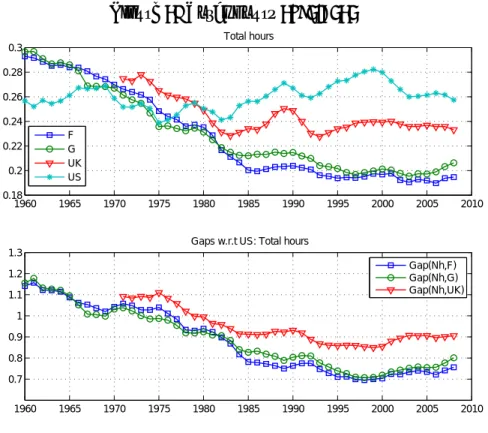

Accounting for Labor Gaps

Texte intégral

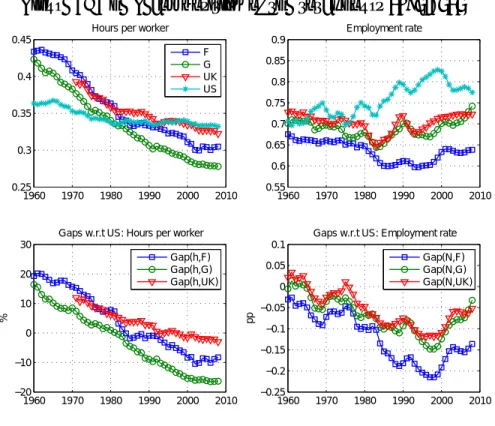

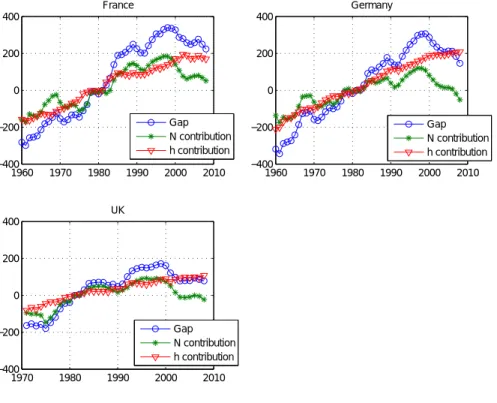

Figure

Documents relatifs

Then, equation(4) shows that increases in reduce the labor market tightness (and then the exit rate out of unemployment of the non-counseled, equal to q( )) if the wage of

In a …rst-best allocation of resources, unemployment bene…ts should provide perfect insurance against the unemployment risk, layo¤ taxes are necessary to induce employers to

Although the EITC provides incentives to search for a job and participate in the labor market, it also encourages workers located in the phase-out range and outside the EITC

In this article I link individual and aggregate impact studies with an agent-based model of the labor market. In particular, I address three issues: a) I evaluate the aggregate

2 A number of variants of the two-sector model with tradables and non tradables have been used to investigate the real exchange rate and trade balance effects of

Then, a tighter environmental tax increases the steady-state unemployment rate, whatever the source of pollution (physical capital or final output) and more frictions on labor

We explore how the propagation properties of frictions in the goods market contrast with propagation in the canonical labor search model and from the amplification due to a

Summarizing, this model with search frictions in the goods market features a lagged response of the demand side of the goods market to productivity shocks, both directly through