Multifractal Methods for Asset Pricing

Texte intégral

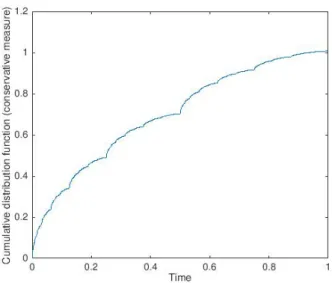

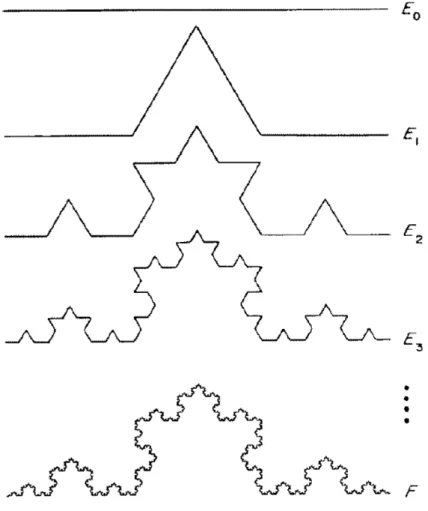

Figure

Documents relatifs

By looking over these results and trying to answer qualitative questions about which type of models make better predictions, we nd that the results broadly suggest that for

“There have been very few people who have spent time in jail for not paying taxes as an explicit act of political resistance,” said Ruth Benn, coordinator of

This conjecture, which is similar in spirit to the Hodge conjecture, is one of the central conjectures about algebraic independence and transcendental numbers, and is related to many

The second one follows formally from the fact that f ∗ is right adjoint to the left-exact functor f −1.. The first equality follows easily from the definition, the second by

Surprisingly, she also joins the Glee Club, where popular kids never want to be, but only to keep an eye on her boyfriend

In this paper, we propose to use quantile regression with an asymmetric Laplace distribution (ALD), coupled with an inference method based on belief func- tions, to estimate

We will establish a local Li-Yau’s estimate for weak solutions of the heat equation and prove a sharp Yau’s gradient gradient for harmonic functions on metric measure spaces, under

In this paper, we will see that a surjective linear local automorphism θ of a von Neumann algebra N is a Jordan isomorphism. In case N is properly infinite, θ is an automorphism. On