Chinese Mortgage Backed Security pricing model

Texte intégral

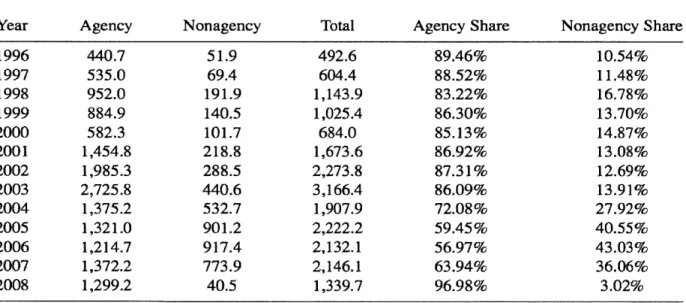

Figure

Documents relatifs

Les approches de thérapie génique sont de plus en plus nombreuses, élaborées, et fructueuses, mais thérapies géniques et cellulaires sont par essence complémentaires parce que

vii But bonding social capital, too, may have negative effects, for example through excessive claims from personal network members connected via strong

This paper demonstrates that the allocation of household savings to State-Owned Enterprises (SOEs) in China, and not to the increasing share of private firms, explains both

The primary outcome was the success rate of the block, which was defined as painless surgery [visual analogue pain scale (VAS),3] after ultrasound-guided spermatic cord block

De manière constante, les investisseurs devraient et devraient se préoccuper de moments plus élevés au-delà de la moyenne et de la variance, parmi lesquels l’asymétrie

The Commission and the ECB argued that securitisation was a policy that was essential to re-start the flow of credit to the real economy in the EU, especially given the limited

Specifically, we argue that the European Commission sought to promote CMU by articulating two narratives, which targeted different audiences, in order to mobilise

with interdependent components. In practice however, this structure raises some questions, especially relating to the differences in character and scope between