GARCH option pricing under skew

Texte intégral

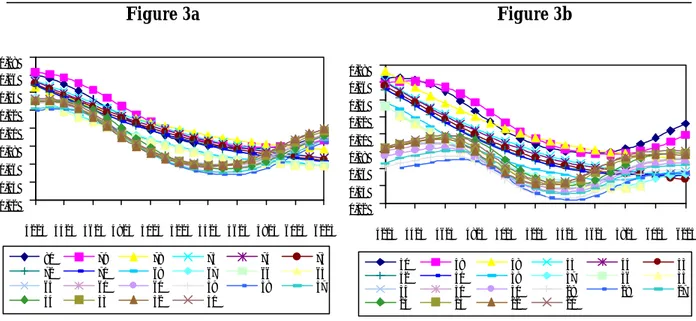

Figure

Documents relatifs

based on a Gaussian, continuous time model) which gives in fact a price independent of this putative average return.. Second, and more importantly, the very procedure of fixing

We document the calibration of the local volatility in terms of lo- cal and implied instantaneous variances; we first explore the theoretical properties of the method for a

Le rôle actif du joueur-apprenant est également fondamental pour l’atteinte des objectifs, tout comme l’immersion dans laquelle il doit être plongé afin d’avoir

From a theoretical point of view, it is also important to observe that the proposed model not only replicates the volatility patterns that have been observed in financial markets,

calculating its expectation with respect to the imaginary log-normal distribution of the stock puce, in which the average return is set equal to the nsk-free interest rate, is in

Studies of antiviral therapy during pregnancy and development of a hepatitis C vaccine are underway.. Infants of mothers infected with HCV should be screened at

1) It is left open which is the model of price movements of the underlying, while of course we can as well assume a geometric Brownian motion, or even an other

By allowing the neural network to capture the implied volatility surface through time, the neural network will be able to forecast future movements of the