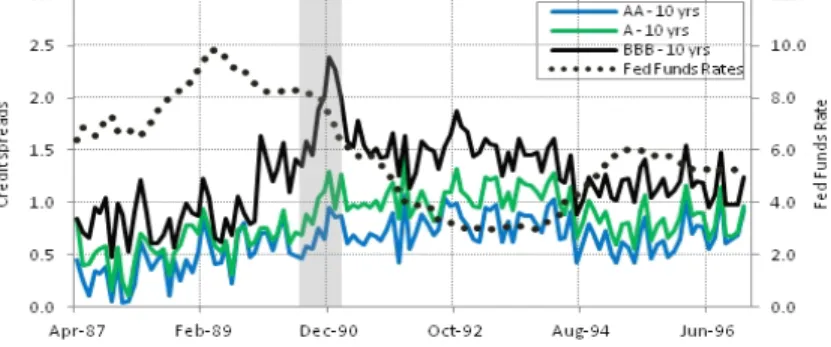

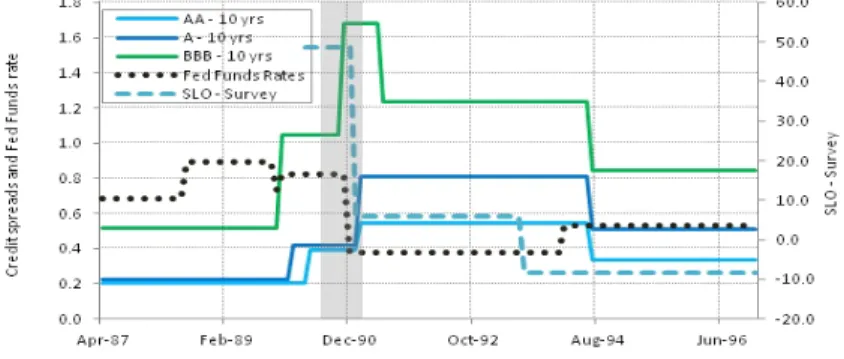

Detecting Regime Shifts in Corporate Credit Spreads

Texte intégral

Figure

Documents relatifs

Using the approach described above of testing and trying interaction terms based on affordability and based on random forest variable importance measures one can improve

L’archive ouverte pluridisciplinaire HAL, est destinée au dépôt et à la diffusion de documents scientifiques de niveau recherche, publiés ou non, émanant des

Keywords: corporate bonds, default intensity, event risk, risk premia, interest rate rule, term structure models, state space models, Kalman filter...

Figure 9 shows the evolution of the median of the gray-levels for linear and logarithmic tone mapping compared to the global and local operators presented here for a selected portion

To sum up, the evidences here found related to the management of reserves, even considering the key variables for the NCM where the Central Bank controls credit supply from attempt

Our study covers a comparatively long period: at least three periods stand out: (i) the period of creation of these businesses in the inter-war years provides insight into

Figure 4 depicts solutions of stock (on the left) and pumping rate (on the right) for the shock of mid-intensity ( r 1 − r 2 =70 Mm 3 ) that takes place at the medium term ( t a = 20

Comme je souhaite le développer dans cette seconde partie qui va davantage faire référence à ma question de départ, je cite : Intégration à inclusion : comment