MIT LIBRARIES DUPL

'lllllllilliiilllllilll '

DEWEY'-3

9080 03317 5925

Massachusetts

Institute

of

Technology

Department

of

Economics

Working

Paper

Series

Complexity

and

Financial Panics

Ricardo

J.Caballero

Alp Simsek

Working

Paper 09-17

May

15,

2009

RoomE52-251

50

Memorial

Drive

Cambridge,

MA

02142

This

paper

can

be

downloaded

withoutcharge

from

theSocial

Science

Research

Network Paper

Collection at httsp://ssm.com/abstract=1414382Complexity

and

Financial

Panics

Ricardo

J.Caballero

and

Alp

Simsek*

May

15,2009

Abstract

During extremefinancial crises, allofasudden, thefinancial worldthat was once

rife with profit opportunities for financial institutions (banks, for short)

becomes

exceedingly complex. Confusion and uncertaintyfollow, ravaging financial markets

and

triggeringmassive flight-to-qualityepisodes. Inthispaperwe

proposeamodel

ofthis

phenomenon.

In our model, banks normally collect information about their trading partners which assuresthem

ofthe soundness ofthese relationstdps. How-ever,when

acutefinancial distress emergesinpartsofthefinancial network, it isnotenough

to be informed about these partners, as it alsobecomes

important to learnabout the health of their trading partners.

As

conditions continue to deteriorate,banks

must

learn about the health of the trading partners ofthe trading partners ofthe tradingpartners, andso on. Atsome

point, the cost ofinformation gatheringbecomes

toounmanageable

for banks, uncertainty spikes, and they have no option but to withdraw fromloancommitments

and illiquid positions.A

fiight-to-quality ensues, and the financial crisis spreads.JEL

Codes:

EO, Gl, D8,E5

Keywords:

Financial network, complexity, uncertainty, flight to quality, cas-cades, crises, information cost, financial panic, credit crunch.*MIT

andNBER,

andMIT,respectively. Contact information: caball@mit.edu andalpstein@mit.edu.We

thank Mathias Dewatripont, Pablo Kurlat, Guido Lorenzoni,JuanOcampo

and seminar participantsDigitized

by

the

Internet

Archive

in

2011

with

funding

from

Boston

Library

Consortium

IVIember

Libraries

1

Introduction

The

dramatic

risein investors'and

banks' perceived uncertainty' isat thecore ofthe2007-2009

U.S. financial crisis. All ofa sudden, a financialworld

thatwas

once rifewith

profitopportunities for financial institutions (banks, for short),

was

perceived tobe

exceedingly complex.Although

thesubprime shock

was

small relative to the financial institutions' capital,banks

acted asifmost

of their counterpartieswere

severelyexposed

tothe shock.Confusion

and

uncertainty followed, triggering the worst case offlight-to-quality thatwe

have

seen in the U.S. since theGreat

Depression.In this

paper

we

present amodel

ofthesudden

rise in complexity, followedby

wide-spread panic in the financial sector. In the model,banks normally

collect informationabout

their direct trading partnerswhich

serves to assurethem

ofthesoundness

ofthese relationships.However,

when

acute financial distressemerges

in parts of the financial network, it is notenough

to be informedabout

these partners, but it alsobecomes

impor-tant for the

banks

to learnabout

the health of their trading partners.And

as conditions continue to deteriorate,banks

must

learnabout

the health ofthe trading partners ofthe trading partners, oftheir trading partners,and

so on.At

some

point, thecost of informa-tion gatheringbecomes

too largeand

banks,now

facingenormous

uncertainty,have

no

option but to

withdraw

from

loancommitments

and

illiquid positions.A

flight-to-quality ensues,and

the financial crisis spreads.The

starting point ofourframework

is a standard liquiditymodel

where banks

(rep-resenting financial institutionsmore

broadly)have

bilateral linkages in order to insure against local liquidit}' shocks.The

whole

financialsystem

is acomplex network

oflink-ages

which

functionssmoothly

in theenvironments

that it is designed to handle,even

though no

bank knows

with

certainty all themany

possible connections within thenet-work

(that is, eachbank

knows

the identities ofthe otherbanks

but not their exposures).However,

these linkagesmay

alsobe

the source of contagionwhen

an

unexpected

event of financial distress arisessomewhere

in the network.Our

point of departurewith

the literature is thatwe

use this contagionmechanism

not as themain

object of study but as the source of confusionand

financial panic.During normal

times,banks

onlyneed

tounderstand

the financial health of their neighbors,which

they can learn at low cost. In contrast,when

a significantproblem

arises in parts of thenetwork and

the possibility of cascades arises, thenumber

ofnodes

tobe

auditedby

eachbank

rises since it is possiblethat the shock

may

spreadto the bank's counterparties. Eventually theproblem

becomes

too

complex

forthem

to fully figure out,which

means

thatbanks

now

face significantThis

paper

is related to several strands of literature.There

isan

extensive literature that highlights the possibilitjf ofnetwork

failuresand

contagion in financial markets.An

incomplete list includes Allenand Gale

(2000),Lagunoff

and

Schreft (2000),Rochet

and

Tirole (1996), Freixas, Parigiand

Rochet

(2000), Leitner (2005), Eisenbergand

Noe

(2001), Cifuentes, Ferucci

and

Shin (2005) (see Allenand

Babus

(2008) for a recent survey).These

papers focusmainly

on

themechanisms

by

which

solvencyand

liquidity shocksmay

cascadethrough

the financial network. In contrast,we

take thesephenomena

as the reason for the rise in the complexity of the

environment

inwhich banks

make

their decisions,

and

focuson

the effect of thiscomplexity

on

banks' prudential actions. In this sense, ourpaper

is related to the literatureon

flight-to-qualityand

Knightian

uncertainty in financial markets, as in Caballero

and Krishnamurthy

(2008),Routledge

and

Zin (2004)and

Easleyand

O'Hara

(2005);and

also to the related literature that investigates the effect ofnew

eventsand

innovations in financial markets, e.g. Liu,Pan,

and

Wang

(2005),Brock

and Manski

(2008)and

Simsek

(2009).Our

contribution relative tothisliteratureisinendogenizing theriseinuncertaintyfrom

thebehaviorofthefinancialnetwork

itself.More

broadly, thispaper

belongs toan

extensive literatureon

flight-to-qualityand

financial crises that highlights theconnectionbetween

panicsand

a decline inthefinancialsystem's abilityto channel resources tothe real

economy

(see, e.g., Caballeroand

Kurlat (2008), for a survey).We

build ourargument

in several steps. In Section 2we

describe thenormal

envi-ronment,

characterize the financial network,and

describe a rare event as a perturbation to the structure of banks' shocks. Specifically,one

bank

suffersan

unfamiliar liquidityshock

forwhich

itwas

unprepared. In Section 3,we show

that ifbanks can

costlessly gather informationabout

thenetwork

structure, the spreading ofthisshock

into precau-tionary responsesby

otherbanks

is typically contained.This

scenariowith

no network

uncertainty is the

benchmark

for ourmain

results.In Section 4

we

make

information gathering costlv- In this context, if the cascade issmall, either

because

theliquidityshock

islimited orbecause

banks' buffersare significant,banks

are able to gather the information theyneed about

their indirectexposure

to the liquidityshock

and

we

areback

to the full information results of Section 3.However,

once

cascades are largeenough,

banks

areunable

to collect the information theyneed

to rule out a severe indirect hit. Their response to this uncertainty is to retrench

on

their lending,

which

triggers a credit crunch. In Section 5we show

thatunder

certain conditions, the response in Section 4 canbe

so extreme, that the entire financialsystem

can

collapse as a result of the fiight to quality.Somewhat

paradoxically, thisextreme

limited precautionary options for banks.

The

paper

concludeswith

afinalremarks

sectionand

several appendices.2

The

Environment

In this section

we

introduce theenvironment

and

the characteristics of the financial net-work.We

first describe thenormal

scenario inwhich

the financialnetwork

facilitates liquidity insurance.We

then introduce a perturbation to this environment:A

shock

which

was

unanticipated at thenetwork

formation stage (i.e. the financialnetwork

was

not designed to deal

with

this shock).2.1

The Normal

Environment

There

are four dates {—

1,0,1,2}.There

is a singlegood

(one dollar) that serves as numeraire,which can be

kept in liquid reserves or itcan

be loaned to production firms.Ifkept inliquid reserves, aunit of the

good

yieldsone

unit in the next date. Instead, ifaunit is loaned to firms at date -1, it then yields

R

>

1 units at date2 ifit is not recalled orunloaded

before this date.The

loanshave

a recall option at date but at date 1 theylose this option

and

become

illiquid:One

unit of loan recalled at date yieldsone

unit to the lender.At

date 1, the loancannot

be

recalled, but the lender canunload

the loan(e.g.

by

settling itwith

the borrower at a discount)and

receive r<

1 units.To

simplify the notation,we assume

r«

throughout

this paper.The

economy

has2n

continuums

ofbanks denoted by

{b^} 'l-^-Each

ofthesecontinu-ums

iscomposed

of identicalbanks

and, for simplicity,we

refer to eachcontinuum

6^ as bank b^,which

is our unit of analysis.'At

the beginning ofdate —1, eachbank

b' hasassets

which

consist of y units of liquid reservesand

I—

y units of loans,and

liabilitieswhich

consist ofameasure one

ofdemand

deposit contracts.A

demand

deposit contract pays /]>

1 ifthe depositor is hit by a liquidity shockand

/o>

/i ifthe depositor is nothit

by

a liquidity shock. Let u)^G

[0, 1]be

themeasure

of liquidity-driven depositors ofbank

fr' (i.e. the size ofthe liquidity shock experiencedby

the bank),which

takesone

of the three values in {uj.lol^ujh} with loh> ^l

and

Gj=

[ujh+

tj^,) /2,and suppose

y

=

liujand

[1—

y)R =

I2CJso that the

bank

has assets justenough

topay

/j (resp. I2) toearly (resp. late) depositors 'The only reason for the continuum is for banks to take other banks' decisions as given.if the size ofthe

shock

is u.However,

the hquidity needs at date 1may

notbe

evenly distributedamong

banks.

There

are three aggregatestatesofthe world,denoted

by

s (0), s (r)and

s {g), revealed at date0. In state s (0) allbanks

expect to receive at date 1 thesame

liquidityshock

O.The

states s (r)

and

s (g) are realizedwith

equal probabilityand

the liquidity shocks in these states are heterogeneous across banks.More

specifically, thebanks

in thiseconomy

are divided halfand

halfbetween two

types: redand

green. In state s (r) (resp. s (g)), thebanks with

red type (resp. green type) expect to receive a high liquidity shock, Uf^,and

the otherbanks

expect to receivealow liquidityshock, Ui.This

means

that instates s(r)and

s (g) there isenough

aggregate liquiditybut

there is aneed

to transfer liquidity across banks,which

highlightsone

ofthe(many)

reasons foran

interlinked financial network.Given

the financial network,banks

make

arrangements

to transfer liquidity in statess (r)

and

s {g)through

bilateraldemand

deposit contractssignedatdate —1. Inparticular,let i

G

{!,..,2n} denote

slots in a financialnetwork

and

consider apermutation

p :{1,..,277} -^ {l,...2n} that assigns

bank

6''^'' toslot i.

We

consider a financialnetwork

denoted

by:b

(p)=

(6^(^)^

fe'^f^)^

^p(3)_

^

f,p(2n)_

^.(D) .(J)where

the arc—

> denotes that thebank

in slot i (i.e.,bank

6''*'') has ademand

deposit inthe

bank

in thesubsequent

slot i+

I (i.e.,bank

6''''''"^' ) equal to•

. .

. . 2

=

(w-

wl)

, . (2)where

we

usemodulo 2n

arithmetic for the slot index i.'We

refer tobank

6''('+i^ as theforward

neighbor ofbank

6^^'^ (and similarly, tobank

6''^*' as thebackward neighbor

ofbank

bP^'+^^ ).We

say that the financialnetwork

is consistent if allodd

slots (resp. alleven

slots)contain

banks

of thesame

type,which

means

that redand

green typebanks

alternatearound

thefinancialcircle. For analyticalsimplicity,we

restricttheset offeasiblenetworks

to consistent ones (as

opposed

to, forexample, any

circularnetwork

inwhich

banks

may

be

arbitrarily orderedaround

the circle), since thesenetworks

ensure that eachbank

that needs liquidity has depositson

abank

with

excess liquidity, facilitating bilateral liquidity insurance (see below)with

theminimally

required level of cross-deposits ~.Next

we

introduce three features—

network

uncertainty, auditing,and

loan recall—

^In particular, i represents the slot with index i' £ {l,..,2n} that is the modulo 2?! equivalent of integer i. For example, i

=

2n-\-1 representsthe slot with index 1.that play

no

role in thenormal environment

but that will prove central duringa

rare event (defined as a perturbation to thenormal

environment).Network

uncertainty

Banks'

tj-pesand

the financialnetwork

are realized at date—1

as follows: First the types ofbanks

are realized atrandom

(half of thebanks

become

red typeand

the other half green type);then

a particular consistent financialnetwork

h

[p] (with respect to thesetypes) is realized.

We

defineB={h{p)

I p: {1, ...

2n}

-^ {1, ..,2n}

is apermutation}

,as the set of consistent financial

networks from an

ex-ante point ofview

(i.e. before the types ofthebanks

are realized)and

we

suppose:Assumption

(FS).

Each bank

has a prior belief /-' (.) overB

with full support.Once

thetypes are realizedand

a consistent financialnetwork

forms, eachbank

IP observes itsslot ?=

p~^ (j)and

the identities (and types) ofthebanks

in its neighboring slots z—

1and

2+

1. This informationnarrows

down

the potentialnetworks

to the set:B^p)

=

{h{p)eB

p{t-l)^p{t-l)

p{i)

^

p{i) p{i+

l)=

p{i+

l)where

t=

p ^ {j)Note

that thebank

b^ does notknow

the types of theremaining

banks

(^),rf{p(j_i)p(i)p{j+i)}i i^or does itknow

how

thesebanks

are assigned to theremaining

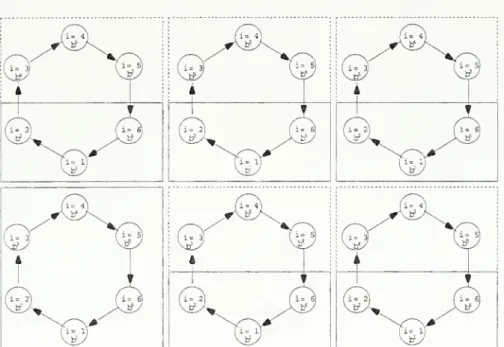

slots (see Figure 1).

The

lattermeans,

and

this is critical, thatbanks do

notknow

how

these

banks

areconnected

to all otherbanks

in the network.Auditing

Technology

Each bank

tP can acquiremore

informationabout

the financialnetwork through an

au-diting technology.At

the beginning ofdateand

after the realization of the aggregate state in {s[0) ,s{r) ,s [g)}, abank

LP in slot i (i.e. with j—

p

{i))can

exert efi"ort toaudit its forward neighbor f^^'^^'^ in order to learn the identity of this bank's forward neighbor ?/'('+2)

.

Continuing

this way, abank

b^ that audits anumber,

a^, of balanceFigure 1:

The

financialnetwork

and

uncertainty.

The

bottom-leftbox

displays the actual financial network.Each

circle corresponds to aslot in the financial network,and

in this realizationofthe network, each slot i containsbank

b^ (i.e. p(?')=

i).The

remaining

boxes

show

the othernetworks

thatbank

b^ finds plausible after observing its neighbors (i.e. the set B^ (p)).Bank

b^cannot

tell the types ofbanks

b^,b'^,b^, norcan

it tellhow

they

are ordered in slots i£

{3,4, 5}.financial

networks

to:~p{i-l)=p{i-l)

BUp

I a')=

{h{p)

eB

p{i+

a^+

1)=

p{i+

a^+

1) ,where

i=

p (j)We

denote the posterior behefs ofbank

tPwith

f^ {.\

p,a^)

which

has support equal to B^ (/9,a^) gi\'enassumption

(FS). In theexample

illustrated in Figure 1, ifbank

b^ auditsone

balance sheet,then

itwould

learn thatbank

6^ is assigned to slot 3and

itwould

narrow

down

the set ofnetworks

to thetwo

boxes at thelefthand

side ofthebottom row

in Figure 1.

^fc.'-Loan

Recalls

Afterlearning

about

the aggregatestateand

narrowng

thefinancialnetwork

ioB^

[p \ a^),each

bank

tP hasupdated

informationabout

its liquidity needs at date 1.The bank

can

rearrange its portfolio

by

recalling a portion ofits loans yg€

[0,yo]and by

keeping theseunitsin liquid reserves. Afterthis portfolioreallocation, each

bank

has y+

y^Q6

[y, y+

yo] invested in liquid reservesand

1—

y—

yj^ in loans.The

parameter

yoE

[0, 1—

y] capturesthe flexibility of the

banks

in portfolio rearrangement. If yo=

0, thebanks cannot

recallany

loans, while ifyo=

1—

y, thebanks can

recall all ofthe loans theymade

at date —1.Bank

Preferences

Consider a

bank

IPand

denote the bank's actualpayments

to earlyand

late depositorsby

q'-yand

q^ (which

may

in principlebe

differentthan

the contracted values /iand

/2).Because

banks

are infinitesimal, theymake

decisions taking thepayments

of the otherbanks

as given.The

bank makes

the auditand

loan recall decisions, a-'G

{0, 1., ..,2n

—

3}and

yo€

[0, yo], at date 0.At

date 1, thebank

chooses towithdraw

some

of its depositson

the neighbor bank,which

we

denoteby

z^€

[0,;:],and

itmay

alsounload

some

ofits outstanding loans.

The

bank

makes

these decisions tomaximize

g^ until it canmeet

its liquidity obligations to depositors, that is, until q\—

li. Increasing q[beyond

/i hasno

benefit for the bank, thus once it satisfies its liquidity obhgations, it then tries tomaximize

the return to the late depositors g^.We

capture this behavior with thefollowng

objective functionwhere

v :R+

—

> IR++ is astrictlyconcave

and

strictly increasing functionand

d{.) isan

increasing

and

convex

functionwhich

captures the bank'snon-monetary

disutilityfrom

auditing.

When

thebank

b^ ismaking

a

decision thatwould

lead toan

uncertainoutcome

for (g^,g^)

(which

willbe

the case in Section 4),then

itmaximizes

the expectation of the expression in (3) given its posterior beliefs f^ (.|

p, a^).

Suppose

that the depositors' early/late liquidity shocks are observable,and a

bank

which

is able topay

its late depositors at least /i at date 2can

refuse topay

the latedepositors if

they

arrive early."^With

this assumption, the continuation equilibrium forbank

IP at date 1 takesone

oftwo

forms. Either there is a no-liquidation equilibrium inwhich

thebank

is solventand

pays

gl

=

h,qi>lu

(4)while the late depositors

withdraw

at date2; or thereis a liquidation equilibrium inwhich

the

bank

is insolvent, unloads all outstanding loans,and

pa3'sqi<luqi

=

0, ,,',/, (5)

while all depositors (including the late depositors)

draw

their deposits at date 1.This completes

the description ofthenormal environment with an

uncertain financial network. Figure 2 recaps the timeline ofevents in thiseconomy.

It canbe

checked, aswe

do

in theAppendix,

that in equilibrium eachbank

b^ is solventand

pays

its depositorsthe contracted values, qi

=

liand

q2—

I2, in each state oftheworld

s (0) ,s (r)and

s (g).In states s (r)

and

s [g], thebanks

inneed

of liquiditymeet

their liquiditydemands

by

withdrawing

their deposits in their forward neighbor banks,and

thebanks with

excess liquiditydo

notwithdraw

their deposits in order to receive higher returns atdate

2.Moreover,

thebanks do

not audit or recallany

loans at date 0.The

financialnetwork

facilitates liquidity insurance

and

enables liquidity to flow acrossbanks even

though

thebanks

areuncertainabout

thenetwork

structure. Inthe next sectionswe

show

how

thingschange

dramaticallyin thepresenceofa perturbation tothisenvironment, especiallywhen

banks

face uncertaintyabout

the financial network.•'Withoutthisassumption, therecouldbe multipleequilibriafor late depositors' early/latewithdrawal

decisions. In cases with multiple equilibria, this assumption selects the equilibrium in which no late

depositor withdraws. ,

Dnte-l

Banlc:' balance•

y liquid receirec, 1—yloDJi:;. Liabilitiec; Measureoneof demanddepodtc tiio.tpaA' /] or ^,Eanf

tj'pecaje realbed atrandom (haJfofbankcbecomered t}-pe,halfgreen)A

condstentfinancial net-u'orlih{p] izrea.li::ed.Do.te

NORMAL

ENV: Statein {r{0),:{T),c{g)\t.realized and obser-i-edby banl;c.

PKKi'URBKD EllY: State i-'(O)hrealized. Banlc;malie theaudit decidona' 6 {0,1,..,2n

Banlc maJietheloanrecall decidonj/^6[0,!/o]

Date

1i

Banlc malie thedepodtwithdravi-aldecidon

^' e 10, .],

Early depodtorsdemand their depozitz.

Late depodtorc; demand their depodt:;ifand only if

the banls cannot promise qi i: /].

Inooh-ent bankc (thatpayq\ < /j

)

unload aJl of theiroutstanding, loans.

Date

2

Banlcc paycito late depocitorc.

Figure 2: Timeline of events.

2.2

A

Rare

Event

Henceforth

we

consider theequihbrium

followingan

unanticipatedchange

inthestructure ofshocks:At

date thebanks

learn that the actual state is s^ (0),which

isjust like s (0)except for the fact that

one

bank, IP,becomes

distressedand

loses 6'<

y of its liquidassets. Figure 2 describes the timeline in the perturbed environment.

We

formally define the equilibrium in this econon\y as follows.Definition

1.The

equilibrium^ is a collection of bank auditing, loan recall, deposit with-drawal,and

payment

decisions {a^ [p) ,yl [p) ,z^ [p) ,q[[p),qi {p)\ \ such that, foreach consistent realization ofthe financial

network

b

[p) at date—1

and

the realization of the unanticipated aggregate state s^ (0) at date 0, each bank IPmaximizes

expected utilityin (3) given its prior belief f^ (.) overB, the insolvent banks (with gj [p)

<

li) unload allof their outstanding loans at date 1

and

the late depositorswithdraw

deposits early ifand

only ifq2 (p)

<

h

(cf- Eqs. (4)and

(b)).As

we

will see in the subsequent sections, the loan recalland

auditing optionsbecome

usefulin thisscenario.

The

distressedbank

tP does nothave

enough

licjuid reserves tomeet

the liquidity

demand

at date 1. Thisbank

tries butcannot

obtain liquidityfrom

cross-deposits (since the other

banks do

nothave

excess liquidity either), thus it benefitsfrom

recalling

some

of its loans at date 0. If the distressedbank

is insolvent despite recalling loans, it willpay

lessthan

li to its depositors, including itsbackward

neighborbank,

and

the crisis will spread in this fashion to the other

banks

in the network. Anticipating this,banks {V}j^j

may

alsowant

to recallsome

loans.These

banks

may

acquire additional informationabout

thefinancialnetwork

tomake

more

accurate loan recall decisions.Note

that each

bank

IP^

b^knows

that thebank

IP is distressed,but

it does not necessarilyknow

the slotofthe distressed bank.

This

is key, since itmeans

that abank

V ^

V

does not necessarilyknow how

farremoved

it isfrom

the distressed bank.More

specifically, note that foreachfinancialnetwork

b

(p)and

foreachbank

b^, thereexists

a unique

/c6

{0, ..,2n

—

1}such

thatj

=

p(j,-k),

which

we

define as the distance ofbank

tPfrom

the distressed bank.As

we

will see, the distance k willbe

the payoffrelevant information for abank

6-' that decideshow

many

of the loans to recall since it willdetermine whether

or not the crisis that originates at the distressedbank

b' will cascade tobank

V

.

The

banks

fc''(*-i),6^(0^5p('+i)^ respectivelywith

distances 1,0and 2n

—

1,know

their distances,but

theremaining

banks

(with distances k£

{2, ..,2n—

2})do

nothave

thisinformation a priori

and

they assign a positive probability to each ^•G

{2,..,2n

—

2} (they rule out k6 {l,2n

—

1}by

observing their forwardand

backwards

neighbors). Note, however, that thebank

W

can use the auditing technology to learnabout

the financialnetwork

and, in particular,about

its distancefrom

the distressed bank.A

bank

b'^^'"'^'^(wdth distance k) that audits a^

>

1banks

either learns its distance k [if k<

a^+

1) or it learns that /c>

a-'+

2.We

next turn to the characterization of equilibrium in theperturbed environment.

3

Free-Information

Benchmark

We

firststudy

abenchmark

case inwhich

auditing is free so eachbank

b''^^"^^ chooses fullauditing a''^'"^^

=

2n

—

3. In this contextbanks

learn thewhole

financialnetwork

b

(p)and, in particular, their distances k.

All

banks

receive aliquidity shock, cj,and have

liquid reserves equal to y=

w/j, exceptfor

bank

IP=

b^^'''which

hashquid

reserves y—

9.At

date 1, the distressedbank

b^^'^withdraws

its depositsfrom

the forward neighbor bank.As we show

in theAppendix,

this triggers further withdrawals until, in equilibrium, all cross deposits are

withdrawn.

That

is ,, ,

;

~j

_

Vie{l,.„2n}.

, (6)

In particular,

bank

t'^''^ tries, but cannot, obtain an}' net liquiditythrough

cross with-drawals.The

bank

alsocannot

obtainany

liquidityby

unloading the loans atdate

1,since each unit of

unloaded

loan yields rw

0. Anticipating that it will not be able to obtain additional liquidity at date 1, the distressedbank

b''^'^ tries to obtain liquidityby

recalling

some

ofits loans at date 0.In order to

promise

late depositors at least /], abank

with

no

liquid reserves left atthe

end

ofdate 1must

have

at leastl_,_5„"=ii^

(T) units of loans.The

level y^ is a natural limiton

a bank's loan recalls (which plans to deplete all of its liquidity at date 1) sinceany

choiceabove

thiswould

make

thebank

necessarily insolvent. If the actual limit

on

loan recalls yo'is greaterthan

i/g,then

thebank

can

recall atmost

y^ loans whileremaining

solvent; or else itcan

recall j/o loans.Combining

thetwo

cases, a bank's buffer is givenby

P

=

min{yo,yo}

•A

bank

canaccommodate

losses in liquidreservesup

tothebuffer/?, butbecomes

insolventwhen

losses arebeyond

/3. ItfoUows

that the distressedbank

6^*'' will be insolventwhene\'er

e

>

/?, (8)that is,

whenever

its losses in liquid reserves are greaterthan

its buffer.Suppose

this isthe case so

bank

6'''''is insolvent. Anticipating insolvenc}', this

bank

will recall asmany

of its loans as it can j/q=

yo (since itmaximizes

q^ )and

unloads allremaining

loansat date 1. Since the

bank

is insolvent, all depositors (including late depositors) arrive earlyand

thebank

pays

where

recallthatqf

denotesbank

fe'^^'^-^^'spayment

to early depositors (which is equal toh

ifbank

bP^'+'^'^ is solvent).Partial

Cascades.

Sincebank

6^^'^ is insolvent, itsbackward

neighborbank

6''^'~-'^ willexperience losses in its cross deposit holdings, which, if severe

enough,

maj' causebank

5p(''-i)'s insolvency.Once

the crisis cascades tobank

6^''~^',it

may

then similarlycascade

to

bank

6''^*~^\ continuingits cascadethrough

thenetwork

in this fashion.We

conjecture that,under

appropriateparametric

conditions, there existsa

thresholdK

E

{1,..,2n

-

2} such that allbanks with

distance k<

K

—

I are insolvent (there areK

such banks)

while thebanks with

distance k>

K

remain

solvent. In other words, thecrisis will partially cascade

through

thenetwork

butwiU be

contained afterK

<

2n

—

2banks have

failed.We

refer toK

as the cascade size.Under

this conjecture,bank

fe''('+^\which

has a distance2n

—

1, is solvent.Therefore

^p('+i)_

i^ g^j^i^ ^p(0 jj-^ gq^ j^g-j

^^^

]-)g calculated explicitl}^Consider

now

thebank

5/'('-i)

^4th

distance 1from

the distressed bank.To

remain

solvent, thisbank

needs

topay

^1on

its depositstobank

i)^('^~2)but

it receives only q^<

lion

its depositsfrom

the distressedbank

6^^'\ so it loses z (li—

q^ ) in cross-deposits. Hence,bank

fo'^^'^i) willalso

go

bankrupt

ifand

only if its lossesfrom

cross-deposits are greaterthan

its buffer, z ill—

<f\ )>

01which can be

rewTitten as..

qt'^Kh-^.

:

: (10)Ifthis condition fails,

then

the only insolventbank

is the original distressedbank

and

the cascade size isK

=

1. Ifthis condition holds,then

bank

6^('~^) anticipates insolvency, itwill recall as

many

loans as it can, i.e.j/q

=

yoand

it willpay

all depositors,

.

\,r'>=f(^f')-"^';^f"

- . , (11)From

this pointonwards,

apattern emerges.The payment

by an

insolventbank

b^'^^~'^^(with /c

>

1) is givenby

' ' -' . ' p(r-fe) f ( p(r-(fc-i))'and

thisbank'sbackward

neighbor fe''*'C^'+i))

js alsoinsolventif

and

onlyif7^'<

Zi

—

7.

Hence, the

payments

of the insolventbanks

converge to the fixed point of the function12-/

(.) givenby

y+

yo,and

if^y

+ yo>li--,

(12)then (under Eq. (10)) there exists a

unique

A'>

2 such thatqf'""^

<h-'^

ioreachke

{0,..J<-2}

(13)and

gf-(^'-i))>l,-^.

If

2n

—

2 is greaterthan

the solution,K,

to this equation, i.e. if2n

-

2>

K,

(14)then, Eq. (13)

shows

that (in addition to the trigger-distressedbank

b''^^^) allbanks

l)P{'-k) Y^ith distance kE

{I,..,

K

—

1} are insolvent since their lossesfrom

cross deposits are greaterthan

their corresponding buffers. In contrast,bank

f^'"^^' (that receivesQi

from

its forward neighbor) is solvent, since it canmeet

its lossesfrom

crossdeposits

by

recalling loanswhilestillpromising thelatedepositorsat least li {i.e. q!^>

/i). Sincebank

6^('-^')

is solvent, all

banks

b''^'-''^with

distance k6

{A"+

1,..,2n-

1} are also solvent since theydo

not incur losses in cross-deposits.Hence

thesebanks

do

notrecall

any

loans y^=

and pay

(qj '=

h.q^

=

'2), verifying our conjecture for a partial cascade ofsize A'under

conditions (12)and

(14).Since ourgoal istostudy theroleof

network

uncertaintyin generating a credit crunch,we

take the partial cascades as thebenchmark.

The

next propositionsummarizes

theabove

discussionand

also characterizes the aggregate level of recalled loans,which

we

use as abenchmark

insubsequent

sections.Proposition

1.Suppose

the financialnetwork

is realized as h{p), auditing is free,and

conditions (8), (12)

and

(14) hold. Let i—

p"^ (j) denote the slot ofthe distressed bank. Then, the banks' equilibriumpayments

((?i ",(?2 '"

) '^''^ (weakly) increasing with

re-spect to their distance k

from

the distressed bank,and

there is a partial cascade ofsizeK

<

2n

—

2where

K

is defined by Eq. (13).Banks

{t''*'~''''}^^_o (luith distance from.the distressed bank k

<

K

—

I) are insolvent while theremaining

banks (f'''^'"'''}? ,, (with distance k>

K

) are solvent.Banks

{6''*'"''"'},_„ recall all of the loans they canand

unload all oftheremaining

loans at date 1, while banks {^^''"''"'j^.^,. do not recallor unload

any

loans.Bank

fc''''"'^' recalls a level of loans y^=

; f /j—

g^ '~ ~ )''if condition (12) fails, then the sequence iql

=

f [Qi '" ~)) always remains below li

—

^,and it can be checked that there isa full cascade, i.e. all banks are insolvent.

5 4 3 2 J . -1 So=0.123 1 "O 0.1 0.2 03 04 05 e 0.8 1*1=0.116 0.6 r ..— ' So=0.123 _ fe,04 i 0.2 __....-. ) 01 02 0.3 0.4 05 e

Figure 3:

The

free-information

benchmark.

The

top figure plots tlie cascade sizeK

as a function of the losses in the originatingbank

6, for different levels of the flexibilityparameter

yo-The

bottom

figure plots the aggregate level ofloan recalls, J-, for thesame

set of

{yo}-which

is justenough

to m^eet its lossesfrom

cross deposits(and

does notunload any

while all other solvent banks

pay

Q'l' '

—

h,Q2^''^'

=

h]-

The

payments

of the insolvent banks aredetermined

by theA'-l loans). This

bank

pays(gj

=

li,q2 '^h

sequence I g^=

/

Ui

p(l-(k-\)) Pil) (9) after substituting q^ p(r+i) fc=0where

the initial value q^ is solvedfrom Eq

h-The

aggregate level of recalled loans is: 'yo

+

yo '15)Discussion.

Proposition 1shows

that the loan recall decisionsand

thepayments

of abank

tP=

6''(*~'^) onlydepends

on

its distance k,and

that the aggregate level of recalled loans,T,

isroughly

linear in the size ofthe cascadeK

(and is roughly continuous in 6) for an)'given level ofyo- Figure 3demonstrates

thisresult for particular parameterization ofthe model.The

top panel of the figure plots the cascade sizeK

as a function ofthe losses in the originatingbank

6 for different levels ofthe flexibilityparameter

yo-This

plotshows

thatthe cascadesize is increasinginthe leveloflosses 6

and

decreasinginthe levelofflexibilityyo- Intuitivel)',

with

a higher 9and

a lower flexibilityparameter

yo, there aremore

lossesto

be

containedand

thebanks have

lessemergency

reserves to counter these losses, thus increasing the spread of insolvency.The

bottom

panel plots the aggregate level of loan recalls J^,which

is ameasure

of the severity ofthe creditcrunch, asafunction of 9.This

plotshows

thatT

also increaseswith

9and

falls with yo-This

isan

intuitive result: In the free-informationbenchmark

only the insolvent

banks

(andone

transitionbank)

recall loans, thus themore banks

are insolvent (i.e. the greater A') themore

loans are recalled in the aggregate.Note

also thatT

increases"smoothly"

with

9.These

results offer abenchmark

for the next sections.There

we

show

thatonce

auditing

becomes

costly,both

K

and

JTmay

be

non-monotonic

in yoand

canjump

with

small increases \n 6.

4

Endogenous

Complexity

and

the

Credit

Crunch

We

have

now

laid out the foundation for ourmain

result. In this sectionwe add

the realisticassumption

that auditing is costlyand demonstrate

that a massive creditcrunch

can

arise in responsetoan

endogenous

increase in complexityonce

abank

in thenetwork

is sufficiently distressed. In other words,

when

K

is large, itbecomes

too costly forbanks

to figure out their indirect exposure. This

means

that their perceived uncertainty risesand

they eventuallyrespond

by

recalling their loans as a precautionarymeasure

(i.e., !F spikes).

Note

that, unlike in Section 3,we

cannot

simphfy

the analysisby

solving theequilib-rium

for a particular financialnetwork

b

[p) in isolation, since, evenwhen

the realization of the financialnetwork

is b(p), eachbank

also assigns a positive probability to other financialnetworks

b

(p)G

B.As

such, for a consistent analysiswe must

describe theequilibrium for

any

realization ofthe financialnetwork

h{p)

(EB

(cf. Definition 1).Solvingthis

problem

infullgenerality iscumbersome

butwe

make

assumptions

on

theform

oftheadjustment

cost function, thebanks' objective function,and on

the flexibility ofthe loan-recall limit, that help simplify the exposition. First,we

consideraconvex

and

increasing cost function d[.) that satisfies

(i(l)

=

and

d\2)>

v{h

+

12)-

v{{)).

(16)

This

means

thatbanks can

auditone

balance sheet for free but it is very costly to audit thesecond

balancesheet. In particular, given thebank's preferences in (3), thebank

willnever choose to audit the second balance sheet

and

thus eachbank

audits exactlyone

balance sheet, {a^ (p)

=

!}

.Given

these audit decisionsand

the actual financialL •'ih(p)sB

network

b(p), abank

b^ has a posterior belief f^ (-l/O;!)with

support

B^ (/5,1),which

isthe set of financial

networks

inwhich

thebank

jknows

the identities of itsneighbors

and

itssecond forward

neighbor. In particular, thebank

bP^'-~'^'> learns its distancefrom

the distressed

bank

6''^''(in addition to

banks

6''^'~-'^ 6^''',6'"^'"'"^)which

already

have

thisinformation

from

the outset ofdate 0).We

denote

the set ofbanks

thatknow

the slot of the distressedbank

(and

thus their distancefrom

thisbank)

by

Qknow

/ \_

np{r-2) ^p(r-i) ^p{l) j^p(r+i)iOn

the otherhand,

each

bank

b^^'"'^^with

k€

{3,..,2n—

2} learns that its distanceis at least 3 (i.e. k

>

3), but otherwise assigns a probability in (0, 1) to all distances kG

{3, ..,2n

—

2}.We

denote

the set ofbanks

that are uncertainabout

their distanceby

^unceTtain / \

_

f ^p{T-3) f^/3(r-4) j^,3(i-(2n-2)) \

Second,

we

assume

that the preference function v{.) in (3) is Leontieff v (x)=

(x^~°'—

1)/ (1—

cr)with

a

—^ DO, so that the bank's objective is:'

min

{l{qi{~p)<h}cf,{p)

+

l{q\{p)>h}qi{p))-d{a^p)).

(17)b(p)eej(p,i)

This

means

thatbanks

evaluate their decisions according to the worst possiblenetwork

realization, b{p),

which

they find plausible.The

thirdand

lastassumption

is thatyo<yo-

'V

(18)That

is, the actual limiton

loan recalls isbelow

the natural limit defined in Eq. (7)(which also implies that the buffer is given

by

/3=

yo).This

condition ensures that,in the continuation equilibrium at date 1, the

banks

thathave

enough

liquidity are also solvent (since theyhave

enough

loans topay

the late depositors at least /] at date 2).We

drop

this condition in the next section.We

next turn to the characterization of the equilibriumunder

these simplifyingas-sumptions.

The

banks

make

their loan recall decision at dateand

depositwithdrawal

decision at date 1

under

uncertainty (before their date 1 lossesfrom

cross-deposits are realized).At

date 1 the distressedbank

6^''^withdraws

its depositsfrom

theforward

neighbor

which

leads to thewithdrawal

of all cross deposits (see Eq. (6)and

thedLx) as in the free-information

benchmark.

Thus, forany

distressed bank, tlie onlyway

to obtain additional liquidity at date 1 is

through

ex-ante (date 0) loan recalls,which we

characterize next.

A

Sufficient Statistic forLoan

Recalls. Consider abank

6^^'"'^' otherthan

theoriginal distressed

bank

(i.e.suppose

k>

0).A

sufficient statistic for thisbank

tomake

the loan recall decision is gj'''

(,5)

<

/j,which

is theamount

it receives in equilibrium,from

itsforward

neighbor. In other words, to decidehow

many

of its loans to recall, thisbank

only needs toknow

whether

(andhow

much)

it will lose in cross-deposits. For example, if itknows

with

certainty that q['"

(p)

—

li (i.e. itsforward

neighbor is solvent),

then

it recallsno

loans j/q=

0. If itknows

with certainty thatQi [p]

<

li—

,3/z (i.e. its forward neighbor willpay

so little that thisbank

will also be insolvent), then it recalls asmany

loans as itcan

j/g—

Vo-More

generally, if thebank

6''('~'^)chooses

some

y^£

[0,yo] at dateand

its forward neighborpays

X

=

q^ [p) Sit date 1, then this bank'spayment

can be

written asqf~'\~P)

=

qi[yi^]

and

qf^'\p)=q2[yix],

(19)where

the functions qi [y'o^x]and

q2 [y'o.x] are characterized in Eqs. (25)and

(26) in theAppendix.

At

date 0, thebank

does not necessarilyknow

x=

q1 ~ [p)and

it has to choose the level of loan recallsunder

uncertainty.The

characterization in theAppendix

alsoshows

that q-[\y'Q,x]and

qily'^.x] are(weakly) increasing in x for

any

given y'^.That

is, the bank'spayment

is increasingin the

amount

it receivesfrom

its forward neighbor regardless of the ex-ante loan recall decision.Using

this observation along with Eq. (19), the bank's objective value in (17)can be

simplifiedand

its optimizationproblem

canbe

written asmax

(1 {q, [y^,x'"]>

h]

q, [y',,x^']+

1{q, [y^,x^]>

l,} q,[y'„ x^]), (20)s.t. .t'"

=

min

lx\x

=

qP'^''''~'>>

(p) ,

h(p) E

B' (/9,1)In words, a

bank

6''''"'^' (with k>

0) recalls loans as if it will receive

from

itsforward

neighbor the lowest -possible

payment

x^.Distance

Based and Monotonic

Equilibrium.

Next

we

definetwo

equilibriumal-location notions that are useful for further characterization. First,

we

say that the equi-librium allocation is distance based ifthe bank's equilibriumpayment

canbe

writtenonlyas a function ofits distance k

from

the distressed bank, that is, if there existspayment

functions Qi, (^2 : {0, ..,

2n

-

1} -^-R

such thatip),qf''Hp))-{Qi{k]

p{i-k)

for all

h{p)

E

B

and

ke

{0, ...2n

—

1}. Second,we

say that a distancebased

equilibriumis

monotonic

ifthepayment

functionsQi

[k],

Q2

[k] are (weakly) increasingink. Inwords,in

a

distancebased

and

monotonic

equilibrium, thebanks

that are furtheraway from

the distressedbank

yield (weakly) higherpayments.

We

next conjecture that the equilibrium is distancebased

and monotonic (which

we

verif}' below).Then,

abank

6''*'~''"''s uncertaintyabout

the forward neighbor'spayment

X

=

Qi (p)=

Qi[k

—

1] reduces to its uncertaintyabout

the forward neighbor's distance k—

1,which

is equal toone

lessthan

itsown

distance k. Hence, theproblem

in (20)

can

furtherbe

simplifiedby

substituting gj ^' ~ {p)=

Qi

[k—

1]. In particular,since a

bank

b''^''~'^^S

Qknow

^-^^ ^^^j, /^>

g)knows

its distance /c, it solvesproblem

(20)with

x"'=

Qi

[/c- 1].On

the other hand, abank

&''('"''=)g

^uncertain f^p-^ assigns a positiveprobabihty

to alldistances k

G

{3, ...,2n—

2}.Moreover,

since the equilibrium ismonotonic,

itsforward

neighbor's

payment Qi

/c—

1 isminimal

for the distance /c=

3,hence

abank

6^^''G

^uncertain

^^) g^j^gg

problem

(20)with

.t'"=

Qi

[2].We

arenow

in a position to state themain

result ofthis section,which shows

that allbanks that are uncertain about their distances to the distressed

bank

recall loans as iftheyare closer to the distressed bank than they actually are.

More

specifically, allbanks

in ^""ce^*""' (^) recall the level ofloans that thebank

with

distance A;

=

3would

recall in the free-informationbenchmark.

When

the cascade size issufficiently large (i.e.

K

>

3) so that thebank

with

distance/c=

3in the free-informationbenchmark would

recallmany

ofits loans, allbanks

in 5""cer(am ^^^with

actual distances k>

K

also recallmany

of their loans,even

though

ex-post theyend

up

notneeding

liquidity.

To

state the result,we

let [y^jreeip)^^i, free (p) ^^i. free (p)) denote the loan recall decisions

and

payments

ofbanks

in the free-informationbenchmark

for each financialnetwork

h

{p) <EB

(characterized in Proposition 1).Proposition

2.Suppose assumptions

(FS), (16),and

(17) are satisfiedand

conditions(8), (12), (14),

and

(18) hold.For

a givenfinancialnetwork

h{p), let i=

p~^ (j) denotethe slot of the distressed bank.

(i)

For

the continuation equilibrium (at date \):The

equilibrium, allocationW(P)V2(P)},'

is distance basedand

monotonic.The

cascade size in the con-h(p)eBtinuation equilibrium is the

same

as in thefree-informationbenchmark,

that is, at date 1,banks {^''^'~'^'}t_n ^^^^ insolvent while banks {&''*'"''"*

},_^

are solvent whereK

is defined in Eq. (13).(a)

For

the ex-ante equilibrium (at date 0):Each

bankIPG

B'^"°^ {p) recalls thesame

level of loans y^ (p)

=

j/q .^^^(p) asm

the free-informationbenchmark,

while each bankV

6

5""'='"""" {p) recalls yl [p]=

yJJ;/j {p) of its loans,which

iswhat

bank bP^''^^would

choose in thefree-information benchmark.

For

the aggregate level ofrecalled loans, there are three cases dependingon

the cascadesize

K:

If

K

<

2, then the crisis in thefree-inform.ationbenchmark would

not cascade to bankb'^''-^),

which

would

recallno

loans y^[^~^^ (/s)=

0. Thus, each bank b>e

5""'^^^*'''" (p) recallsno

loansand

the aggregate level of recalled loans is equal to thebenchmark

Eq. (15).If

K

—

2), then the crisis in thefree-informationbenchmark would

cascade toand

stop at bank b^'^^'^^,which

would

recallan

intermediate level of loans yQ l^J [p)€

[0,yo]• Thus,each bankbP

G

5""'=^'"'°'" (p) recalls y^r^f.^ {p) ofits loansand

the aggregate level of recalled loans is:-^-Eyo

=

3yo+

(2n-4)<(;-t^.

(21)j

If

K

>

4, then in the free-informationbenchmark

bank 6^''"'^'would

be insolvent

and

would

recallasmany

ofits loans as it cany^L^J

—

fjo- Thus, each banktPe

^uncertain ^^^recalls as

many

of their loans as they canand

the aggregate level ofrecalled loans is:J'

=

Y.yl

=

{2n-l)y,.

(22)The

proof of this result is relegated to theappendix

sincemost

of the intuition isprovided in the discussion preceding the proposition.

Among

other features, the proofverifies that the equilibrium allocation at date 1 is distance based

and

monotonic,and

that the cascade size is the

same

as in the free-informationbenchmark.

The

date loan recall decisions are characterized as in part (ii) since thepayments

Qi

[k—

1] for/c

€

{1, 2, 271-

1} (that abank

b^^'-^^G

5'-'"°"' [p)with

^>

expects to receive)and

thepayment

Qi

[2] (that thebanks

in^""=6^''""

(p) effectivelyexpect to receive) are the

same

as their counterparts in the free-information

benchmark.

0,1 0.2

3»=0.116

Jm=ai23_

0.3 04 0.5

0,2 03 0.4 0.5

Figure 4:

The

costly-audit

equilibrium.

The

top panel plots thecacade

sizeK

asa

function of the losses in the originatingbank

for different levels of the flexibilityparameter

yQ.The

bottom

panel plots aggregate level of loan recallsF

for thesame

set of {yo}-The

dashed

lines in thebottom

panelreproduce

the free-informationbenchmark

in Figure 3 for comparison.

Discussion.

The

plots in Figure 4 are the equivalent to those in the free-information case portrayed in Figure 3.The

top panel plots the cascade sizeK

as a function of the losses in the originatingbank

9.The

parameters

satisfy condition (18) so that the cascade size inthis caseis thesame

asthe cascade size inthe free-informationbenchmark

characterized in Proposition 1,

and

both

figures coincide.The

key differences are in thebottom

panel,which

plots the aggregate level of loanrecalls j^ as a function of 6.

The

solid linescorrespond

to the costly audit equilibrium characterized in Proposition 2, while thedashed

linesreproduce

the free-informationbenchmark

also plotted in Figure 3.These

plotsdemonstrate

that, for low levels ofK

(i.e. for

K

<

?)), the aggregate level ofloan recallswith

costly-auditing is thesame

as thefree-information

benchmark,

in particular, it increases roughly continuouslywith

6.As

K

switchesfrom

below

3 toabove

3, the loan recahs in the costly audit equilibriummake

a very large

and

discontinuousjump.

That

is,when

the losses(measuring

the severity of the initial shock) arebeyond

a threshold, the cascade sizebecomes

so large thatbanks

are

unable

to tellwhether

they areconnected

to the distressed bank. All uncertainbanks

act as if they are closer to the distressed

bank

than

they actually are, recallingmany

more

loansthan

in the free-informationbenchmark

and

leading to asevere creditcrunch

episode.

This

is ourmain

result.Note

also that theaggregate levelofloan recalls (and theseverity ofthecreditcrunch)

is not necessarily

monotonic

in the level of flexibility in loan recalls yo- Forexample,

when

9=

0.5, Figure 4shows

that providingmore

flexibility to thebanks by

increasingi/o actually increases the level of aggregate loan recalls.

That

is, at low levels of 6,an

increase in flexibility stabilizes the

system

but the oppositemay

take placewhen

the shock is sufficiently large. Intuitively, ifthe increase in flexibility is not sufficientenough

to contain the financial panic (by reducing the cascade size tomanageable

levels), nioreflexibilit}' backfires since it enables

banks

to recallmore

loansand

therefore exacerbate the credit crunch.5

The

Collapse

of

the

Financial

System

Until

now,

the uncertainty that arisesfrom

endogenous

complexity affects the extent of the creditcrunch

but not thenumber

ofbanks

that are insolvent. A'. In this sectionwe

show

that ifbanks have

"toomuch"

flexibility, in the sense that condition (18)no

longerholds

and

yo

e

(%", 1-

y] (23)(which also implies (3

=

tJq), then the rise in uncertainty itselfcan increase thenumber

of insolvent banks.The

reason is that a large precautionary loan-recallcompromises

banks' long runprofitability

by swapping

high returnR

for low return 1. In this context, even if the worstoutcome

anticipatedby

abank

does not materialize, itmay

stillbecome

insolventif sufficiently close (but farther

than

K)

from

the distressed bank. In other words, a bank's large precautionary reactionimproves

its liquidationoutcome

when

very close to the distressedbank

but it does so at the cost of raising its vulnerabilitywith

respect tomore

benign

scenarios. Since ex-post alargenumber

ofbanks

may

find themselves in thelatter situation, there

can be

asignificant rise in thenumber

of insolvencies as aresult of the additional flexibility.The

analysis is very similar to that in the previous section. In particular, a bank'spayment

stilldepends on

its choice j/q€

[0,yo] at dateand

its forward neighbor'spayment

x=

q^ {p) at date 1.That

is:qf"''^ [p]

^

gj [y^, x]and

g^''"'''[p]

=

q2 [y'o,x]for

some

functions qi [y'o,x]and

92 [y'o,^]-However,

the characterization of the piecewisefunctions q-[ [vq.x]

and

§2 [y'o^x]changes

a littlewhen

condition (18) is not satisfied. In particular, these functions are identical to those in (25)and

(26) in theAppendix

(as inSection 4) but

now

there isan

additional insolvency region:y'o

>

Vo [ih-x)z].

The

criticalnew

element

is thebound

j/q [(/j—

x) z].This

is a function of the lossesfrom

cross-depositsand

is calculated as the level of loan recalls abovewhich

the bank'sremaining

loansand

liquid reserves (net of losses)would

not be sufficient topay

the late depositors at least li.That

is,j/q [(/i

—

x) z] is the solution toRil-y-

yo" [(/:-

x) z])+

y^ [{h-

x) z]-

{h-

x) z=

h

{l-

O)

.

We

referto scenarioswhere

y^>

j/q [(/j—

x) z] as, forlack ofabetter jargon, scenariosof precautionary insolvency.

The

functions gi [yo,x]and

^2 [y'o,^]remain

(weakly) increasing in x.Moreover,

we

conjectureasbefore that the equilibrium is

monotonic

and

distancebased

(whichwe

verify below), so the banks' loan recall decisions still solveproblem

(20). Itcan be

verified thatall

banks

(except potentiallybank

6''^'"'"-'^)recall the level of loans as characterized in part (h) of Proposition 2. In particular, all

banks

b^€

5""<^erta2n ^-^^ choose the level of insurance thebank

with

distance k—

3would

choose in the free-informationbenchmark.

However,

part (i) oftheproposition,which

characterizes theequilibrium atdate 1,changes

once

yo exceeds y^. • .We

divide the casesby

the cascade size:K

<

2,K

=

3,and

K

>

4. In the firsttwo

of these cases there isno

additional panic relative to the casewhere

banks' flexibilityis hmited. If

K

<

2,each

bank

V

e

^^"c'^rtain ^^^ y:ecal\s y^=

0.The

date 1equilib-rium

in this case is as described in part (i) of Proposition 2, in particular, there areno

precautionary insolvencies

and

the cascade size is equal to A'. Similarly, if /("=

3,each

bank

b^€

5""'=^^*'^'" (p) recalls y^=

yg/7ee—

^o>where

the inequality follows since thetransition

bank

6^('~^)is solvent in the free-information

benchmark.

Since yo—

^O' itcan

be

seen that y^<

y^ [{h—

x)z], so thebanks

in_g""certain

^^^ ^^^.g golvent.^ It follows that there are

no

precautionary insolvenciesand

the equilibrium is again as described in part(i) ofProposition 2,

with

a cascade size equal to A'—

3.^Tosee this, first note that y^

<

j/q; which impHes{R-l)yi<Ry^-yi

=

{l-y)R-^{l-0)h-yi,

where the equality follows from Eq. (7). Combining this inequality with the inequality j/q