Auctions of digital goods with externalities

Texte intégral

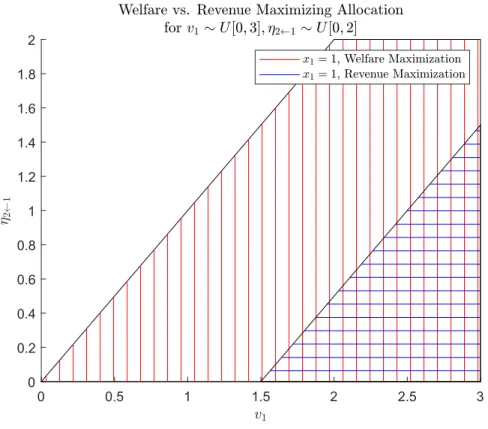

Figure

Documents relatifs

Thus far, models of common value 1 English auctions have focused almost exclusively on rational bidders leading to Nash equilibria: each bidder plays the best response to his

suppose that , then in the second step, a bidder with valuation v* does not participate since he prefers losing the auction than winning it for a price higher or equal to

(b) Differences of individual 13 C chemical shifts between primary wall celluloses and crystalline I α and Iβ celluloses. Two similarly good assignments are each found for

bidding strategy is rational when the level of competition is intense because demand is low and/or marginal cost is constant pitting every unit for sale against every other. 3) The

In the presence of direct externalities Caillaud and Jehiel (1998) identify a necessary and sufficient condition for the existence of an ex-post efficient mechanism for the

This empirical methodology also allows us to identify the channel through which some variables affect bilateral trade (resp. bilateral holdings of financial assets): as

To identify the brain regions associated with subjects recog- nizing the different market types, we analysed the neural ac- tivity during the MARKET stage of the task, which informs

To better understand the underlying organization that regulates the large-scale brain dynamics, and henceforth the phase relationships between network nodes, we analyze