A Test for the Presence of Central Bank Intervention in the Foreign Exchange Market With an Application to the Bank of Canada

Texte intégral

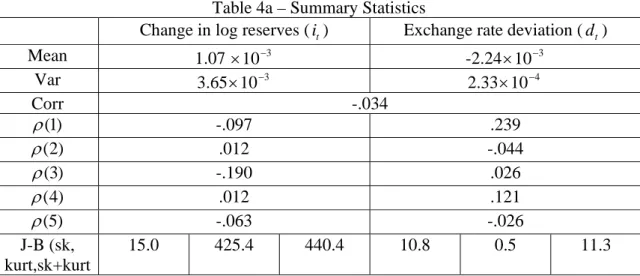

Figure

Documents relatifs

Standard tests for the rank of cointegration of a vector autoregressive process present distributions that are affected by the presence of deterministic trends.. We consider the

In line with Lewis (1995), Andrade and Bruneau (2002) (AB) proposed a partial equilibrium model where the risk premium, defined as the difference between the expected change in

Both the NBB’s primacy in foreign exchange policy and the breadth of its operations (covering up to six currencies at the time) make the Bank an ideal candidate for a

r = hi [q A Vi ) of the phase gradient vortex centres ~phase singularities, phase slip centres) perpendicular to the direction of the potential drop, which leads to the phase

phase difference across the barrier becomes linear in time in the same way as the phase difference of the order parameter of a superconductor or of a superfluid in the presence of

In the vein of fractional Brownian models, one of the most recent and advanced models assumes that the time-varying Hurst exponent follows a stochastic process: it is

The domestic market rate almost constantly coincided with the Bank’s discount rate, which acted as its upper bound (see table 1). It might be tempting to infer that the

Dans ce cas, le syst`eme physique est le simu- lateur d’´ecoulement, les variables d’entr´ee sont les param`etres incertains du mod`ele g´eologique (par exemple la position des