Corporate financing and investment decisions when firms have information that investors do not have

Texte intégral

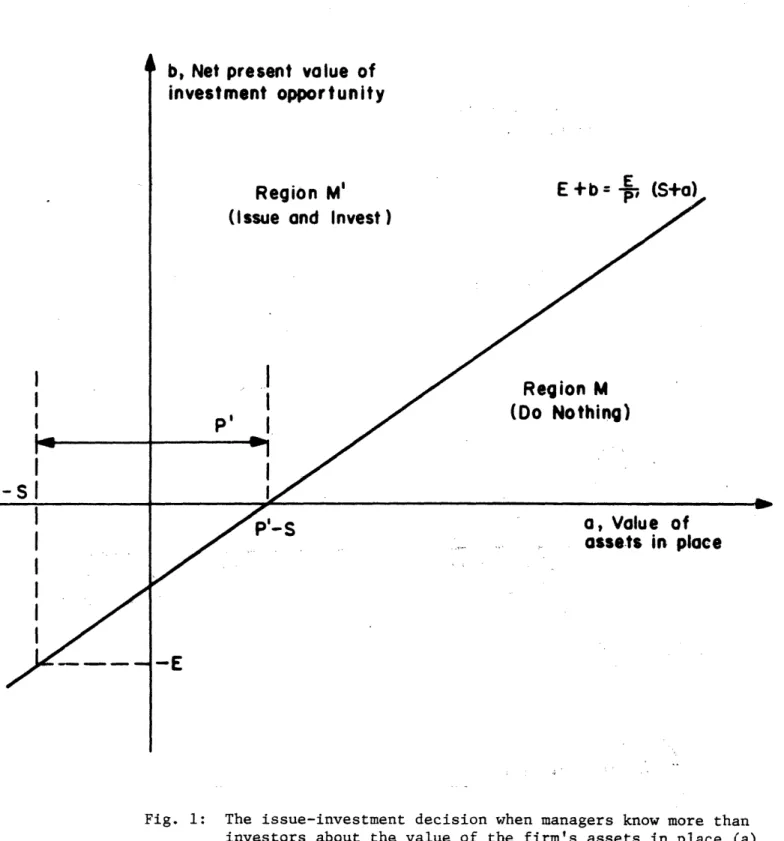

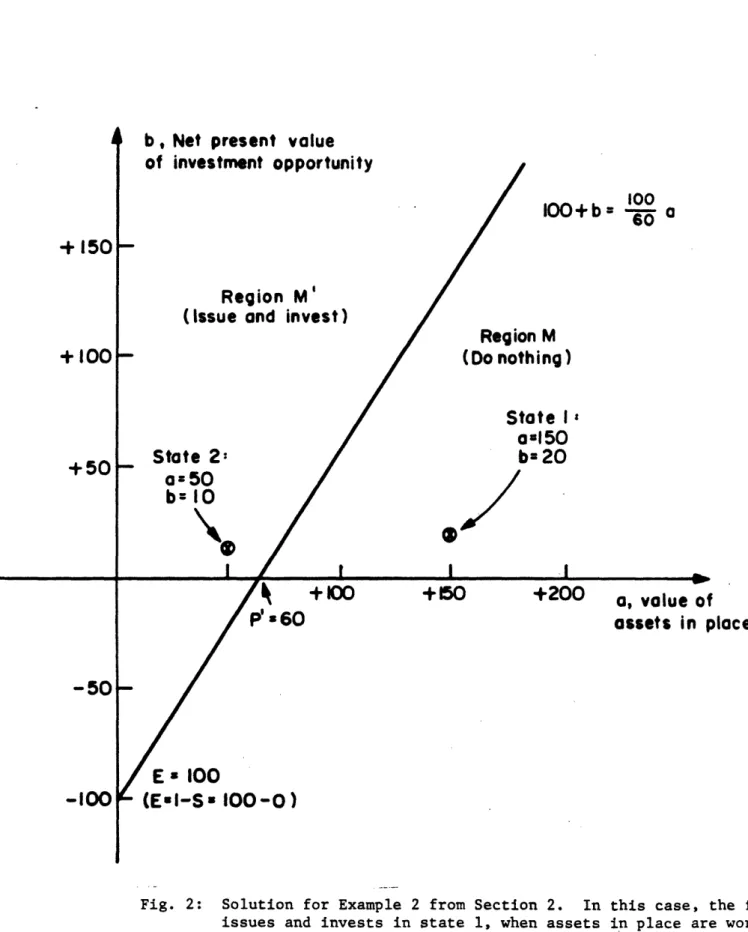

Figure

Documents relatifs

This last step does NOT require that all indicator be converted - best if only a small percent need to be reacted to make the change visible.. Note the

Classically, a Poisson process with drift was used to model the value of an insurance company and in that case, under some assumptions on the parameters of the process, the

Old mutual (SA financial institution) South African agricultural fund & African Agricultural Fund (2010) Souther n Africa -Land acquisition with direct

On the other hand, other international (RaboBank is already engaged in agriculture in about ten countries, prospection of Chinese banks through South African

Inspired by [MT12], we provide an example of a pure group that does not have the indepen- dence property, whose Fitting subgroup is neither nilpotent nor definable and whose

By characterizing the reproductive systems of 11 species from the thermophilic ant genus Cataglyphis, in this issue of Molecular Ecology, Kuhn, Darras, Paknia, & Aron (2020)

The mismatching concept was defined as ‘‘using the amount of substance concept as equivalent to the concepts of mass, molar mass, number of particles or molar

Moreover, in the presence of lump-sum debt issuance costs, the optimal investment scale of - nancially constrained rms exhibits an inverted U-shaped relationship with the rm's