MITLIBRARIES

DEWEY

i]He

21

'

W$

3

9080 03317 5842

Massachusetts

Institute

of

Technology

Department

of

Economics

Working

Paper

Series

Complexity

and

Financial Panics

Ricardo

J.Caballero

Alp Simsek

Working

Paper 09-17

May

15.2009

Revised June

17,2009

RoomE52-251

50

Memorial

Drive

Cambridge,

MA

02142

This

paper

can

be

downloaded

withoutcharge

from theSocialScience Research

Network Paper

Collection atComplexity

and

Financial

Panics

Ricardo

J.Caballero

and

Alp

Simsek*

June

17,2009

Abstract

During extreme financialcrises, all ofasudden, thefinancialworld thatwas once

rife with profit opportunities for financial institutions (banks, for short)

becomes

exceedingly complex. Confusion and uncertainty follow, ravaging financial markets

and triggeringmassiveflight-to-quality episodes. In this paper

we

proposeamodel

ofthis

phenomenon.

In our model, banks normally collect information about theirtrading partners which assures

them

of the soundness ofthese relationships.How-ever,

when

acutefinancial distressemergesin partsofthe financialnetwork, it is notenough to be informed about these partners, as it also

becomes

important to learnabout the health of their trading partners.

As

conditions continue to deteriorate,banks

must

learn about the health of the trading partners of the trading partnersofthe trading partners, and so on. At

some

point, thecost ofinformation gatheringbecomes

toounmanageable

for banks, uncertainty spikes, and they have no option but to withdraw from loancommitments

and illiquid positions.A

flight-to-qualityensues, and the financial crisis spreads.

JEL

Codes:

E0. Gl, D8,E5

Keywords:

Financial network, complexity, uncertainty, flight to quality,cas-cades, crises, information cost, financial panic, credit crunch.

"MIT

andNBER,

and MIT,respectively. Contact information: caball@mit.edu andalpstein@mit.edu.We

thank Mathias Dewatripont, Pablo Kurlat, GuidoLorenzoni, JuanOcampo

and seminarparticipantsDigitized

by

the

Internet

Archive

in

2011

with

funding

from

Boston

Library

Consortium

Member

Libraries

1

Introduction

The

dramatic

rise in investors'and

banks' perceived uncertainty is at the core of the2007-2009

U.S. financial crisis. All of a sudden, a financialworld

thatwas once

rifewith profit opportunities for financial institutions (banks, for short),

was

perceived to beexceedingly complex.

Although

thesubprime shock was

small relative to the financialinstitutions' capital,

banks

acted as ifmost

of their counterpartieswere

severelyexposed

to the

shock

(seeFigure 1).Confusion

and

uncertainty followed, triggering the worst caseof flight-to-quality that

we

have

seen in the U.S. since theGreat

Depression.-^r-

6eT

,oK . Hi,»5^i55n

«av .-sr-

5»nr.r

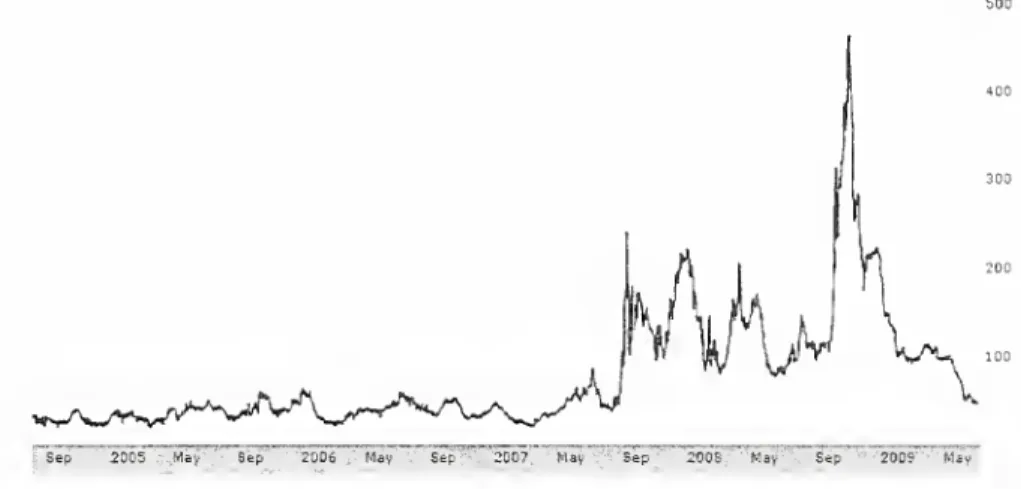

sir-Figure 1:

The

line corresponds to theTED

spread in basis points (source:Bloomberg),

the interest rate difference

between

the interbank loans (3month

LIBOR)

and

theUS

government

debt (3month

Treasury bills).An

increase in theTED

spread typicallyreflects a higher perceived risk of default

on

interbank loans, that is,an

increase in thebanks' perceptions of counterparty risk.

In this

paper

Ave present amodel

of thesudden

rise in complexity, followedby

wide-spread panic in the financial sector. In the model,banks

normally collect, informationabout

their direct trading partnerswhich

serves to assurethem

of thesoundness

of theserelationships.

However,

when

acute financial distressemerges

in parts of the financialnetwork, it is not

enough

to be informedabout

these partners, but it alsobecomes

impor-tant for the

banks

to learnabout

the health of their trading partners.And

as conditions continue to deteriorate,banks

must

learnabout

the health of the trading partners of the tradingpartners, oftheir trading partners,and

so on.At

some

point, the cost ofinforma-tion gathering

becomes

too largeand

banks,now

facingenormous

uncertainty, choose towithdraw

from

loancommitments

and

illiquid positions.A

flight-to-quality ensues,and

the financial crisis spreads.

The

starting point ofourframework

is a standard liquiditymodel

where banks

(rep-resenting financial institutionsmore

broadly) have bilateral linkages in order to insureagainst local liquidity shocks.

The

whole

financialsystem

is acomplex network

oflink-ages

which

functionssmoothly

in theenvironments

that it is designed to handle,even

though no

bank knows

with certainty all themany

possible connections within thenet-work

(that is, eachbank knows

the identities ofthe otherbanks

but not their exposures).However,

these linkagesmay

alsobe

the source of contagionwhen

an

unexpected

eventof financial distress arises

somewhere

in the network.Our

point of departurewith

theliterature is that

we

use this contagionmechanism

not as themain

object ofstudy

but

as the source of confusion

and

financial panic.During normal

times,banks

onlyneed

tounderstand

the financial health of their neighbors,which

they can learn at low cost. In contrast,when

a significantproblem

arises in parts of thenetwork

and

the possibility ofcascades arises, the

number

ofnodes

tobe

auditedby

eachbank

rises since it is possible that theshockmay

spread to the bank's counterparties. Eventuallytheproblem

becomes

too

complex

forthem

to fully figure out,which

means

thatbanks

now

face significantuncertainty

and

they react to itby

retrenching into liquidity-conservationmode.

This

paper

is related to several strands of literature.There

isan

extensive literature that highlights the possibility ofnetwork

failuresand

contagion in financial markets.An

incomplete list includes Allenand Gale

(2000),Lagunoff

and

Schreft (2000),Rochet

and

Tirole (1996), Freixas, Parigiand Rochet

(2000), Leitner (2005), Eisenbergand

Noe

(2001), Cifuentes, Ferucci

and

Shin (2005) (see Allenand

Babus

(2008) for a recent survey).These

papers focusmainly

on

themechanisms

by

which

solvencyand

liquidityshocks

may

cascadethrough

the financial network. In contrast,we

take thesephenomena

as the reason for the rise in the complexity of the

environment

inwhich

banks

make

their decisions,

and

focuson

the effect of this complexityon

banks' prudential actions.In this sense, our

paper

is related to the literatureon

flight-to-qualityand Knightian

uncertainty in financial markets, as in Caballero

and

Krishnamurthy

(2008),Routledge

and

Zin (2004)and

Easleyand

O'Hara

(2005);and

also to the related literature thatinvestigates the effect of

new

eventsand

innovations in financial markets, e.g. Liu, Pan,and

Wang

(2005),Brock

and

Manski

(2008)and Simsek

(2009).Our

contribution relativetothisliteratureisinendogenizing therise inuncertainty

from

thebehavior ofthefinancialnetwork

itself.More

broadly, thispaper

belongs toan

extensive literatureon

flight-to-quality

and

financial crises that highlights theconnectionbetween

panicsand

a decline inthe financialsystem's ability tochannel resources tothe real

economy

(see, e.g., Caballeroand

Kurlat (2008), for asurvey).network

and

describe a rare event as a perturbation to the structure of banks' shocks.Specifically,

one

bank

suffersan

unfamiliarliquidityshock

forwhich

itwas

unprepared.We

next

show

thatifbanks

can costlesslygatherinformationabout

thenetwork

structure, thespreadingofthisshock into precautionary responses

by

otherbanks

istypically contained.This

scenariowith no network

uncertainty is thebenchmark

for ourmain

resultsand

is similar (although withan

interior equilibrium) to Allenand Gale

(2000).Our

main

contribution is in Section 3,where

we

make

information gathering costly. Inthiscontext, ifthe cascadeissmall, either because theliquidity

shock

is limited orbecause

banks' buffers are significant,banks

are able to gather the information theyneed

about

their indirect

exposure

totheliquidityshock

and

we

areback

to thefullinformation results of Section 2.However,

once cascades are large enough,banks

are unable to collect the information theyneed

torule out a severe indirect hit. Their response to this uncertaintyis to

hoard

liquidityand

to retrenchon

their lending,which

triggers a credit crunch. InSection 4

we show

thatunder

certain conditions, the response in Section 3can

be

soextreme, that the entire financial

system

can collapse as a result of the flight to quality.The

paper

concludeswith

a finalremarks

sectionand

several appendices.2

The

Environment

and

a

Free-Information

Bench-mark

In this section

we

first introduce theenvironment

and

the characteristics ofthe financialnetwork

alongwith

ashock which was

unanticipated at thenetwork

formation stage (i.e.the financial

network

was

not designed to deal with this shock).We

next characterizethe equilibrium for a

benchmark

case inwhich

information gathering is free so that themarket

participantsknow

the financial network.2.1

The

Environment

There

arethree dates{0. 1,2}.There

isasinglegood

(onedollar) that serves asnumeraire,which

canbe

kept in liquid reserves or it can be loaned to production firms. If kept inliquid reserves, a unit of the

good

yields one unit in the next date. Instead, if a unitis loaned to firms at date 0, it then yields

R

>

1 units at date 2 if it is notunloaded

before this date.At

date 1, the lender canunload

the loan (e.g.by

settling itwith

theborrower

at a discount)and

receive r<

1 units.To

simplify the notation,we assume

r%

throughout

this paper.Banks

and

Their

Liquidity

Needs

The

economy

has2n continuums

ofbanks denoted

by

{b3}~_1

.

Each

of thesecontinuums

is

composed

of identicalbanks

and, for simplicity,we

refer to eachcontinuum

b3 asbank

b3

,

which

is our unit ofanalysis.1

Each

bank

b3 has initial assetswhich

consist of y units of liquid reserves set aside for liquidity

payments,

fjo<

I—

y units offlexible reserves setaside for

making new

loans at date (butwhich can

alsobe

hoarded

as liquid reserves)and

1—

y—

yo units ofloans.The

bank's liabilities consist of ameasure one

ofdemand

deposit contracts.

A

demand

deposit contract pays l}

>

1 at date 1 if the depositor ishit

by

a liquidity shockand

^

>

h at date 2 if the depositor is not hitby

a liquidityshock. Let

u

3€

[0, 1]

be

themeasure

of liquidity-driven depositors ofbank

b3 (i.e. thesize ofthe liquidity

shock

experiencedby

the bank),which

takesone

of the three valuesin {<Z\uL,u

H

} with ujh

>

loland

u>=

(u>H

+

uiL) /2,

and suppose

y

—

l\(I)and

(1—

y)R

=

12 Cj.Note

that, if the size of the liquidity shock is Cu, thebank

that loans all of its flexiblereserves j/n at date has assets just

enough

topay

l\ (resp. U) to earl}' (resp. late)depositors.

The

central trade-off in thiseconomy

willbe

whether

thebank

will loan itsflexible reserves yo (which it set aside for this purpose) or

whether

it willhoard

some

ofthis liquidity as aprecautionary response to a rare event that

we

describe below.The

Financial

Network

The

liquidityneeds atdate 1may

notbe

evenlydistributedamong

banks,which

highlightsone

ofthe (man}') reasons for an interlinked financial network. Moreover, themain

sourceof complexity later

on

willbe

confusion about the linkagesbetween

different banks.To

capturethispossibility

we

letiE

{1, .., 2ra} denote slots in afinancialnetwork

and

considera

permutation

p : {1. ..,2n}

—

> {1, ..,2n}

that assignsbank

bp^

to slot i.We

consider afinancial

network

denoted

by:b

(p)=

(bp(1) -> 6"(2) ->

^

(3)-.... -» bp

W

^

6P(i)) ) (!)where

the arc—

» denotes that thebank

in slot ? (i.e.,bank

bp{-l)

) has a

demand

deposit inthe

bank

in thesubsequent

slot i+

1 (i.e.,bank

bp^+l) ) equal toz

=

(Q-u

L), (2)where

we

usemodulo

2n

arithmetic for the slot index i 2We

refer tobank

6p('+1) as the

forward

neighbor ofbank

bp^

(and similarly, tobank

bp^l) as thebackward neighbor

ofbank

fr^!+1)).

The

possibility ofconfusionarises lateron from banks

knowing

the identityofother

banks

but not their particular linkages (i.e., the actualpermutation

p).As

we

formally describe inAppendix

A.l (and similar to Allen-Gale (2000)), in thenormal

environment, the financialnetwork

facilitates liquidity insuranceand

enablesliq-uidity to flow

from

banks

that experience a low liquidity shock (ujl) to thebanks

thatexperience a high liquidityshock (w

w

). evenwhen

the financialnetwork

b

[p) isunknown

to the banks.Our

focus ison

the effect of the financial interlinkages in case ofan

unan-ticipated shock for

which

the financialnetwork

is not necessarily designed for,which

we

describe next.

A

Rare Event

At

date thebanks

learn that allbanks

will experience the average liquidityshock

uj atdate 1, however, theyalso learn thatone bank, b3,

becomes

distressedand

loses 6<

y ofitsliquid assets.

As we

formallydemonstrate

below, thelosses inthedistressedbank

b3might

spill over to the other

banks

viathe financialnetwork

b

[p), thus the banks'knowledge

ofthefinancial

network

ispotentiallypayoffrelevant. In particular, thisknowledge

influenceswhether

thebanks

use the flexiblereserves j/n tomake

new

loans or tohoard

liquidity.We

are thus lead to describe the central feature of our model: the banks' uncertainty about the financial

network

b

(p).Network

Uncertainty

and

Auditing

Technology

We

letB =

{b

(p) | p: {1,..,

2n}

—

> {1, ,.,2n} is apermutation}

. (3)denote the set of possible financial networks.

Each

bank

b3 observesits slot i

=

p~

l

(j)

and

the identities ofthebanks

in its neighboring slots i—

1and

i+

1. This informationnarrows

down

the potentialnetworks

to the set:B

3(p)=

(h{p)<EB

p(i-l)

=

p(i-l)

p(i)=

p(i) I p(i+

l)=

p(i+

l) ,where

i=

p l (j)-In particular, i represents the slot with index i' £ {l,...2n} that is the modulo In equivalent of

Figure 2:

The

financialnetwork

and

uncertainty.

The

bottom-leftbox

displays theactual financial network.

Each

circle corresponds to aslot inthe financial network,and

inthis realization ofthe network, each slot i contains

bank

b1 (i.e. p(i)=

i).The

remaining

boxes

show

the othernetworks

thatbank

61 finds plausible after observing its neighbors (i.e. the setB

l (p)).Bank

bl cannot tellhow

thebanks

{b5.b4,b5} are ordered in slots {3.4.5}.

are

Note

that thebank

b3 does notknow

how

the remainingbanks

(V)-*,,^^

,

{, „/i+x)\

assigned to the

remaining

slots (see Figure 2). In particular, eachbank

b3^

b3knows

that the

bank

b3 is distressed, but it does not necessarilyknow

the sloti=P~

lQ)

ofthe distressed bank.

This

is key, since itmeans

that a bank b3^

b3 does not necessarilyknow

how

jarremoved

it isfrom

the distressed bank.Each bank

b3 can acquiremore

informationabout

the financialnetwork through an

auditing technology.

At

date 0, abank

b3 in slot i (i.e. withj

=

p(i)) can exert effortto audit its forward neighbor 6p(i+1' in order to learn the identity ofthis bank's

forward

neighbor bp(-'^2^

.

Continuing

this way, abank

V

that audits anumber,

a3

, of

balance

sheets learns the identity ofits a3+

1 forward neighborsand narrows

the set ofpotentialfinancial

networks

to: B> (p | a 3 )=

{b

(p)£

B

p(i-l)

=

p(i-l)

_ p{i+

a 3+

1)=

p(t+

a3+

1) ,where

i=

p (j)We

denote the posterior beliefs ofbank

b3with f

3 (. | p,a3

)

which

has supportequal

toB

3(p.a3) given assumption:

Assumption

(FS).

Each

bank

has a prior belieff

3(.) over

B

with full support.In the

example

illustrated inFigure 2, ifbank

b1 auditsone balancesheet, thenitwould

learn that

bank

b3 is assigned to slot 3and

itwould narrow

down

the set ofnetworks

to thetwo

boxes at the lefthand

side ofthebottom

row

in Figure 2.Bank

Preferences

and

Equilibrium

Consider a

bank

b3and

denote the bank's actualpayments

to earlyand

late depositorsby

q\and

qi (whichmay

in principle be differentthan

the contracted values l^and

/2).

Because

banks

are infinitesimal, theymake

decisions taking thepayments

of theother

banks

as given.The

bank makes

the auditand

liquidity hoarding decisions, a3E

{0,1.,..,277

—

3}and

y3

E

[0,yo], at date (equivalently, j/o—

yJ

E

<0,j/oi denotes thenumber

ofnew

loansthebank makes

at date 0).At

date 1, thebank

chooses towithdraw

some

ofits depositsin the neighbor bank,which

we

denoteby

z3E

[0, z],

and

itmay

alsounload

some

of its outstanding loans.The

bank

makes

these decisions tomaximize

q\until it can

meet

its liquidity obligations to depositors, that is, until q\=

l\. Increasingq\

beyond

l\ hasno

benefit for the bank, thus once it satisfies its liquidity obligations, itthen

tries tomaximize

the return to the late depositors q\.We

capture this behavior with the following objective function«(lW</i}g{' +

lW>Zi}^)-d(aO

(4)where

v :R+

—

>K

++

is a strictly concaveand

strictly increasing functionand

d(.) isan

increasingand convex

functionwhich

captures the bank'snon-monetary

disutilityfrom

auditing.

When

thebank

b3is

making

adecision thatwould

lead toan

uncertainoutcome

for (qi^qi) (which will be the case in Section 3), then it

maximizes

theexpectation ofthe

expression in (4) given its posterior beliefs

f

J(. | p,

a3

).

Suppose

that the depositors' early/late liquidity shocks are observable,and

abank

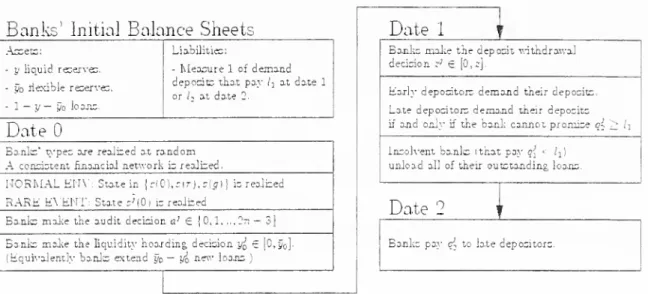

Banks'

InitialBalance

Sheets

Assets: Liabilities:- yliquid reserves

- Date 1 paymentto early

depositors: Dl^ =y

- yo tiexiblereserves

- Date 2 pavmenttolate

- 1—y—po loans. depositors: Qlz

=

(1—y)R- j demand depodtsin - ? demand deposit:neld by

forward neighborbank backward neighborbank.

Date

Bankslearn that

- Eachwillhave shod;u> frerlected onabove balancesheetcl.

- Ba.nkb1 becomesdistressed and loses 8 liquid reserves

Banksmakethe audit dedsiona1 6

{0,1, 3}.

Banksmoke theliquidity hoardingdecidony'€ [0,§ ]

(Equivalent!}-banks extend y — y^new loans,)

Date

1Banksmoke thedepodtwithdrawal

dedsion ,-; e [0,;j.

Earlydepodtorsdemand their deposits

Late depodtorsdemand tneirdeposits

ifand onlyifthe bo.nl;cannot promise ql

Insolvent banks (thatpay q{ < /]!

unload allof theiroutstandingloans

Date

2

Bankspayqi to la,tedepodtors.

Figure 3: Timeline of events.

depositors if they arrive early.3

With

this assumption, the continuation equilibrium forbank

V

at date 1 takesone

oftwo

forms. Either there is a no-liquidation equilibrium inwhich

thebank

is solventand

paysq{

=

li,q3

2

>k,

(5)while the late depositors

withdraw

at date 2; or there is a liquidation equilibrium inwhich

the

bank

is insolvent, unloads all outstanding loans,and

paysq{

<

lu

4

=

0, (6)while all depositors (including the late depositors)

draw

their deposits at date 1.Figure 3 recaps the timeline of events in this

economy.

We

formally define theequi-librium as follows.

Definition

1.The

equilibrium, is a collection ofbank auditing, liquidity hoarding, depositwithdrawal,

and

payment

decisions{a^p),yi(p)

)^(p),ql(p),q

J

2 (p)}j

such

that,b(p)£B

given the realization of the financial

network

b

(p)and

the rare event, each bank b3maxi-3Without

this assumption, therecould bemultiple equilibria for latedepositors'early/latewithdrawal

decisions. In cases with multiple equilibria, this assumption selects the equilibrium in which no late

raizes expected utility in (4) according to its prior belief

f

J(.) over B, the insolvent

banks

(with q\ (p)

<

l\) unload all of their outstanding loans at date 1and

the late depositorswithdraw

deposits early ifand

only ifq^ (p)<

l\ (cf. Eqs. (5)and

{&)).We

next turn to the characterization of equilibrium.Note

that for each financialnetwork

b

(p)and

for eachbank

b3, thereexists a unique kG

{0, ..,2n

—

1} such thatj

=

p(i-

k),

which

we

define as the distance ofbank

b3from

the distressed bank.As we

will see,

the distance k will

be

the payoff relevant information for abank

b3 that decideshow

much

liquidity tohoard

at date since it will determinewhether

or not the crisis thatoriginates at the distressed

bank

b3 will cascade tobank

b3.

The

banks

bp^~l

\bp

^

, bp(-l+1

\

respectivelywith distances 1,

and 2n

—

1,know

their distances,but

the remainingbanks

(with distances k

€

{2. ...2n—

2})do

not have this information a prioriand

they assign apositive probability toeach k

£

{2, ..,2n

—

2} (they rule out k e {1,2n-

1} by observingtheir forward

and backwards

neighbors). Note, however, that thebank

b3 can use the auditing technology to learnabout

the financialnetwork

and, in particular,about

itsdistance

from

the distressed bank.A

bank

bp^~

h' (with distance k) that audits a3>

1banks

either learns its distance k (if k<

a?.+ 1) or it learns that k>

a3+

2.In the

remaining

half of this section,we

characterize the equilibrium in abenchmark

case in

which

auditing is free so eachbank

learns its distancefrom

the distressedbank.

In subsequent sections,

we

characterize the equilibrium with costly auditand

compare

itwith

the free-informationbenchmark.

2.2

Free-Information

Benchmark

We

first describe abenchmark

case inwhich

auditing is free so eachbank

bp^x~k

>

chooses

full auditing ap^~k}

=

2n

—

3. In this contextbanks

learn thewhole

financialnetwork

b

(p) and, in particular, their distances.At

date allbanks

anticipate receivinga liquidityshock, Co, at date 1and

have liquid reserves equal to y—

CjIi (plus y offlexiblereserves), except forbank

b3=

6p(i'which has

liquid reserves y

—

9.At

date 1, the distressedbank

bp^

withdraws

its depositsfrom the

forward neighbor bank.

As we show

inAppendix

A.2, this triggers furtherwithdrawals

until, in equilibrium, all cross deposits are

withdrawn.

That

isIn particular,

bank

bp^

tries, but cannot, obtainany

net liquiditythrough

crosswith-drawals.

The bank

also cannot obtainany

liquidity by unloadingthe loans at date 1, sinceeach unit of

unloaded

loan yields r«

0. Anticipating that it will notbe

able to obtainadditional liquidity at date 1, the distressed

bank

bp^

hoardssome

its flexible reserves yby

cuttingnew

loans at date in order tomeet

its liquiditydemand

at date 1. In order topromise

late depositors at least /l5 a

bank

withno

liquid reserves left atthe

end

ofdate 1must

have

at leasti-y-g.Ozm

(8)units ofloans.

The

level yj is a natural limiton

a bank's liquidity hoarding (which plansto deplete all ofits liquidity at date 1) since

any

choiceabove

thiswould

make

thebank

necessarily insolvent. Ifthe

amount

offlexible reserves y"oisgreaterthan

yj. then thebank

can

hoard

atmost

y"o of the flexible reserves whileremaining

solvent; or else it canhoard

all ofthe flexible reserves yo-

Combining

thetwo

cases, a bank's buffer is givenby

j3

=

min

{j/o,yo} •A

bank

canaccommodate

losses in liquidreservesup

tothebuffer3, butbecomes

insolventwhen

losses arebeyond

3. It follows that the distressedbank

6p(l) will be insolventwhenever

>

P, (9)that is,

whenever

its losses in liquid reserves are greaterthan

its buffer.Suppose

this isthe case so

bank

6/,(l) is insolvent. Anticipating insolvency, thisbank

willhoard

asmuch

liquidity as it can y$

=

y"o (since itmaximizes

ql )and

unloads all remaining loans atdate 1. Since the

bank

is insolvent, all depositors (including late depositors) arrive earlyand

thebank

payswhere

recall that gf denotesbank

6^'+1''s

payment

to early depositors (whichisequal

to /] if

bank

bp(l+l) is solvent).Partial

Cascades.

Sincebank

bp^

is insolvent, itsbackward

neighborbank

bp^~

l> willexperience losses in its cross deposit holdings, which, if severe enough,

may

causebank

£,p(i-!)-s insolvency.

Once

the crisis cascades tobank

bp(-l~l

\

itmay

then similarlycascade

to

bank

bp<~'~ 2\ continuing its cascadethrough

thenetwork

in this fashion.We

conjecture that,under

appropriate parametric conditions, thereexists athresholdK

€

{1,..,2n—

2} such that allbanks with

distance k<

K

—

1 are insolvent (there areK

such banks) while thebanks with

distance k>

K

remain

solvent. In other words, thecrisis will partially cascade

through

thenetwork

but will be contained afterK

<

2n

—

2banks have

failed.We

refer toK

as the cascade size.Under

this conjecture,bank

bp^ +1\ which

has a distance2n

—

1, is solvent.Therefore

q

p(-'

=

/:

and

cfi in Eq. (10) canbe

calculated explicitly. Considernow

thebank

^p(r-i)

^,'i-j-j distance 1

from

the distressed bank.To

remain

solvent, thisbank needs

topay

l\on

its deposits tobank

6p('_2)but it receives only qp

<

/]on

its depositsfrom

thedistressed

bank

bpl<L\ so it loses z il\—

qp j in cross-deposits. Hence,bank

bpl-L

~l>

will

also

go bankrupt

ifand

only if its lossesfrom

cross-deposits are greater than its buffer,'i

—

*?i )>

^iw

hich can be rewritten asqf

]<h--z

- (11)

Ifthis condition fails, then the onlyinsolvent

bank

isthe original distressedbank

and

thecascade size is

K

=

1. If this condition holds, thenbank

bpii~1

^ anticipates insolvency, it

will

hoard

asmuch

liquidity as it can, i.e. j/q=

yand

it willpay

all depositors•T"

-

/

(O

-

!+*£*?..

(12,From

thispoint onwards, a pattern emerges.The

payment

by an

insolventbank

{/,(, ~fc) (with k>

1) is givenby

qf-k)=

f

(qf-{k-']) )and

thisbank'sbackward

neighborbp^~^k+l^ isalso insolvent ifand

only ifqp

'

<

lj

—

-.

Hence, the

payments

of the insolventbanks

converge to the fixed point of the function/(.) given

by

y -f y ,and

ifQ

y+

yo>

h

—

, (13) 'JIfcondition (13) fails, then the sequence lq^'

=

f (qp '))

always remains below li

—

-,andit can be checked that there is a full cascade, i.e. all banks are insolvent.

then (under Eq. (11)) there exists a unique

K

>

2 such thatqf'

k)<h--

for each ke

{0. ...K

-

2} (14) , p{T-(K-\)) . ,8

and

<7j>

m

•If

2n

—

2 is greaterthan

the solution, A', to this equation, i.e. if2n

-

2>

A', (15)then, Eq. (14)

shows

that (in addition to the trigger-distressedbank

6p(!)) allbanks

bp(L ~k

) with distance k 6 {1,...A'

—

1} are insolvent since their losses

from

cross de-posits are greaterthan

their corresponding buffers. In contrast,bank

bp(l~ h) (thatre-ceives qp

from

its forward neighbor) is solvent, since it canmeet

its lossesfrom

cross deposits

by

hoardingsome

liquidity while still promising the late depositors atleast

h

(i.e.qf~

K)

>

h). Sincebank

bp{J- K) is solvent, allbanks

bp{T-k)

with

dis-tance k

6

{K

+

l,..,2n—

1} are also solvent since theydo

not incur losses in cross-deposits.Hence

thesebanks do

nothoard

any

liquidity, j/q=

0,and

theypay

(<7i

=

h,<JP

~

^2)i verifying our conjecture for a partial cascade ofsize

K

under

conditions (13)

and

(15).Sinceourgoal is tostudy the roleof

network

uncertainty in generating acredit crunch,we

take the partial cascades as thebenchmark.

The

next propositionsummarizes

theabove

discussionand

also characterizes the aggregate level of liquidity hoarding,which

we

use as abenchmark

in subsequent sections.Proposition

1.Suppose

the financialnetwork

is realized as b(p), auditing is free,and

conditions (9), (13)

and

(15) hold.For

a given financialnetwork

b(p), let J=

p~

l (j)denote the slot ofthe distressed bank.

(i)

For

the continuation equilibrium (at date I):The

banks' equilibriumpayments

(9i

•

?2 ) are (weakly) increasing withrespect to their distance k

from

the distressedbank

and

there is a partial cascade ofsizeK

<

2n

—

2where

K

is defined by Eq. (14).In particular, banks {frp(t

~^},

n (with distance

from

the distressed bank k<

A'—

I) are insolvent while theremaining

banks {bpi-'~k^} (with distance k

>

K)

are solvent.(ii)

For

theex-ante equilibrium (at date0):Banks

{bp^~

k'>

},_

n hoard as

much

liquidity as they canand

unload all of their existing loans at date 1, while banks {i>p(t~fc)

}

do not hoard

any

liquidity or unloadany

loans.Bank

bp<"L~h

^ hoards a level of liquidity

j/q

!

=

z (l\—

qp

'

)

which

is justenough

tomeet

its lossesfrom

cross deposits (and does not unloadany

loans).5r 4 -3 -2 -1 • O1

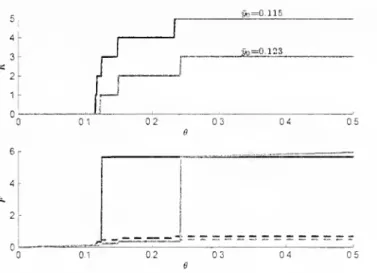

-08 o.e fa.04 0.2 0.2 _kr=!L122_ l7n=n,llfl _i*)=a.,iz3_ 1 0.2 04Figure 4:

The

free-information

benchmark.

The

top figure plots the cascade sizeK

as a function of the losses in the originatingbank

9, for different levels ofthe flexiblereserves y~o.

The bottom

figure plots the aggregate level ofliquidity hoarding, !F, for thesame

set of {y~o}.The

aggregate level ofliquidity hoarding is:T

- 5Z

yo=

K

vo+

yo{L~ A')

(16)

Discussion.

Proposition 1shows

that,under

appropriate parametric conditions, the equilibrium features a partial cascadeand

the aggregate level of liquidity hoarding, J-',is roughly linear in the size of the cascade

K

(and is roughly continuous in 0).Figure

4demonstrates

this result for particular parameterization of the model.The

top panel of the figure plots the cascade sizeK

as a function of the losses inthe originating

bank

9 for different levels of the flexible reserves j/o- This plotshows

that the cascade size is increasing in the level of losses 6

and

decreasing in the level offlexible reserves y . Intuitively, with a higher 9

and

a lower y , there aremore

losses tobe

containedand

thebanks have

lessemergency

reserves to counter these losses,thus

increasing the spread of insolvency.

The

bottom

panel plotstheaggregate levelofliquidityhoardingJF

which

isameasure

ofthe severity ofthe creditcrunch, asafunction of9. Thisplot

shows

thatT

alsoincreaseswith

9and

fallswith

y . This isan

intuitive result: In the free-informationbenchmark

only the insolvent

banks

(andone

transitionbank)

hoard

liquidity, thus themore banks

are insolvent (i.e. the greater

K)

themore

liquidity ishoarded

in the aggregate.Note

also that

T

increases "smoothly" with 9.These

results offer abenchmark

for the next sections.There

we show

that onceaudit-ing

becomes

costly,both

A'and

T

may

benon-monotonic

in y anch

more

importantly,can

jump

with small increases in 9.

3

Endogenous

Complexity

and

the

Credit

Crunch

We

have

now

laid out the foundation for ourmain

result. In this sectionwe add

therealistic

assumption

that auditing is costlyand demonstrate

that a massive creditcrunch

can arise in responseto

an

endogenous

increase in complexityonce

abank

in thenetwork

is sufficiently distressed. In other words,

when

A" is large, itbecomes

too costly forbanks

to figure out their indirect exposure. This

means

that their perceived uncertainty risesand

they eventuallyrespond

bj' hoarding liquidity as a precautionarymeasure

(i.e.,T

spikes).

Note

that, unlike inSection 2.2,we

cannot

simplify the analysisby

solvingtheequilib-rium

for a particular financialnetwork

b

(p) in isolation, since, evenwhen

the realizationof the financial

network

is b(p), eachbank

also assigns a positive probability to otherfinancial networks

b

(p) 6 B.As

such, for a consistent analysiswe

must

describe theequilibrium for

any

realization ofthe financialnetwork

b

(p)£

B

(cf. Definition 1).Solving this

problem

in full generality iscumbersome

butwe make

assumptions

on

the

form

of theadjustment

cost function, the banks' objective function,and on

the levelof flexible reserves, that help simplify the exposition. First,

we

consider aconvex

and

increasing cost function d(.) that satisfies

d{l)

=

and

d(2)>v(l

1+

l2)-v(0).

(17)This

means

thatbanks

can audit one balance sheet for free but it is very costly to auditthe second balance sheet. In particular, given the bank's preferences in (4), the

bank

willnever choose to audit the second balance sheet

and

thus eachbank

audits exactlyone

balance sheet, {a3 (p)

=

1} .

Given

these audit decisionsand

the actual financialL JJb(P)e/3

network

b

(p), abank

IP has a posterior belieff

J {.\p,l) with supportB

J(p,l),

which

isthe set of financial

networks

inwhich

thebank

jknows

the identities of itsneighbors

and

its second forward neighbor. In particular, thebank

6p('~2) learnsits distance

from

the distressed

bank

bp(l) (in addition tobanks

6pl' 1),6

p(l>

,6

p(,+1)

which

alreadyhave

thisinformation

from

the outset).We

denote the set ofbanks

thatknow

the slot ofthe

distressed

bank

(and thus their distancefrom

thisbank) by

B

know (p)=

{b p^-2\b

p(I-l) .bp{1),bp{T+l) } .On

the other hand, eachbank

&^'-,c> with k

6

{3,..,2n-2}

learns that its distanceis at least 3 (i.e. k

>

3), but otherwise assigns a probability in (0. 1) to all distancesk

6

{3. ... 2n—

2}.We

denote the set ofbanks

that are uncertainabout

their distanceby

^uncertain i \

_

np(r-3) ^p(T-4) ^p(J-{2n-2))\Second,

we

assume

that the preference function v(.) in (4) is Leontieff v (x)=

(xl~a—

1) / (1

—

a) witha

—

> oo, so that the bank's objective is:mm

(1 {q{ (p)<

h}

q{ (p)+

1{^

(p)>

I,} qi (p))-

d {a? (p)) . (18)b(p)£BJ(p,l)

This

means

thatbanks

evaluate their decisions according to the worst possiblenetwork

realization, b(p),

which

they find plausible.The

thirdand

lastassumption

is thatyo

<

PS- (19)That

is, thebank

has less flexible reservesthan

the natural limiton

liquidityhoarding

defined in Eq. (8) (which also implies that the buffer is given by

3

=

j/o)- This condition ensures that, in the continuation equilibrium at date 1. thebanks

that haveenough

liquidity are also solvent (since,

no matter

how much

of their flexible reserves they hoard,they

have

enough

loans topay

the late depositors at least l\ at date 2).We

drop

thiscondition in the next section.

We

next turn to the characterization of the equilibriumunder

these simplifyingas-sumptions.

The

banks

make

their liquidity hoarding decision at dateand

deposit with-drawal decision at date 1under

uncertainty (before their date 1 lossesfrom

cross-depositsare realized).

At

date 1 the distressedbank

bp^x)withdraws

its depositsfrom

theforward

neighbor

which

leads to thewithdrawal

of all cross deposits (see Eq. (7)and

Appendix

A.2) as in the free-information

benchmark.

Thus, forany

distressed bank, the onlyway

to obtain additional liquidity at date 1 is

through

hoarding liquidity at date 0,which

we

characterize next.A

Sufficient Statistic forLiquidity

Hoarding.

Consider abank

bp^~k) otherthan

the original distressedbank

(i.e.. A;>

0).A

sufficient statistic for thisbank

tomake

the' liquidity hoarding decision is qp

''

(p)

<

li,which

is theamount

it receives in equilibriumfrom

itsforward

neighbor. In other words, to decidehow much

of its flexiblereserves to hoard, this

bank

only needs toknow

whether

(andhow

much)

it will lose in cross-deposits. For example, if itknows

with certainty that qp (p)=

li (i.e. itsforward neighbor is solvent), then it hoards

no

liquidity, i.e. y^ '=

0. Ifit

knows

with

certainty that qp (p)

<

li—

fi/z (i.e. its forward neighbor willpay

so littlethat thisbank

will alsobe

insolvent), then it hoards asmuch

liquidity as it can, i.e. y^=

y .More

generally, if thebank

bp^~k) hoardssome

y'G

[0,j/o] at date

and

itsforward

neighbor pays

x

=

qP '(p) &t date 1, then this bank's

payment

can be written asqf-k)

{p)

=

q,\y'(y x}and

qf

~k}

(p)

=

q2 [y',x], (20)where

the functions qi[y',x]and

cj2[y'..x] are characterized in Eqs. (26)and

(27) inAppendix

A.2.At

date 0, thebank

does not necessarilyknow

x—

qp

(p)

and

ithas to choose the level ofliquidity hoarding

under

uncertainty.The

characterization inAppendix

A.2 alsoshows

that q-y [y',x]and

q2 [y',x] are(weakly) increasing in x for

any

given y'Q.

That

is, the bank'spayment

is increasingin the

amount

it receivesfrom

its forward neighbor regardless of the ex-ante liquidityhoarding

decision.Using

this observation along with Eq. (20), the bank's objective valuein (18) can be simplified

and

its optimizationproblem

can be written asmax

(1{Ql [y',xm

]>

hjq,

\y'Q,xm

}+

1 { 9l {y'.xm

}>l

l}q

2 \y'.xm

}) , (21) y e|0.yo] s.t. xm

=

min

fx\z =

^-

(*_1» (p) ,b

(p)G

B

1 (p,l)}In words, a

bank

bp^ k^ (with k>

0) hoards liquidity asifit will receive

from

itsforward

neighbor the lowest possible

payment

x

m

.Distance

Based

and

Monotonic

Equilibrium.

Next,we

definetwo

equilibriumal-location notions that are useful for further characterization. First,

we

say that the equi-librium allocation is distance based ifthe bank's equilibriumpayment

can be writtenonly

as a function of its distance k

from

the distressed bank, that is, if there existspayment

functions

Q\,Qi

: {0. ...2n—

1}—

>R

such that(q?-

k)(p),4

{i~k)

(p))

=

(Qi[k},Q2[k]) 16forall

b

(p)6

B

and

kE

{0,..,2n

—

1}. Second,we

say that a distancebased

equilibrium ismonotonia

ifthepayment

functionsQi

[k],

Qi

[k] are (weakly) increasingin k. Inwords,in a distance

based

and monotonic

equilibrium, thebanks

that are furtheraway from

thedistressed

bank

yield (weakly) higher payments.We

next conjecture that the equilibrium is distance basedand monotonic (which

we

verify below).

Then,

abank

6p(,~^'s uncertaintyabout

the forward neighbor'spayment

x

=

qp l~

(p)

=

Q]

[k-

1] reduces to its uncertaintyabout

the forward neighbor's distance k—

1,which

is equal toone

lessthan

itsown

distance k. Hence, theproblem

in (21)

can

further be simplifiedby

substituting qp (p)=

Qi

[k—

1]. In particular,since a

bank

bp(l'k)

6

B

know {p) (for k>

0)knows

its distance k, it solvesproblem

(21)with

x

m

= Q

1[k-l].

On

the other hand, abank

bp^l~k>G

B

uncertairi^

assigns a positive probability to all distances kG

{3, ...,2n—

2}. Moreover, since the equilibrium is monotonic, itsforward

neighbor's

payment

Qi

k—

1 isminimal

for the distance fc=

3, hence abank

b?^

G

^uncertain

^

sq[wqs probl e

m

(21) WithX™

= Q

X [2].We

arenow

in a position to state themain

result ofthissection,which shows

that allbanks that are uncertain about their distances to the distressed bank hoard liquidity as if they are closer to the distressed bank than they actually are.

More

specifically, allbanks

inB

uncertam (p)hoard

the level of liquidity that thebank

with

distance k—

3would hoard

in the free-informationbenchmark.

When

thecascade

size is sufficiently large (i.e. A'

>

3) so that thebank

with distance k=

3 in thefree-information

benchmark

would hoard

extensive liquidity, allbanks

inB

unceTtain(^

with

actual distances k

>

K

alsohoard

largeamounts

of, eventhough

theyend

up

notneeding

it.

To

statetheresult,we

let (j^jree (p) .q{jree (p),Qojree (p)) denote theliquidity

hoard-ing decisions

and

payments

ofbanks

in the free-informationbenchmark

for each financialnetwork

b

(p)6

B

(characterized in Proposition 1).Proposition

2.Suppose assumptions

(FS), (17),and

(18) are satisfiedand

conditions(9), (13), (15),

and

(19) hold.For

a givenfinancialnetwork

b

(p), let i—

p~

l

(j)

denote

the slot ofthe distressed bank.(i)

For

the continuation equilibrium (at date 1):The

equilibrium allocation is distance basedand

monotonic.The

cascade size in the continuation equilibrium is thesame

as in the free-information benchmark, that is. at date 1, banks {bp^~k%>} are insolvent whilebanks {bp(l~k)

} are solvent where

K

is defined in Eq. (14).(li)

For

the ex-ante equilibrium (at date 0):Each

bankb>6

B

know (p) hoards thesame

level ofliquidity j/q(p)

=

yJ jree (p) as in thefree-information benchmark, while eachbank

b>

e

B

uncertain (p) hoards yJ {p)=

Vqj'H

[p), which is the level of liquidity bank bp^~

3'>would

hoard in the free-information benchmark.For

the aggregate level of liquidity hoarding, there are three cases dependingon

thecascade size

K

:

If

K

<

2. then the crisis in the free-informationbenchmark would

not cascade tobank 6p(,

~3

',

which would

hoardno

liquidity, i.e. y$ \Tee (p)=

0- Thus, each bank bP£

^uncertain

^

hoards

no

liquidityand

the aggregate level of liquidity hoarding is equal tothe

benchmark

Eq. (16).If

K

=

3, then the crisis in thefree-informationbenchmark would

cascade toand

stopat bank bpi-'~ 3].

which would

hoardan

intermediate level of liquidity y$ \£, (p)

£

[0,yo].Thus, each bank bP

£

^uncertain^

hoards yPi\~

ee (p)

and

the aggregate level of liquidityhoarding is:

^

=

W

=

3y+

(2n-

4)y^]

. (22)3

If

K

>

4, then in the free-informationbenchmark

bank 6P'!_3)would

be insolvent

and would

hoard asmuch

liquidity as it can. i.e.yQjree

—

yo- Thus, each bank bP6

^uncertain^^

hoards asmuch

liquidity as it canand

the aggregate levelofliquidityhoarding

is:

T

=

Y,y

J o=

(°-n-l)yo-

(23) 3The

proof of this result is relegated toAppendix

A.2 sincemost

of the intuition isprovided in the discussion preceding the proposition.

Among

other features, theproof

verifies that the equilibrium allocation at date 1 is distance based

and monotonic,

and

that the cascade size is the

same

as in the free-informationbenchmark.

The

date

liquidity hoarding decisions arecharacterized as inpart (ii) since the

payments Q\

[k—

1]for k

E {l,2,2n-

1} (that abank

bp{T-k)

G

B

know(p) with k>

expects to receive)and

the

payment

Qi

[2] (that thebanks

inB

vncertain

(p) effectively expect to receive) are the

same

as their counterparts in the free-informationbenchmark.

Discussion.

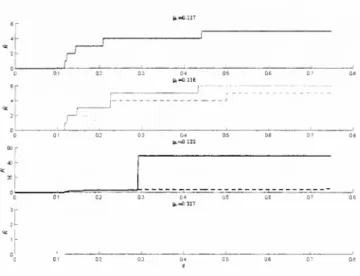

The

plots in Figure 5 are the equivalent to those in the free-informationcase portrayed in Figure 4.

The

top panel plots the cascade sizeK

as a function ofthe losses in the originating

bank

8.The

parameters

satisfy condition (19) so that thecascadesize in this case isthe

same

as thecascadesize inthe free-informationbenchmark

characterized in Proposition 1,

and both

figures coincide.The

keydifferences areinthebottom

panel,which

plotstheaggregate levelof liquidity0.1

yv=0.115

' c: 0.3 04

C5

Figure 5:

The

costly-audit

equilibrium.

The

top panel plots the cacade sizeK

as a function of the losses in the originatingbank

6 for different levels of the flexible reservesyQ.

The bottom

panel plots aggregate level of liquidity hoardingT

for thesame

set of{y~o}-

The

dashed

lines in thebottom

panel reproduce the free-informationbenchmark

inFigure 4 for comparison.

hoarding

J

7 as a function of6.

The

solid lines correspond to the costly audit equilibriumcharacterized in Proposition 2, while the

dashed

lines reproduce the free-informationbenchmark

also plotted in Figure 4.These

plotsdemonstrate

that, for low levelsofK

(i.e.for

K

<

3), theaggregate level ofliquidity hoarding with costly-auditingisthesame

as thefree-information

benchmark,

in particular, it increases roughly continuously with 9.As

K

switchesfrom

below

3 toabove

3, the liquidity hoarding in the costly audit equilibriummake

a very largeand

discontinuousjump.

That

is,when

the losses(measuring

theseverity of the initial shock) are

beyond

a threshold, the cascade sizebecomes

so largethat

banks

are unable to tellwhether

they are connected to the distressed bank. Alluncertain

banks

act as if they are closer to the distressedbank

than

they actually are,hoarding

much

more

liquiditythan

in the free-informationbenchmark

and

leading to a severe credit crunch episode. This is ourmain

result.Note

also that the aggregate level ofliquidity hoarding (and the severity of the creditcrunch) is not necessarily

monotonic

in the level of flexible reserves y . Forexample,

when

6=

0.5, Figure 5shows

that providingmore

flexibility to thebanks by

increasingf/o actually increases the level of aggregate liquidity hoarding.

That

is, at low levels of 6,an

increase in flexibility stabilizes thesystem

but the oppositemay

take placewhen

the shock is sufficiently large. Intuitively, if the increase in flexibility is not sufficientto contain the financial panic (by reducing the cascade size to

manageable

levels),more

flexibility backfires since it enables

banks

tohoard

more

liquidityand

thereforeexacerbate

the credit crunch.

4

The

Collapse

of

the

Financial

System

Until

now,

the uncertainty that arisesfrom

endogenous

complexity affects the extent of the credit crunch but not thenumber

ofbanks

that are insolvent,K.

In this sectionwe

show

that ifbanks have

"toomuch"

flexibility, in the sense that condition (19)no

longerholds

and

Vo

e (yl

1-

y) (24)(which also implies j3

=

y£), then the rise in uncertainty itselfcan increase thenumber

of insolvent banks.The

reason is that a large precautionary liquidity hoardingcompromises

banks' longrun profitability

by

givingup

high returnR

for low return 1. In this context, even if theworst

outcome

anticipatedby

abank

does not materialize, itmay

stillbecome

insolventif sufficiently close (but farther

than

K)

from

the distressed bank. In other words, abank's large precautionary reaction

improves

its liquidationoutcome

when

very close tothe distressed

bank

but it does so at the cost of raising its vulnerabilitywith

respect tomore

benign

scenarios. Since ex-post a largenumber

ofbanks

may

find themselves in thelatter situation, there

can

be a significant rise in thenumber

of insolvencies as a result ofthe additional flexibility.

The

analysis is very similar to that in the previous section. In particular, abank's

payment

stilldepends on

its choice y'E

[0, yo] at dateand

its forward neighbor'spayment

x=

q{ ~ (p) at date 1.That

is:q p i l~k) (p)

=

Qi Wo,*}and

Q2 (1~k) (p)=

<?2 [vo,x]for

some

functions q^ [y',x]and

q2[y',x].However,

the characterization of the piecewisefunctions q\ [y',x]

and

qo [y'o,x] changes a littlewhen

condition (19) is not satisfied. In particular, these functions are identical to those in (26)and

(27) inAppendix

A.2 (as inSection 3) but

now

there isan

additional insolvency region:y'

>

yu[(/,