Bubbles and Self-Enforcing Debt

Texte intégral

Figure

Documents relatifs

All of them may be described by the same second- order partial differential equation, the wave equation, which allows us to think of light and sound as forms of waves, much like

2, we have plotted the complex quasiparticle spectrum for strong axial tilt while neglecting the ∝ ω terms in the self-energy, resulting in a flat bulk Fermi ribbon with a

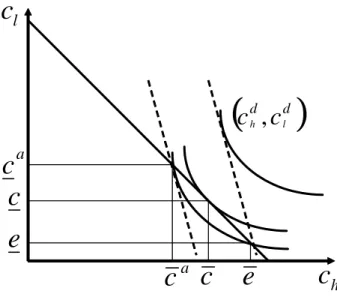

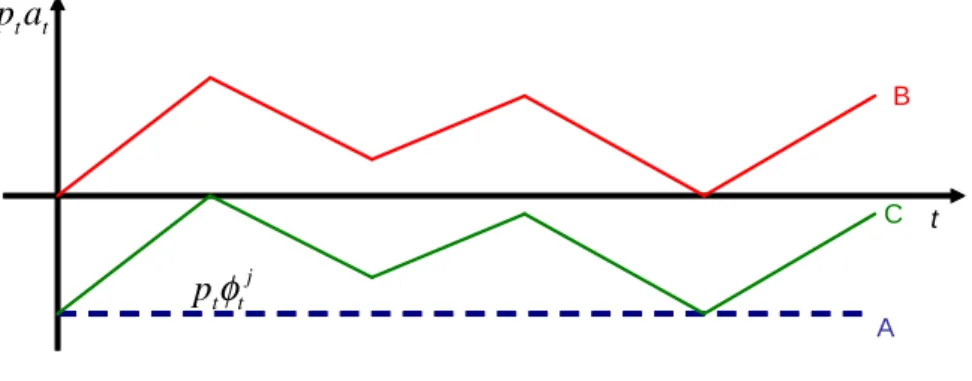

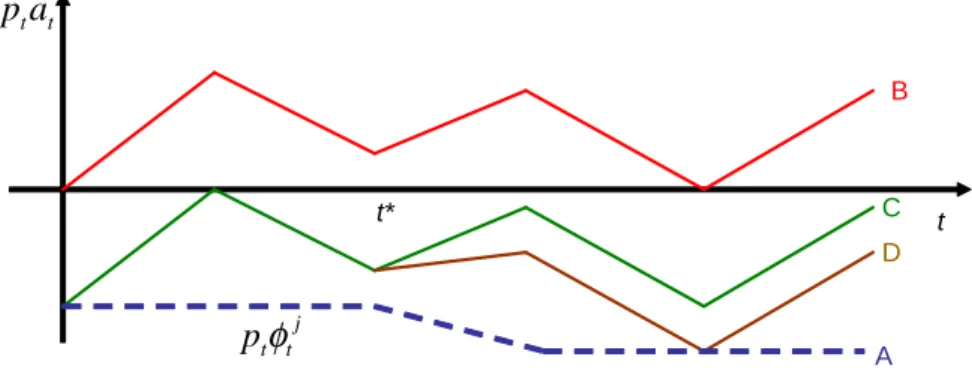

First, in the absence of cost of public funds ( = 0), the debt is not optimal because V ( ) has been shown to be positive 8 2 [ ; ]. The government cares only about the economic

The Impossibility Theorem of Bulow and Rogoff (1989) does not apply since we exhibit equilibria where one country borrows more than its natural ability to repay, that is, the

Following Lerner, now define the external debt burden by the steady-state trade surplus needed to finance public debt service.. This steady-state debt logically is ”paid for” by

If the total number of permits is fixed, this higher demand will translate in an inefficiently high permit price (i.e., above the marginal harm from pollution); unless the total

This means that there are many dierent expectations leading to an underemployment equilib- rium, ranging from the expectations that no household and no rm will supply a positive

If the growth of the American debt can partly be explained by macroeconomics imbalances, the causes of the growth of the European domestic debt must be found in a change in the