A Reduced Form Model of Default Spreads with Markov Switching Macroeconomic Factors

Texte intégral

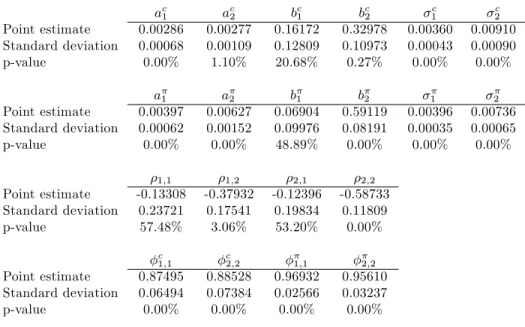

Figure

Documents relatifs

After the Second World War, Clement Attlee’s labor Government gave independence to India, Pakistan, Burma, and Ceylon, terminated Britain’s Mandate in Palestine, and

The Sherlock fluorescence signal of BKV detection (ATCC synthetic standard) at the indicated target concentrations is depicted as colour intensity relative to the highest

of a digital filter bank, we would like to emphasize that In terms of comparisons, most of the recent works in the methodology introduced here is generic and can be

L’accès à ce site Web et l’utilisation de son contenu sont assujettis aux conditions présentées dans le site LISEZ CES CONDITIONS ATTENTIVEMENT AVANT D’UTILISER CE SITE WEB.

63 مكحلا : نب دمب٧ ثيدح نع بِطقرادلا لئسك ،ؿوهب٦ اهيفك ؽازرلا دبع دنع ةروكذم لىكلأا ةياكرلا ملسك ويلع للها ىلص بينلا نع ونع للها يضر ةريرى بيأ نع ردكنب٤ا

The underlying semi-Markov chain represents the succession of growth phases while the linear mixed models attached to each state of the underlying semi-Markov chain represent both

This paper studies the volatility of the Bitcoin price using a Markov-switching model augmented with jumps under the Lévy form.. Distinct and significant dynamics are captured

Hence, in this paper, we will define a mean reverting local volatility regime switching model where the volatility structure will depend on a first Markov chain and the drift