Arbitrage and Equilibrium with Portfolio Constraints

Texte intégral

Figure

Documents relatifs

Feng, Strong solutions to a nonlinear parabolic system modeling compressible misci- ble displacement in porous media, Nonlinear Anal., Theory Methods Appl., 23 (1994), 1515–1531.

The theory of spaces with negative curvature began with Hadamard's famous paper [9]. This condition has a meaning in any metric space in which the geodesic

Dynam.. Tachibana, An entire solution to the Lotka-Volterra competition-diffusion equations, SIAM J. Wang, Entire solutions in nonlocal dispersal equations with bistable nonlin-

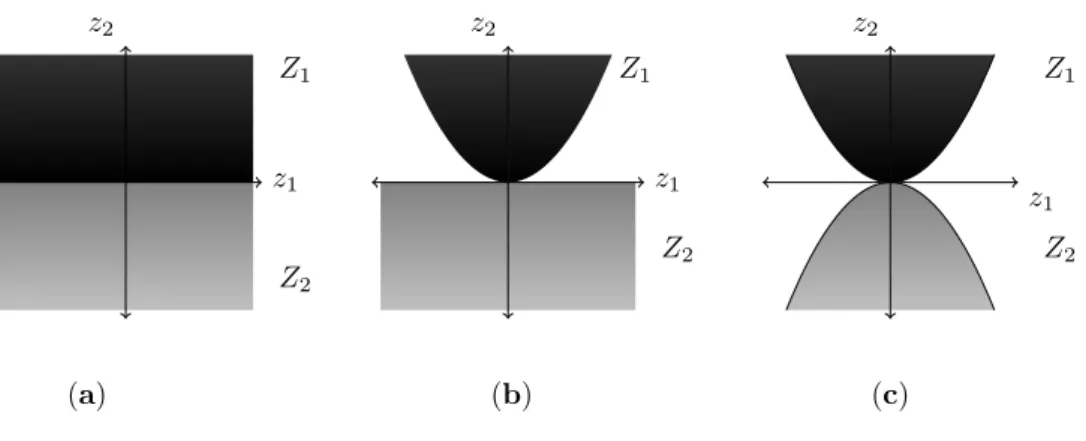

In case (c), where the photoelectron flux is nearly equal to the proton flux, the electric field intensity is signifi- cantly larger than in case (a), and

We conclude that credible incen- tive equilibria with dierentiable incentive functions do not exist without strong conditions on the payo functions of the players.. On the other

This allows us to give the asymptotic distribution of the number of (neutral) mutations in the partial tree.. This is a first step to study the asymptotic distribution of a

The winding number of a closed curve around a given point is an integer representing the total number of times that curve travels anti-clockwise around the point.. The sign of

The proof presented by Daniel Matthews blends together an interesting mix of ingredients, group theory, linear algebra and complex numbers to arrive at a rather surprising result..