MoLT.

UBRARJES

-0£WEf

»Digitized

by

the

Internet

Archive

in

2011

with

funding

from

Boston

Library

Consortium

Member

Libraries

HB31

.M415

AO,

Dewey

@

working

paper

department

of

economics

COMPARING

APPLES TO ORANGES:

PRODUCTIVITY CONVERGENCE AND

MEASUREMENT

ACROSS INDUSTRIES AND COUNTRIES

Andrew

6.Bernard

Charles

I.Jones

94-12

Dec.

1993

massachusetts

institute

of

technology

50 memorial

drive

Cambridge, mass.

02139

COMPARING APPLES TO ORANGES:

PRODUCTIVITY CONVERGENCE AND

MEASUREMENT

ACROSS INDUSTRIES AND COUNTRIES

Andrew

6.Bernard

Charles

I.Jones

M.I.T.

LIBRARIES

JUL

12

1994

Comparing

Apples

to

Oranges:

Productivity

Convergence

and Measurement

across Industries

and

Countries*

Andrew

B.Bernard

Chaxles

I.Jones

Department

ofEconomics

Department

ofEconomics

M.I.T.

Stanford University

Cambridge,

MA

02139

Stanford,CA

94305

March,

1994

*We

thank Roland Benabou, Antonio Ciccone, Steven Durlauf, Michael Kremer, PaulRomer

RobertSolow, John Taylor,and Alwyn Youngforhelpfulcomments as well as seminarparticipants at Boston

Uni-versity, U.C. Berkeley,Harvard, Stanford, and the

NBER

Growthgroup.We

aJso thank Kevin Hetherington and Huijdng Li for excellent research<issistance. All errors are ours.Abstract

This

paper examines

the role of sectors in the convergenceof aggregate productivity levels in 14OECD

countriesfrom

1970-1987.The

major

finding is thatmanufacturing

shows

little evidence of either labor productivity or multi-factor productivity convergence while other sectors, especially services, are driving the aggregate convergence result.

The

paper

introduces a

new

measure

of multi-factor productivitywhich

avoidsproblems

inherent to traditionalTFP

measures

when

comparing

productivity levels.A

model

of trade,learning-by-doing,

and

spillovers is developedwhich

can explain convergence insome

sectorsand

divergence in others.

1.

Introduction

Comparisons

ofproductivityperformance

across countries are central tomany

ofthe ques-tions concerning long-runeconomic

growth: are less productive nations catchingup

to themost

productive countries,and

ifso,how

quicklyand by

what

means?

Groups

as disparateas

economic growth

theoristsand

business leaders expressprofound

interest in theanswer

to the question of

whether

the U.S. canmaintain

its role as the world productivity leader.^The

question itself is potentially misleading; shouldwe

be interested in the productivity ofthe entire private sector or that of individual industries;

and whatever

the level of analysis, arewe

concerned with labor productivityoramore

generalnotion oftechnologicaladvance?

Using data

for agroup

of 14 industrialized countriesfrom

1970-1987.we

askwhether

trendsin aggregate productivity are also reflected at the individual industry level taking care to distinguish

between

productivity of laborand

that of all factors taken together. In the process,we

consider the complicated question ofhow

tocompare

multi-factor productivitylevels across

economies

and

provide anew

measure

oftotal technological productivity.The

results for individual industries are quite striking.While

aggregate productivitywas

converging over the period, the sectorsshow

disparate behavior. For allmeasures

of productivity, themanufacturing

sectorshows no

or little convergence, while other sectors,especially services,

show

strong evidence in favor of convergence. This finding for servicestogether with the declining share of

manufacturing

in all 14 countries contributes to theconvergence

found

at the aggregate level.The

lack of convergence withinmanufacturing

overthis seventeen year periodindicates that convergenceis not

an automatic

phenomenon.

Most

theoriesofeconomic growth

predict thatopenness

and

spilloversfrom

R&D

investmentwould

contribute to convergence across countriesand

thus are not easily reconciled withthese findings.

However,

we

interpret this result in the context ofa

simplemodel

of tradeand

learning-by-doingand

argue that the lack of convergence withinmanufacturing

may

not be all that surprising.

These

results are especiallypertinent to thestudy ofconvergencein countries at

more

heterogeneous levels of development. In a recentpaper

Young

(1992)showed

that whileHong Kong

and

Singapore apparentlyfollowed similargrowth

paths, theirproductivity

performances were

quite dramatically different.Our

results suggest further that convergenceofaggregate productivitymay

mask

substantial differences at the sectorallevel.

Previous

work

on

convergence across countries has concentrated almost exclusivelyon

labor productivity using

GDP

per capitaas the measure. Thisisdue

largely toa lack ofdataon

laborand

capital inputs necessary to construct broadermeasures

of productivity.Using

cross-section regressions,

Baumol

(1986),Barro

and

Sala-i-Martin (1991, 1992)and

Mankiw.

Romer

and Weil

(1992) argue that countriesand

regions are converging, or catching-up,since initially

poor

areasgrow

fasterthan

their richer counterparts.However,

thecross-section evidence is not uniform.

Barro

(1991)and

DeLong

(1988)show

that the particularsample

ofcountries determineswhether

catch-up holds.Time

series resultson

longer series forOECD

countries alsoshow

evidence ofcommon

trends butno tendency

for convergencein levels (for

example,

seeBernard

and Durlauf

1991).The

use of labor productivity necessarily entails restrictionson

thedepth

of analysis.By

its very definition, achange

in labor productivityconfounds

potential changes intech-'Forexample,

nology

and

factor accumulation.Convergence

in a neo-classicalgrowth framework

placesheavy emphasis on

the accumulation of capital as the driving force behind convergence, but analysis oflabor productivity does not allow theidentification ofseparate influences oftechnology

and

capital.To

thisend

we

considerboth

multi-factor productivitymeasures

and

labor productivity measures.To

conduct

our analysis of convergencewe

requireboth growth

rates of productivityand

the productivity levels themselves.Most

analyses of productivity concentrateon

thechanges, thus avoiding complicated issues concerning the

measurement

and comparison

ofproductivity levels across industries

and

countries,which

is particularly difficult for multi-factor productivity. In section 2.we

describe in detail ourmeasure

of Total Technological Productivity(TTP).

Thismeasure

is constructed to ensure thatwe

canconduct

cross-country

and

cross-industrycomparisons

with as fewassumptions

as necessary.1.1.

Aggregate

Convergence

The

fundamental

piece ofevidenceon

cross-nationalgrowth

in theOECD

countries is thatproductivity

and output

per capita differenceshave

narrowed

overtime.Log

levels oflabor productivity,Yj

L,and

TFP

areshown

for total industry, excludinggovernment,

for 14OECD

countriesfrom

1970-1987 in Figure 1.^y/i

hasgrown

on

average at a rate of2.4%

per year, but thegap between

themost

productive country, the U.S. over the entire period,and

the least productive country declined consistentlyfrom

1970 to 1987.The same

qualitative results hold for the

measure

ofTFP;

there is substantialnarrowing

of thegap

between

the leader, again the U.S.,and

the less productive countries.However,

liie--degiee_of catch-up is less for the

TFP

measure, suggesting that capitalaccumulation

is playing arole in the convergence oflabor productivity.

The

reduction in cross-section dispersion can be seen again in the lower halfofFigure 1which

plots the cross-section standard deviations ofY

jL

and

TFP.

Cross-section dispersion declines steadilythroughout

the periodfrom

24%

to 14%

forboth

labor productivityand

from

17%

to12%

for multi-factor productivity. Tests for catch-up, regressions of averagegrowth

rateson

initial levels ofthe productivitymeasures

for the 14 countries, confirm the visual evidence.'^ (i.i; 0.71-(l),=

-

^

(i):"

3coef

0.3109-0.0298

R

s.e. (0.0501) (0.0052)'^Y/L isconstructed asoutput per worker.

TFP

isconstructed asaweighted averageofcapital andlaborproductivities vnth theweights being the averagefactor shares over timeand across countries. All analysis

with productivity is done using the logs of the levels. Throughout the paper we maintain the assumptions

ofconstant returns toscale and perfectcompetition. This means wecalculateour laborshares usingoutput

rather than cost shares, notan innocent assumption. Here wehold the laborshareconstant across countries

and time. In Section 2 we discuss this assumption in greater detail. The countries in the sample are the U.S.,Canada, Japan, Germany, France, Italy, U.K., Australia,theNetherlands, Belgium, Denmark, Norway,

Sweden and Finland. The U.S. is denoted by a "o" and Japan by a "-(-" in most figures.

"'Average growth rates here and throughout the paper are constructed as the trend coefficient from a

regression of the log level on a constant and a linear trend. This minimizes problems with measurement

ATFP,

=

a

+

f3TFP}^'°

+

coef

0.1428-0.0226

Js.e. (0.0322) (0.0056)

(1.2)

R^

: 0.54The

coefficientson

the initial levels are negativeand

strongly significant forboth

mea-sures.

Both

laborand

total factor productivitymeasures

for aggregateoutput

indicate thatless productive countries are catching-up to the

most

productive countries."*Based on

thesimple

model

presented in the third section, these estimatesimply

that labor productivity is converging at a rate of3.85%

per year, faster than the2.87%

forTFP.^

The

resultsfrom

Equations

1.1and

1.2 suggest that convergence is continuing for theseeconomies even

intothe 1970"s

and

1980's.To

understand

what

is drivingthis strongevidenceofconvergencefortotal industry pro-ductivity,we

now

turn to the evidencefrom

the sectoral data. First,we

examine problems

with simple

TFP

measures

and

construct an alternativemeasure

called total technological productivity, orTTP.

We

then construct six broadly defined sectors for eacheconomy

and

test for

convergence

in labor productivityand

TTP

within each sector across countries. Finallywe

develop amodel

of trade, learning-by-doingand

spilloverswhich

accords withmany

of the empirical factson

sectoral convergence.The

rest of thepaper

is divided into 5 parts: Section 2 discussesproblems measuring

multi-factor productivity levels

and

introduces anew

measure; Section 3 presents asimplemodel

of technologicalchange

within sectors; Section 4 analyzes themovements

of laborproductivity

and

technological productivity within industries across countriesand

tests forconvergence; Section 5 develops a

model

of trade, leaning-by-doingand

spillovers; Section6 concludes

and

discusses further research.2.

Measuring

Factor

Productivity

Beginning

with thework

ofSolow

(1957),growth

accountingand comparisons

of factorproductivity

have

played aprominent

role inmacroeconomics.

Most

such analyseshave

compared

growth

rates ofmulti-factorproductivity(MFP),

and

the theoretical foundationsfor

measuring

multi-factor productivitygrowth

rates are well-established. FollowingSolow

(1957).

one

can defineMFP

growth

as theamount

by which output would

grow

iftheinputswere

held constant,and

thisgrowth

rate can be calculated asAlnYt

-

aAlnLt

-

(1-

a)\lnKt,

""Time series testsalso provideevidenceofconvergence for measuresofTotal Industry TFP. SeeBernard

and Jones (1993).

^In contrast, Barroand Sala-i-Martin (1992) havefound

2%

convergenceforaggregateoutput per capitai.e. as the

Solow

residual,where q

is labor's share of final output.The

motivation for this calculation is extremely general;no

assumptionson

the specific functionalform

oftheproduction function are required.^ In recognition of the fact that the labor share variesover

time, it is

common

toemploy

a Divisia index of multi-factor productivity growth,which

in this case corresponds to the

Solow

indexwhere

Qt=

.5(at+

Q(_i) is used in place ofa

(e.g. see Caves, Christiansen,

and

Diewert (1982)). This is themeasure

of multi-factorproductivity

growth

thatwe

employ throughout

the paper. In contrast, the question ofconvergence is intrinsically a question of

comparing

productivity levels, notgrowth

rates.Moreover,

the theoreticalfoundations forcomparing

multi-factorproductivity levels arelesswell established.^

Combining

these observations, theproblem

ofcomparing

productivitylevels at all pointsin time reduces to a

problem

ofcomparing

productivity levels at asingle point in time: theremaining

levels can be calculated using the Divisia productivitygrowth

rates. In thecontext of convergence, then, it is natural to think of the

problem

asone

ofcomparing

initial levels of multi-factor productivity.

In this section,

we

argue that themost

obviousmethod

ofcomparing

multi-factorpro-ductivity levels,

examining

Hicks-neutralTFP

level measures, results incomparisons

thatcan be arbitrarily altered

under

very simple assumptions.We

document

the use of suchmeasures

in empiricalwork

relevant to this paper. Finally,we

introduce anew

measure

of multi-factor productivity.Assuming

aCobb-Douglas

production function,Y

=

AK^'"'

L^

, the Hicks-neutralmea-sure of

TFP

is givenby

A,which

is equal to a weighted average of capitaland

labor productivity:lnTFP

=

aln{^)

+

{l-a)ln{'^).

(2.1)L

A

The

problem

with thismeasure

is that iftheparameter

a

differs across countries,com-parisons ofthis

measure

ofTFP

can be misleading, for at leasttwo

reasons. First,suppose

that

two

countrieshave

exactly thesame

inputs (i.e. thesame

capitaland

thesame

labor)as well as the

same

level ofA, but theyhave

different q's. Clearly, thesetwo

countries willproduce

different quantities of output.The

problem

withA

as ameasure

of technology here is that it is incomplete: the technology of production varies with thea

parameters

a^ well as with the A's,and

the simple Hicks-neutralmeasure

ofTFP

does not take this intoaccount.

However,

there is anothermore

seriousproblem

with the Hicks-neutral measure;ar-bitrarily small differences in the

a

parameters

across countriesimply

that changes in theunits of

measurement

for an input canchange

the ranking of productivity levels. This iseasily seen in equation 2.1 above.

Suppose

thattwo

countrieshave

capital-output ratiosthat are equal to one, so that the

TFP

is simply equal to(Y/L)f.

Notice thatTFP

isnow

measured

in, forexample,

dollars perworker

raised tosome power

that differs across countries.By

changing

the units ofmeasure

(e.g.measuring

labor in millions ofworkers),^The key assumptions, ofcourse, are constant returns and competitive factor markets.

'Authors suchas Kendrick and Sato(1963), Christiansen, Jorgenson, and Lau (1971), and Caves, Chris-tensen, and Diewert (1982) haveproposed methods for comparing multi-factor productivity levels, and we

this will rescale

TFP

by

a factor that varies across countries. It is easy toshow

formallythat

one

can always reverse ranks in pairwisecomparisons

ofTFP

levels given arbitrarilysmall differences in the

a

parameters.^It is

tempting

to infer that thesame

problem

must

exist incomparing

TFP

levels attwo

points in time, implying thatcomputations

ofTFP

growth

rates are arbitrary. Infact, this is the motivation for using Divisia

growth

rateswhen

factorexponents

vary overtime. In the Divisia calculation, the

same

factor share (an average) is used tocompare

theproductivitylevels in

two

different years toproduce

agrowth

rate,eliminating the problem.As

the intervalbetween

thetwo

periods gets small, the changes in factor shares also getsmall so that usingtheaveragefactorshare

imposes

verylittledistortionon

theproductivity measure.The

problem

with cross-countrycomparisons

is that there isno

sense inwhich

the factor shares will necessarily be getting closer together:

we

can reduce differences intime

by

increasing the frequency ofobservationand

invoking continuity;we

cannot reducedifferences across countries.

2.1.

A

Solution:

Total Technological Productivity

(TTP)

According

to the results in the previous section, if factor shares vary substantially across countries,comparisons

of productivity levels using the Hicks-neutralmeasure

ofTFP

can be misleading.The

first questionwe must

ask, therefore, iswhether

or not thisvariation infactor shares is a

problem

empirically. Figure 2 illustrates that it is: for total industry inour data, the labor share varies substantially

both

across countriesand

over time.^With

this motivation,

we

turnnow

toa

new method

forcomparing

productivity levels.The

joint productivity of capitaland

labor varies withboth

the"A"

term

in front oftheproduction

functionand

with the factor exponents.To

captureboth

ofthese contributionsto productivity,

we

definea

new

measure

that will be referred to as total technologicalproductivity

(TTP). At

any

point in time for country (or country-sector) i,TTP

is definedas

TTP,t^FiKo,Lo,i,t).

(2.3)TTP

has a very intuitive interpretation: itshows which

countrywould produce

more

output

if all countriesemployed

exactly thesame

quantitiesof capitaland

labor. Since A'^and

Loare constant across time

and

country or sector,comparisons

using thismeasure

incorporate only variation in the production function itself, not in the quantities of the inputs. In'We

show the following: Ifthe factor exponents in the production function differ, then a pairwisecom-parison of

TFP

using the simple measuredefined above can generatedifferences that are arbitrarily largeand either positive or negative bychoosing the appropriate unit ofmeasure for asingle input.

Proof: Considercomparing

TFP

in region 1 wdthTFP

in region 2. Without lossof generality, alter the units used to measurethe labor input by amultiple, 9. Thedifferencebetween the twoTFP

levels, denotedDtfp{S) is

DTFp{e)

=

[nAi{8)-\nA2{9) (2.2)=

ln(yi/y2)-ln(A'i/A'2)-l-ailnA'i-

02InA'2-

ailn{eLi)+

a2\n(dL2)=

DTFp{l)+lRS{a2-ai).

By choosing non-negative valuesof9, Dtfp(9) can takeon any value.

QED

^Laborsharevariesover timeandacrosscountriesforothersectorsas well,especially manufacturingand

this sense, this definition of multi-factorproductivity is closely related to the definition of

MFP

growth

givenby Solow

(1957). In practice,we

willassume

that the function F(-) isCobb-Douglas

so thatIn

TTP^t

=

In A,t+

(1-

a.*)In h'o+

a,t In!„

(2.4)where

In Ait is defined as:In A,t

=

(1-

a,() In(^^)

+

au

In(|^)

(2.5)Here, the labor share is allowed to vary across countries, sectors,

and

time to allow for thepossibility that different industries in different countries

have

access to differenttechnolo-gies. Similarly, recognizing that

we

are usually dealing with aggregate data,we

allow theexponents

in the aggregate production function to vary over time. This variation couldresult

from

true technological variation orfrom changing

sectoral composition within acountry.

It is easy to

show

that this definition of multi-factor productivity is robust to thecrit-icisms of Hicks-neutral

TFP

given above. First,by

its very definition, countries with thesame

levels ofinputsand

thesame

technology willproduce

thesame

output. Second, themeasure

is alsorobust tochanges inthe units used tomeasure

the inputs. Intuitively,what-ever scaJe

changes

areinduced

by

changes in the units ofan

input affect the calculation ofIn

A

in exactly the opposite way, leavingTTP

unaffected.2.2.

Other Production

Functions

and

Productivity

Measures

The

variation in factor shares across countriesand

over time suggests that the standardCobb-Douglas

production functionmust

be generalized.We

choose to generalize in thestraightforward

way

of allowing the factorexponents

in theCobb-Douglas form

to varyacross countries, sectors,

and

time.However, two

alternative generalizations are theCES

production function

and

the translog production function,which

have been

used elsewherein the literature

on

productivity comparison.While

extending our analysis to thesemore

generalfunctionalforms

might

be useful,we

discussbelow

thelimitationsofsuchan

exercise.One

alternative is theCES

specification,recommended

by Kendrick and

Sato (1963),which

allows factor shares to vary monotonically with the capital-labor ratio. In our data,however, it appears that factor shares

do

not vary monotonically with the capital-laborratio, nor

do

the factor sharesbehave

similarly across countries.Within

a country, forexample,

the relationship is typically not monotonic,and

across countries, factor sharesdiffer substantially.

Thus,

toexamine

productivity differences using theCES

productionfunction,

we

would have

to allow theelasticity of substitutionbetween

factors tovary across countriesand

even, perhaps, overtime.Another

alternativeis thedefinitionofproductivityproposed

by

Caves, Christensenand

Diewert (1982). Theirdefinitionisbased

on

the translogproductionfunctionfirst consideredby

Christensen, Jorgenson,and

Lau

(1971).While

we

feel itwould

be useful to extendthe empirical results in this

paper

using the translog definition of productivity, tentativeexplorations in this direction suggest that the extension

would

notbe

straightforward. Forproduction function

depend on

thelevelof capitaland

thelevel of labor. Specifically, Caves, Christensen,and

Diewert (1982)show

thatSit

=

/3l+

f3KLInK,t+

Pll

InLa

where

sa represents factorpayments

to labor asa

shareofoutput. Noticethat the interceptin this equation is allowedto vary

by

country, but the other coefficients are constant across countriesand

over time. Empirical estimates of this equation using ourdata

reveal that the null hypothesis that the coefficientson

InK

and

InL

are constant across countries isstrongly rejected. For

example,

theF

test ofthis hypothesis for thetotalindustry aggregateproduces

a statistic of 9.35compared

to the1%

critical value of 1.70; for manufacturing,the statistic is 7.54,

which

can becompared

to thesame

critical value.Using

either theCES

or translog production setup does not address thefundamental

problem

that theparameters

of the production functionmay

vary across countries. Forthis reason

and

withan

appeal tosimplicity,we

maintain

theassumption

ofCobb-Douglas

functional

form

and

allow the factor shares to vary across time, country,and

sector.As

willbe

discussed inmore

detail later, Dollarand Wolff

(1993) also focuson

produc-tivity

convergence

using industrydata

and employ

the followingmeasure

ofproductivity:J'ppPW _

'^nIt

aUt^[l-a)Ku

where

a

is the labor share oftotalcompensation,

assumed

constant across units of obser-vation.It iseasy to

show,

using thearguments

provided above,thatthismeasure

ofproductivity is not robust toa

change

ofunits. Forexample, by

choosing the units inwhich

tomeasure

L,

one

canmake

the contributionofL

tothismeasure

arbitrarily small sothatcomparisons

win

look exactly likecomparisons

of capital productivityY/K.

Similarly,by

choosing the units inwhich

tomeasure K, one

canmake

the contribution ofK

arbitrarily small so thatcomparisons wiU

look exactly likecomparisons

of labor productivity. If the rankings of capital productivityand

labor productivity differ fortwo

countries, theneither country canbe

shown

to be themore

productiveby

choosingthe appropriate units atwhich

tomeasure

the inputs.

Our

data

suggests that suchproblems

are not simply theoretical oddities: forall three key aggregates (total industry, manufacturing,

and

services) in 1970,Japan

has a highercapital productivity levelthan

the U.S. while the U.S. has higher labor productivity.Thus,

productivitycomparisons

of the U.S.and

Japan

using themeasure

ofDoUar

and

Wolff

(1993) willdepend

criticallyon

the units inwhich

capitaland

labor aremeasured.

In addition, it is

worth

noting that theproblem

heremay

bemore

severethan

with themeasure

ofTFP

discussedabove

becausethis criticism holdseven

when

thefactorexponents

(the q's) are constant across countries. This

measurement argument

providesone

possibleexplanation for the differences

between

our resultsand

thoseemphasized

by

DoUar

and

Wolff.

2.3.

Remaining

Issues

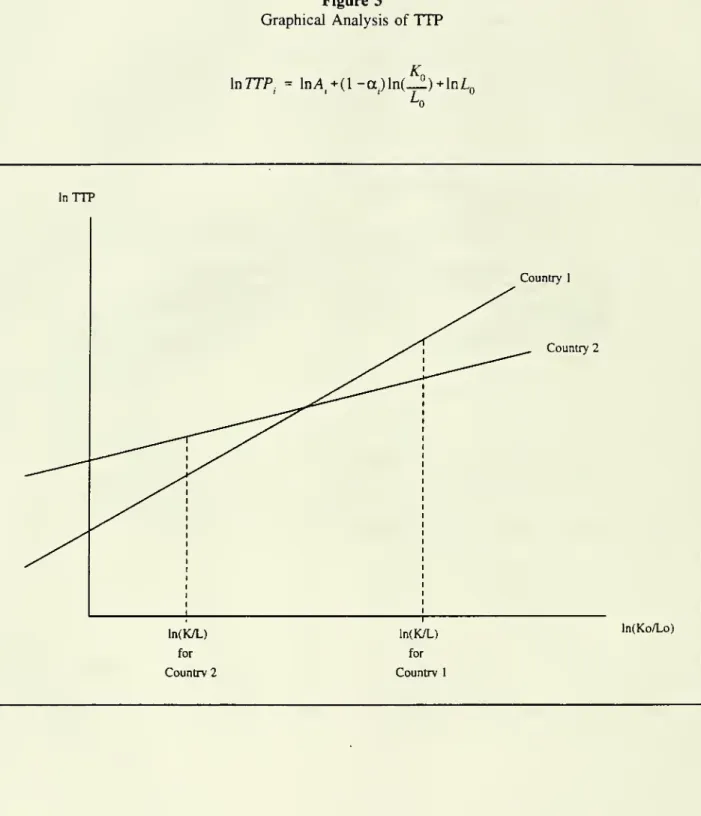

Several issues concerning Total Technological Productivity

remain

to be discussed. First,comparisons

ofTTP

may

be sensitive to the capital-labor ratioKol

Lo, as is obviousfrom

Equation

2.4. Iftwo

countrieshave

different capital-labor ratios theTTP

measure

may

change

rankdepending on which

capital-labor ratiois chosen. This isshown

graphically inFigure 3.

This aspect ofthe

TTP

measure

is unfortunate. Ideally,we

would

likea

singleanswer

to the question, "In the aggregate,

which

country ismore

productive, the U.S. orJapan?"

However,

theanswer

may

depend

onwhether

we

use the U.S. capital-labor ratio or theJapanese

capital-labor ratio. This is analogous to the classic indexnumber

problem.Sup-pose

we

wishtocompare

the totaloutput oftwo economies

thatproduce

different quantitiesofapples

and

oranges.Depending on

the relative price used to weight applesand

oranges,one

countrymay

appear

to bemore

productivethan

the other.^°Several other candidate

measures

of multi-factor productivity also share this problem. Forexample,

one

canimagine

constructing aTFP

measure by

converting labor units into dollars tomake

themeasured

labor inputcomparable

to capitaland

labor.However,

the choice of the realwage

used in the conversion can alter the productivity rankings. Itcan be

shown

that this choice is analogous to choosing a capital-labor ratio since thetwo

are related

under

cost minimization.By

focusing onlyon

the '"A"term

in the productionfunction, this

measure

can alsoprovide misleadingresults.Once

again, countries(orsectors)with identical

K,

L,and

A

terms canhave

differing outputs as a result of different factorexponents.

A

comparison

ofthe"A"

terms would

not capturethis productivity differential.Alternatively,

one

could return to the "naive"measure

ofTFP

basedon

constant factorexponents

across countriesand

time. Thismeasure

now

seems

less naive because it is the onlyTFP

measure

that iscomparable

across countriesand

time.However,

the choice of the factorexponent

still remains,and

the rankings of the productivity levelswiU

typically besensitive to this decision. Moreover, this

measure

has thedrawback

ofignoring convergencethat results

from

intertemporalmovement

in the factor exponents.That

is, it looks at onlyone

ofthetwo

dimensions alongwhich

factorproductivity varies. Despite thesedrawbacks,

we

will report results basedon

the Hicks-neutralmeasure

ofTFP

for comparison.There

does notseem

tobe an

easyway

around

the choice of the appropriatecapital-labor ratio. In the

remainder

of the paper,we

proceedby

evaluatingTTP

at themedian

capital-labor ratiofor the initial year in the

sample and

thenexamine

robustness.^^2.4.

Comparing

TFP

and

TTP

Our

proposed

method

forcomparing

productivitylevels isTTP

whose

construction requiresa

measure

oftotalfactor productivity(TFP),

factor shares,and

capitaland

labor data.To

construct

TTP

levels in practice for 1970-87,we

applyEquation

2.4 to calculate the level in 1970and

generate levels for the subsequent yearsby cumulating

the Divisia multi-factorproductivity

growth

rates.The

1970 level is used as an initial value.^^Figure 1

compared

labor productivityand

theconstant-ameasure

ofTFP

basedon

con-stant factor shares across timeand

countries,and

the resultswere

fairly similar.However,

'°Wethank John Taylorfor pointing this out to us.

''The results are robust to this choice. Choosing the lowest capital-labor ratio causes convergence for

total industry andagriculture to weaken.

'^As an alternative, wealsoused

TTP

levelscalculated ateachpointintime using theTTP

formula. Thefactor shares vary across time

and

countries, aswas

shown

earlier. Therefore, this simpleTFP

measure

may

distort productivity comparisons. Figure 4 plots aTTP

measure

as well asa

TFP

measure

constructed using q's that vary across country, i.e. ameasure

that issubject to the

problems

discussed above.The

differencesbetween

thetwo

measures

are readily apparent.The

cross country standard deviation for the varyinga

version ofTFP

shows

episodesofsome

convergenceand

divergenceleaving the overall dispersion essentiallyunchanged.

In addition, the relative ranks ofcountries are dramatically different, with theU.S. in the

middle

of the 14 countrygroup

and Japan

near thebottom.

In contrast,TTP

is well-behaved

and

consistent with thedata on

labor productivity.TTP

for total industryexhibits substantial

convergence

over the period 1970-1987, as is obviousfrom both

partsof the figure.

3.

A

Basic

Model

of

Productivity

Convergence

The

neoclassicalgrowth

model

without technology predicts convergence inoutput

perworker

for similar, closedeconomies

basedon

theaccumulation

of capital.However, even

in the neoclassical

model,

if theexogenous

technology processes follow different long-run paths across countries, then therewill beno tendency

foroutput

levels to converge.To

seethis

we

construct a simplemodel

ofproductivity catch-up.We

abstractfrom

issues of multi-factor productivitymeasurement

and assume

that multi-factor productivity, Pa, evolves according toInP.t

=

7ij+

AlnAt+lnP.t-i

+lne.t (3.1)with 7,j being the

asymptotic

rate ofgrowth

of sector j incountry

i, \ parameterizingthe speed of catch-up

denoted by

Da,

and

e,t representingan

industryand

country-specificproductivity shock.

We

allowDa,

thecatch-upvariable,tobe

a functionof theproductivitydifferentialwithin sector jin country i

from

that incountry 1, themost

productive country.lnA(

=

-InP.t-i

(3.2)where

a hat indicatesa

ratio of a variable in country i to thesame

variable incountry

1, i.e.Pu

=

^.

(3.3)This

formulationofproductivity catch-up impliesthat productivity gapsbetween

coun-tries are

a

function of the laggedgap

in thesame

productivity measure. Forexample,

if

TTP

is themeasure

of productivity, then laggedgaps

inTTP

determine

the degree ofcatch-up.

This

simple diffusion process is subject to criticism.Dowrick

and

Nguyen

(1989) allow the catch-upinTTP

tobe determined by

labor productivitydifferentials; however, itseems

appropriate tosuppose

that technological catch-upmay

be

occurringindependent

of capital deepening.This

formulation ofoutput

leads toa

naturalpath

for productivity:In this

framework,

values ofA>0

provide animpetus

for "catch-up": productivitydiffer-entials

between two

countries increase the relativegrowth

rate of the country with lowerproductivity.

However,

only ifA>0

and

if 7,=

71 (i.e. if the asymptoticgrowth

rates ofproductivity are the

same)

will countries exhibit a tendency to converge. Alternatively, if A=

0, productivity levels willgrow

at diiferent ratespermanently

and

show

no tendency

to converge asymptotically.^'^ Considering the relationship

between

long-rungrowth

rates across countries,we

can rewrite the difference equation in 3.4 to yieldPi

=

--(^-(^-^n,

6

1^

InAo

+

^7;E

(1- ^f~'

(7.-

71+

Ini,j ) (3.5)^

^

j=0where

p, denotes the averagegrowth

rate relative to country 1between

timeand

timeT.^'* This is the familiar regression of long-run average

growth

rateson

the initial level,where

catch-up isdenoted

by

a negative coefficienton

the level.^^This simple set-up for analyzing productivity

movements

across countriesis convenient because the regression specificationis notdependent on

theform

oftheproductionfunction.4.

Convergence

inIndustry Productivity

In this section

we

present cross-section convergenceresults forlabor productivity, a "naive"measure

ofTFP,

and

ourproposed

measure

ofTTP

for six sectors for 14 countries.We

describe thedata

set before looking at thechanging

compositionofoutput

across countries.Results for /^-convergence

and

cr-convergence foUow. Finally,we

review previous empiricalwork

on

industry productivityand

convergence.4.1.

Data

The

empiricalwork

for thispaper

employs

data for six sectorsand

total industry for (amaximum

of)fourteenOECD

countriesovertheperiod 1970to 1987.The

fourteen countries are Australia. Belgium,Canada,

Denmark,

Finland, France, Italy, Japan, Netherlands,Norway, Sweden,

U.K., U.S.,and

West Germany.

The

six sectors are agriculture, mining, manufacturing, electricity/gas/water(EGW),

construction,and

services.The

basicdata

source is

an updated

version of theOECD

IntersectoralDatabase (ISDB),

constructedby

Meyer-zu-Schlochtern (1988).^^'^Ofcourse, if the country with the lower initial level has a higher 7,, the countries

may

appear to beconvergingin small samples- thiscaseis extremely difficult to rule outin practice.

'*An alternative testing approach, employed in Bernard and Jones (1993), is to estimate Equation 3.4

directly. IfA

>

0, then the difference betweenthe technology levels in the twocountries will be stationary. Ifthereisnocatch-up (A=

0), then the difference ofTFP

in countryifrom thatin country 1 willcontain aunit root. Thedriftterm 7i-7i willtypicallybe small but nonzeroifthe countries'technologiesaredrivenby

differentprocesses(i.e. underthehypothesisofnoconvergence). Underthehypothesisofconvergence,7,

=

71is plausible.

'^Forpotential problems with this typeofregression,see Bernard and Durlauf(1993).

'^With the exception ofthe services aggregate, all the other sectors are taken directly from the ISDB.

The services aggregate is constructed by summing Retail Trade, Transportation/Communication, F.I.R.E.,

and Other Services. GovernmentServices areexcluded. Ourmeasureofaggregate outputalso excludes the

governmentsector.

The ISDB

database containsdata

on

GDP,

totalemployment,

number

of employees,capital stock,

and

thewage

bill.AU

of the currencydenominated

variables are in 1980dollars,

having been

convertedby

theOECD

usingpurchasingpower

parities.We

constructour labor productivity

and

multi-factor productivitymeasures

using these variables. In particular, sincewe

do

nothave

hours data,we

measure

laborby

totalemployment.

We

measure

labor productivity as the log of value-added per worker. Sincewe must

obtain levelsof multi-factor productivity to

conduct

our convergence analysis,we

construct ameasure

of the log of total factor productivity(TFP),

designated A,t. Thismeasure

is constructedinastandard way,as aweighted

averageof capitaland

labor productivity,where

the weights are the factor shares calculated

assuming

perfect competitionand

constantreturns to scale. In order to be able to

make

cross-country comparisons,we

restrict our labor share tobe

sector-specific, i.e. it is calculated asan

average overtimeand

country foreach

sector.^^ Finally,we

constructdata

on

TTP

by

applying theformula

in equation 2.4,evaluated at the

median

capital-labor ratioforeachsectorin 1970.Whatever

themeasure

ofproductivitylevels

we

employ,we

continue to use the Divisiagrowth

rates,and

subsequent productivity levels are calculatedby cumulating

thegrowth

rates using the initial level topin the series

down.

To

summarize

the data.Table

6.1 reports averageannual

labor productivityand

Divisiagrowth

ratesby

countryand

sector for the period 1970 to 1987.^* Similarly, Figures 5and

6 plot the log of labor productivity

and

TTP

respectivelyby

sector for each country.^^The

table

shows

substantial heterogeneity ingrowth

rates acrossboth

industriesand

countries.Average

sectoralgrowth

rates of labor productivity varyfrom 4.0%

per year inmining

to0.9%

in construction.The

Divisiagrowth

ratesshow

similar variation with agricultureex-periencing the fastest multi-factorproductivity growth, 3.0%,

and mining and

constructionactually

showing

negativegrowth

over the period.Within

sectors, thereis alsosubstantiallydifferent

growth

experiences.Manufacturing growth

inlabor productivity variesfrom

a highof

5.9%

inJapan

toa low

of1.7%

inNorway.

MFP

growth

inmanufacturing was

highest inBelgium,

3.5%

per year,and

lowest again inNorway, 0.7%

per year.Labor

productivity inservices, the largest sector in these economies,

grew

ata

2.8%

rate inJapan

and

only0.6%

in Italy.

For every sector, average labor productivity

growth was

fasterthan

MFP

growth

sug-gesting a continuingrole for capital

accumulation

in changes in labor productivityeven

forthese developed

economies

over the 1970'sand

1980's.The

differencewas

most dramatic

in

mining which

had

the fastest labor productivitygrowth

but the lowest,even

negative, multi-factor productivity growth.The

differencesbetween

labor productivityand

multi-factor productivitywas

smallest in services.As

a

checkon

the validity of thesenumbers,

we

cancompare

thegrowth

rates forproductivity in the U.S. to productivity

growth

rates calculatedby

theBureau

ofLabor

Statistics (1991), as

shown

in the following table:^°''We relax this assumption later.

'*For a fewsectors, 1986is taken as the endpoint because ofdata avaUability.

'^The

TFP

figures look verysimilar.^°The

BLS

usedataon labor hours as opposed to the total employment measureused by the ISDB.Y/L

MFP

Total Ind.

Manufac.

Total Ind.Manufac.

BLS

ISDB

1.5%

0.6%

2.8%

2.6%

0.8%

0.2%

2.2%

1.8%

The

growth

rates forthemanufacturing

sectoragreenicely, while thosefor totalindustryare

somewhat

different.Because

the keyfindings in thispaper

focuson

themanufacturing

sector, the slightly

anomalous

results for the total industrymeasure

is less disconcerting.Looking

at the labor productivityand

TTP

levelsby

sector in Figures 5and

6,we

can see several

immediate

differencesfrom

the aggregatemovements shown

earlier. Sectorsdo

notshow

thesame

patterns in either trend or dispersion over time. Neither laborproductivity nor

MFP

show

much

change

in dispersion formanufacturing, while in services,both measures

display anarrowing

of thegap

between

the highest productivity countryand

the lowest.The

figures also bear out the substantial heterogeneity of productivityperformances

across sectors.One

perhaps

puzzling feature of the figures concernsJapanese

productivity in theser-vices sector.

According

to the labor productivity measure,Japanese

productivity in theservice sector in 1970

was

at thebottom

ofthe sample, while theTTP

measure

(and theTFP

measure, although this is not reported) placeJapan

right at the top.As

acompari-son, Baily (1993) cites

numbers

from

theMcKinsey

Global Institute that suggest that totalfactor productivity in

Japanese

generalmerchandise

retailingwas

only55%

of that of theU.S. as of 1987,

which

suggests thatmeasurement

errormay

plague theservice sector data.Once

again, however,as longas themanufacturing data

areaccurate, the key resultsofthispaper

hold up.4.2.

Industry Shares

inGDP

To

help usfocuson

the sources ofconvergencein totalindustry productivitywe

firstexamine

the share of sectors in

GDP.

Even

if there is convergence within sectors, aggregate conver-gencemay

not occur. Forexample, ifoutput shares of industriesvary across countries, then once all sectorshave

converged to theirsector-specific long-run productivitylevelsthere willstill be differences in aggregate productivity levels across countries.

Convergence

inoutput

shares together with sector-specific convergence is sufficient for aggregate convergence. In

this section,

we

examine

the evidenceon

the share ofoutputaccounted

forby each

ofoursix sectors.

Figure 7

shows

the share oftotal industry output (excluding thegovernment)

for each country in the sixbroad

sectors.Both

the leveland change

in shares differs dramatically over time.Within

manufacturing, services, construction,and

agriculture,most

countriesshow

similartrends overtime. Generally, the share ofmanufacturing

is declining(Japan

is a notable exception to this trend), as are the shares ofconstructionand

agriculture. Servicesis the only sector to

show

substantial sharegrowth

formost

countries, accounting for atleast

49%

and

asmuch

as64%

oftotal industry output in 1987.These

figures suggest thatmanufacturing and

services mcikeup

at leasttwo

thirds of totaloutput

in every countrythroughout

the period.^^^To test whether these countries are becoming more similar inoutput composition, broadlydefined, we

In testing for convergence at the industry level,

we

will concentrateon

the results forthese

two

sectors.4.3.

Cross-Country

Convergence

Distinct definitions of convergence

have emerged

in recent empirical work. Cross-sectionanalyses focus

on

thetendency

of countries with relatively high initial levels ofoutput

per

worker

togrow

relatively slowly (/3-convergence) oron

the reduction in cross-sectionalvarianceof

output

perworker

(^-convergence), as inBarro

and

Sala-i-Martin (1991, 1992).This idea of

convergence

as catching-up is linked to the predictedoutput

pathsfrom

aneo-classical

growth

model

with different initial levels of capital.Once

countries attain their steady-state levels of capital, there isno

further expected reduction in cross-sectionoutput

variance.Time

series studies define convergenceas identical long-run trends, either deterministic or stochastic. This definitionassumes

that initial conditionsdo

notmatter

within

sample and

tests for convergence using theframework

ofcointegration.^'^The

model

ofcatch-up in Section 3 implies thatboth

types ofconvergence should holdgiven a long

enough

sample. If the 14OECD

countries areon

their long-run steady stategrowth

paths as of 1970 then the appropriateframework

for testing industry levelconver-gence

is that of cointegration.However,

if technology catch-up is still taking place as of1970 then the cross-section tests are

more

informative. In this paper,we

wiU

focuson

thecross-section analysis of convergence

and examine

/3-convergenceand

cr-convergence.Else-where (Bernard

and

Jones, 1993)we

have

tested for convergence using the sectoraldata

ina

time

seriesframework.

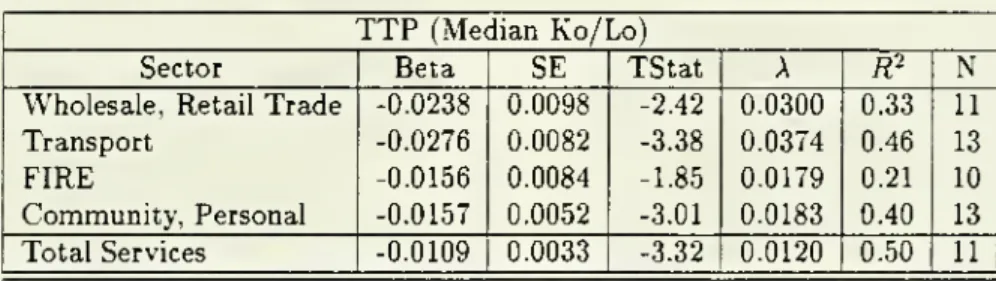

Tables6.2 presents the results

on

/^-convergencefor labor productivity. Foreach

sector,the

growth

rate of productivity is regressedon

its initial level(and a

constant) generatingan

estimate of f3.The

implied speed of converge. A, is then calculated using theformula

from Equation

3.5. In thisframework,

the speed of convergence A can be interpreted asthe rate at

which

the productivity levelis converging tosome

worldwide

productivity level,which

may

itselfbe growing

over time.For labor productivity, the basic convergenceresult for totalindustry

shown

inEquation

1

appears

to hold forsome

sectors but not forothers. Forservices, construction,and

EGW,

a significant negative estimate of /3 is obtained, implying that there has

been

calch-up inlabor productivity during this period.

The

convergencerates for these industries varyfrom

2.46%

per yearinEGW

to2.83%

peryearin services.However, even

withintheseconvergingsectors,thesimpleregressionformulationdifferswidelyinits ability toexplain cross-country

testedfor convergencein thesectoraloutput shares. Only agricultureand constructionshowed anarrowing

of the differences of output shares across countries during the sample. Mining shares diverge, due most

Likelyto dramatic changesin theoUindustry, whUeshares ofmanufacturing,servicesand

EGW

donotshowmuch

chajigein thecross-countrydispersion. Thecross-sectiongrowthrateregressionsconfirmtheseresults.Agricultureandconstruction showconvergencein shares with negative andsignificant coefficientson initial

levels, Services is negative and significant at the

10%

level, and the others have negative coefficients butare insignificcint. These resultson sectoral output shares suggest that whileservices is growing as a share

ofoutput and majiufacturingis decliningin most countries, there remain substantial differences in sectoral

shares across countries. In particular,thereislittletendencyforshares tobecome more simUar, asmeasured

by standard convergencecriteria.

^^For a discussion ofthe theoretical and empirical inconsistenciesassociated with these two measures of

convergencesee Bernard and Durlauf (1993).

growth

rates. In services, the regression accountsfor56%

oftotal cross-countrygrowth

rate variation whileR^

is only 0.19 in the construction sector.Surprisingly, the evidence for convergenceis

weak

inmanufacturing

as thenullhypoth-esis of

no

convergenceis not rejectedeven

at the10%

level.The R^

is correspondingly low. Similar results hold formining

and

agriculture as well.Table 6.3

shows comparable

results for theTFP

measure

of multi-factor productivity.Looking

atTFP, we

find less evidence for convergence withinmanufacturing

as theco-efficient, although still negative, is smaller

and

the f-statistic is lower.The

R'^ for themanufacturing

regression is also smaller at 0.02. Services, once again,shows

convergenceat a rate of

1.34%

per yearand

the simple regression explains56%

of the cross-countryvariation. Agriculture

now

shows

strong evidence of convergence, suggesting that capitalaccumulation

may

even

be offsetting technological convergence. Mining, construction,and

EGW

allshow

broadly similar patterns forTFP

and

labor productivity.Table

6.4 reports our preferred estimates of /3-convergence in multi-factor productivity usingTTP.

We

see resultson

convergence roughly similar to thosefrom

the laborand

TFP

productivitymeasures

used earlier.However, manufacturing

now

shows

even lessconvergence,

both

the leveland

significanceofthe coefficient arereducedand

theR^

isnow

negative. Total industry

TTP

is catching-up at a rate of2.68%

per year. Thiscompares

to apoint estimate for the

manufacturing

sector ofonly0.86%

yearwhich

is insignificantlydifferent

from

zero.Four

sectorsshow

strong evidence of convergence inTTP,

services,agriculture, construction

and

EGW

with negative significant estimates of /3and

high R'^statistics.

To more

clearlyunderstand

themovements

and

convergence of productivity,we now

turn to a

measure

of cr-convergence, the cross-section standard deviation of productivity over time.'^"^ In the graphs, cr-convergenceis indicatedby a

declining standard deviation,reflecting the fact that countries' productivity levels are getting closer together over time.

The

different sectoralcontributions toaggregate laborproductivity can be seenmore

clearlyin Figure 8

which

plots the cross-country sectoral standard deviations of labor productivity over time. Servicesand

EGW

display substantial evidence ofcatch-up, as at is decliningthroughout

the period.The

results formanufacturing

are particularly interesting: duringthe 1970s there is gradual convergence as the standard deviation ofproductivity falls

from

22%

to18%;

however, after 1982 the standard deviation rises sharply for theremainder

ofthe 1980s reaching

more

than

23%

by

1987.Evidence on

theother sectors is less clear-cut,construction

and

agriculture fall initiallyand

then steady,and mining

rises dramaticallyand

then fallsback somewhat.

These

resultsdo

notchange

ifthe U.S. isremoved

from

thesample. In fact, the increase in

manufacturing

TFP

dispersion isaugmented.

Figure 9 plots the cross-country standard deviation in the log of

TTP

for the sixmajor

sectors.^'*

The

results are similar to those for labor productivityand

the /3-convergenceregressions. Services, agriculture,

and

EGW

all exhibit substantial convergence,confirming the regression results. In contrast, productivity in themanufacturing

sectorshows no

convergence

in the 1970sand

diverges during the 1980s.^^Combining the 13- and <T-convergence results allows us to avoid potential problems associated with

Galton's Fallacy.

Quah

(1993) shows that negative coefficients on /? are consistent with a constantcross-section distribution.

^*The resultsfor the

TFP

measureare similar.4.4.

Convergence

within

Manufacturing and

Services

To compare

our results with previouswork

we

also estimate /?-convergence regressions for9 2-digit sub-sectors of

manufacturing

and

4 2-digit sub-sectors of services.^^ Table 6.5presents the results for manufacturing.

Only

4 of the 9manufacturing

industriesshow

evidence of convergence, textiles, chemicals,

non-metaUic

minerals,and

basic metaJs.Ma-chinery

and

equipment,

a sectorwhich

hasbeen

associated withgrowth

in recent work,shows

little evidence of convergence in TTP.'^^ This suggests that the lack of convergencefor

manufacturing

as awhole

extends to individual industries as well.The

convergence

regressions for services areshown

in Table 6.6.Once

again thegeneralfinding of

convergence

in servicesisborne

outby

negativeand

significant estimates of/3 in3 of the 4 sub-sectors.

Only

the coefficient for Finance, Insuranceand

Real Estate is notsignificant at the

5%

level.The

explanatorypower

ofthe regressions is higher here as well.4.5.

Robustness

of

the

TTP

Results

The

TTP

results of the previous section highlightone

ofthekey

results ofthis paper: theaggregate

convergence

in technological productivity within theOECD

economies

over thelast

two

decades is drivenby

thenon-manufacturing

sectors; within manufacturing,there isvirtually

no

evidence ofconvergenceand

evenweak

evidence for divergence.These

resultsare

based

on

TTP

evaluated at themedian

capital-labor ratio for each sector in 1970. Thisresult does not

appear

to be sensitive to the choice of the capital-labor ratio, however, apoint

we

now

examine

inmore

detail.Instead of presenting additional tables of regression results,

we

demonstrate

the point graphically. Figures 10and

11 plot the log ofTTP

for total industryand

for themanu-facturing sector for a

subsample

of theOECD

economies.Log

ofTTP

is plotted for eachcountry

for 1970and

1986, together with U.S.TTP

in 1970and

1986.The

symbol

'o' inthe figure indicates the U.S. capital-labor ratioforeach year (togetherwith the

min

and

themax

for each sector), while thesymbol

'x" does thesame

thing for anotherOECD

economy.

Figure 10illustrates that the convergenceof

TTP

intotalindustryisrobust tothechoice ofthe capital-labor ratio, at least in these pairwise comparisons.Within

the relevant range (i.e.between

themin

and

ma.x capital-labor ratio for the sector), there are few crossings of theTTP

lines,and

the convergence result appears to apply at virtually every capital-laborratio.

As

an example,

consider the picture for Japan. U.S.TTP

grows

relatively slowlyduring this period, indicated

by

the relatively smaller shiftupward

in theTTP

line forthe U.S.

when

compared

to the shift for Japan. This is true at all (relevant) capital-laborratios, indicating that regardless of the capital-labor ratio chosen,

Japanese

technologicalproductivity

was

catchingup

to U.S. productivity in total industry.Figure 11 illustrates that thelack ofconvergence within

manufacturing

is alsorobust tothe choice of the capital-labor ratio. For

example,

consider the picture forWest Germany.

U.S.

TTP

growth

is clearly fasterthan

West

German

TTP

growth

at all capital-labor ratiosthat are relevant, including the U.S.

and

West

German

capital-labor ratios. Since the U.S. ^^There are often fewer countriesfor the regressions within sub-industriesthus the results must be takenas suggestive.

^®The labor productivity results forthese sectorsshoweven less convergence withsome industries

regis-tering positive coefficients.

is the technological leader here, there is divergence in technological productivity for these

two

countries.Of

the six pairwisecomparisons

in the figure, onlyJapan

(and perhaps

Italy) potentially are converging to the U.S.

TTP

level over this period, ajideven

thisconvergence

appears to be sensitive to the choice of capital-labor ratio (e.g. evaluated atthelargest capital-labor ratio of11.5,

TTP

growth

forthe U.S.isfasterthan

that ofJapan).Overall, the results

from

this section confirm that the empirical results forTTP

docu-mented

earlier are robust to the choice ofthe capital-labor ratio.4.6.

Previous Empirical

Work

on

Sectors

Most

previouswork

on

convergence has concentratedon

aggregate data, looking inpartic-ular at

output

per capita or labor productivity, output per worker.A

notable exceptionto this is

work

by

Dollarand

Wolff (1988),Wolfr (1991),and

especially Dollarand

Wolff (1993)who

consider convergence using industry data.DoUar

and

Wolff (1993) considermany

of thesame

issues addressed in this paper, such as convergence within sectorsand

the differences

between

labor productivityand

TFP.

Largely in opposition to our findings,they conclude that therehas

been

substantial convergenceinmost

sectors,and

in particularwithin

manufacturing

during the period 1963-1985.However,

theyshow

thatmost

ofthe convergence occurred prior to 1973,and

since that timeany

convergence hasbeen

weak

atbest for

most

sectors.Several

important

differences indata

and methodology

existbetween

Dollarand Wolff

(1993)

and

this analysis. First, they usean

early versionoftheOECD

data

setwe

employ,

which

may

contribute to the different findings.A

symptom

oftheproblems

with theirdata

is that Dollar

and

Wolff (1993) findNorway

tobe

themost

productive countryafter 1982, aresult not confirmed

by any

outside source.However,

thedominant

disparitiesbetween

theempirical analyses in that

work

and

those in thispaper

stem from

differences themeasures

of multi-factor productivity.

As

discussed in Section 2, theirprimary

measure

of multi-factor productivity is not robust to a simple choice of units(and

this is trueeven

if the factorexponents

do

not differ across countries or sectors).Stockman

(1988)and CosteUo

(1993)have

alsoexamined

industry-leveldata

forOECD

economies,

although

not in the context ofconvergence.Stockman

(1988)decomposed

thegrowth

rate of industrial production for eightOECD

countriesand

ten two-digitmanufac-turingindustriesinto

a

country-specificcomponent

and an

industry-specificcomponent

(by using the appropriatecombination

of indicator variables).With

this setup,Stockman

re-ports the fraction ofthe varianceof

output growth

that is explainedby

the country-specificcomponent,

the industry-specificcomponent,

and

the covariationbetween

the two. Hisre-sults indicate that the

two

types ofshocks explain roughly thesame

percentageof variationin

output growth.

Costello(1993)follows the

methodology

ofStockman

(1988) butfocuseson

multi-factorproductivity

(MFP)

growth

instccid ofoutput

growth

and examines

five industries in sixcountries. Costello's results areconsistent with thoseof

Stockman

and

suggest the presenceofnationaleffectsthatare atleast as

important

as sectoraleffectsinexplaining thevariation ofMFP

growth.

Costello alsoprovidessome

evidence usingpairwise correlations suggestingthat