Environmental taxation, health and the life-cycle

Texte intégral

Figure

Documents relatifs

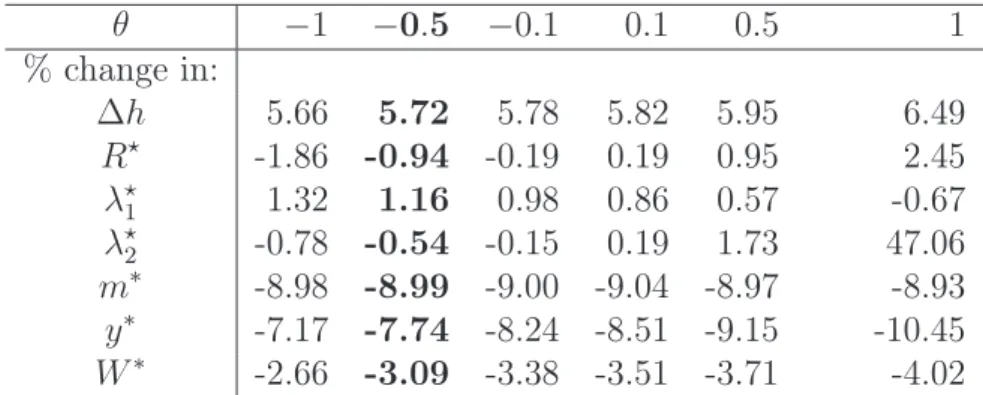

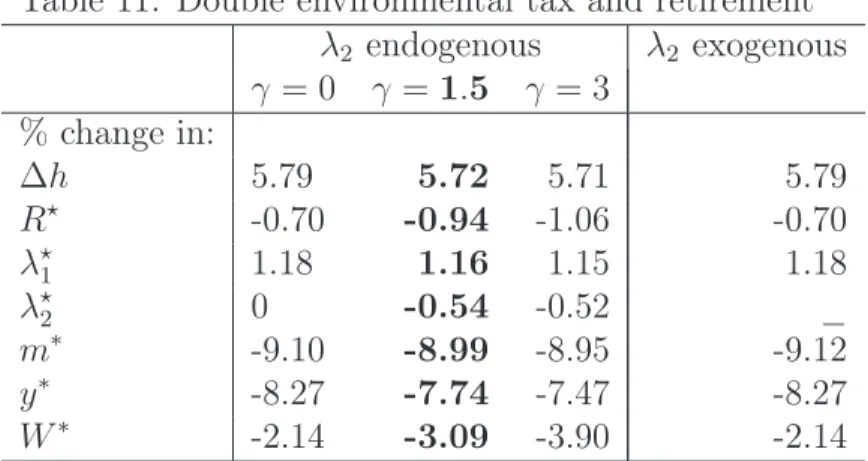

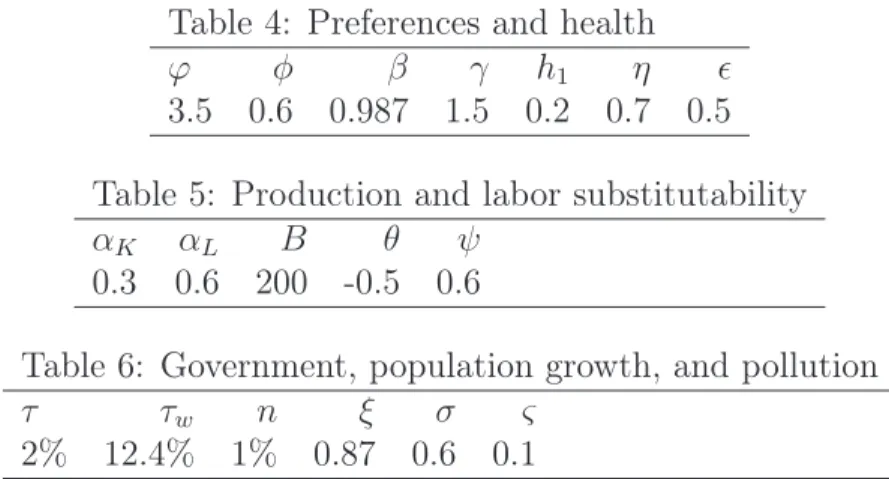

Then, a tighter environmental tax increases the steady-state unemployment rate, whatever the source of pollution (physical capital or final output) and more frictions on labor

On peut bien se figurer comment, dans le contexte que nous venons d’esquisser, l’émergence des livrets de ballet pouvait être perçue comme extrêmement

The resulting participation and employment rates have values that are intermediate between the benchmark model and the simulated joint taxation system. Under this mix system, the

To quantify the effects of bad health on labor market trajecto- ries, wealth, and consumption, we develop a life-cycle heterogeneous agents model with a formal and an informal

Sim- ilar to these models, ours allows to study the effects of early retirement transfers and aging on labor force participation but we find that these two shocks are insufficient

Early studies show an above-average decline in well-being for young people compared with the middle aged and elderly as a result of the COVID-19 pandemic and the measures taken

Secondly, we included (i) saving motives: life expectancy, bequest, precaution, investment, health and earnings; and motives for subscribing to a retirement saving scheme (PPR):

Is there a significant, positive correlation between the five dimensions of lifestyle measured by the SLIQ and health status, health-related quality of life and well-being.. Do