The volatility process: a study of stock market dynamics via parametric stochastic volatility models and a comparaison to the information embedded in the option price

Texte intégral

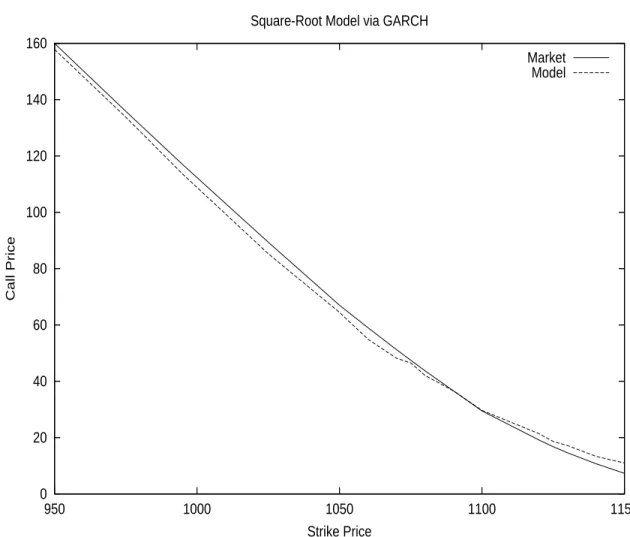

Figure

Documents relatifs

P (Personne) Personnes âgées Personnes âgées Aged Aged : 65+ years Aged Patient atteint d’arthrose Arthrose Osteoarthritis Arthrosis I (intervention) Toucher

Maurice Nédoncelle s’est plu à rechercher “l’expression de la notion de la personne en grec et en latin” et a relevé que chez un auteur aussi représentatif de la

Based on the MA’s autosegmenatl analysis mentioned in the third chapter, a set of non- assimilatory processes have been extracted namely metathesis, epenthesis, deletion,

Cite this article as: Holger Dette and Mark Podolskij, Testing the parametric form of the volatility in continuous time diffusion models - a stochastic process approach, Journal

Most of these men whom he brought over to Germany were some kind of "industrial legionaries," who — in Harkort's own words — "had to be cut loose, so to speak, from

by the Commodity Futures Trading Commission (CFTC) at the end of 2000 and the implementation of expansionary monetary policies after September 11 have triggered a strong

In this paper, we obtain asymptotic solutions for the conditional probability and the implied volatility up to the first-order with any kind of stochastic volatil- ity models using

Keywords: Hull & White model, functional quantization, vector quantization, Karhunen-Loève, Gaussian process, fractional Brownian motion, multifractional Brownian motion,