Crisis-Robust Bond Portfolios

Texte intégral

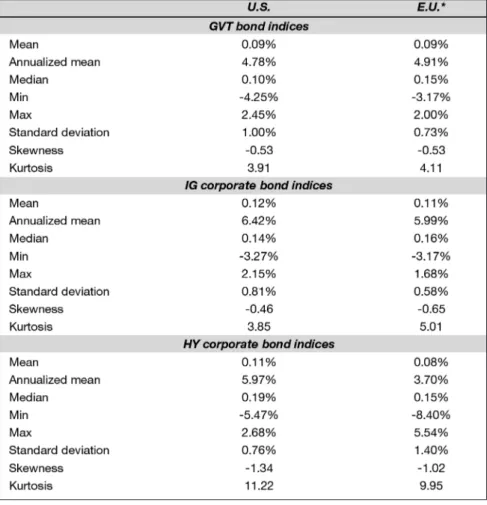

Figure

Documents relatifs

L’archive ouverte pluridisciplinaire HAL, est destinée au dépôt et à la diffusion de documents scientifiques de niveau recherche, publiés ou non, émanant des

Il procède ici de la même manière, en utilisant de petits morceaux de papiers découpés qu'il ajoute ou retranche, successivement, comme s'il s'agissait de touches de

Analyzing figure 6 it is visible that the MDS curves of the four stock market indexes seem to be divided into six periods with different flows, separated by the end of an economic

For instance, a technology shock determines a negative correlation on the stock-bond market; a financial expectation shock a positive one and a sovereign risk shock an

For example, for the bottom tail returns and the entire period sample, three out of five volatility marginal effects are significant and positive for the Non-euro group, indicating

Finally, French banks might have been simply lucky. The Kerviel fraud was discovered in February 2008. It first forced the Société Générale to increase its capital by 5,5 billion

European institutions actively encouraged the Greek credit binge, Streeck argues, first on the supply side (by lowering fiscal transfers to Greece and turn- ing a blind eye when

European institutions actively encouraged the Greek credit binge, Streeck argues, first on the supply side (by lowering fiscal transfers to Greece and turning a blind eye when