to using 2-period lagged values ofsales andprices as instruments withGLS

estimation.A

final concern with ourVAR

isthe handlingofseasonality.Here

we

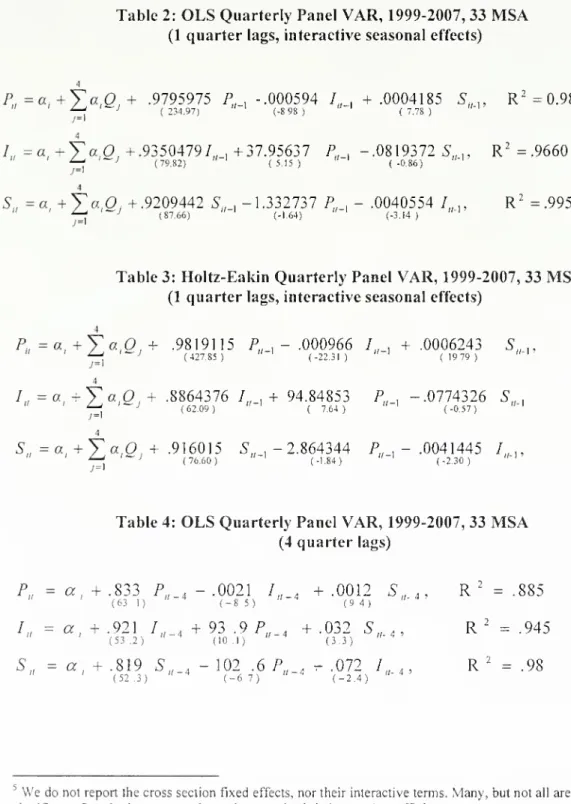

propose 2adjustments. In Tables 2and 3,

we

report results using quarterly seasonal effectsinteracted withthecross section fixed effects. This effectivelyallows each

MSA

to have itsown

setofseasonal influences.Our

second approach isto change all ofthe lags intheVAR

to4-periods ratherthan one. In effectwe

areaskinghow

ourvector ofvariablesrelates to thevector lagged a year previousratherthan a quarter ago.

The

year-over-yearVAR

results are presented in Table 4.5

Table

2:OLS

Quarterly Panel

VAR,

1999-2007,33

MSA

(1

quarter

lags, interactive seasonal effects)P=a

+YaO,+

.9795975P

u . -.000594 /„ ,+.0004185

S,n

,R

2=0.9889

" '4f

'*-> (234.97) ""' (-8,98) ""' (7,78) ""' 4 /=

a,+Y

a,O,+.93504797,

.+37.95637

P..-.0819372

5,,.,R

2=.9660

" '^

'-' (79.82) ""' (5.15) ""' (-0.86) ""'' 4S

=a+Ya,0,

+.9209442

S

u .-1.332737

P. ,-

.0040554 /„..R

2=.9950

(87.66) (-164) (-3.14)Table

3:Holtz-Eakin Quarterly Panel

VAR,

1999-2007, 33MSA

(1

quarter

lags, interactive seasonal effects)p

'=

a

,+

Y

a,0,+

.9819115 P...-

.000966 I...+.0006243

S.n

, " 'j^

'~> (427.85) ""' (-22.31) ""' (1979) ""' 4 /=

a

.+

Y

a,Q,

+

.8864376 /„ ,+

94.84853 P„ ,-

.0774326 S„ , " '^

' («09) """' ( 764) "-' (-0.57) ""' 4 S.=

a,.+Ya,.0,T

.916015 5„,-

2.864344

P,.-

.0041445 /, ,, '^

J (76.60) "-l (-184) ""' (-2.30) ""'Table

4:OLS

Quarterly

PanelVAR,

1999-2007,33

MSA

(4

quarter

lags)P„

=

a,

+

.833P„

4-

.0021 /„ 4+

.0012

5,

4,R

-=

.885 (63 1) "-4 (-S 5) ""4 (9 4) "" 4 ' /„= a, +

.921 /„_<+93

.9/>„_4+

-032 5„.4>R

2=

.945 (53 .2) (10.1) (3 3)S„

= a,

+.819

S„_

4-102

.6P„_

4-.072

7„.4 ,R

2=

.98 (52 .3) (-67) (-2.4) 5We

donot report the cross section fixed effects,northeirinteractiveterms. Many, butnotallaresignificant.Standarderrorsareshownin parenthesisbeloweach coefficient.

In

examining

Tables2-4,we

find that ourthree hypotheses are validated in every case. First,the inventory negatively impactsprice while sales hasa positive effect.Interestingly thecoefficienton inventory is alwaysslightly largerthansales. Ina log

model

ifthe ratio(duration)were

all thatmattered the coefficientswould

be identical inmagnitude. In this linear

model

theyare closeenough

to suggesta similarconclusion. Secondly, the inventory respondsquite significantly (and positively) to prices. Thirdly, prices negatively impact subsequent sales. All ofthese effects are statistically significant, but the price impact on Salesshows up

more

strongly inthe 4-quarter lagmodel. In the1-quarter

model

itis atthe thresholdofsignificance. In all respects, the results fully support equations (2)-(5) and the pairofrelationships in Figure 3. Duration negatively"Granger

causes" subsequentprices to decline. Pricethen positively

"Granger

causes" theinventoryto grow, and likewise for sales to decline.

The

firstVAR

equation validates theupward

schedule in Figure3 whilethe secondand thirdcombine

to yield thedownward

schedule.

In

comparing

the differentmodels

we

note that the Holtz-Eakin estimation does increasethe coefficients abitand reduce standard errors-

relative to theOLS

results.We

did notundertake Holtz-Eakin estimation for our 4-quarter lag model.

The

OLS

4-quarter results areexpected!}' different. Inventoryand sales, forexample, have an impactonprices4 periods hencethat is roughly4 timestheir impact inthe 1-quarter model.

Similarly, prices impactsales 4 quarters hencewith

much

greater impactthan fromjust 1quarterback.

V.

A

long-PanelofMetropolitan Salesand

Prices.It is possible totestthe just the relationshipbetween prices and salesovera

much

longertime horizon-

ifwe

ignore theinventory.6 Forthiswe

assemblea larger panel data base covering 101MSA

and spanning theyears 1982 through 2006. This panelwas

6

There have beenafewrecentattemptstestthe relationshipbetweenmovementsinsales andprices. Leung, Lau, andLeong(2002) undertakeatimeseriesanalysisofHong KongHousing and concludethat

strongerGrangerCausalityisfoundforsalesdrivingprices ratherthan pricesdrivingsales. Andrewand

Meen(2003)examinea

UK

MacrotimeseriesusingaVAR

model andconcludethattransactions respond toshocksmorequickly thanprices,butdonot necessarily "GrangerCause"priceresponses. Bothstudiesarehamperedby limited observations.

purposely structured to be annual so asto avoid the seasonalityofthe shorter panel,while still maintaining plentiful time-based degrees of freedom.

Over

this longer period,many

metropolitan areas almostdoubled theirhousing stock sowe

decided to standardizethe salesdata to eliminatesome

ofthe trend.Raw

saleswere

compared

with yearlyCensus

estimates ofthenumber

oftotal households inthose markets. Dividing singlefamily sales

by

total householdswe

getan estimated sales rate for each market in each period.Using

sales rates also eliminatedmuch

ofthecross section variation intheraw

number

ofsales. In a similarmanner

we

setthereal price level in each marketto 100 in the baseyear.These

re-scalingofthe datawill helpmake

thecross section fixed effects smaller in the estimated

VAR

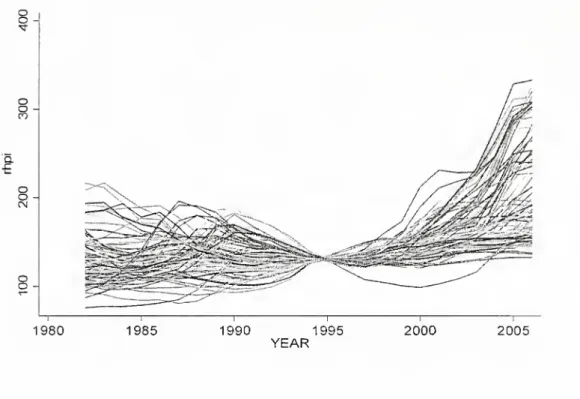

models.In Figures 7and 8

we

illustratethe constant dollarOFHEO

price seriesalong with the yearlyNAR

sales rate data, forall 101 of ourmarkets.Over

this time frame, the priceseries vary widelyacross markets, withsome

areas experiencing long termalthough episodic increases (e.g. San Francisco)while othersare almosttotally constant

(e.g. Dallas).

As

forthe salesrates, virtually everymarkethas aslow gradual trend insalesrates, with the

sample

average increasing from3%

to 5.6%.

InappendixIIIwe

presentthe

summary

statistics for each market'sprice and sales rate series.The

data in Figure 4through 6 forthe shortpanelshowed

no obvioustrends;'prices, sales and the inventory generallyriseand then fall.

The

longerterm series inFigures 7 and 8

may

havemore

persistenttrends and so againwe

need to test forwhether

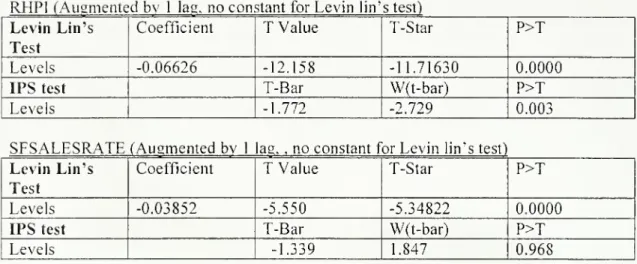

theseries are stationary. InTable 5

we

reporttheresults ofboth Levin-Lin and IPStests forboth housing priceand sale rate levels.With

bothtests the null for house prices is rejected athighconfidence levels, butwiththe IPS testthe null hypothesis forthe sales rate is quite likely to hold.

Given

the steady trends seen in Figure 8, this of courseseems

reasonable.To

be onthe safe side,then

we

estimateour long term sales-priceVAR

in differences aswell as levels.Figure7:

Annual House

Prices (101MSA),

1982-2006

o

o

CO a.o

o

1980 1985 1990 1995YEAR

2000

2005

Figure8:

Annual

SalesRate

(101MSA),

1982-2006

CD a CO Lf) 1980 1985 1990 1995

YEAR

2000

2005

l"TABLE

5: Stationary tests,Long

Panel

RHPI

(Augmented bv

1 lag, no constant forLevin lin's test)Levin

Lin's TestCoefficient

T

Value

T-StarP>T

Levels -0.06626 -12.158 -11.71630 0.0000IPS

testT-Bar

W(t-bar)P>T

Levels -1.772 -2.729 0.003

SFSALESRATE

(Augmented

bv

1 ag. .no

constantfor Levin lin's test)Levin

Lin's TestCoefficient

T

Value

T-StarP>T

Levels -0.03852 -5.550 -5.34822 0.0000

IPS

testT-Bar

W(t-bar)P>T

Levels -1.339 1.847 0.968

Since

economies change

more

in the longer term,we

decided to include several conditioning variables.The

conditioning variableswe

choose are market specificemployment,

and thenationalmortgage

rate.The

resulting 2-variableVAR

in levels isshown

in(7), while in(8) thecompanion model

ispresented in first differences.P,j

=ao+«i p

/.,-i

+«aV,

+

/7'^//+

3

+*,.,Su

=7o

+

r,Vi

+/2

P

U-\+^

X

U +

7l+£

u

AP,,=a +a

iAP

IJ_l+a

2AS

IJ_l+/3'AX

IJ+5,

+£,, ^,.«=7o +

/iA

V>

+y

2&P,.l_i+A

,AX,

J +?],+£

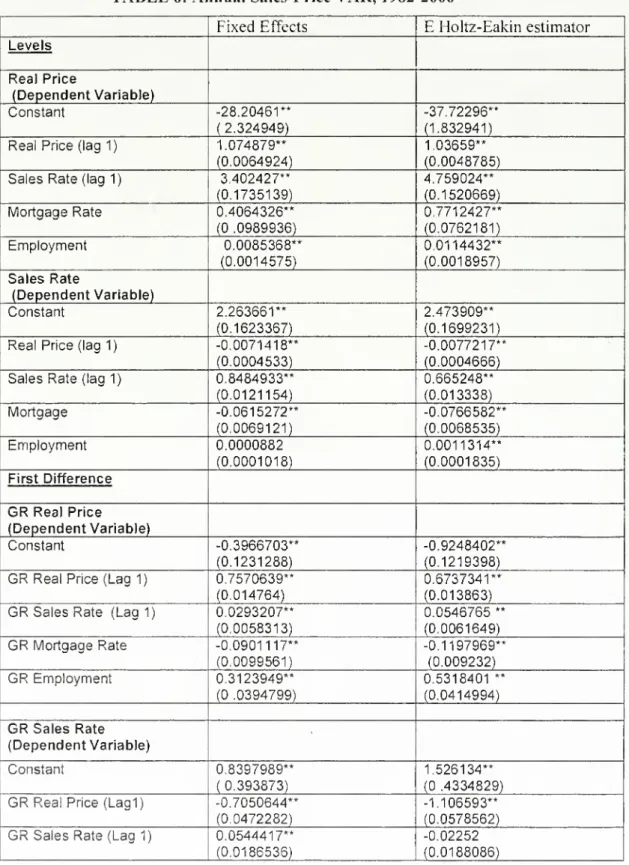

(7) (8)We

estimateeachmodel

using bothOLS

andalso applying the previously discussed estimation strategyby

Holtz-Eakin etal.From

either estimates,we

conduct a"Granger"

causalitytest. Sincewe

are onlytesting for a single restriction, the t statistic is the square root oftheF

statistic thatwould

be used to testthehypothesis in the presence ofa longer lag structure (Greene,2003). Hence,we

can simply use a ttest (appliedto7

In (6)the fixedeffects arecross-section trendsratherthan cross sectionlevels asin(5)

thea, and

y

2)as thecheck ofwhether changes in sales"Granger cause" changes in price and/orwhetherprices"Granger

cause" sales.In table 6

we

report the results ofequations(7) and(8) in each setofrows.The

firstcolumn

usesOLS

estimation, thesecond theRandom

EffectsIV

estimatesfrom

Holtz-Eakinet al. Interestingly, the

two

estimation techniquesyield quite similar coefficients-

asmight be expected with a largernumber

oftimeseries observationsand datarescaling to reduce the cross sectioneffects.The first setofequations is in levels,while the second setof

rows

reportsthe resultsusing differences. In all Tables, variablenames

are selfevidentand variable differences are indicatedwith the prefixGR.

Standarderrors are reported in parenthesis.

Among

the levels equations,we

firstnoticesome

anomalies.The

mortgageinterest rate inthe price levels equation is always ofthe

wrong

sign, andtheemployment

coefficient inthe

OLS

sales rate equation is insignificant (despitealmost2500

observations).

A

more

troublesomeresult isthat the price levelsequation has excess"momentum"

-

lagged priceshave acoefficientgreaterthan one.Hence

prices (levels)can

grow

on theirown

without necessitating any increases in fundamentals, orsales.We

suspectthatthese

two

anomaliesare likely the resultofthe non-stationary feature toboth the price andsales serieswhen

measured

in levels.When we move

tothe results of estimating theequations in differences all ofthese issues disappear.The

lagged price coefficients are lessthan one so the price equations are stable in the 2n degree, and the signsofall coefficients are both correct-

and highly significant.As

tothe question ofcausality, in everyprice orprice growth equation, lagged sales orgrowth in sales is always significantly positive.Furthermore in every salesrate or growth in sales rateequation, lagged prices (or itsgrowth) arealso alwayssignificant.There is clearevidence ofjoint causality,

and

the effectof

laggedpriceson

salesisalways

of a

negativesign. Holding lagged sales (and conditioning variables)constant, ayearafterthere is an increase in prices

-

salesfall. Thisisthe opposite ofthatpredictedby

theories ofloss aversion or liquidity constraints, butfully consistentwiththe roleplayedby tenurechoices in Figure2 and our simple

model

ofthese flows.TABLE

6:Annual

Sales-PriceVAR,

1982-2006

Fixed Effects

E

Holtz-Eakin estimator Levels Real Price (DependentVariable) Constant -28.20461** ( 2.324949) -37.72296** (1.832941) Real Price (lag 1) 1.074879**(0.0064924)

1.03659** (0.0048785) Sales Rate (lag 1) 3.402427"

(0.1735139) 4.759024** (0.1520669) MortgageRate 0.4064326** (0 .0989936) 0.7712427** (0.0762181) Employment 0.0085368** (0.0014575) 0.0114432** (0.0018957) Sales Rate (DependentVariable) Constant 2.263661** (0.1623367) 2.473909** (0.1699231) Real Price (lag 1) -0.0071418**

(0.0004533)

-0.0077217** (0.0004666) Sales Rate (lag 1) 0.8484933**

(0.0121154) 0.665248** (0.013338) Mortgage -0.0615272** (0.0069121) -0.0766582** (0.0068535)

Employment

0.0000882 (0.0001018) 0.0011314** (0.0001835) First DifferenceGR

Real Price (DependentVariable) Constant -0.3966703** (0.1231288) -0.9248402** (0.1219398)GR

Real Price (Lag 1) 0.7570639**(0.014764)

0.6737341** (0.013863)

GR

Sales Rate (Lag 1) 0.0293207**(0.0058313) 0.0546765 ** (0.0061649)

GR

MortgageRate -0.0901117** (0.0099561) -0.1197969** (0.009232)GR

Employment

0.3123949** (0 .0394799) 0.5318401 ** (0.0414994)GR

Sales Rate (DependentVariable) Constant 0.8397989** ( 0.393873) 1.526134** (0 .4334829)GR

Real Price(Lag1) -0.7050644**(0.0472282)

-1.106593** (0.0578562)

GR

SalesRate (Lag 1) 0.0544417**(0.0186536)

-0.02252 (0.0188086)

GR

Mortgage Rate -.3251265" (0.0318483) -0.3078643** (0.031781)GR

Employment 1.134269** (0.126291) 1.391958** (0.1463704) ** indicates significanceat5%.

We

have experimented with thesemodels

usingmore

thana single lag, but qualitatively the results are the same. In levels, the priceequation withtwo

lagsbecomes

dynamically stable in thesensethatthe

sum

ofthe lagged price coefficients is lessthan one.As

tocausal inference, thesum

ofthe lagged sales coefficients ispositive, highly significant, and passes theGranger

F

test. Inthe salesrate equation,thesum

ofthetwo

lagged sales rates is virtually identical tothe single coefficient

above

andthe lagged price levelsare again significantly negative(in theirsum). Collectively higher lagged prices"Granger

cause"a reduction in sales.We

have similarconclusionswhen

two

lags areused in the differences equations, but indifferences, the 2nd lag isalways insignificant.

As

a final test,we

investigate arelationship between thegrowth

in house pricesand the levelofthe salesrate. Inthe search theoretic

models

sales ratesdetermine pricelevels,but ifprices are

slow

to adjust,the impactofsales mightbettershow

up on pricechanges. Similarly the theoriesofloss aversionand liquidityconstraints relate price

changesto sales levels.

While

the mixing oflevelsand changes in time seriesanalysis is generally not standard, thiscombination ofvariables is alsothestrong empirical factshown

in Figure 1. InTable 7 pricechanges are tested forGranger

causality againstthe level ofsales (as a rate).TABLE

7:Annual

Sales-PriceMixed

VAR,

1981-2006

Differencesand Levels Fixed Effects

E

Holtz-Eakin estimatorGR

Real Price (DependentVariable) Constant -6.698605** (0.3568543) -11.10693** (0.4174099)GR

Real Price (lag 1) 0.5969905**(0.015889)

0.4286127** (0.0156827) Sales Rate (lag 1) 1.424051**

(0.0760102) 2.340478** (0.0912454)

GR

Mortgage Rate -0.1230876** (0.009451) -0.1573441** (0.0086482)GR

Employment 0.4987545** (0.0349922) 0.7781044** (0.0373462) 23Sales Rate (DependentVariable) Constant -0.0458271" (0.0541373) 0.283191" (0.0642588)

GR

House

Price (lag 1) -0.0328973"(0.0024105)

-0.0355432" (0.002961) Sales Rate (lag 1) 1.01549"

(0.0115313) 0.9482599" (0.0139037)

GR

Mortgage Rate -0.0156137" (0.0014338) -0.0132519" (0.0013497)GR

Employment

0.0462483" (0.0053086) 0.7280071" (0.1643153) ** indicatessignificance at5%

In terms

of

causality,these results areno different than themodels

estimated either in all levelsorall differences.One

yearafteran increase in the levelofsales, thegrowth

in house prices accelerates. Similarly, one yearafterhousepricegrowth

accelerates the levelof

home

salesfalls. All conditioning variables are significantand correctly signed and lagged dependent variableshave coefficients lessthan one.VII.

Long

Panel

Tests ofRobustness.In panel

models

it is alwaysagood

ideatoprovidesome

additionaltests ofthe robustness ofresults, usually by dividingup eitherthe cross section ortime seriesof

the panel intosubsets andexamining

theseresults aswell.Here

we

perform bothtests. Firstwe

divide theMSA

markets intotwo

groups: so-called "coastal" citiesthatbordereither ocean, and "interior" citiesthatdo

not. There are31 markets in the former group and70

in the latter.

The

coastal citiesareoften feltto bethose with strong price trends and possibly different market supply behavior.These

results are in Table 8.The

second test isto dividethe

sample

upby

year-

inthis casewe

estimate separatemodels

for 1981-1992

and 1993-2006.

The

year 1992generallymarks

thebottom ofthe housing marketfrom

the

1990

recession.These

results are depicted in Table 9.Both

experiments usejustthe differencesmodel

thatseems

toprovidethe strongest resultsfrom

the previous section.TABLE

8:Geographic

Sub

Panels,1982-2006

FixedEffects EHoltz-Eakin estimator

Coastal

MSA

InteriorMSA

CoastalMSA

InteriorMSA

GR

Real Price (Dependent Variable) Constant -0.4766326** (0.272633) -0.3510184 (0.130979) -1.188642** (0.2669406) -0.721773" (0.1290227)GR

Real Price (Lag1) 0.7340125** (0.0271992) .77654** (0.0173987) 0.6845244** (0.0255055) 0.6926984** (0.0162093)GR

Sales Rate (Lag 1) 0.0615042** (0.0133799) 0.016732** (0.0061206) 0.089245** (0.0135344) 0.0373314** (0.0064948)GR

Mortgage Rate -0.0885175** (0.0214447) -0.0908632** (0.0107238) -0.1275495** (0.020204) -0.1119299** (0.0098326)GR

Employment 0.413934** (0.0864868) 0.2599301** (0.0422536) 0.6823408** (0.0890938) 0.4168953** (0.0438112)GR

Sales Rate (Dependent Variable) Constant 1.01577** (0 .71945) 0.726351** (0.4706282) 0.9888512** (0.7707496) 1.406108** (0.5151945)GR

Real Price (Lag1) -0.7510799** (0.0717759) -0.680113** (0.0625164) -0.9596828** (0.0802649) -1.092057** (0.0775659)GR

Sales Rate (Lag1) -0.0111514 (0.0353082) 0.0786527** (0.0219922) -0.0686389** (0.0362451) .013674 (0.0219432)GR

Mortgage Rate -0.3092647** (0.0565903) -0.3335691** (0.0385322) -0.3139948** (0057035) -.3112734** (0.0383706)GR

Employment 1.265646** (0.2282296) 1.097809** (0.1518239) 1.651104** (0.2580107) 1.285375** (0.1738679) Note: a) *- 10 percent si b)MSAs

denoted c)MSAs

denotedgnificance. **- 5 percent significance.

coastal are

MSAs

nearthe East orWest

Coast(seeAppendix

I).interiorare

MSAs

that arenot located at the East orWest

Coast.InTable 8, the results of Table 6 holdup remarkably strong

when

the panel is divided by region.The

coefficientofsales rate (growth)on prices is always significant although so-called "costal"citieshave larger coefficients. In the equationsofprice(growth) on salesrates,the coefficients are alwayssignificant, and thepoint estimates are very similar as well.

The

negativeeffect ofprices on sales rates is completelyidentical across the regional division ofthe panel sample. Itshould be pointed outthat all

ofthe instrumentsare correctlysigned and significantas well.

The

conclusion isthesame

when

thepanel is split intotwo

periods (Table 9).The

coefficients ofinterestare significantand ofsimilar magnitudes acrosstime periods, andall instruments are significantandcorrectly signed as well.

The

strongnegative impact ofpriceson sales clearlyoccurred during

1982-1992

as wellas overthemore

recentperiodfrom

1993-2006.With

fewer time series observations in each ofthe(sub) panels inTable9, the Holtz-Eakin estimatesare

now

sometimes

more

differentthan theOLS

results.

TABLE

9:Time

Subpanels,

101MSA

Fixed Effects

E

Holtz-Eakinestimator1982-1992 1993-2006 1982-1992 1993-2006

GR

Real Price (Dependent Variable) Constant -2.648239** (0.2403419) 0.1098486 (0.1788311) -2.597524** (0.2538611) 0.0280176 (0.1594721)GR

Real Price(LaaU

.5533667** (0.0273908) 0.7581002** (0.0202692) 0.7006637** (0.0281998) 0.709152** (0.0212374)GR

Sales Rate (Lag 1) 0.0204875** (0.0074812) 0.0631485** (0.0114222) 0.0273097** (0.0081297) 0.0373903** (0.0114339)GR

MortgageRate -0.2309851** (0.0195574) -0.113025** (0.0148469) -0.2164034** (0.0174734) -0.1088119** (0.0120579)GR

Employment

0.6215331** (0.0644479) 0.3634738** (0.0594376) 0.5073589** (0.0719732) 0.5722806** (0.0629962)GR

Sales Rate (Dependent Variable) Constant -6.077011** (0.9073653) 3.339319** (0.494379) -4.553209** (1.017364) 4.601864** (0.5978177)GR

Real Price (Lag1) -0.8804394** (0.1034087) -0.7628642** (0.0560344) -0.9065855** (0.1359358) -0.8880742** (0.0738609)GR

SalesRate (Lag 1) 0.0053538 (0.0282439) -0.0100386** (0.0315767) 0.0706683 (0.0302102) -0.0313258 (0.035461)GR

Mortgage Rate -0.5534765** (0.0738353) -0.3843505** (0.0410443) -0.5593403** (0.0731325) -0.2695104** (0.0383087)GR

Employment

2.564815** (0.2433108) 0.7280071** (0.1643153) 1.88701** (0.293079) 0.5015754** (0.2095683) Note:a)

Column

labeled under 1982-1992 refer tothe results using observationsthat span those years..b)

Column

labeled under1993-2006

refer tothe results using observations that span those years.VII.

Conclusions

We

haveshown

thatthe"Granger

causal" relationshipfrom

prices-to-sales is actuallynegative-

ratherthan positive.Our

empirics are quite strong.As

anexplanation,we

have

arguedthat actual flows in the housing marketareremarkably largebetween

tenuregroups

-

andthat anegative price-to-sales relationshipmakes

senseas areflectionoftheseinter-tenure flows. Higherprices lead

more

householdsto choose renting thanowning

andthese flows decreaseSALES.

Higherprices also increaseLISTS

and sothe inventory grows. Conversely,when

prices are low, entrantsexceedexits into ownership,SALES

increase,LISTS

decline and so does the inventory.Our

empirical analysisalsooverwhelmingly

supportsthe positive sales-to-price relationship thatemerges

from search-basedmodels

of housing churn. Here, a high sales/inventon' ratio causes higherprices anda lowratio generates lowerprices.Thus

we

arrived at amore

completedescription ofthehousingmarketat equilibrium-

asshown

with thetwo

schedules in Figure 3.Figure 3 offers acompelling explanation for

why

in the data, the simple price-sales correlation is sooverwhelmingly

positive.Over

time itmust

be the "price basedsales"' schedule that is shifting up and

down.

Remember

that this schedule is derivedmainly fromthe decisionto enterorexittheownership market.

Easy

credit availabilityand lower

mortgage

rates, forexample would

shiftthe scheduleup (orout). Forthesame

level of housingprices,easier credit increases the rent-to-own flow, decreases the

own-to-rent flow, and encourages

new

households toown.

SALES

expand

andthe inventory contracts.The

end result ofcourse isa rise in both prices aswell assales. Contracting credit doesthe reverse. In thepostWWII

history ofUS

housing, such credit expansions and contractionshave indeedtended to dominate housing marketfluctuations [Capozza, Hendershott,Mack

(2004)].Figure3 also isuseful forunderstandingthe currentturmoil in the housing market.

Easy mortgage

underwritingfrom "subprime capital" greatly encouragedexpanded homeownership

from themid

1990s through2005

[Wheaton

andNechayev,

(2007)].This generated an outward shift in the price-based-sales schedule.

Most

recently, rising foreclosures haveexpanded

the rent-to-own flow and shifted the "price basedsales" schedule

back

inward. This has decreased both sales and prices. Preventingforeclosuresthrough credit amelioration

programs

theoreticallywould

move

the scheduleupward

again, but so couldany countervailing policyofeasingmortgage credit.REFERENCES

Andrew,

M.

andMeen,

G., 2003,"House

priceappreciation, transactionsand structuralchange

in the British housing market:A

macroeconomic

perspective"',RealEstateEconomics,

31, 99-116.Baily, M.J., R.F.

Muth,

andH.O.

Nourse, 1963,"A

RegressionMethod

forReal Estate Price IndexConstruction".Journalof

theAmerican

StatisticalAssociation, 58, 933-942.Berkovec, J.A. and

Goodman,

J.L.Jr., 1996."Turnover

as aMeasure

ofDemand

for ExistingHomes", Real

EstateEconomics,

24 (4), 421-440.Case, B., Pollakowski, H., and

Susan

M.

Wachter, 1991."On

Choosing

among

Housing

Price Index

Methodologies,'Mi?Et/£4

Journal, 19, 286-307.Capozza, D., Hendershott. P., and Charlotte

Mack,

2004,"An Anatomy

ofPriceDynamics

in Illiquid Markets: Analysis and Evidencefrom

LocalHousing

Markets,"Real

EstateEconomics,

32:1, 1-21.Chan, S., 2001, "Spatial Lock-in:

Do

FallingHouse

PricesConstrain Residential Mobility?",Journalof

Urban

Economics.

49, 567-587.Engelhardt, G. V., 2003,

"Nominal

lossaversion, housingequity constraints, and household mobility: evidencefrom

the United States."Journalof

Urban

Economics,

53(1), 171-195.

Genesove,

D. and C.Mayer,

2001, "Loss aversion and seller behavior: Evidencefrom

the housingmarket." QuarterlyJournalofEconomics,

116(4), 1233-1260.Greene,

W.H.,

2003,Econometric

Analysis, (5th

Edition), Prentice Hall,

New

Jersey.Harding, J., Rosenthal, S., and C.F.Sirmans, 2007, "Depreciation of

Housing

Capital,maintenance, and house price inflation...",Journal

of

Urban

Economics, 61.2. 567-587.Holtz-Eakin, D.,

Newey,

W., and Rosen, S.H, 1988, "EstimatingVector Autoregressions with Panel Data", Econometrica, Vol. 56,No.

6, 1371-1395.Kyung

So

Im,M.H.

Pesaran, Y. Shin. 2002, "Testing forUnit Roots in HeterogeneousPanels",

Cambridge

University,Department

ofEconomics

Lamont,

O. and Stein. J., 1999, "Leverage andHouse

PriceDynamics

in U.S. Cities."RAND

Journalof Economics,

30, 498-514.Levin,

Andrew

and Chien-Fu Lin, 1993,"UnitRoot

Tests in Panel Data:new

results."Discussion

Paper

No. 93-56,Department

ofEconomics, University ofCalifornia atSan

Diego.

Leung, C.K.Y., Lau,

G.C.K.

and Leong, Y.C.F., 2002,"Testing Alternative Theoriesof

the Property Price-Trading

Volume

Correlation." The Journalof

RealEstate Research, 23 (3), 253-263.Nickell, S., 1981,"Biases in

Dynamic

Models

with Fixed Effects,"Econometrica, Vol. 49. No. 6. pp. 1417-1426.Per Lundborg, and Per Skedinger, 1999, "Transaction

Taxes

in a SearchModel

oftheHousing

Market",Journalof Urban

Economics, 45, 2, 385-399.Pissarides,Christopher, 2000, Equilibrium

Unemployment

Theory, 2ndedition,MIT

Press, Cambridge, Mass.Stein,C. J., 1995, "Prices and Trading

Volume

in theHousing

Market:A

Model

withDown-Payment

Effects." The Quarterly JournalOf

Economics, 110(2), 379-406.Wheaton,

W.C.. 1990, "Vacancy, Search, and Prices in aHousing

Market

Matching Model,"

Journalof

PoliticalEconomy,

98, 1270-1292Wheaton.

W.C., andGleb

Nechayev

2008,"The

1998-2005Housing

'Bubble" and theCurrent 'Correction':

What's

different thistime?" JournalIof'Real EstateResearch,30,1,1-26.

APPENDIX

I: Sales, Prices,Inventory

statistics forShort

Panel

MarketCode

Market Average YearlyChange

in Real Price Index (%) Average Inventory Averagenumber

of Sales 1 Dallas 0.009389 27765.84 5060.031 2 Houston 0.021073 29451.69 5274.866 3 Austin 0.030452 8341.217 1846.983 4 LosAngeles 0.075205 169724.2 37086.3 5 San Francisco 0.054361 59371.1 18343.6 6 San Diego 0.060397 85596.3 14763.43 7 Riverside 0.064271 65512.58 16534.53 8 Oakland 0.05496 34458.68 10413.08 9 Ventura 0.059364 14962.35 5015.75 10 Orange County 0.066787 68704.65 14874.88 11 Akron -0.00793 21536.21 2954.509 12 Atlanta 0.011579 251270.1 26648.73 13 Baltimore 0.064701 30307.89 6897.025 14 Columbus 0.000834 46261.74 6603.301 15 Honolulu 0.067967 7333.894 1394.813 16 Kansas City 0.010979 52400.64 9495.937 17 LasVegas 0.042517 19149.78 9506.009 18 Louisville 0.00919 30180.93 4507.799 19Memphis

-0.00037 38817.24 5431.602 20 Miami 0.082253 97230.11 9453.403 21 Milwaukee 0.024482 21320.8 4223.433 22 Nashville 0.018568 34115.38 6109.578 23New

York 0.063452 67426.32 31415.68 24Oklahoma

City 0.017577 32241.31 6680.985 25Omaha

0.003076 16562.51 3143.348 26 Phoenix 0.054298 89985.95 17518.8 27 Portland 0.042035 42870.82 8640.185 28 Providence 0.056324 18498.47 2737.019 29 Richmond 0.04495 24590.73 5294.051 30 St. Louis 0.023095 29147.49 9707.496 31Tampa

0.055711 66049.88 11035.37 32 Tucson 0.047889 10922.03 2710.266 33 WashingtonDC

0.068125 39808.88 10710.28 30APPENDIX

IILet

Ap

T=[AP

irAP

m

]'andAs

r=

[AS

U,....,AS

NT]\where

N

is thenumber

of markets. LetW

T

=

[e,Ap

7_,,As

r_,,

AX,

T]bethe vector ofright hand side variables,

where

e isa vectorofones. LetV

T=[s

]T,...,sNT] be the TVx 1 vectorof transformed

disturbance terms. Let

B

=

[a ,ai,a2,/3i,

S

t]'

bethe vectorofcoefficients for the

equation.

Therefore,

Ap

T=W

TB

+V

T (1)Combining

all the observationsforeach time period into a stack ofequations,we

have,Ap

=

WB

+

V

. (2)The

matrix ofvariables thatqualifyfor instrumental variables in periodT

will beZ

T=

[e,Ap

T_2,As

T_2,AX

IT] , (3)which

changes with T.To

estimate B,we

premultiply (2) byZ' toobtainZ'Ap

=

Z'WB

+

Z'V

.

(4)

We

then form a consistent instrumental variables estimatorby applyingGLS

to equation(4),

where

the covariancematrixQ

=

E{Z'WZ}

. Q. is notknown

and hasto beestimated.

We

estimate (4) for each timeperiodandform

thevectorofresiduals foreach period and forma consistent estimator,Q

, forQ

.B

, theGLS

estimatoroftheparameter vetor, is hence:

b

=[w

z(Q)"

1rwy^w

z(ny

}r

Ap

.

(5)

The

same

procedureappliesto the equation wherein Sales (S) are on theLHS.

APPRENDIX

III: Sales,Prices Statistics forlongPanel

MarketCode

Market AverageGRRHPI

(%) AverageGREMP

(%) AverageSFSALES

RATE

AverageGRSALES

RATE

(%) 1 Allentown* 2.03 1.10 4.55 4.25 2 Akron 1.41 1.28 4.79 4.96 3 Albuquerque 0.59 2.79 5.86 7.82 4 Atlanta 1.22 3.18 4.31 5.47 5 Austin 0.65 4.23 4.36 4.86 6 Bakersfield* 0.68 1.91 5.40 3.53 7 Baltimore* 2.54 1.38 3.55 4.27 8 BatonRouge

-0.73 1.77 3.73 5.26 9Beaumont

-1.03 0.20 2.75 4.76 10 Bellingham* 2.81 3.68 3.71 8.74 11 Birmingham 1.28 1.61 4.02 5.53 12 Boulder 2.43 2.54 5.23 3.45 13 Boise City 0.76 3.93 5.23 6.88 14 BostonMA*

5.02 0.95 2.68 4.12 15 Buffalo 1.18 0.71 3.79 2.71 16 Canton 1.02 0.79 4.20 4.07 17 Chicago IL 2.54 1.29 4.02 6.38 18 Charleston 1,22 2.74 3.34 6.89 19 Charlotte 1.10 3.02 3.68 5.56 20 Cincinnati 1.09 1.91 4.87 4.49 21 Cleveland 1.37 0.77 3.90 4.79 22Columbus

1.19 2.15 5.66 4.61 23 Corpus Christi -1.15 0.71 3.42 3.88 24 Columbia 0.80 2.24 3.22 5.99 25 Colorado Springs 1.20 3.37 5.38 5.50 26 Dallas-Fort Worth-Arlington -0.70 2.49 4.26 4.64 27 DaytonOH

1.18 0.99 4.21 4.40 28 Daytona Beach 1 86306

4.77 5.59 29 DenverCO

1.61 1.96 4.07 5.81 30 Des Moines 1.18 2.23 6.11 5.64 31 DetroitMl 2.45 ' 1.42 4.16 3.76 32 Flint 1.70 0.06 4.14 3.35 33 Fort Collins 2.32 3.63 5.82 6.72 34 FresnoCA*

1.35 2.04 4.69 6.08 35 FortWayne

0.06 1.76 4.16 7.73 36 Grand Rapids Ml 1 59 2.49 5.21 1.09 37 GreensboroNC

0.96 1.92 2.95 7.22 3238 1 Harrisburg

PA

0.56 1.69 4.24 3.45 39 Honolulu 3.05 1 28 2.99 12.66 40 Houston -1.27 1.38 3.95 4 53 41 Indianapolis IN 0.82 2.58 4.37 6.17 42 Jacksonville 1.42 2.96 4.60 7.23 43 Kansas City 0.70 1.66 5.35 5.17 44 Lansing 1.38 1.24 4.45 1.37 45 Lexington 0.67 2.43 6.23 3.2546 Los Angeles

CA*

3.51 0.99 2.26 5.4047 Louisville 1.48 1.87 4.65 4.53 48 Little Rock 0.21 2.22 4.64 4.63 49 Las

Vegas

1.07 6.11 5.11 8.14 50Memphis

0.46 2.51 4.63 5.75 51 Miami FL 1.98 2.93 3.21 6.94 52 Milwaukee 1.90 1.24 2.42 5.16 53 Minneapolis 2.16 2.20 4.39 4.35 54 Modesto* 2.81 2.76 5.54 7.04 55 Napa* 4.63 3.27 4.35 5.32 56 Nashville 1.31 2.78 4.44638

57New

York* 4.61 0.72 2.34 1.96 58New

Orleans 0.06 0.52 2.94 4.80 59Ogden

0.67 3.25 4.22 6.08 60Oklahoma

City -1.21 0.95 5.17 3.66 61Omaha

0.65 2.03 4.99 4.35 62 Orlando 0.88 5.21 5.30 6.33 63 Ventura* 3.95 2.61 4.19 5 83 64 Peoria 0.38 1.16 4.31 6.93 65 Philadelphia PA* 2.78 1.18 3.52 2.57 66 Phoenix 1.05 4.41 4.27 7.49 67 Pittsburgh 1.18 69 2.86 2.75 68 Portland* 2.52 2.61 4.17 7.05 69 Providence* 4.82 0.96 2.83 4 71 70 PortSt. Lucie 1.63 3.59 5.60 7.18 71 RaleighNC

1.15 3.91 4.06 5 42 72Reno

1.55 2.94 3.94 8.60 73 Richmond 1.31 2.04 4.71 3.60 74 Riverside* 2.46 4.55 6.29 5 80 75 Rochester 0.61 0.80 5.16 1.01 76 Santa Rosa* 4.19 3 06 4 90 2.80 77 Sacramento* 3.02 3.32 5.51 4.94 3378 San Francisco

CA*

4.23 1.09 2.61 4.73 79 Salinas* 4.81 1.55 3.95 5.47 80 SanAntonio -1.03 2.45 3.70 5.52 81 Sarasota 2.29 4.25 4.69 7.30 82 Santa Barbara* 4.29 1.42 3.16 4.27 83 Santa Cruz* 4.34 2.60 3.19 3.24 84 San Diego* 4.13 2.96 3.62 5.45 85 Seattle* 2.97 2.65 2.95 8.10 86 San Jose* 4.34 1.20 2.85 4.55 87 Salt Lake City 1.39 3.12 3.45 5.72 88 St. Louis 1.48 1.40 4.55 4.82 89 San Luis Obispo* 4.18 3.32 5.49 4.27 90 Spokane* 1.52 2.28 2.81 9.04 91 Stamford* 3.64 0.60 3.14 4.80 92 Stockton* 2.91 2.42 5.59 5.99 93Tampa

1.45 3.48 3.64 5.61 94 Toledo 0.65 1.18 4.18 5.18 95 Tucson 1.50 2.96 3.32 8.03 96 Tulsa -0.96 1.00 4.66 4.33 97 Vallejo CA* 3.48 2.87 5.24 5.41 98 WashingtonDC*

3.01 2.54 4.47 3.26 99 Wichita -0.47 1.43 5.01 4.39 100 Winston 0.73 1.98 2.92 5.51 101 Worcester* 4.40 1.13 4.18 5.77Notes: Table providesthe average real price appreciation over the 25 average job growth rate, average sales rate, and

growth

in sales rate.* Denotes"Costal city" in robustnesstests.

years.