Information Flows across the Futures Term Structure: Evidence from Crude Oil Prices

Texte intégral

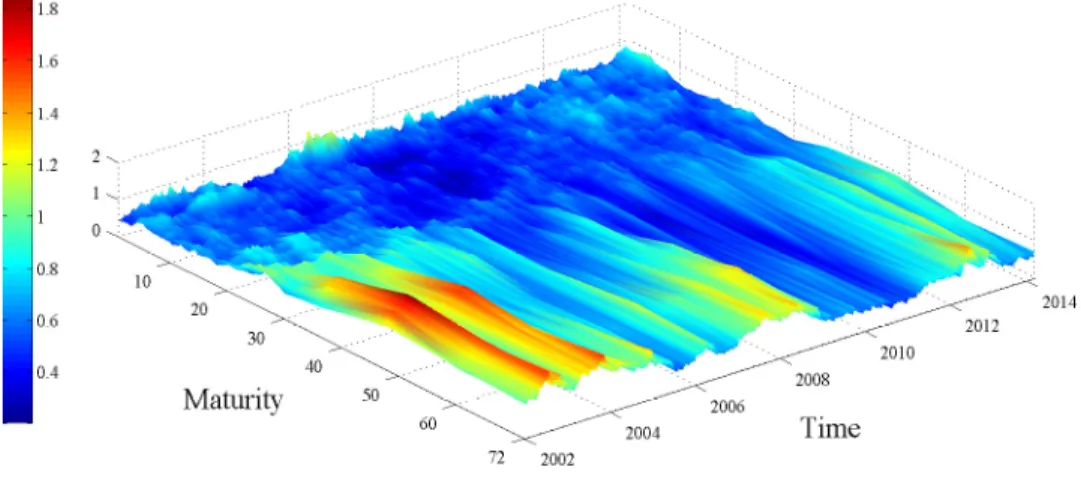

Figure

Documents relatifs

Simulations numériques à deus dimensions (2D) pour les cellules solaires IBC-SiHJ ont été étudiées en utilisant le dispositif logiciel Atlas Silvaco, et

Therefore, this will not affect its price, nor the number of issues sent to subscribers, nor the publication of a second issue next autumn.. There are two reasons

He said: “People employed on zero-hours contracts are only entitled to the minimum wage for the hours they actually work and receive nothing when ‘on call’, which serves

• the flame displacement speed is unequally altered by stretch and curvature so that two distinct Mark- stein lengths should be used: one characterizing the dependence of

Contrairement à l’enquête citée dans cette partie j’ai volontairement proposé des questions ouvertes laissant les participants choisir ou non de définir ces deux types

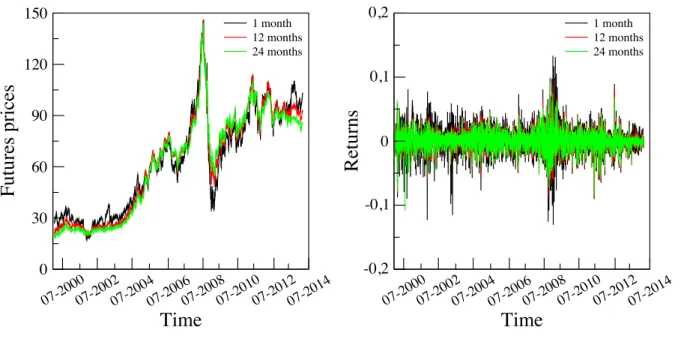

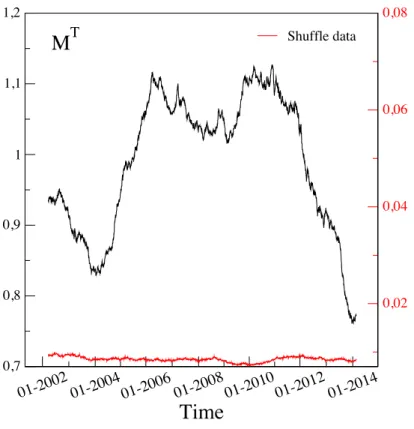

Finally, we estimate the variance risk premium in the crude oil futures market and analyze whether this risk premium is priced, and thus, causes implied volatility to be a

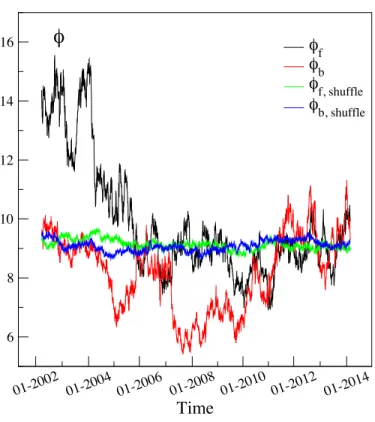

On average across our 2000-2014 sample period, we find that the nearby contract sends more information than any other maturity and that short-dated contracts (maturities up to 6

In what follows, we consider this graph as a benchmark case, first because it represents what happens on the whole period, second because this configuration correspond to the