Asset Prices and Exchange Rates

Texte intégral

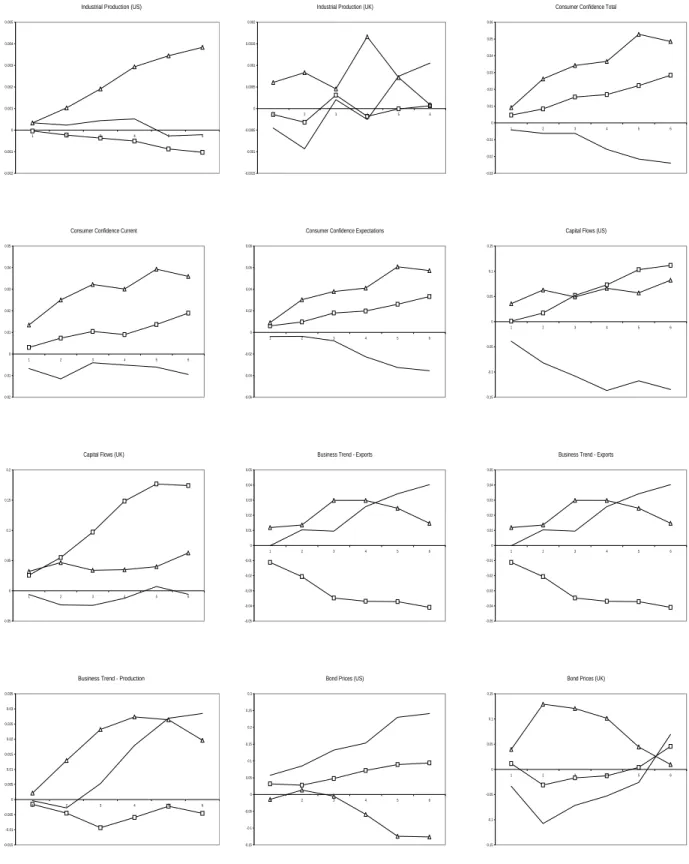

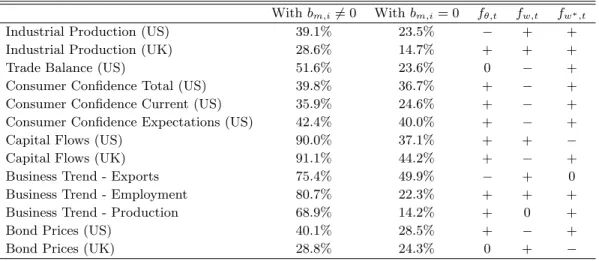

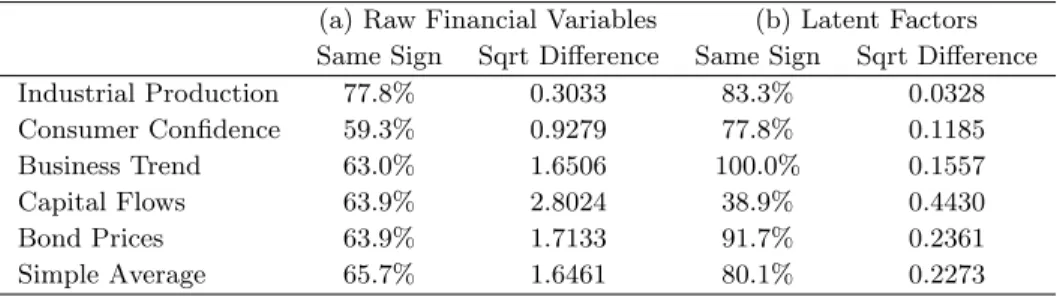

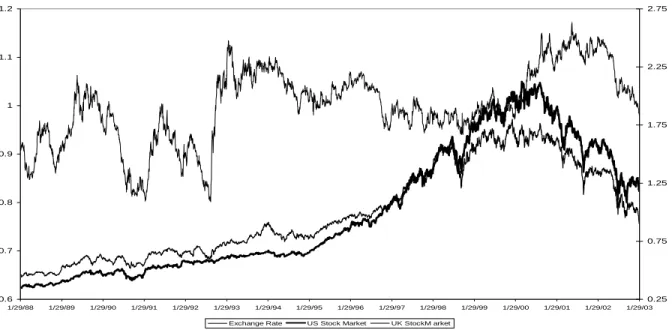

Figure

Documents relatifs

This thesis ultimately provides, explains, and analyzes a viable method that can form a transmit- side null at the receiver and extract a weak signal of interest

The TNO gastrointestinal tract model (TIM; Zeist, Netherlands) is an alternative dynamic multicompart- mental in vitro system which presently allows the closest simulation of in

The first is a reference emissions forecast that includes no specific climate policy (Reference). Then three global participation scenarios include the international policy in our

The problem of computing preferred continuous relaxations, instead of suspen- sions, for temporal bounds in over-subscribed temporal plans, based on a user

Both venting and deck slope appeared to cause moisture movement out of the insulation but the rates in both cases were so slow that permeation through the O.IS-mm polyethylene

In conclusion, frequency of citrus fruit, but not other fruits, intake is associated with lower rates of acute coronary events in both France and Northern Ireland, suggesting

is a ring homomorphism for every finite group G.. This implies by thm. This proves that is multiplicative, and it is clearly stable.. Remark.. Hence it is an

In addition, the coupling loss of the input power from the WR8 waveguide to the actual circuit is around 4-5 dB according to HFSS simulations of an ideal coupler, but in fitting