Macro factors in oil futures returns

Texte intégral

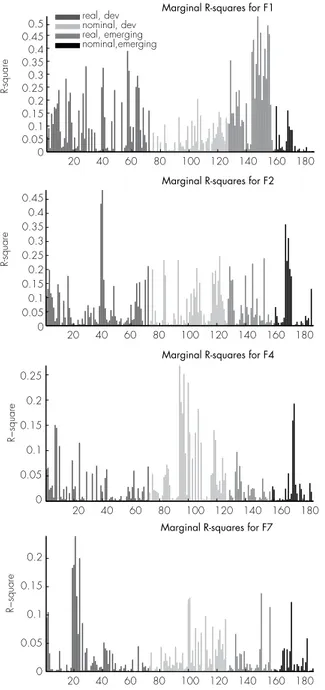

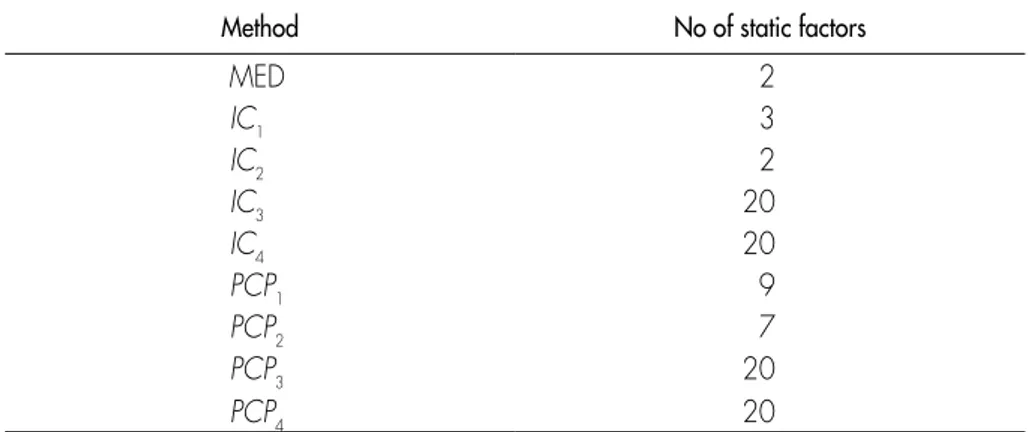

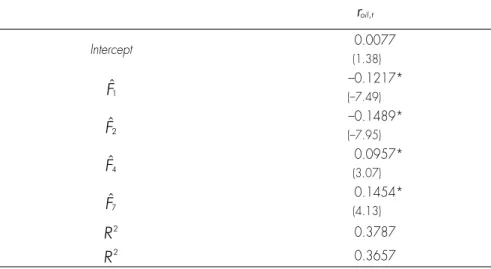

Figure

Documents relatifs

Abstract — Risk Factors in Oil and Gas Well Electronics Compared to Other Electronic Industries — The oil and gas well electronics industry is a low volume industry in which

A debt financed increase in public expenditure raises the (real) interest rate, but an expansionary monetary policy reduces the nominal interest rate and the real interest rate,

There, we find that extreme disasters are likely to be those first responsible for trade reductions, but the effect differs again, with respect to its type and that of the

The average rate of growth during the three years, which precede the opening of a procedure, has a negative coefficient but is not significant. Cyclical variations thus seem to

This means that a preservation of the pattern (a continuous decline of the exchange rate) over the whole period would lead to a decrease of the number of inquiries.. c)

This paper analyzes the relation between nominal exchange rate volatility and several macroeconomic variables, namely real per output growth, excess credit,

Using panel cointegration methods robust to cross-sectional dependence, we found that four of the five factors, namely the exchange rate regime, the degree of trade openness, the

Prices and wages change in response to market disequilibria, even if we do not let them clear markets (eqs. A.5), Given expectations, the tech- nology (eqs. A.1, A.2 and A.3 or