Pricing without martingale measure

Texte intégral

Figure

Documents relatifs

Clinical case We describe here a case of a 30-month-old girl with a history of remitting varicella infection, diagnosed for a lumbar epidural abscess and sacro-ileitis, secondary

When switches open or close in a dc RC circuit with a single capacitor, all voltages and currents that change do so exponentially from their initial values to their

ou à une zone vide. Justifie ta réponse en expliquant pourquoi. 8 – Les zones denses et vides de population dans le monde. Domaine: Les grands contrastes de

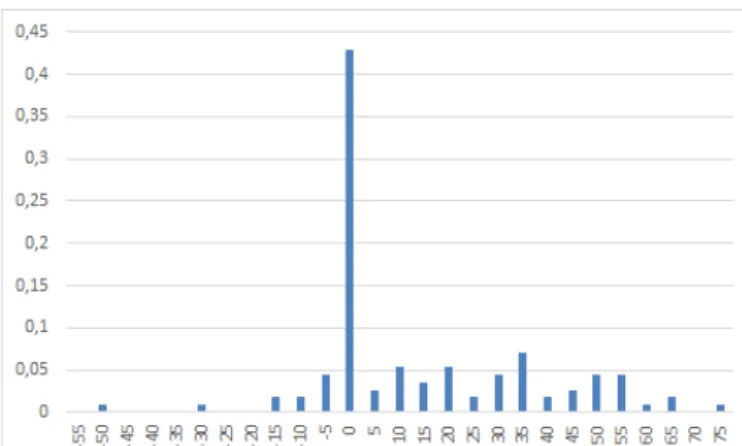

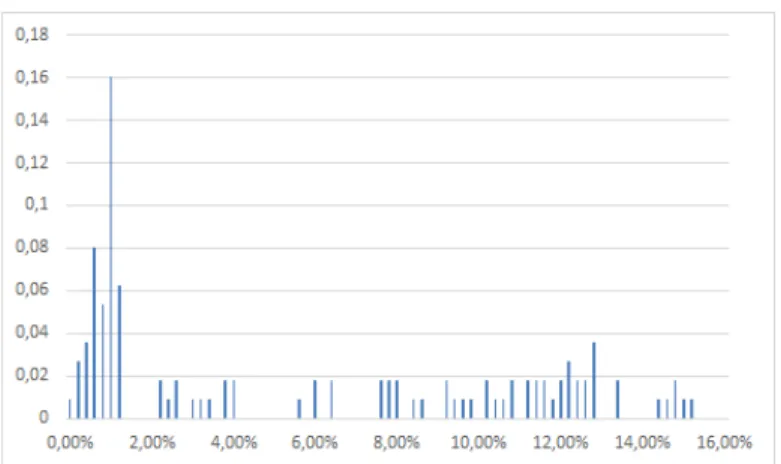

Nous discutons les résultats de Shen et Starr (2002) et montrons que la fourchette de prix de réservation d’un teneur de marché ne dépend pas de son inventaire lorsque celui-ci fixe

Equation ( 2.1 ) shows that under any martingale measure Q ∈ M loc (W ) , the given price of the asset is justified from a speculative point of view, given the possibility of

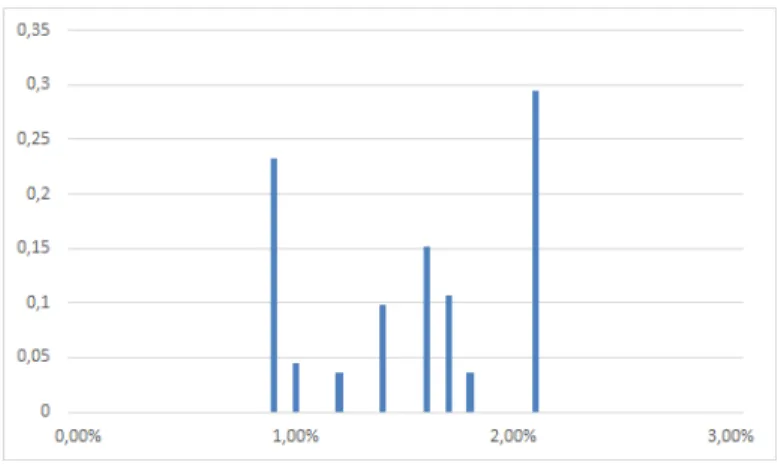

When the condition (9) is met, the CAPM produces a maximum pricing error larger than that of the basic model which ignores the trade-off between risk and return. It is thus so

Assuming the system is Markovian and using the Hamilton-Jacobi-Bellman-Isaacs (HJBI) equation, we show that if there exists a control u ˆ which annihilates the noise coefficients of

The paper is organised as follows: in Section 2, we give the basics of the behavioural theory of imprecise probabilities, and recall some facts about p-boxes and possibility