MIT LIBRARIES DUPL

^CBir«t^

\

Digitized

by

the

Internet

Archive

in

2011

with

funding

from

Boston

Library

Consortium

IVIember

Libraries

, , ^

DEWEY

Massachusetts

Institute

of

Technology

Department

of

Economics

Working

Paper

Series

Contingent Reserves

Management:

An

Applied

Frameworii

Ricardo

J.Caballero

Stavros

Panageas

Working

Paper

04-32

September?,

2004

Room

E52-251

50

Memorial

Drive

Cambridge,

MA

02142

This

paper

can be

downloaded

without

charge

from

theSocial

Science Research

Network Paper

Collection athttp://ssrn.com/abstract=59522 1

MASSACHUSETTS

INSTITUTEOF

TECHNOLOGY

DEC

72mk

Contingent Reserves

Management:

An

Applied

Framework

Ricardo

J.Caballero

and

Stavros

Panageas

September

9,2004*

Abstract

One

ofthemost

seriousproblems that acentralbank

inan

emerg-ingmarketeconomy

canface, is thesudden

reversal of capital inflows.Hoarding international reserves can be used to

smooth

the impact of suchreversals, but these reserves areseldomsufficientand

alwaysex-pensive to hold. In this paper

we

argue that adding richer hedginginstruments to the portfolios held

by

central banks can significantly improve the efficiency of the anti-sudden stop mechanism.We

il-lustrate this point with a simple quantitativehedging model,

where

optimallyusedoptions

and

futureson

theS&PlOO's

impliedvolatilityindex (VIX), increases the expected reserves available during

sudden

stops

by

asmuch

as40 percent.JEL

Codes:

E2, E3, F3, F4, GO,CI

Keywords:

Sudden

stops, reserves, portfolio,VIX,

hedging, options,futures.

"MIT

andNBER,

andMIT,

respectively. Prepared for the CentralBank

of Chile'sconference on "External Vulnerability and Preventive Policies," Santiago Chile, August 2004.

We

are gratefulto Andres Velascoand conference participantsfortheir comments, andtoFernandoDuarte andJoseTessadaforexcellent research assistance.1

Introduction

One

ofthemost

seriousproblems

thata

centralbank

inan emerging market

economy

can

face, is thesudden

reversal of capital inflows(sudden

stops).Hoarding

international reservescan be used

tosmooth

theimpact

of suchreversals (see, e.g.,

Lee

(2004)),but

these reserves areseldom

sufficientand

always

expensive to hold.In Caballero

and

Panageas

(2004)we

deriveand

estimatea

quantitativemodel

to assess the (uncontingent) reservesmanagement

strategy typicallyfollowed

by

centralbanks.We

conclude

thatthisstrategyisclearlyinferiortoone

inwhich

portfoliosinclude assets that are correlatedwith

sudden

stops.As

an

illustration,we

show

that holding contractson

theS&PIOO

implied volatilityindex

(VIX) can

yielda

significant reduction in the averagecost ofsudden

stops.This

result should notbe

surprising to those following the practices ofhedge

fundsand

other leadinginvestors.Except

forextremely high frequencyevents,

which

unfortunatelysudden

stops are not, institutional investorssel-dom

immobilize

largeamounts

of "cash" to insureagainstjumps

involatilityand

risk-aversion.The

use ofderivatives,and

the creation oftheVTX

inpar-ticular, aredesigned precisely to satisfy

hedging

needs.Why

should centralbanks,

which

asidefrom

theirmonetary

policymandate,

are thequintessen-tial public risk

management

institutions, notadopt best-risk-management

practices?

In this

paper

we

revisit this point in the context ofa

simplermodel

de-signedtoisolatetheportfolio

dimension

ofthereservesmanagement

problem.

We

estimatethekey parameters

ofthemodel from

thejoint behavior ofsud-den

stopsand

theVIX, which

we

then

use to generateoptimal

portfolios.We

show

that inan

ideal setting,where

countriesand

investorscan

identifythe

jumps

in theVIX

and

thereexist call optionson

thesejumps,

an

averageemerging

market

economy

may

expect to facea sudden

stopwith

up

to40

percent

more

reservesthan

when

theseoptionsarenot includedinthecentralbank's portfolio.

The

main

reasonbehind

thisimportant

gain isthecloserelationwe

probability of

a

sudden

stop conditionalon a

jump

in theVIX

isabout four

times the probability of

a

sudden

stopwhen

there isno

jump. Another

di-mension

of thesame

findingbut

that speaksmore

directly of thehedging

virtues ofthe

VTX,

is that while the probability ofa

jump

in theVIX

when

there is

no

sudden

stop inemerging markets

is slightlyabove 30

percent, itrises to over 70 percent

when

a

sudden

stop takes place in that year.Section 2 in the

paper

presentsa

simple static portfoliomodel

fora

cen-tral

bank

concerned

with

sudden

stops. Section 3 presents the solution ofthe

model

under

variousassumptions

on

hedging

opportunities. Section 4discusses

implementation

issues. Section 5 quantifiesthemodel.

It startsby

illustrating the behavior ofthe

VIX

and

its coincidencewith

sudden

stopsinemerging markets

(representedby

nine economies: Argentina, Brazil, Chile,Indonesia, Korea, Malaysia,

Mexico,

Thailand

aiidTurkey). Itthen

estimates the differentparameters

ofthemodel

and

reports the optimal portfolios fora range

of relevant parameters. Section 6documents

theimpact

ofthedif-ferent

hedging

strategieson

the availability of reserves duringsudden

stops.Section 7 concludes.

2

Basic

Framework

We

analyze theinvestmentdecisionsofa

centralbank

thatseeks tominimize

the real costs of a

sudden

stop of capital inflows.Our

goal is to providea

simple

model

toisolate theportfolioproblem

associatedwith such

an

objec-tive.

We

refer the reader to Caballeroand

Panageas

(2004) fora

dynamic

framework

that discusses theoptimal

path

of reserves as well as themicro-economic

frictionsbehind

sudden

stops.Here

we

simply takefrom

thatpaper

that

when

a sudden

stop takes place, the country's ability to use its wealthfor current

consumption

is significantly curtailed.The

immediate

implica-tion ofsuch a

constraint is a sharp rise in themarginal

value ofan

extra unitofreserves.

There

aretwo

dates in the model: date 0,when

portfolio decisions areplace.

We

assume

thata

centralbank

hasan

objective ofthe form:m^-p[{R,-K-l{SS}Zf]

((P))where Ri

denotes total reserves atdate

1.X

>

isa

"target" level of reserves at date 1,which

we

take tobe

constant throughout,and

capturesreasons for holding reserves other

than

the (short run) fear ofsudden

stopswe

emphasize. Deviationsfrom

this target are costly:a

shortfallfrom

the target implies that the objectives of the centralbank

cannot be

met

ade-quately. Similarly,

an

excess level of reserves implies costs ofaccumulation

(which

among

other things captures the differencebetween

theborrowing

and

the lendingrate, theslope oftheyield curve, etc.).The

term

1{SS}Z

iscomposed

oftwo

terms.An

indicatorfunction IfS'^'} thatbecomes

1 duringa

sudden

stop (SS)and

is otherwise,and

a

constantZ

>

that controlsthe

need

for fundsduring

thesudden

stop.This

constant captures theshiftin the

marginal

utility ofwealth that occursonce a

sudden

stop takes place.Hence,

by

construction of the optimizationproblem,

a

centralbank

desiresto transfer reserves to

sudden

stopstates.The

program

((P)) is tobe

solved subject to:Ro

=

ttPo+

Bo

(1)i?i

=

Bi+ttPi

where Rq

is the initial level of reserves, tt is theamount

of risky securitiesheld

by

the central bank, Pq is the price ofsuch

securitiesand

Pi is the(stochastic) payoffoftheseassets at i

=

1.Bq

istheamount

ofuncontingentbonds

heldby

the central bank,whose

interest ratewe

fix to for simplicity, so thatPi

=

Po,and

Pi

=

Po

+

7r(Pi-Po).

Replacing

this expression in ((P))and computing

the first order conditionswith

respect toRq and

vr, yields:Ro

=

K

+

PriSS)Z

(2)^

==^

yar(Pi)

(^^where

we

have

removed

Merton's

portfohoterm

by

assuming

fair-risk-neutral pricing oftherisky asset (anassumption

we

maintain

throughout):E[P,]

=

Po.There

are three observationsabout

this simplesetup

worth

highhghtingat this stage. First, the central

bank

hasan

aversion to over-accumulating

reserves.

U

Z =

and

K

=

0, thenRq

—

0.Under

these circumstances, thecentral

bank

achieves themaximum

ofthe objective.Our

main

concern inthis

paper

iswith

those reserves that aredue

to the possibility ofa

costlysudden

stop,Z

>

0.Second, the level of reserves invested at date 0, Rq, is

independent

ofthe portfolio, tt, or the properties of the risky asset.

This

isdue

to the"certainty-equivalence" property ofthe quadratic

model.

Infact,with

more

general preferences that exhibit

a

prudence

motive,such

asa

theCRRA,

an

increase inhedging

(tt) reduces the totalamount

of reserves held (see Caballeroand

Panageas,

2004).Third,

and

most

importantly, risky assetsarenot heldifPi isuncorrected

with

thesudden

stop, Ij^S"}.Risky

assets are only held to the extent thatthey

succeed in creating attractive payoffs duringsudden

stops, i.e., as longas:^

E[Pi\SS

=

l]>

E[Pi\SS

=

0]3

Prom

Conventional Reserves

to

Hedges

Let

us characterize the solution for afew

cases of special interest.Our

firstbase

casemodel

assumes

away

hedging

completely,which

is not farfrom

what

centralbanks

do

in practice.The

secondcase isan

Arrow-Debreu

setupwhere

contractscan

be

written contingenton

thesudden

stop. It captures the opposite extreme.The

third isan

intermediate case, that allows for "proxy"hedging

through

contracts that are correlated,but

not perfectly,with sudden

stops.3.1

No

Hedging

Assume

thatwe

set tt=

in thebase

casemodel

and

drop

the optimizationwith

respect to tt.Then

obviously:Bo

=

Ro

=

K

+

Fi{SS)Z.

(4)As

one

might

expect, the possibilityofa sudden

stop inducesthecountry

to hold reserves

beyond

the "target" levelK.

This

isprobably

one

themain

reasons

why

Chile, forexample,

holds four tofive times asmuch

reserves asAustraliaor

Canada.

3.2

Hedging

vvith

Arrow-Debreu

Securities

Taking

the opposite extreme,assume

that thereexistsan

asset that pays:1 if

55 =

1 if55

=

Inthis case

our

assumption

of fair-pricing implies Po=

Pr(55).

It follows

from

(3)and

thefact that inthis case:Cm;(l{55},

Pi)=

yar(l{55})

=

Var{P^)

that

TT

=

Z. (5)Replacing

thisexpression in (1)and

(2)we

obtain:Bo

=

K

+

PviSS){Z-7r)

=

K.

Not

surprisingly,with

perfectArrow Debreu

securities(and

fair pricing)the central

bank

willcompletelyhedge

away

thesudden

stop risk, so that:Now

let us express the portfolio ofArrow-Debreu

securities asa

propor-tion of total reserves:

^^

Ro

~

K

+

Pv{SS)Z'

In the interesting special case

where

K

=

(corresponding to the casewhere

thecountry

finds it optimal to holdno

reserves in theabsence

ofsudden

stops)we

have

that:0=1.

That

is, all resources areinvested inArrow Debreu

securities.3.3

The

intermediate

case

In reality,

one

neither observesArrow Debreu

securities nor doesone

observecontracts written contingent

on

thesudden

stop (at least inan

amount

suf-ficient to insulate thecountry

from

it).There

aregood

reasons for that:in practice, the

sudden

stop itselfis unlikely tobe

fully contractible sinceits occurrence

may

depend on

a

country's actionsand

private information.Hence

the practicalrelevance ofthe simplemodel

proposed

above

restscrit-ically

on

whether

there are assetsand

trading strategies that could functionas

good

substitutesfor theidealized assets envisaged above. Letus developa

simple extension to the

Arrow Debreu

world

above,by

introducingan

assetthat

pays

1when

an

event thatwe

callJ

happens

(corresponding to, e.g.,a

discrete

drop

insome

asset price).We

introduce the notation:i^' ^=

Pr(55=l|J

=

l)^' -=

Pr(S'5=

1|J=

0)V

--=Pr(J=l)

i; --=

Pr(55

=

1)=

ryV''and assume

that<

-0'<

'0''<

1In this case it is

suboptimal

for thecountry

to invest all ofits assets in riskysecurities,but

in general is willing to investsome,

provided thatThe new

optimizationproblem

yields:5o

=

K

+

i>Z-'nr].Notice that these formulas

encompass

the ones obtained previously. If ip^=

ip^then

thetwo

indicators areindependent

and

thus tt=

0.However,

as V''* -^ 1

and

-0'—

> 0,then

ip^

rjand

thecountry

insuresthesudden

stop completely. Short of that, the centralbank

finds itoptimal

todo

some

ofthe

hedging

ofsudden

stopswith uncontingent

reserves: litfj'^<

1, there isa chance

that the risky assetdoes

not deliver duringa

sudden

stop.And

if ip>

0, the countrypays

for protection that does notneed

from

the risky asset-^Note

that asa

percentage of total reserves,we

have

that the risky asset portfolio represents:ttPo Zrj , , ,.

-no -no

This

expression hasa

natural interpretation.Let

x

G

[0, 1] representthe share of reserves allocated to the prevention of

sudden

stops in the nearfuture:

_

_tpZ__

^~

K

+

ipZ'Due

to quadratic utility thisnumber

isindependent

of thehedging

instru-ments

(notice that the properties ofJ

do

not influence thisnumber).

Then

the

optimal

portfolio is:<t,

= x^

{^^

-

^') . (7)That

is, the portfolioiscomposed

ofthree terms: thefirstone

is thefraction of reservesused

for the preventionofsudden

stops, x.^The

second

captures^Note thatwithquadratic utiHty itsuffices thatip

=

andtp>

forthecountrytoinvestits entire portfolio intherisky asset (for

K

=

0). The proximity oftp'^ to oneonlydetermines

how much

hedgingis achievedbythis strategy.'Note that our sense of prevention is different from that in Garcia and Soto (this

volume)wherea stockof reserves isneededto prevent runsonthe country. Theirconcept

issubsumedinourfixedK,althoughifrunsare relatedto factorsthat tighten international

financialmarkets, thenthisterm alsoshouldbe analyzedasan optimalportfolio decision.

the relative frequency of

jumps and sudden

stops; as this rises the price ofthe insurance rises.

The

thirdone

is the differencebetween

the probability of ajump

conditionalon a

sudden

stop takingand

not taking place.The

latter

term

capturestheriskyasset's abilityto transferresourcestothestateswhere

they

areneeded

the most.Dividing (/!>

by x

isolates the share oftherisky asset in thecomponent

ofreserves

used

forhedging

sudden

stops.This

is the conceptwe

emphasize

henceforth

by

settingx

=

1 (or i^=

0).4

Implementation

issues

Let

usnow

taketheanalysisone

step closertoactualassets.For

thispurpose,we

startby

specifyinga

state variable, Sj,thatiscorrelatedwith

sudden

stopsbut

is notunder

the country's "control."Assume

that St evolves accordingto the (discretized) stochastic differential equation:

sj+i

-St

=

nist)At

+

ctN{0, 1)-/At+

edJi (8)where

/^(sf) is the drift (themean

appreciation rate of the state variable),and a

is the volatility.The

most

interesting part of this expression is thejump

process dJi,which

is zero except at date 1,when

it takes the valueone with

probabilityrjand

zero otherwise, in perfectanalogy

to thesetup insection 3.3.

We

let ebe a

random

variablenormally

distributed,with

mean

fj,^

>

Qand

standard

deviation a^.4.1

Call

Options

Given

theabove framework,

we

consider the followingthought

experiment: Is therea

simple strategythatcan

"create"an

asset ofthe sort envisagedin section 3.3by

writing contracts contingenton

s^?The

answer

is yes.To

seethis, take the continuous

time

limit of (8)and

considera

contractwith

an

investmentbank

or insurer inwhich

the centralbank

pays

an

amount

Kdtinexchange

foreachdollarreceivedif Stexhibitsa

jump

at i=

1. Incontinuoustime such

a contract is well defined. In reality,one can approximate

itby

options (furthermore,

such

optionscan

be

wellapproximated

by

regular putsand

calls)which

cost -t]dt per unit of time.The

cost ofsuch a

position overthe full period is:

1

rjdt

=

77and

the payoffisone

ifa

jump

happens

at i=

1,and

zero otherwise. Noticethat this strategy is also feasibleif

one extends

themodel

to the casewhere

a

jump

in Stcan

happen

atany

time r

as in Caballeroand

Panageas

(2004).In fact, thisis the process

we

estimate in the empirical section.In conclusion, this

sequence

of shortterm

"digital" options isfor allprac-tical purposes identical to the contract described in section 3.3.*

4.2

Futures

contracts

Consider

now

simple futures contracts. If investors are risk neutralwith

respect to St risk,

a

futures contracton

Stwith

maturity

at t=

1can

be

entered into at

a forward

"price" of:Po

=

E

[si]with

return:si

-

E[si\so].The

expected

payoffofsuch

a

position at i=

1 is approximately:^V

^

N{-l^^l,, a)+

1{J}N

ill,,a,).

where

{J}

corresponds toan

indicatorfunction that takes valueone

when

ajump

in the state variable takes place,and

zero otherwise.It is

important

tonote

that futureshave

a price of zero.However,

in order tokeep

the analysiscomparable with

the results obtained in section 3.3we

considera

slight variation ofa

futures contractand assume

that the''Wereferthe reader to Caballeroand Panageas (2004)foramoreextensive discussion

of theseissues.

^To

make

the argument inthis sectionexact one needs acontinuous timemodel.country

must

pay

rjfj,^ upfront for every contract that it enters inexchange

for

a

payoffof:vr^N{0,a)

+

l{J}N{fi^,a,).

Hence,

thesolution to theproblem

((P)) in this case is(^

+ 1-")

(^

+

1-")

Bo

=

K

+

'tpZ—

TXT]^^There

are several observationsabout

tt that areworth

highlighting. First,we

can

set /i^=

1without

loss of generality, sincethedollaramount

investedintherisky assetis tt/i^ at

a

price of77perdollar invested. Moreover, observe that the righthand

sidedepends

onlyon

the ratios—

,—

.Hence

from

now

on

let us set /i^=

1and

denote

a

=

—

and

similarly for 5^,7?.Thus,

indollar

amounts

we

have:n

=

Z{^^-^')

i^"^

(9)Comparing

(9) to (6)shows

that theamount

invested in risky assets declineswhen

goingfrom

digital optionson

thejump

to the simplefutures (thedenominator

is larger in (9)).The

ratiobetween

thetwo

portfolios is:^

52 -2

^

+

a,^+

1-

77<

1 (10)which

declines as a,a^ increase.This

is intuitive:The

more

noisethere is in thehedging

opportunities, the less appealingthey

become

toa

risk averse central bank.Note

that the portfolio 4) also is attenuatedby

the ratio in(10).

To

summarize,

we

have

that in order to justifyadding a

risky asset tothe centralbank's holdings,

sudden

stopsmust

be

severe,and

the risky assetmust

be

sufficiently correlatedwith such

events.On

the otherhand,

it isimportant

toemphasize

that neither causality nor predictability ofsudden

stops

and

returns arepart oftheargument

fora

positive tt.5

Quantitative

Assessment

The

theoreticalargument

forhedging

isdifficult toargue

with.The

relevantquestion is

then

an

empirical one:Are

thereglobal financial instrumentsand

indices that offer

good enough

hedging

opportunities againstsudden

stops?Obviously, the

answer

to this question is toa

large extent country-specific, as not allemerging market economies

areexposed

to thesame

sources offragility.

Our

goal in this section ismore modest

but

alsomore

robust:Rather than performing a

collection ofcases studies,we

show

that thereis atleast

one

global asset that has significant correlationwith

emerging

market

crises.

More

importantly, absent better country-specific alternatives, thisglobal asset

should

constitutea

significantshareofthesecountries portfolios.5.1

The

basics:

Sudden

Stops

and

Jumps

We

study a

group

ofnineemerging market economies

open

to international capitalmarkets during

the 1990s forwhich

we

have complete

data:^Ar-gentina, Brazil, Chile, Indonesia, Korea, Malaysia,

Mexico,

Thailand

and

Turkey.

These

economies

are representative ofwhat

is often referred to as"emerging market

economies."Our

main

exclusion is thegroup

ofEastern

and

CentralEuropean

economies,who

became

significant participantsinin-ternational capital

markets

during thesecond

half of the 1990s, but facedeconomic problems

ofa

somewhat

different natureduring

much

ofoursam-ple.

The

first point to highlight is the wellknown

fact that there issignifi-cant

comovement

in private capital fiows tothese econoinies. Figure 1 splitsinto

two

panels thepaths

ofthechange

in capitalflows—

more

precisely, thedifference

between

contiguousfour-quarter-moving averagesofquarterlycap-ital flows

—

toeach

oftheseeconomies

from 1992

to 2002.The

shaded

areasmark

the periods corresponding to the systemic Tequila crisis,Asian

crisis,and

Russian

crisis,and

thesequence

ofsomewhat

less systemic Turkish-Argentinean-Brazilean crises. It isapparent

from

this figure that there aresignificant correlations across these flows, especially within regions.

Turkey

^The exceptionisMalaysia, forwhich we donot havequarterly capital flows.

is

somewhere

inbetween

thetwo

regions.These

comovements

are encourag-ing, asthey

indicate thepossibility offindingglobal factors correlatedwith

sudden

stops. 15 -fi 10~\

5 1 <^ 3 -5 a. O -10 -15 Arg . - - Bra Chi -20—

MexCapitalflowsforLatinAmericancountries

Asian -> '

Tur-Q1-92 Q1-94 Q1-96 Q1-98 Q1-00 Q1-02

CapitalflowsforEast Asian countriesandTurkey

-20 --30 Q1 - As an-» r Tur-> Arg ->

-A

y—

\i\\

rA

-V^-''Ap'

=<><^

^

^

'tsi^'

|v

t3C^{>*^

• Tur^^

IndoV

\ ' KorThai Tequila -*

\y

*-Russian Bra —>Q1-94 Q1-96 Q1-98 Q1-00

Figure1: Capitalflowsforvariouscountries.

The

figuredepictsthedifferencebetween

4 quarter averages of capital flowsand

thesame

quantityone

yearbefore.

The

shaded

areasshow

times ofmajor

crises.The

second,and

main

point, is that indeed there are clearly identiflableglobal factors

—

in fact, traded factors—

correlatedwith emerging market

sudden

stops.The

key

in finding such factors is to note that these episodesare generally

understood

as timeswhen

investors are reluctant to partici-pate in risky markets.The

VIX

precisely captures this reluctanceand

isavailable in the

US

since 1986.This

isan

index ofthe "implied volatilities"from

puts

and

calls (typically 8)on

theS&P

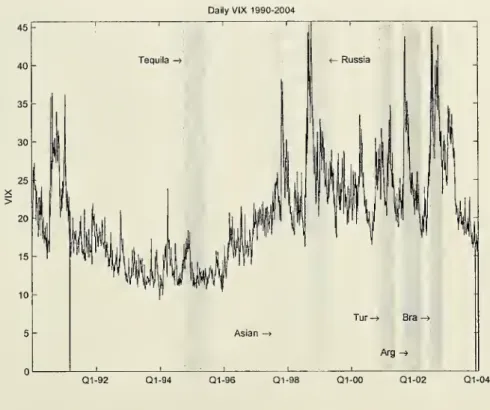

100. (Implied volatilities areDailyVIX 1990-2004

Q1-92 Q1-94 Q1-96 Q1-98 Q1-00 Q1-02 Q1-04

Figure 2: Daily

VIX

series.The

gray areas depict the periodsofmajor

crises.determined

by

using theBlack

and

Scholes (1973)formula

todetermine

the level ofvolatility thatwould

be compatible with

the observedprices ofputsand

calls).Figure

2 reproduces theshaded

areas forsudden

stops regionsdescribed in the previous graph,

and

plots the dailyVIX.

It isapparent

inthisfigurethat

some

ofthelargest"jumps"

intheVIX

occur preciselyduring

sudden

stops. In fact, the only systemicsudden

stop that does not coincidewith a

jump

is theTequilacrisis,where

therewas

a

rise in theVIX

but

notlarge

enough

tocount

asa

distinctjump.

In the next

sectionwe

document

formally the joint behavior ofsudden

stops

and

jumps

intheVIX.

But

beforedoing

so,it isinstructivetoexploreinmore

detailthebehavior oftheVIX

during

thetwo

largestsystemic crisesofthe 1990s (the

Asian

and

Russian

crises).The

top panelinFigure 3plotsthepath

oftheVIX

during thelasttwo

weeks

ofOctober

1997 (the onset oftheAsian

Crisis), while thebottom

panel does thesame

forAugust-September

1998,

which

corresponds to thepeak

of theRussian/LTCM

crisis. In these events theVIX

reaches levelsabove 30

and

45

percent, respectively,which

are close tothe

maximum

levels ofthe index. Ina

matter

ofdays, theVIX

doubled.

DailyVIXduring theAsianCrisis

Jul97 Oct97 Jangs

DailyVIXduringtheRussianCrisis

Jul98 Oct98

Figure 3: Plots ofthe

VIX

intheweeks

surroundingmajor

crises in interna-tional financial markets.Finally, Figure 4 reinforces the

message

of high correlationby

plottingthe

path

oftheVIX

togetherwith

theEMBI

for three of themost

fragileeconomies

inemerging markets during

recent years: Argentina, Braziland

Turkey. Again, the dipsin thecorresponding

EMBIs

as theVIX

experiencessharp

rises areapparent/

A

variable that is primarilymeant

to capture the "feelings" of investors inUS

equitymarkets,happens

tobe

highly correlatedwith

the fortunes ofemerging

market

economies.This

highlights anotherimportant

aspect of ourmethodology,

according towhich

the onlyrequire-ment

for a variable like theVIX

tobe

useful in hedging, is that therebe

achange

in the conditional probability ofhaving a

crisis inemerging markets

too.

This

is nota statement about

causation,but

about

correlation.VIX and Emerging MarketBondIndex

200 E

Q1-98 Q1-99 Q1-00 Q1-01 Q1-02 Q1-03 Q1-04

Figure 4:

The

VIX

and

theEMBI

for Argentina, Braziland

Turkey.In concluding this section

we

stress that our claim is not thatdomestic

factors

do

not playa

paramount

role incrises.Quite

thecontrary, our choice of Argentina, Braziland Turkey

in the previous figure is preciselybecause

'^The

EMBI

data are from Datastream. Note that the Argentine (permanent) crashalso coincideswitha spikein the VIX. 16

their

own

domestic weaknesses

make them

more

responsive toglobalfactors. Importantly, thiscompounding

effect often raises ratherthan

dampens

theneed

forhedging

global risk factors.5.2

Quantification

We

now

turnintoa

structural analysis ofthecorrelations highlighted above.5.2.1

Estimation

of

the

VIX

process

To

operationalize themodel

ofthe previous section take thelog(VIX)

tobe

the state variable St,

which

follows the continuoustime

process:dst

=

—9{\og{st)—

y)dt+

adBt

+

edJt-This

isthecontinuoustime

limit of(8),with

the modification thatjumps

can

happen

atany

point in time.^The

functionalform

//(sj)=

—

^(log(st)-

y),corresponds to

an

AR(1)

process in discretetime

for the log(st).Thus,

we

start

by

estimatingan

AR(1)

process for\og{VIX)

with

monthly

data

and

focus

on

the residuals, v,which

are distributed (for smallAt)

roughly ast;

~

(1-

p)N{-T]ij.^At,aVAt)

+

pN

{/j,^,cr^).

Given

the veryfew

observationswith

jumps,

we

identifythesedirectlyby

inspection; this processfixes 77

=

0.417and

hence

p

=

1—

e"''^*.The

rest ofthe

parameters

are estimatedby

maximum

likelihood of themixing

oftwo

normal

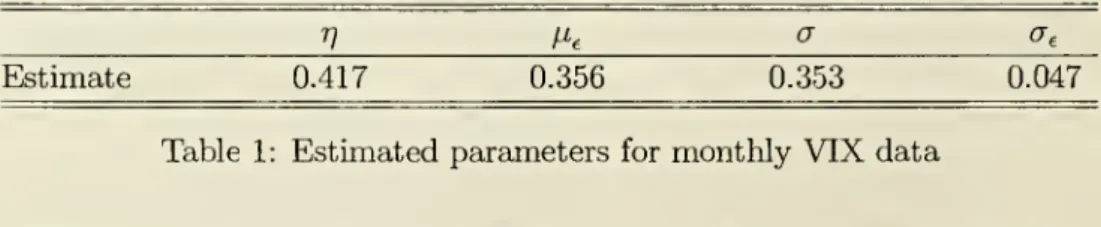

distributions.Table

1 reports the results.V /J^ CT a.

Estimate

0.417 0.356 0.353 0.047Table

1:Estimated parameters

formonthly

VIX

data

Thisisnot aseriousdepartureifthe "horizon" inthe decision modelisunderstoodto

be oneyearandtheprobabiHtyofmorethan 1

jump

taking placeinasingleyearissmall.5.2.2

The

Likelihood

of

Sudden

Stops

The

results in section 5.2.1 suggest the presence of fivejumps

in theVIX

in our sample:

The

gulf war, theAsian

crisis, theRussian

crisis,9/11

and

the simultaneous crisis of Turkey/Brazil,

and

the corporate scandals in theUS.

Conditionalon

thesejumps,

we

calculate the probability thata country

experiences

a

sudden

stop.We

identifyan

observation asa

sudden

stopbased

on

a mixture

of informationon

capital flows reversalsand

reserves losses (see Caballeroand

Panageas

2004). Mainly, foran

observation tocotmt

asa sudden

stop capital flowsmust

declineby

at least 5 percent ofGDP

with

respect to theflows in the previoustwo

years,and

reservesmust

be

declining.This procedure

yields estimates ofip'^and

ip^ for each country.We

then

estimateipfrom

the relation:The

results are reported inTable

2. Note,however,

that the country-specific estimates are highly imprecise asthey correspond

to theproduct

ofbinary variables

with

veryfew

transitions ineach

case.^For

this reason,we

pool the observations,which

yields the result in the average row.We

also report results for

two

sub-categories: High-riskeconomies

(Argentina,Brazil,

and

Turkey)

and

for the East-Asian

economies.The

formergroup

iscomposed

ofthoseeconomies

thathave

the highest estimated likelihoodofa

sudden

stop in the sample.The

pooled estimateindicatesthatan

averageemerging market

economy

ismore

than

four timesmore

likely to experiencea

crisis at atime

when

the

VIX

hasjimiped

than

when

it has not.Again,

this is nota statement

ofcausation

but

of correlation.At

timeswhen

theVIX

spikes, the averageemerging

market

economy

has a 41 percentchance

ofexperiencinga

sudden

stop.

This chance

drops

to 11 percentwhen

theVIX

is tranquil.^Thecase ofMexico isparticularly revealing.

The

estimate of^

=0

missesthe factthat while Mexico did not experience a very significant capital flow reversal during the Russian/LTCM/Brazilean turmoil, its stockmarket declined verysharply, reflectingthat

it experienced significant pressure atthe time, but adjusted primarily via pricesinstead

ofquantities. Chile and the Ea^t Asian countries have a, ip

=

becausewe identifyonlyasingle SS foreachofthem and we observea

jump

intheVIX

duringthesameperiod.^

i^' ^'Argentina

0.42 0.80 0.14 Brasil 0.42 0.60 0.29 Chile 0.17 0.40 0.00Mexico

0.17 0.00 0.29 Indonesia 0.17 0.40 0.00Korea

0.08 0.20 0.00Malaysia

0.25 0.40 0.14Thailand

0.17 0.40 0.00Turkey

0.33 0.60 0.14Average

0.24

0.41

0.11

High-risk

Countries

0.39

0.67

0.19

East

Asia

0.17

0.35

0.04

Table

2:Estimates

for0, '^'^and

i/)'. 0'* is estimatedas thenumber

ofyearswhen we

observea

jointjump

in theVIX

and

a

SS

in thecountry

dividedby

thenumber

ofjumps

in theVIX.

Symmetrically, ip^ is the ratio of thenumber

ofyears inSS

when

therewas no

jump

divided in the totalnumber

of yearswithout a

jump.

In order todetermine

whether a

SS and

a

jump

coincide

we

allow fora

2-quarterwindow

around

thedate

when we

identifythe

jump,

because

jumps

areidentified ata

higherfrequencythan

SS.With

the estimatesfor77, ip

and

il) inhand

we

obtain theestimatefor ippresentedin thefirst

column

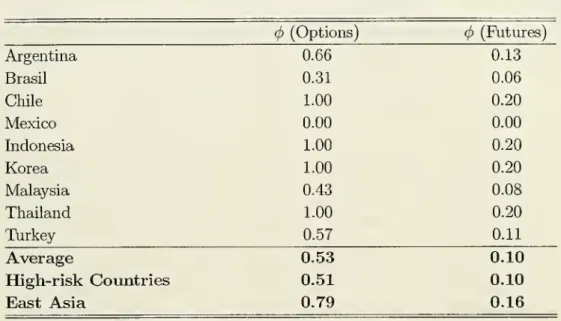

ofthe table.(f) (Options) ({) (Futures)

Argentina

0.66 0.13 Brasil 0.31 0.06 Chile 1.00 0.20Mexico

0.00 0.00 Indonesia 1.00 0.20Korea

1.00 0.20Malaysia

0.43 0.08Thailand

1.00 0.20Turkey

0.57 0.11Average

0.53

0.10

High-risk Countries

0.51

0.10

East

Asia

0.79

0.16

Table

3: Representative portfolios for optionsand

futures.5.3

Representative VIX-portfolios

and

Reserves

Gains

With

thesenumbers

inhand

we

are able to operationalize formulas (7)and

(10) to estimate the portfohos impliedby

themodel. Again,country

specificnumbers

are very impreciseand

attention shouldbe

placedon

thepooled

results.

Table

3 reportstheportfolios.The

valuesof(pare large.The

futurescontracts

show

shares ofrisky assets of 10 percent or higher for the different groupings, despite the largeamount

of noise in theVIX.

When

the noise isremoved

and

thecall-options strategy isfollowed,the sharesrisetoabove

50 percent in all cases,and

to near80

percent for theAsian

economies.The

reasonfor thehigh share for

East

Asian economies

isworth

highlighting: inthe

sample they

experiencecrisesmostly

when

these aresystemic (again, thisis not

a

causal statement); this is in contrastwith

the high risk economies,which

also experience idiosyncratic crises.^"These

are dramatically different portfoliosfrom

thosenormally

heldby

central

banks

inemerging

markets.Finding

outwhy

seems

imperative: Is it^"Note also that the difference betweenthe optimal precautionary behavior ofa high

risk and an averageeconomyisnot only reflectedinthedifferent 4>sbut alsoonthe level

ofreserves held. Recall thatRq

=

K

-\-i>Z.the lack of liquidity ofthe potential markets,

domestic

political constraints, orsimply

institutional herding?6

The

Benefits

Our

reduced

form

portfoliomodel

is not well suited fora thorough

"wel-fare" comparison.Thus,

in assessingthe benefitsofthehedging

strategy,we

ratherfocus

on

statisticsthat arerobust across preferencesand

otherhard

toquantify details. In particular,

we

report theexpected

gains conditionalon

a

sudden

stop takingplace.We

illustrate this for thecall-options scenario.The

first step incomputing

this statistic is to estimate the likelihood ofa

jump

given that thecountry

has experienceda

sudden

stop.Using

Bayes' rule,we

have

that:Pv{J=l\SS=l)=i^^^.

V

Column

1 inTable

4 reports the estimates. It isaround 70

percent foran

average

emerging

market

economy and

close to90

percent for the relatively stableEast Asian

economies.This

isimportant.The

VIX

jumps

with

a

highlikelihood at times

when

the countriesneed

it todo

so.The

rate ofreturn ofthe "call" strategy is:I/t?

-

1 ifJ

=

1-1

ifJ

=

0.Hence

theexpected

gain inreservesconditionalon

enteringa

sudden

stopis:

Column

2 in Table 4 reports the results.For

an

averageeconomy,

theex-pected

gain isaround 40

percent.That

is,an

averageeconomy

followingthe strategy described here

can

expecta 40

percent rise in its reservesupon

entering into

a

sudden

stop.^^This

isa

significantnumber, which

exceeds^^Of course, the counterpart of this expected gain during sudden stops is that the

economy

may

expect to lose 13 percent ofitsreserveswhen

thereis nosuddenstop.Argentina

0.80 Brasil 0.60 Chile 1.00Mexico

0.00 Indonesia 1.00Korea

1.00Malaysia

0.67Thailand

1.00Turkey

0.75Average

0.72

High-risk Countries

0.71

East

Asia

0.88

Country

Pr(J

=

1155

=

1)Expected

Gain

(options)060

0.14 1.40 0.00 1.40 1.40 0.26 1.40046

039

0.36

0.86

Table

4:Revised

probabilitiesand

Expected Gains

when

following theop-tions strategy.

the actual reserveslosses of

many

oftheseeconomies during

their respectivesudden

stops.Of

course, there aremany

caveats thatcan

be

raisedand

that arelikely toreduce

these largenumbers. For example,

ina

dynamic

model

the centralbank

might

find itoptimal

to hold a level of reservesabove a

certainmini-mum

in allcontingencies,even

in"good"

states. Inthe presentmodel

this isjust equivalent to

assuming

that the centralbank

targetsa

non-zerolevel of reserves, i.e.K

>

0,which

impliesx

<

1.As

we know

from

expression (7),the portfolio of risky assets is scaled

down

proportionallywith

x. Alterna-tively,one

couldimagine

asituationwhere

a

centralbank

wishesunder

no

circumstances to lose

more

than

c percent ofits reserves, inwhich

case theoptimal

portfoliowould

become:

min{c,(f)}.

All these caveats notwithstanding,

we

feel that theabove

calculationsmake

a

simple point:no

matter

which assumptions

we make

about

pref-erencesand

constraints, the driving forcebehind

our results is the strongcorrelation

between

theVIX

indexand

the incidence ofsudden

stops.The

simple quadratic

framework

thatwe

propose

is particularly well suited tomake

this separationbetween

preferences (which solely affect x)and

corre-lation explicit.Even

though

amore

elaboratemodel

like that in Caballeroand

Panageas

(2004) is required in order tohave a

satisfactory theory for X, the effects thatcome

from

the strong correlations areindependent

ofthe specifics ofthemodel.

7

Final

Remarks

We

shall startour

conclusionwith

a

disclaimer.The

portfolioswe

illustrate for theemerging market economies

we

study,and

theemphasis on

theVIX,

are neither country-specific

nor

instrument-specificrecommendations.

Our

goal is

simply

to illustrate the potential benefits of enriching the portfoliooptions for central

banks

and,most

importantly, ofsearching for assetsand

indices that are global in

nature

but

correlatedwith

capital flow reversals.Within

thislimitedgoal, our results arepromising: theexpected

gainsin reserves duringsudden

stopscan

be

significant (slightly lessthan 40

percentof reserves for

an

average country).This

is noteworthy, considering thatwe

are only considering

a

single risky assetwhich

is not optimized to capture therisks facedby

emerging market

economies.The

latterpointraisesan

issueof international financial architecture:The

VIX

is usefulbecause

it is correlatedwith

implied volatilitiesand

risks inemerging markets but

it alsocapturesproblems

that are US-specific. Ideally,one

would

want

an

index that weights differentlyUS-events

that are likelyto

have world-wide

systemic effectsfrom

those thatdo

not. It shouldbe

relatively easy to construct implied volatility indices that isolate the former

factors

and

stillpreserve the country-exogeneityproperties oftheVIX.

Con-structing

such

indicesisimportant

to createbenchmarks

and

develop liquidhedging

markets

foreconomies

exposed

to capital flow volatility.An

issue thatwe

avoided

entirely is theincentive effects thata

modifiedcentral banks' policy of

hedging

externalshocksmay

have

on

the private sec-tor.This

isan important

concern,astheprivate sectormay

undo some

oftheexternal insurance in anticipation of

a

the central bank's intervention.This

is

a

complex

issue thatprobably

requires coordination ofthehedging

pol-icy

with

monetary

and

regulatorypolicies (see Caballeroand Krishnamurthy

2003).

However, even

in theabsence

ofthesecomplementary

policies, per-verse incentive effects are unlikely tobe

strongenough

to fully offset the justification formore

aggressivehedging

practices. After all, current reservepolicies alsosuffer

from

theseproblems

and

arejustifiedon

thegrounds

thatmany

in the private sector aresimply

not forward-lookingenough

tohedge

aggregate risks in sufficient

amount.

Moreover, if

such

practiceswere

tobe adopted

collectively,soon

we

would

observe the

emergence

ofnew

implied volatility indices that bettermatch

the needs of

emerging market

economies.The

welfareimprovement

from

such enhancements

couldbe

very significantand

thereforemay

justify a coordination roleby

the IFIsand

centralbanks

around

the world. In fact,such

coordinationmay

be a

necessity, ifwe

are to limit the potentialpoliticalcosts

from hedging

losses.To

conclude,we

reiterate that ouremphasis

on

external sources of caj>ital flow volatility

does

not seek to shift theblame

formuch

of capital flowvolatility

away

from

the countries themselves.Our

goal issimply

toshow

that there is

a hedgable

component and

that thiscomponent

is significant.Moreover,

there isan important

interactionbetween

the issuewe

highlighthere

and

thedomestic

sources ofexternalfragility:Weak

countries aremore

likely to

be

hitby

global turmoil,and

hence should

putan

even

bigger effort inhedging

these global shocks.References

[1] Caballero, R.J.

and

A.Krishnamurthy,

"Inflation Targetingand Sudden

Stops,"

MIT

Mimeo,

2003.[2] Caballero, R.J.

and

S.Panageas,

"Hedging

Sudden

Stopsand

Precau-tionaryRecessions:

A

QuantitativeApproach,"

MIT

Mimeo,

2003.[3] Caballero, R.J.

and

S.Panageas,

"Insuranceand

ReservesManagement

in

a

Model

ofSudden

Stops,"MIT

Mimeo,

2004.[4] Garcia, P.

and

C. Soto,"Large Hoarding

of International Reserves:Are

they

worth

it?", in thisvolume,

2004.[5]

Jaewoo

Lee, "InsuranceValue

of International Reserves,"IMF

mimeo,

August

2004.MITLIBRARIES