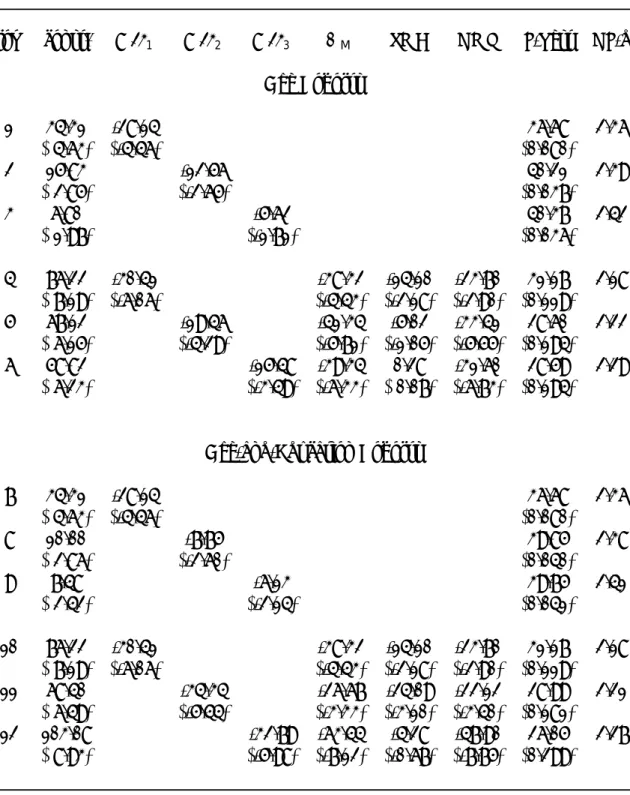

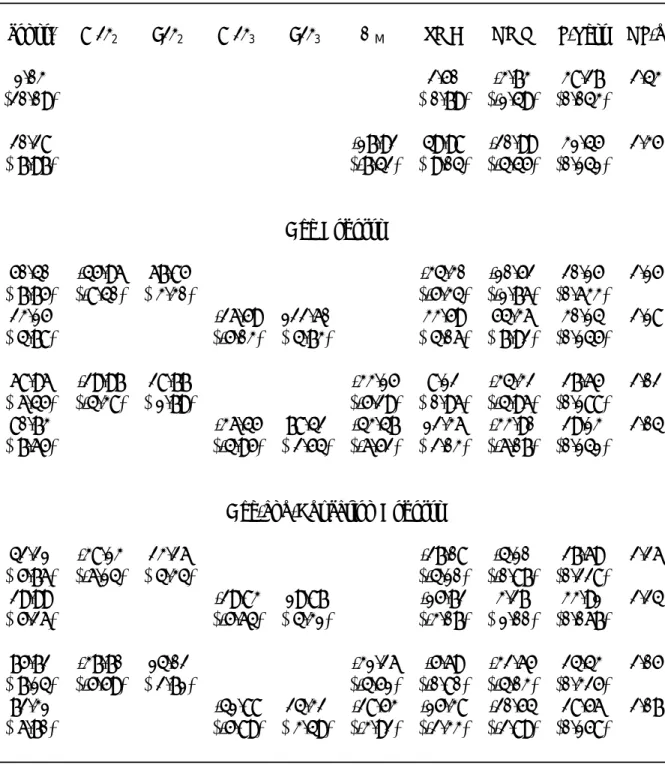

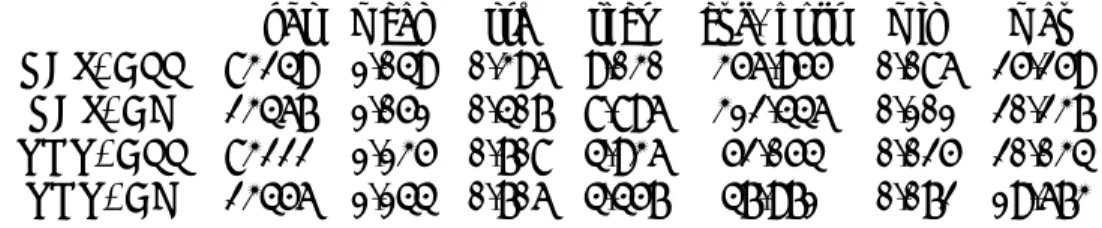

Idiosyncratic Consumption Risk and the Cross-Section of Asset Returns

Texte intégral

Figure

Documents relatifs

Results highlighted the following: the role of generativity and death preparation reminiscence on identity preservation issues in later life, the strong desire to contribute

economic model to compare these cost-containment instruments directly to each other. First, a single-period economic model of 2015 was used to test the performance of a

Extraction of cartographic objects in high resolution satellite images for object model generation.. Guray Erus,

L’archive ouverte pluridisciplinaire HAL, est destinée au dépôt et à la diffusion de documents scientifiques de niveau recherche, publiés ou non, émanant des

comparables. Il constitue ainsi un des premiers jalons de cette modernité qui va s’emparer des arts dans les années 1920, nourri de ce regard posé sur la statuaire

these vitamin A-deficient children, Hb concentrations after 6 months of intervention were estimated to be 8·0 and 7·1 g/ l higher in the FB group than in children receiving the

1963 to 2008, while unexpected idiosyncratic volatility is. Several studies are moreover adding to the literature by showing that idiosyncratic volatility is negatively

After calibration and validation, the WAVE model was used to estimate the components of the water balance of forest stands and agricultural land for a 30-year period (1971– 2000)..